The beneath is an excerpt from a current version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

New laws from the British Monetary Conduct Authority (FCA) have taken impact over UK companies that cope with Bitcoin and different cryptoassets, resulting in fast public disapproval.

These new laws, quietly imposed in mid-February, got here as a shock to most of the customers impacted. The FCA has already impacted a number of fee processors like PayPal and Luno, which have ceased all capacity for customers to buy Bitcoin. The primary thrust of those new laws, nevertheless, has been in creating what the FCA calls “optimistic frictions.” Piggybacking on earlier choices in 2023 to fight the rise of “finfluencers,” corresponding to banning refer-a-friend bonuses and different incentives from non-crypto funding websites, the FCA has aimed its new laws at countering “social and emotional pressures to speculate”. In the principle, this initiative amounted to at least one most controversial rule: quizzes and different competency assessments on all main exchanges, stopping customers from accessing their very own funds.

The background for brand new laws of this scale are, unsurprisingly, fairly sophisticated. For starters, the FCA is a monetary regulator that exists on the behest of the British authorities, however shouldn’t be instantly managed by it. Though the Treasury does make appointments to this board, its every day features are however unbiased of direct oversight. For instance, the FCA’s predecessor company, the Monetary Companies Authority (FSA), was based partly to curtail the apply of business self-regulation within the finance sector, which is a legally acknowledged sort of commerce affiliation. Actually, CryptoUK, the self-regulating commerce affiliation in Britain’s digital asset sphere, instantly spoke towards these new laws.

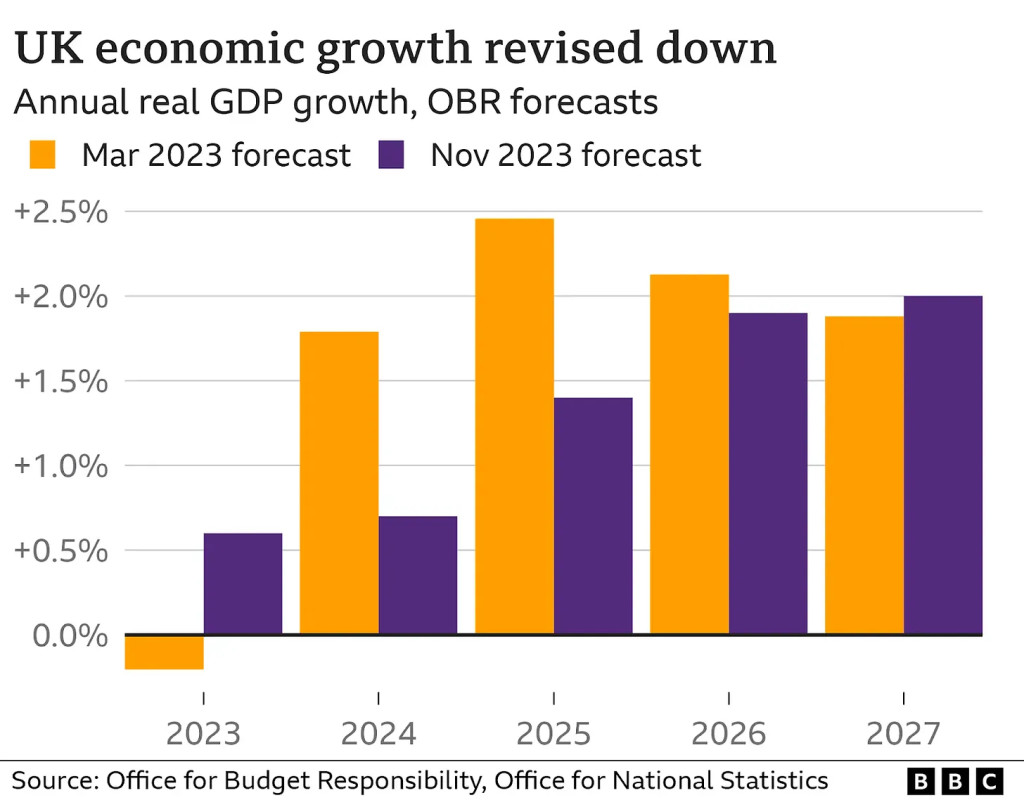

All that is to say, it’s little surprise that the FCA feels empowered to behave this unilaterally, particularly when it’d contradict a few of Parliament’s long run financial objectives. British Prime Minister Rishi Sunak has made an formidable coverage out of attempting to advertise progress within the crypto sphere. Sunak needs to make the nation a “crypto hub”, attracting worldwide capital and facilitating business growth via pleasant regulation. It’s little surprise that Sunak has recognized Bitcoin as an space of main progress: A considerable share of Britain’s present financial system is powered by related longstanding worldwide relationships on the earth of banking and finance, and expectations for the financial system because it stands have been lagging.

