Bitcoin (BTC), the main cryptocurrency by market capitalization, is dealing with renewed bearish strain as its value falls beneath the 1-day Easy Shifting Common (SMA). This technical indicator, extensively utilized by merchants to gauge market traits, alerts a possible continuation of the downward trajectory for BTC.

As Bitcoin targets new lows, the breach of the 1-day SMA underscores rising bearish sentiment and heightened volatility available in the market. Traders and analysts are intently monitoring this growth, as it could point out additional declines and set the stage for Bitcoin to check decrease help ranges.

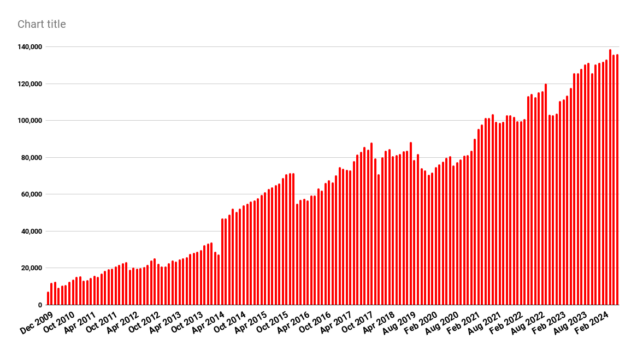

With a market capitalization of greater than $1.3 trillion and a buying and selling quantity of greater than $25 billion as of the time of writing, the worth of Bitcoin is presently down by 1.49%, buying and selling at round $66,133 within the final 24 hours. BTC market cap and buying and selling quantity are presently down by 1.52% and 4.84% respectively.

Bitcoin Market Sentiment Turns Bearish

On the 4-hour chart, the worth of BTC appears to be like bearish as it’s presently buying and selling beneath the 100-day easy transferring common. It may also be noticed right here that Bitcoin is trying an additional transfer in direction of the $64,515 help degree.

The composite pattern oscillator on the 4-hour chart additionally alerts a bearish signal as each the sign line and SMA of the indicator are presently trending within the oversold zone. Because it stands now, these two will linger there for some time thereby sending the worth bearish.

A cautious take a look at BTC value motion on the 1-day chart exhibits that there’s at all times a profitable break of the worth beneath the 100-day SMA. Presently, the crypto asset appears to be trying a short-term retracement earlier than dropping additional.

Moreover, the formation of the 1-Day Composite Development Oscillator alerts a bearish fall forward as each the sign line and the SMA of the indicator after crossing one another are descending in direction of the zero line and will drop beneath this level.

Key Assist Ranges To Watch

Presently, there are 4 key help ranges $64,515, $60,158, $56,523, and $50,604 to look out for respectively. If the worth of Bitcoin continues bearish as predicted, it would begin to transfer downward towards the $64,515 help degree. Within the occasion of a break beneath this degree, BTC will decline additional to check the $60,158 degree and presumably different help ranges.

Nonetheless, provided that the digital asset fails to say no additional as predicted and decides to start out a transfer upward, it would start to maneuver towards the $71,909 resistance degree. It may transfer even increased to problem the $73,811 resistance degree if it breaks above the aforementioned degree and presumably strikes on to create a brand new excessive.

Featured picture from iStock, chart from Tradingview.com