On-chain knowledge reveals the Ethereum long-term holders have not too long ago been rising their complete share of the cryptocurrency’s provide.

Ethereum HODLers Presently Carry The Majority Of ETH Provide

In accordance with knowledge shared by the market intelligence platform IntoTheBlock in a submit on X, the Ethereum long-term holder provide has been on the rise not too long ago. The “long-term holders” (LTHs), as outlined by IntoTheBlock, seek advice from the ETH traders who purchased their ETH greater than a yr in the past.

Statistically, the longer an investor holds onto their cash, the much less probably they turn into to promote at any level. As such, these LTHs, who have a tendency to carry for lengthy durations, embrace the traders least possible to promote available in the market.

One technique to hold monitor of the habits of those HODLers is thru the whole quantity of provide held by them. The beneath chart reveals the development on this provide for Ethereum because the begin of the yr 2024.

Appears to be like like the worth of the metric has been going up over the previous couple of months | Supply: IntoTheBlock on X

As is seen within the above graph, the Ethereum LTH provide has been using an uptrend this yr to this point. This improve has continued in the previous couple of weeks, with the metric even noticing a soar sharper than regular.

One thing to notice, although, is that when this indicator goes up, it doesn’t signify that these HODLers are shopping for within the current. Relatively, it implies that some accumulation occurred a yr in the past and these cash have now matured sufficient to turn into part of the cohort.

Nonetheless, a rise within the indicator continues to be naturally a bullish signal for the cryptocurrency, because it means that HODLing habits is rising among the many traders.

Following the newest rise, the Ethereum LTHs maintain round 78% of the complete circulating provide of the asset. Because of this a majority of the availability is at the moment locked within the fingers of those holders who don’t simply promote.

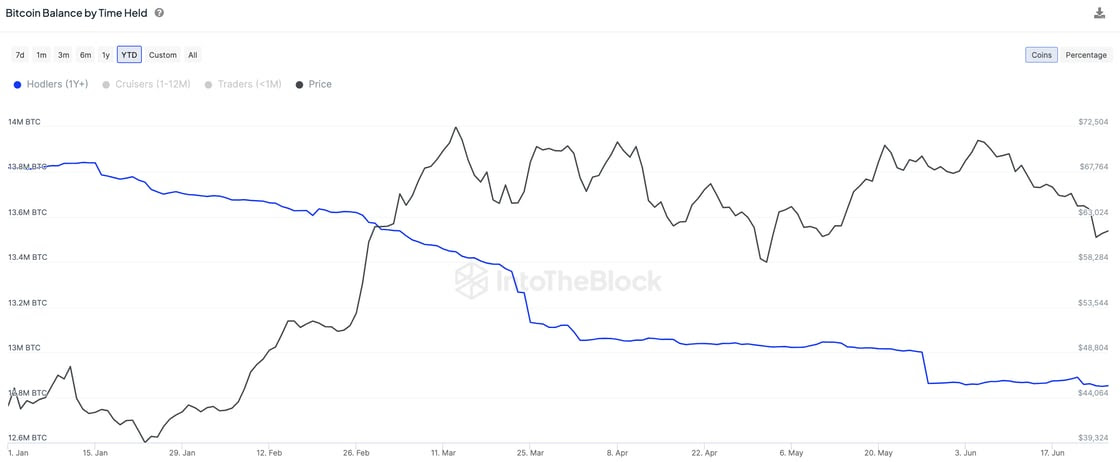

Whereas ETH has been seeing this bullish improvement when it comes to its LTHs, the identical hasn’t been true for Bitcoin. Because the analytics agency has identified in one other X submit, the BTC HODLers have been shedding their provide all year long.

The worth of the metric seems to have been happening not too long ago | Supply: IntoTheBlock on X

Whereas shopping for has a one yr delay, promoting doesn’t have the identical quirk hooked up to it. This is because of the truth that cash have their age reset to zero as quickly as they’re transferred on the blockchain, so they’re immediately faraway from the group.

In Could, the Bitcoin LTHs bought round 160,000 BTC, price a whopping $10.1 billion on the present alternate charge. Their promoting did decelerate final month, although, as they distributed about 40,000 BTC ($2.5 billion).

ETH Value

On the time of writing, Ethereum is floating round $3,500, up greater than 5% over the past seven days.

The worth of the asset appears to have been on the rise over the past day or so | Supply: ETHUSD on TradingView

Featured picture from Dall-E, IntoTheBlock.com, chart from TradingView.com