So, if the identical sources of earnings have been failing to fulfill expectations, why not look in the direction of a quickly rising business that would doubtlessly profit from these present ties? Sunak claimed that the primary merchandise on his pro-Bitcoin agenda has been to move clear laws round a stablecoin, however new FCA laws have additionally been very excessive up his priorities record. There’s only one query, then. Why has an agenda supposed to put exchanges beneath the “similar authorized framework that covers funding banking and insurance coverage” led to such an overreach?

For starters, the FCA has been marked for a infamous hostility to Bitcoin within the final a number of months. Though america has made worldwide headlines with its approval of a Bitcoin spot ETF, the futures ETF with extra oblique ties to bitcoin’s precise valuation has been authorized properly earlier than that. The FCA, nevertheless, established an entire shutdown of Bitcoin-related derivatives in 2021, and has not given any indication that they want to change this stance. This backwards angle places the UK not solely behind the US, but additionally most of its different largest buying and selling companions; each distinguished members of the English-speaking world like Canada and Australia in addition to the European Union have all begun embracing this multibillion greenback derivatives market. Even Hong Kong, with longstanding financial ties to Britain, has proven far higher receptiveness on this entrance.

The FCA’s conservative angle in the direction of such a large and rising business has hardly gone unnoticed, for sure. Lisa Cameron, MP and Chair of the Crypto and Digital Property All-Get together Parliamentary Group (APPG), has made public statements alongside very related strains because the studies revealed by APPG, claiming that the world of Bitcoin is of significant financial significance. Though “The APPG has been clear in its current inquiry report that..we should be sure that the U.Ok. has sturdy requirements when it comes to regulation and client safety,” stated Cameron. “The APPG is conscious that the brand new monetary promotions regime has brought about issues for some crypto and digital companies, and of studies that various operators have paused crypto purchases whereas they adapt to the brand new regime.” She went on so as to add that “Whereas client safety should stay a high precedence, authorities and regulators should additionally take care to make sure that we don’t inadvertently deter accountable and controlled operators from selecting to put money into the U.Ok.”

So, if nothing else, the priority about these laws is shared by precise legislators and never solely the group. Cameron’s criticism appears notably noteworthy in that she has solely been a part of Sunak’s social gathering since October 2023, having beforehand received 3 elections beneath an SNP ticket. Moreover, Coinbase has additionally made headlines with its January hiring of George Osborne, former Chancellor of the Exchequer, in an advisory function. Contemplating that Coinbase is among the exchanges most instantly impacted by these new guidelines, a person who was accountable for the Treasury for six years is certain to have helpful recommendation.

In different phrases, there are doable sources for opposition from a number of completely different sectors, as each authorities figures and business leaders have voiced their objection, alongside the customers as a complete. As for a timeline on the FCA altering their insurance policies, nevertheless, it’s anybody’s guess. In the meantime, there have been a number of different distinguished interactions between the British authorized system and the world of Bitcoin. Craig Wright, the so-called “Pretend Satoshi,” is at the moment concerned in a court docket case over his continued claims that he’s the true inventor of Bitcoin. If the court docket guidelines towards him, it could show the tip for a recurring episode in Bitcoin’s subculture. Equally, though america is understood for making essentially the most distinguished mass-scale seizures of Bitcoin, British regulation enforcement did handle to grab greater than £1.4 billion in bitcoin in late January.

It’s possible that the FCA’s guidelines will ultimately be loosened a method or one other, because the British authorities has put such a precedence on making these new laws pleasant to the business. If pushback is loud and diversified sufficient, it’ll be clear {that a} new course is important. Bitcoin’s financial star has been going up and up over the previous few years, and it’s manner too highly effective for unelected regulators to place up a excessive diploma of stubbornness. If we are able to see it within the US’ battle for a Bitcoin ETF, we are able to see it within the pushback to the FCA: no person is robust sufficient to problem Bitcoin’s crown.