One of many central worth propositions of Bitcoin is that it doesn’t matter what occurs, in the event you pay a excessive sufficient charge some miner on the market on the planet will verify your transaction. In different phrases, Bitcoin is censorship resistant. There’s a excellent cause that the phrase “censorship resistant” is the wording you hear each time this matter comes up, not “censorship proof.” Any particular person miner can censor no matter they need, within the sense that they will refuse to incorporate one thing in any block they mine themselves. They can’t, nevertheless, stop different miners from together with that transaction in their very own blocks each time they discover one.

Bitcoin is proof against censorship, however it isn’t proof against it. Any miner can censor no matter they need, and that’s free, ignoring in fact the potential alternative price of income loss if there usually are not sufficient transactions obtainable paying a comparable feerate to the transaction(s) they select to censor. However this doesn’t cease the worldwide system from processing that transaction anyway, until these miners 1) comprise a majority of the complete community hashrate, 2) select to leverage that actuality to orphan the block of any miner who chooses to course of the transaction(s) they want to censor.

To do that would lose nearly all of miners partaking within the orphaning assault cash so long as the minority set of miners continued mining blocks that included the “verboten” transaction. Every time such a block was discovered, it will basically improve the time till the subsequent block that made it into the chain was discovered, reducing nearly all of censoring miners’ earnings on common. This could stay the case till the minority gave up and capitulated or was run out of enterprise (as they might be forgoing income on any block together with the censored transaction as properly).

For now, let’s assume that this state of affairs will not be within the playing cards. If it have been, Bitcoin is both a failure, or should exist on this state till non-censoring miners are in a position to quietly amass sufficient hashrate with a purpose to overpower the present majority intent on orphaning blocks containing transactions they are not looking for confirmed within the blockchain.

So what occurs when a set of miners, within the minority, resolve they’re going to censor a selected subset of transactions from their blocks? The quantity of blockspace that’s obtainable to these transactions shrinks. There’s much less blockspace obtainable to them than each different class of transactions. What’s the finish results of this? Price strain for this class of transactions will hit saturation quicker than each different class of transactions.

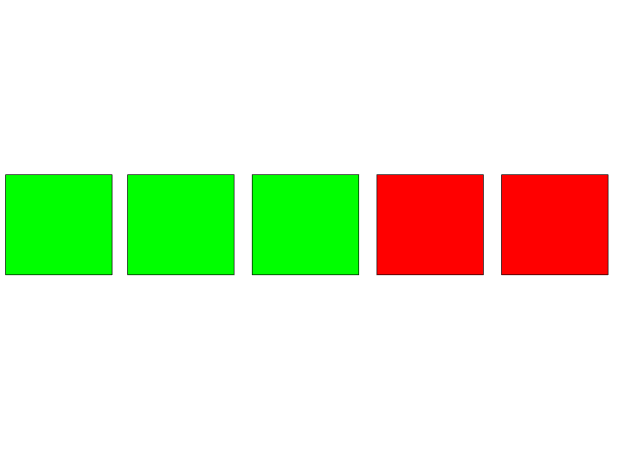

Only for the sake of simplicity within the instance, think about it solely takes 10 transactions to replenish any given block. We’ll name common transactions merely “common transactions”, and the transactions being censored “verboten transactions.” Every day there are on common 5 blocks discovered, and there are 5 miners. The pink blocks characterize miners who is not going to mine verboten transactions, and the inexperienced blocks are miners who will. For normal transactions to saturate the obtainable blockspace and begin driving up charges, there must be 50+ transactions pending to ensure that the bidding frenzy to start driving up charges and growing the income for miners. At this level the charge generated income for all miners will start growing.

For the verboten transactions, solely 20+ transactions must be pending to ensure that a bidding frenzy to start amongst them, driving up charge revenues. However the charge income from the verboten transactions will solely be collected by the inexperienced miners.

In a scenario the place the verboten transactions usually are not saturating mempools in extra of the block capability obtainable to them, all miners will make the identical tough degree of earnings. These verboten transactions should compete with common transactions with a purpose to have some assure of well timed affirmation, so if common transactions are saturating the mempool however verboten transactions usually are not the general charge strain will probably be comparatively evenly distributed amongst all miners and nobody could have any disproportionate charge income unavailable to the others.

Nevertheless, if verboten transactions are saturating the mempool in extra of the obtainable blockspace, that charge strain will drive up charges paid by verboten transactions just for the inexperienced miners. Having elected to censor these transactions, pink miners is not going to be realizing any elevated charge income from the verboten transactions. Common transactions on this state of affairs is not going to must compete with verboten transactions in feerates until they should verify within the subsequent block, so the oblique feerate rise in common transactions due to verboten transactions’ charge strain is not going to result in an equal improve in income for pink miners.

This disequilibrium leaves inexperienced miners incomes extra income per block/hash than pink miners. That is, incentivize smart, clearly unsustainable. One among two issues will occur over time: 1) both the inexperienced miners will reinvest the additional income they’re buying and broaden their proportion of the hashrate, or 2) miners will defect from the pink aspect and the inexperienced set of miners will develop in proportion of the hashrate that method.

This dynamic of upper charges for inexperienced miners will end result within the development of the hashrate of inexperienced miners, no matter whether or not by means of reinvestment or defection from pink miners, till it reaches an equilibrium the place the verboten transactions’ blockspace demand ranges off with common transactions, and each teams of miners are making roughly the identical earnings. This equilibrium will final till the verboten transactions’ demand for blockspace exceeds that obtainable to them, after which the complete dance of inexperienced miners incomes extra till they develop in community hashrate share to an equilibrium level of equal charge income once more.

This dynamic is why Bitcoin is censorship resistant. Not as a result of all miners usually are not able to censoring one thing, however as a result of miners are incentivized to incorporate one thing different miners are censoring by means of market dynamics. If some miners censor a category of transactions, they lower the quantity of blockspace obtainable to them and drive up the charges they’re keen to pay. Pure and easy. Except miners are fully irrational, by which case Bitcoin’s complete safety mannequin is known as into query, some will embody these transactions and earn the additional income.