Within the ever-evolving panorama of economic innovation, the current approval of Bitcoin ETFs stands as a watershed second, not only for digital asset lovers, however for the broader monetary markets and the political area. As we edge nearer to the 2024 elections, it is changing into more and more clear that bitcoin is ready to play a pivotal position in shaping the political discourse round digital belongings, their regulation, and their integration into the mainstream monetary ecosystem.

The Surge of Mainstream Adoption

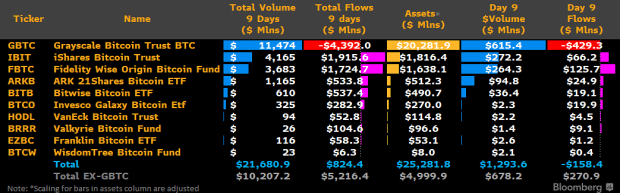

Bitcoin, as soon as a distinct segment curiosity of tech lovers and libertarians, has catapulted into the limelight, due to the sustained development in adoption and the current introduction of Bitcoin ETFs. This groundbreaking growth is just not merely a triumph for Bitcoin advocates; it signifies a leap in direction of widespread acceptance and normalization of digital belongings. By offering a regulated and acquainted funding car for Bitcoin, these ETFs bridge the hole between conventional finance and the burgeoning world of digital belongings, making Bitcoin accessible to a broader vary of buyers, together with establishments.

The involvement of institutional buyers in Bitcoin ETFs brings a stage of legitimacy and stability that was beforehand elusive within the cryptocurrency market. Establishments like pension funds, endowments, and huge asset managers are identified for his or her rigorous due diligence processes and conservative funding methods. Their entry displays a broader acceptance of Bitcoin and cryptocurrency as a professional asset class, one which deserves inclusion amongst historically conservative monetary entities.

The mainstreaming of Bitcoin is poised to have profound implications for the 2024 elections. For the primary time, Bitcoin and digital belongings are prone to emerge as a big coverage subject, one which candidates can’t afford to miss. As extra people and establishments put money into Bitcoin, public curiosity within the regulatory and coverage framework governing digital belongings is surging. This heightened curiosity will compel political candidates to develop and articulate clear positions on Bitcoin and cryptocurrency, framing it as a important part of their financial and technological platforms. Regulatory readability and strong coverage frameworks for digital belongings will turn out to be key speaking factors in election campaigns.

Digital Asset Coverage And Regulation At The Forefront Of The 2024 Elections

The 2024 elections will probably see intense debates over the long run course of the U.S. and world economies, with digital currencies enjoying a key position. Insurance policies surrounding Bitcoin and digital belongings can be indicative of broader financial methods, bearing on points of economic inclusion, the digitalization of the economic system, and the U.S.’s aggressive place within the world monetary know-how race.

The mixing of Bitcoin into mainstream finance brings with it a bunch of regulatory challenges and questions. Points like shopper safety, market stability, anti-money laundering (AML) insurance policies, and cross-border transactions are simply the tip of the iceberg. Candidates might want to navigate these advanced points, balancing the necessity for innovation-friendly insurance policies with the crucial of defending buyers and sustaining monetary stability. Moreover, candidates within the 2024 elections should contemplate the U.S.’s place within the world economic system, addressing points like worldwide cooperation on regulatory requirements and the competitors to draw and retain digital asset companies. Essentially the most close to time period subject is that of AML and terrorist financing that was surfaced by the error-filled WSJ article and has been parroted by Senator Warren an untold variety of instances. Correct knowledge, and pushing again in opposition to the worry mongering of individuals like Elizabeth Warren is extra simply executed from the bully pulpit of the Presidency.

Shifting Voter Sentiments And Demographics

As Bitcoin turns into a mainstream monetary instrument, its affect extends past funding portfolios to the very coronary heart of voter sentiment. The burgeoning class of digital asset buyers, starting from tech-savvy millennials to institutional stakeholders, represents a big and influential demographic. Their considerations and pursuits in digital foreign money coverage are prone to form the political panorama in 2024, forcing candidates to interact with a broader vary of financial points, together with the way forward for decentralized finance and the position of digital belongings within the economic system.

The evolution of voter demographics and sentiments heralds a brand new period in political campaigning, the place understanding and addressing the nuances of digital finance turns into crucial. Candidates will discover themselves navigating a posh panorama the place conventional financial insurance policies intersect with rising digital monetary applied sciences. To resonate with this rising voter base, candidates might want to exhibit not solely an understanding of digital belongings and their implications but additionally current forward-thinking methods that combine these applied sciences into their financial visions. Individuals beneath the age of 30 are seven instances extra prone to personal digital belongings than an American over 65. Primarily based on polling in Texas, we see that this pattern cuts evenly throughout occasion strains.

This shift in voter base additionally raises the bar for political discourse, demanding a extra nuanced understanding of know-how amongst political figures. Not can digital belongings be sidelined as a distinct segment curiosity; they now signify a vital part of financial discussions that may sway voter opinions. Candidates who adeptly navigate these discussions, providing progressive but pragmatic options, are prone to achieve traction amongst this pivotal demographic. The 2024 elections stand on the crossroads of conventional finance and the burgeoning digital asset business, signaling a transition in direction of a political panorama more and more formed by Bitcoin, digital asset, and monetary innovation.

The Position Of Instructional Outreach And Advocacy

Because the implications of Bitcoin ETFs permeate the mainstream, there’s an rising want for instructional outreach and advocacy. Each the general public and policymakers should be knowledgeable in regards to the nuances of Bitcoin, digital currencies and blockchain know-how. This schooling will play a vital position in shaping knowledgeable public opinion and, consequently, the electoral selections of voters. Organizations and advocates throughout the digital asset house can have an necessary position to play on this schooling and advocacy effort, serving to to demystify digital belongings for the broader public and policymakers alike. On this dynamic surroundings, the management proven by key regional councils in advancing blockchain understanding and advocating for sound insurance policies units a benchmark in driving the dialog ahead, showcasing the potential of targeted experience and strategic foresight in shaping the way forward for Bitcoin and digital belongings.

Conclusion: A New Period Of Politics

The approval of Bitcoin ETFs is greater than only a milestone for the digital asset market; it is a harbinger of a brand new period in political discourse. The mainstream adoption of Bitcoin and different digital currencies will pressure a reevaluation of financial insurance policies, regulatory frameworks, and even the very nature of economic techniques. Candidates within the 2024 elections might want to navigate this new panorama, addressing the complexities of digital belongings whereas resonating with a voter base that’s more and more knowledgeable and influenced by the world of cryptocurrency. As we method the 2024 elections, the intersection of Bitcoin, digital belongings, blockchain, and politics isn’t just a passing pattern however a basic shift within the cloth of financial and political life.

It is a visitor publish by Mark Shut. Opinions expressed are solely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.