Galaxy Analysis’s newest temporary argues that the “wealth channel” in america—the community of roughly 300,000 monetary advisors overseeing about $30 trillion in shopper belongings—is lastly beginning to open to crypto belongings, with implications which can be each mechanical and doubtlessly transformative.

$600 Billion May Enter The Crypto Market Quickly

The crux of the thesis is arithmetic however not trivial: “If even a modest 2% allocation to bitcoin ETFs emerged throughout this channel, that might translate to roughly $600 billion in potential inflows,” the observe states, including that such a sum “is akin to the complete international gold ETF market (~$472 billion) and greater than 3x the US spot bitcoin ETF AUM (~$146 billion).”

The agency frames this because the second crypto begins shifting from retail-driven hypothesis towards advisor-led portfolio development, as approvals, custody, and compliance guardrails converge inside the biggest wirehouses and banks.

The catalyst, in Galaxy’s telling, is a collection of platform-level entry adjustments and infrastructure buildouts that take away long-standing bottlenecks. On October 10, Morgan Stanley “eliminated longstanding restrictions on crypto fund entry for its monetary advisors,” permitting proactive suggestions “to all purchasers throughout any account kind.” Galaxy highlights the financial institution’s latest home steerage—“as much as 4%” of portfolios in digital belongings—as a conservative however significant sign that crypto is being slotted alongside established diversifiers.

The shift issues much less as a branding train and extra as a workflow change: when publicity turns into commonplace inside advisory toolkits, it may be modeled, rebalanced, and supervised beneath the identical threat and suitability processes that govern equities, bonds, and options.

The analysis temporary stresses how the wealth channel’s inside approval equipment has been the actual gating issue. Advisors “can solely allocate to merchandise formally accredited by their companies,” and people approvals rely upon “custody readiness, compliance frameworks, operational integration, and shopper suitability requirements.”

Crypto has lagged not as a result of advisors lack curiosity, Galaxy argues, however as a result of “approval of crypto merchandise has been particularly cautious” amid volatility, evolving regulation, and a restricted on-platform observe report. That calculus is altering as banks construct the “vital spine” internally—buying and selling, custody, and advisory methods that permit them “provide safe, scalable crypto entry via their wealth platforms.”

In the identical vein, the observe flags motion among the many largest model names in US asset administration and banking. Vanguard—lengthy the archetype of crypto skepticism—“is reportedly getting ready to supply choose third-party crypto ETFs to its brokerage purchasers,” a reversal Galaxy attributes to “sturdy shopper demand and a extra supportive regulatory local weather,” whereas noting that there’s “not but [a] particular timeline or which ETFs shall be made obtainable.”

Citi, for its half, “plans to launch institutional-grade crypto custody in 2026,” and JPMorgan “signaled that its purchasers will quickly be capable of commerce bitcoin and different crypto belongings,” albeit with out in-house custody for now. Galaxy treats these strikes much less as remoted headlines than as proof that banks intend to seize crypto flows “utilizing their very own built-in buying and selling, custody, and advisory methods” to supply regulated entry at scale.

Coverage context additionally options in Galaxy’s evaluation. The temporary factors to the current government order permitting 401(ok) plans to incorporate crypto as an possibility” as a legitimizing step that helps fiduciaries and compliance groups develop snug with the danger profile of digital belongings inside retirement plans. Whereas implementation finally will depend on how plan sponsors interpret fiduciary obligations, Galaxy’s level is that headline regulatory posture is not completely restrictive—decreasing a key narrative and operational headwind for wealth platforms.

Importantly, Galaxy situates the potential 2% allocation inside a broader spectrum of public steerage from outstanding allocators over the previous yr. The agency notes that “BlackRock, Constancy, Bridgewater’s Ray Dalio, and Ric Edelman have publicly prompt crypto allocations starting from a conservative 1% to as excessive as 40% in aggressive eventualities.”

Inside this vary, Morgan Stanley’s “as much as 4%” ceiling is neither fringe nor maximalist; it reads as a risk-budgeted sleeve for an asset class the financial institution now describes as “each a hedge towards inflation and a long-term progress alternative.” Galaxy extends the maths: if common allocations throughout suggested belongings land nearer to 1% than 2%, bitcoin ETF belongings might nonetheless attain “$500 billion inside a couple of years.”

