UAE retail traders are more and more targeted on homegrown markets, with 85% at the moment invested in UAE-listed shares

Confidence runs excessive within the UAE’s financial system, with over 90% assured within the UAE financial system and efficiency of UAE-listed firms respectively

Nonetheless, 90% count on commerce tensions to considerably affect their portfolios within the subsequent six months, resulting in extra investments in native equities and commodities

Dubai, United Arab Emirates – August 19, 2025: A whopping 85% of UAE-based retail traders are at the moment invested in native shares, and plenty of are shopping for much more in response to world commerce tensions, based mostly on the most recent version of the UAE Retail Investor Beat by buying and selling and investing platform eToro.

Robust perception within the UAE financial system and markets

The research, which surveyed 1,000 retail traders throughout the United Arab Emirates, revealed that UAE-based traders are sturdy supporters of their native market. 85% are at the moment invested in domestically listed equities, with 39% of respondents holding Abu Dhabi shares, 28% holding Dubai shares, and 18% holding each.

These investments replicate their confidence within the UAE financial system. 63% of traders said they’re “very assured” in its present efficiency, and an extra 29% indicated they’re “considerably assured”. In terms of the long-term efficiency of domestically listed shares, 59% expressed that they’re “very assured”, with an extra 32% who’re “considerably assured”.

Wanting forward, 48% of traders forecast important beneficial properties within the UAE inventory market over the following 12 months, whereas 34% count on regular progress. This conviction can also be evident in traders’ long-term expectations. 58% imagine that the Center East will ship probably the most substantial returns over the following 5 years, adopted carefully by the U.S. (50%).

When requested which UAE sectors evoke probably the most optimism for investments over the following 12 months, actual property topped the record at 55%, adopted by expertise (48%), monetary providers (37%), and vitality (37%).

Commenting on the findings, George Naddaf, Managing Director at eToro MENA, shared: “The DFM and ADX are among the many best-performing inventory exchanges on this planet this 12 months, outperforming the S&P 500 by a substantial margin. In opposition to this backdrop, our analysis confirms that investor confidence within the UAE market stays sturdy, supported by resilient efficiency throughout native indices, stable macroeconomic indicators, and sustained earnings throughout key sectors. Buyers are favouring actual property, expertise, monetary providers, and vitality, as these sectors proceed to profit from government-backed initiatives. The truth that 85% are already invested in UAE equities displays a transparent choice for native alternatives within the present atmosphere.”

World tensions drive dwelling bias and commodity curiosity

Regardless of sturdy confidence of their native market, geopolitical danger is firmly on the minds of traders: 90% say tariffs and commerce wars will considerably affect their portfolios within the subsequent six months, and 89% have already adjusted or plan to regulate their investments in response.

