A provide shock could also be brewing in Bitcoin as on-chain information reveals 57% of all BTC hasn’t seen any motion since at the very least two years in the past.

Bitcoin Provide Dormant Since 2+ Years Has Been Setting New All-Time Highs

As identified by Capriole Investments founder Charles Edwards in a put up on X, the BTC provide, dormant since at the very least two years in the past, has been hitting consecutive new all-time highs (ATHs) not too long ago.

The Bitcoin buyers holding provide this outdated make-up for a phase of the broader “long-term holder” (LTH) group. The LTHs check with the buyers who’ve been holding their cash since at the very least 155 days in the past.

A statistical reality is that the longer holders preserve their cash nonetheless on the blockchain, the much less seemingly they grow to be to maneuver them at any level. Due to this motive, the LTHs are thought of the extra cussed facet of the BTC market.

The two+ years phase would then embrace the buyers who could be essentially the most stalwart of diamond fingers even amongst these HODLers, as their holding time is considerably better than simply 155 days.

Now, here’s a chart that reveals the development within the proportion of the overall circulating Bitcoin provide held by this phase of the LTHs over the historical past of the cryptocurrency:

The worth of the metric appears to have been going up in latest days | Supply: @caprioleio on X

As displayed within the above graph, the availability held by these LTHs has been following an upward trajectory because the FTX collapse and has been repeatedly setting new ATHs.

Not too long ago, the expansion within the metric has slowed a bit, nevertheless it has nonetheless been going up. At current, round 57% of the Bitcoin provide is locked within the fingers of those HODLers.

Edwards notes that that is creating an enormous provide squeeze for the cryptocurrency. The quant has additionally identified {that a} related development has been seen within the leadup to all previous bull runs (marked with the inexperienced traces within the chart).

Earlier as we speak, the US SEC lastly authorized the Bitcoin spot ETFs. Edwards has defined that this might lead towards the availability shock solely rising deeper since “the ETFs have been solely authorized for CASH subscriptions (not in-kind). So each buy takes extra Bitcoin off the market.”

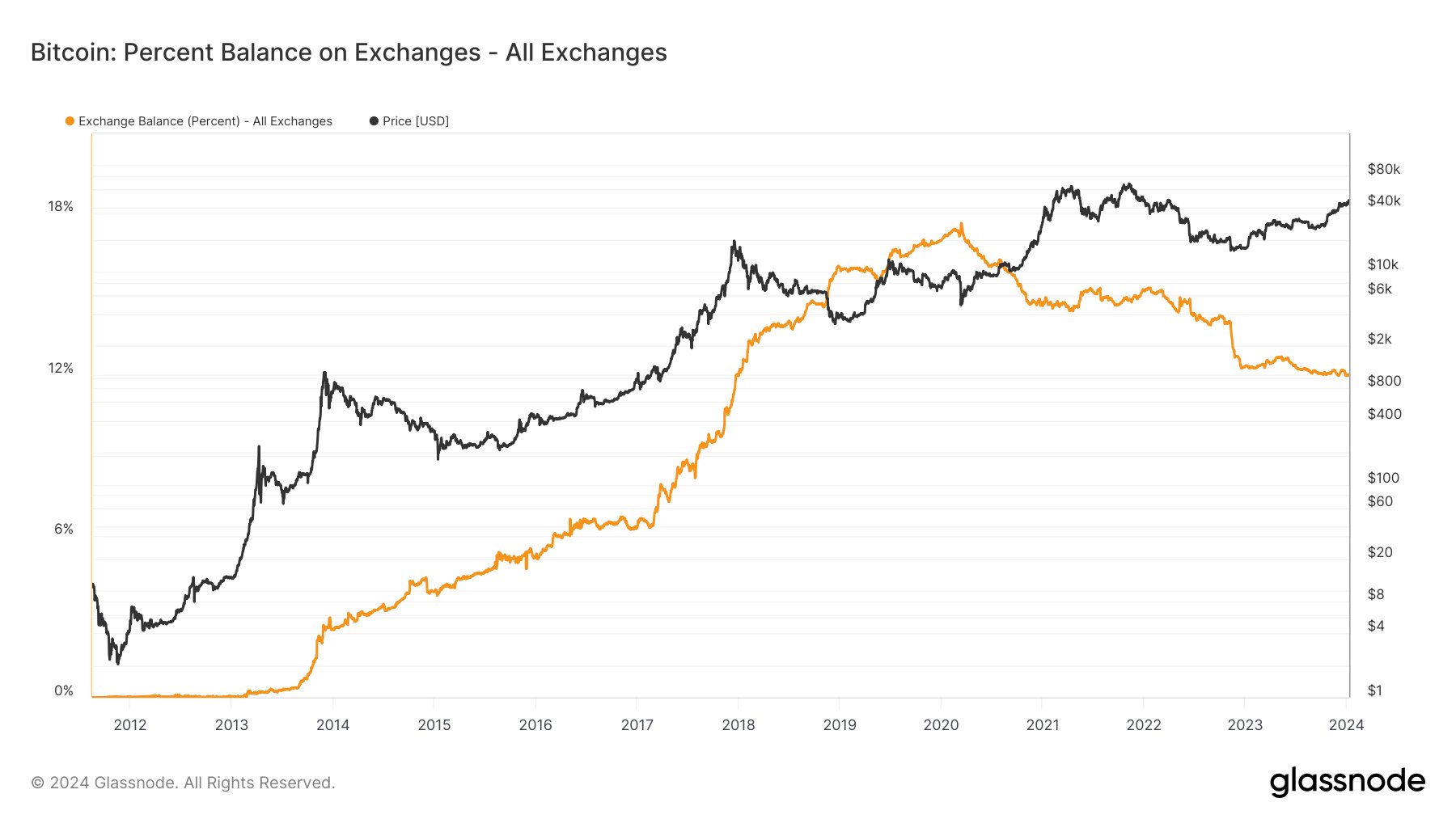

A chart analyst, James V. Straten, shared that might additionally present one other angle at a provide shock brewing within the asset.

Appears to be like just like the metric’s worth has been taking place since some time now | Supply: @jimmyvs24 on X

The above graph reveals the info for the share of the Bitcoin provide sitting within the centralized exchanges’ wallets. This metric has been taking place over the previous few days, and now, simply 12% of all BTC is being saved on these platforms.

The trade provide is considerably extra prone to be concerned in shopping for and promoting actions (since that’s what these platforms are for, naturally), so taking place means the efficient buying and selling provide of the asset can also be reducing.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $45,900, up greater than 4% during the last week.

The worth of the coin has gone via a rollercoaster previously day | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com