The underside line: If advisors can lastly “combine crypto straight into conventional balanced portfolios,” the agency concludes, the business will doubtless look again on this era as the purpose “the place crypto transitions from a distinct segment funding to a regular portfolio element, alongside equities, bonds, and gold.”

At press time, the overall crypto market cap was at $3.71 trillion.

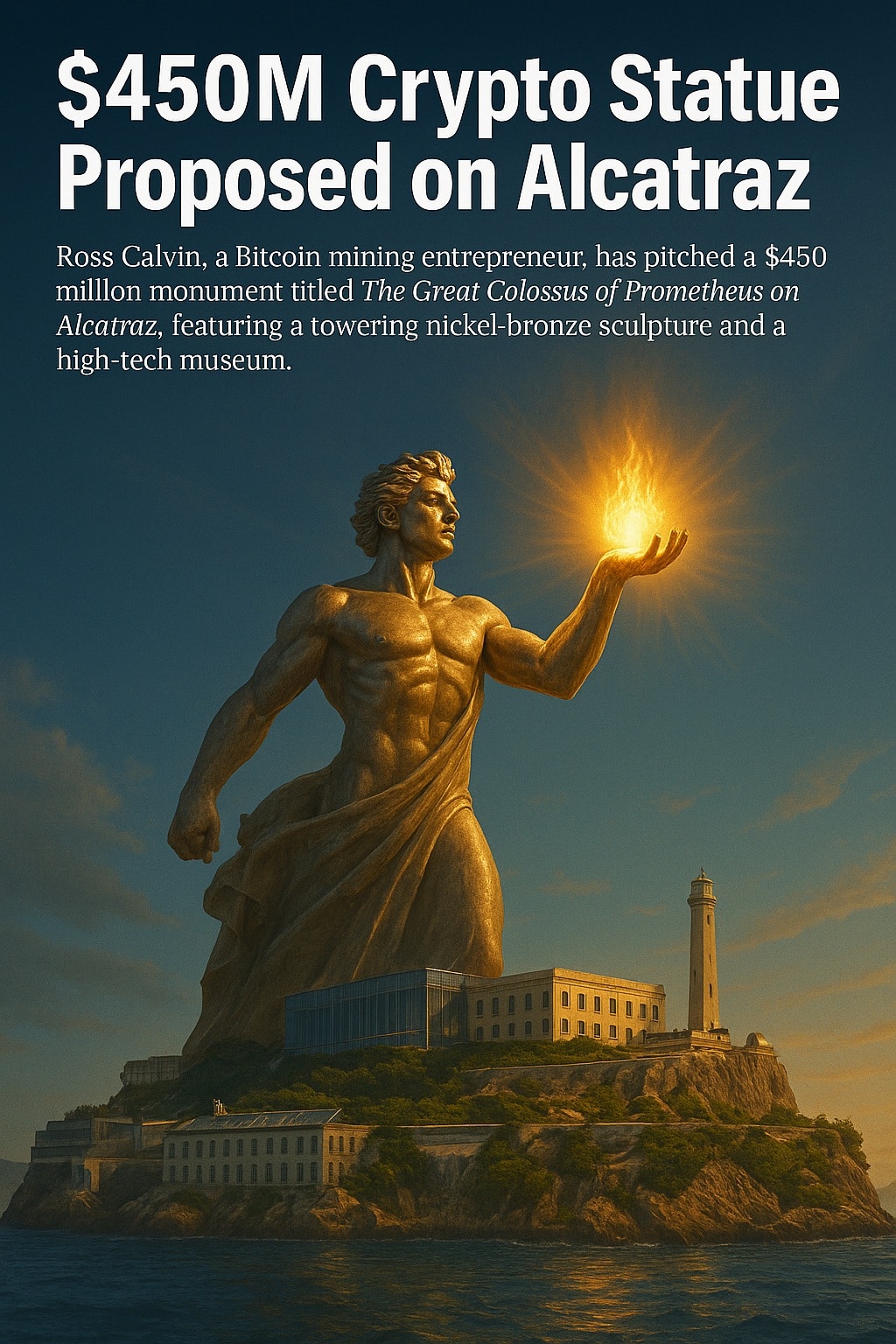

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.