The Bitcoin community and its underlying belongings have advanced since its launch in 2009, and maintaining with the adjustments and updates will be difficult. In a put up, monetary strategist Lyn Alden broke down 5 key metrics to assist BTC traders assess the community’s present state.

Past Value: A Look At The Bitcoin Community Vitality

As Lyn Alden suggests, a deeper dive into the Bitcoin community is important for any investor. This method gives a extra nuanced understanding of Bitcoin’s standing, shifting previous the “superficialities of value fluctuations” to gauge its true potential and challenges.

Alden claims that value could not seize the entire story however stays a crucial sign of adoption and market positioning. Bitcoin competes not simply with different cryptocurrencies but additionally with conventional belongings like gold and fiat currencies.

Its fluctuating value displays its relative youth and volatility in comparison with extra established currencies. Nevertheless, its fastened provide of 21 million Bitcoin gives an alternative choice to the consistently inflated provide of fiat currencies, such because the US greenback. The analyst acknowledged:

The Bitcoin community itself is likely to be serving as a heartbeat of clockwork order in a world of chaos, however value is nonetheless a measure of its adoption.

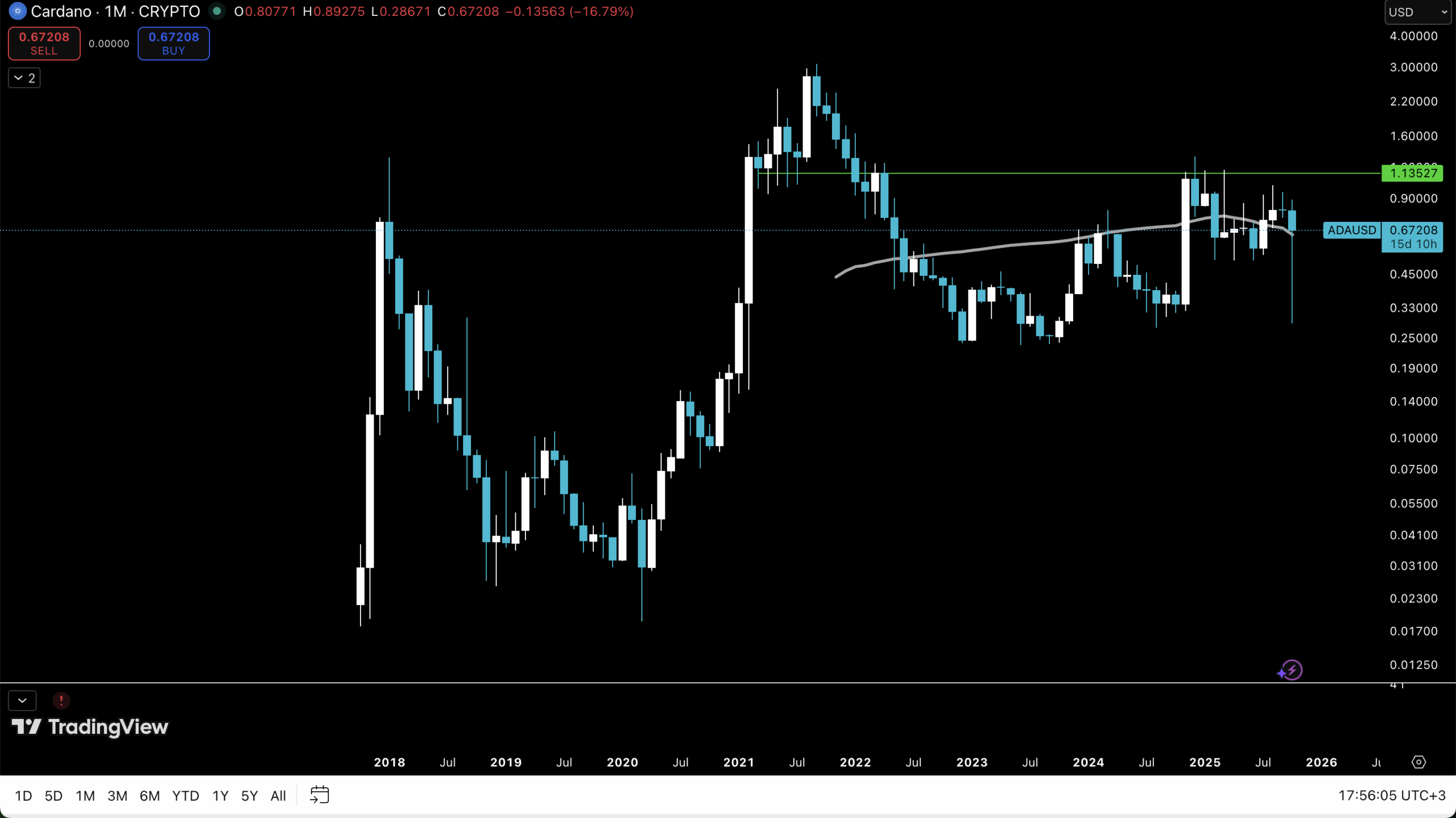

Bitcoin has persistently proven an upward pattern, traditionally making it one of many best-performing belongings, as seen within the chart beneath. The uptrend within the BTC value exhibits that the challenge has efficiently operated as an alternative choice to conventional types of cash.

A key side to contemplate is liquidity – how a lot each day buying and selling quantity happens and the way a lot transaction worth is circulated on-chain. Excessive liquidity signifies a strong, extensively used community. On the latter, Alden identified:

(…) now that bitcoin has billions of {dollars} of buying and selling quantity, there are trillion-dollar swimming pools of capital that may’t put significant percentages into it; it’s nonetheless too small and illiquid for them. If they begin placing a couple of hundred million {dollars} or a pair billions of {dollars} per day into it, that’s sufficient to tilt the availability/demand towards the purchase aspect and critically inflect the worth upward. Since inception, the Bitcoin ecosystem has needed to obtain sure ranges of liquidity earlier than it even will get on the radar of larger swimming pools of capital. It’s like leveling up.