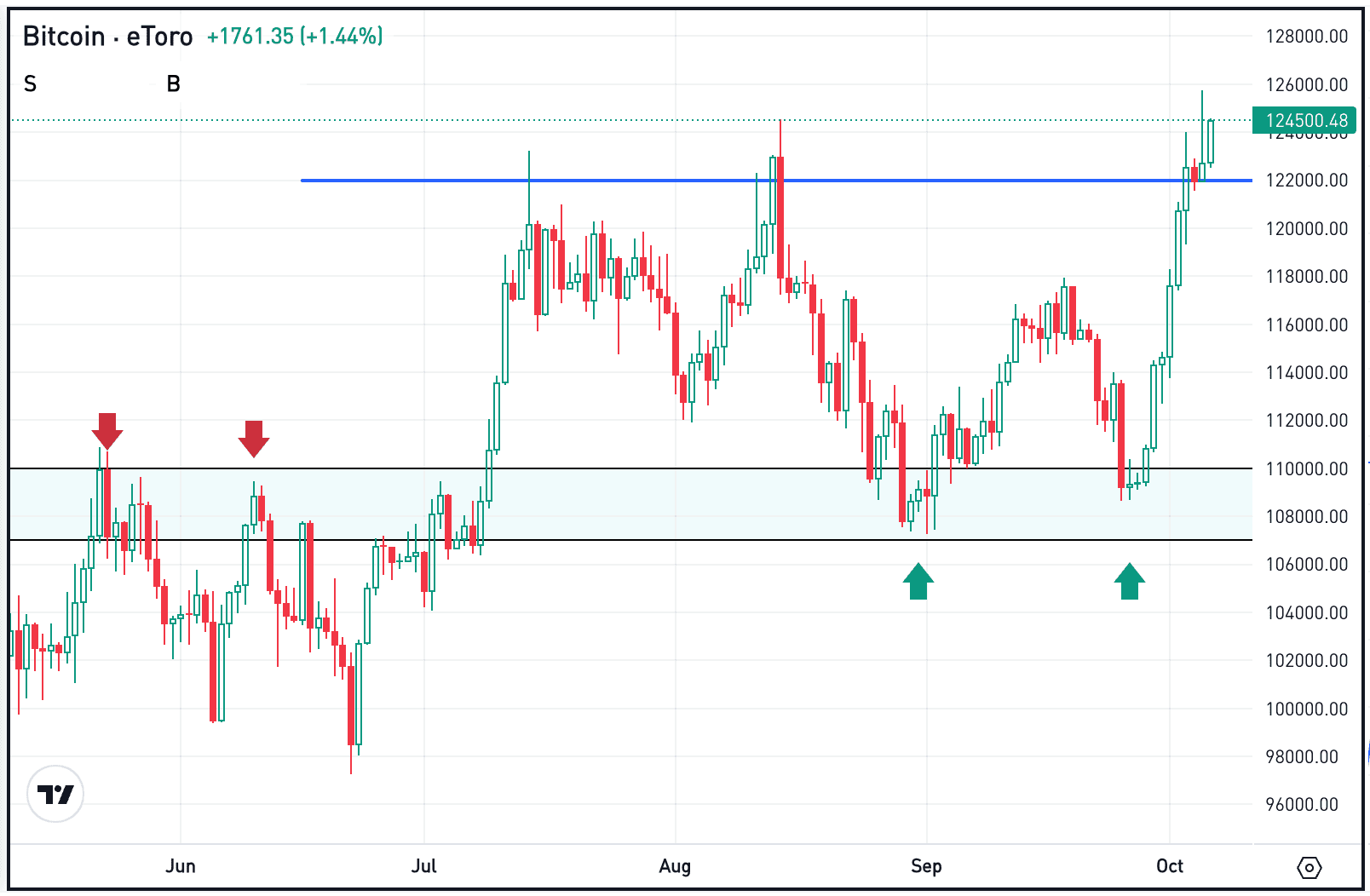

Whereas the most typical approach traders are adjusting their portfolios in response to commerce tensions is by growing publicity to UAE equities (53%), a detailed second is growing allocations to commodities (51%). This corresponds with respondents selecting gold or treasured metals as probably the most resilient kind of asset in a unstable commerce atmosphere (49%). Crypto (45%) was the second-most in style possibility, and it’s already probably the most held asset class amongst UAE traders at the moment with 54% invested.

George Naddaf added: “With 90% of traders anticipating an affect from tariffs and commerce wars, and 89% adjusting their portfolios accordingly, UAE traders present a formidable stage of adaptability. Moreover native shares, many are reallocating in the direction of commodities equivalent to gold and oil, that are seen as dependable hedges towards exterior volatility. This implies a disciplined, dual-track strategy: reinforcing publicity to home markets which might be shielded from the affect of tariffs, whereas managing danger by defensive asset lessons.”

Uncertainty isn’t deterring traders from persevering with to hunt alternatives available in the market. 65% of UAE retail traders have already elevated contributions to their funding portfolios over the earlier months, and 76% count on to extend contributions over the following three months.

-ENDS-

Notes to Editor:

The survey, commissioned by the buying and selling and investing platform eToro, sampled 1,000 retail traders residing within the UAE. The survey was carried out from July 10, 2025 – July 21, 2025 and carried out by analysis firm Appinio. Retail traders have been outlined as self-directed or suggested and needed to maintain a minimum of one funding product together with shares, bonds, funds, funding or equal. They didn’t must be eToro customers.

Media Contacts:

etoro@golin-mena.com

About eToro:

eToro is a buying and selling and investing platform that empowers you to speculate, share and study. We have been based in 2007 with the imaginative and prescient of a world the place everybody can commerce and put money into a easy and clear approach. Right now we’ve 40 million registered customers from 75 international locations. We imagine there may be energy in shared data and that we will turn into extra profitable by investing collectively. So we’ve created a collaborative funding neighborhood designed to give you the instruments it is advisable to develop your data and wealth. On eToro, you possibly can maintain a spread of conventional and progressive property and select the way you make investments: commerce straight, put money into a portfolio, or copy different traders. You may go to our media centre right here for our newest information.

Disclaimers:

eToro is a multi-asset funding platform. The worth of your investments might go up or down. Your capital is in danger.

eToro is a bunch of firms which might be authorised and controlled of their respective jurisdictions. The regulatory authorities overseeing eToro embody:

The Monetary Conduct Authority (FCA) within the UK

The Cyprus Securities and Change Fee (CySEC) in Cyprus

The Australian Securities and Investments Fee (ASIC) in Australia

The Monetary Providers Authority (FSA) within the Seychelles

The Monetary Providers Regulatory Authority (FSRA) of the Abu Dhabi World Market (ADGM) within the UAE

The Financial Authority of Singapore (MAS) in Singapore

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any explicit recipient’s funding goals or monetary scenario, and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.

Regulation and License numbers

Center East

eToro (ME) Restricted, is licensed and controlled by the Abu Dhabi World Market (“ADGM”)’s Monetary Providers Regulatory Authority (“FSRA“) as an Authorised Particular person to conduct the Regulated Actions of (a) Dealing in Investments as Principal (Matched), (b) Arranging Offers in Investments, (c) Offering Custody, (d) Arranging Custody and (e) Managing Belongings (below Monetary Providers Permission Quantity 220073) below the Monetary Providers and Market Laws 2015 (“FSMR”). Its registered workplace and its principal place of work is at Workplace 207 and 208, fifteenth Ground Ground, Al Sarab Tower, ADGM Sq., Al Maryah Island, Abu Dhabi, United Arab Emirates (“UAE”).