The narrative surrounding Bitcoin is ever-evolving. It’s been considered as each a cost methodology and a financial savings software, reflecting its multifaceted utility. The stability between these capabilities – having the ability to execute transactions globally whereas serving as a dependable retailer of worth – is important.

The rising variety of conversion factors, the place Bitcoin will be exchanged for items, providers, or fiat currencies, performs a vital function in its adoption and sensible use.

Bitcoin’s basic worth proposition lies in its safety and decentralization. The community should stay resilient in opposition to assaults and preserve its decentralized nature to proceed being a reputable and beneficial digital asset. Regardless of going through technical challenges and bugs in its historical past, Bitcoin has demonstrated outstanding robustness, sustaining 100% uptime since 2013.

What About The Bitcoin Person?

As Bitcoin evolves, so does the convenience of its use. Growing user-friendly {hardware} wallets, improved software program interfaces, and elevated Bitcoin ATMs have considerably enhanced the consumer expertise. This evolution is crucial for Bitcoin’s wider adoption past tech-savvy people to most of the people.

On this key metric, Alden factors to the progress in BTC {hardware} wallets, which permit individuals to retailer their non-public keys whereas sustaining the usability of their cash. Organising a BTC pockets is turning into simpler and can probably proceed shifting in that route.

The authorized panorama surrounding Bitcoin varies considerably throughout totally different jurisdictions. Whereas some governments have embraced it, others stay skeptical. Nevertheless, Bitcoin’s world nature gives a form of resilience to localized regulatory challenges. Its decentralized nature makes it a formidable entity to manage or ban successfully.

In conclusion, whereas challenges in miner decentralization and consumer expertise persist, the general pattern is optimistic. Alden believes the community continues to develop in liquidity, technical robustness, and world acceptance.

For traders and fans alike, Bitcoin stays a “dynamic and promising area, ripe with alternatives for development and innovation.” As Alden factors out, Bitcoin’s open-source nature invitations steady refinement and enhancement, making it a “resilient and adaptive digital asset.”

Cowl picture from Unsplash, chart from Tradingview

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info supplied on this web site solely at your personal danger.