Provided that the market has lately pushed up the worth of Bitcoin as soon as once more to the pivotal $65,000 degree, merchants and traders are presently seeing large earnings from their positions, particularly holders of the crypto asset within the quick time period.

Quick-Time period Bitcoin Holders In The Inexperienced

A latest report from the world’s main on-chain and knowledge platform, Glassnode, reveals a major enhance in revenue dominance for the short-term holders of Bitcoin. This rise in revenue supremacy is available in gentle of latest optimistic value actions in BTC and the final market.

After weeks of volatility and consolidation, the worth of BTC has recovered notably, placing a better proportion of short-term merchants in revenue. As costs rise, short-term traders are benefiting from the scenario, additional driving the upward momentum of the crypto asset.

In response to Glassnode, the short-term holders of BTC presently are dominating the market when it comes to earnings with their Revenue/Loss Ratio buying and selling at 1.2. Glassnode highlighted that the metric lately breached a 1 normal deviation above its 90-day imply, suggesting a potential enchancment in traders’ temper.

As Bitcoin continues to showcase progress, this improvement is believed to influence future value actions and the path of the market as a complete.

Whereas short-term holders are seeing large earnings as a result of latest value upswing, Glassnode, in a earlier publish, identified a possible volatility forward because of a decline in Open Curiosity. A lower in open curiosity implies that merchants are closing their positions due to heightened value volatility, triggering worry and uncertainty amongst traders.

The platform famous that through the rally final weekend, about $2.5 billion in futures in futures open curiosity was closed, which signifies a flushing of quick sellers. Nonetheless, the open curiosity discount on the highest 3 perpetual exchanges fell wanting the 5% degree, making the market susceptible to volatility and potential squeezes on leveraged merchants.

BTC’s Worth Maintains Current Tempo

Buyers’ optimism round Bitcoin is brewing following a latest value rebound witnessed on Monday. The crypto asset has displayed sturdy value efficiency ever since, holding firmly above the $65,000 degree after recovering the mark.

Prior to now day, BTC has recorded an almost 3% enhance, buying and selling at $65,660. In the meantime, within the broader outlook, just like the weekly and month-to-month time frames, the crypto asset has risen by over 5% and 9%, respectively.

Contemplating Bitcoin’s renewed energy, a number of analysts consider that the transfer might be a part of a a lot larger rally, presumably to new all-time highs within the quick time period or earlier than the tip of the yr.

In accordance to Captain Faibik, a crypto knowledgeable, BTC’s motion up to now has been good. It has shaped a wedge sample and is as soon as once more drawing nearer to the $68,000 key resistance. If BTC breaks out of the wedge sample, Faibik is assured that costs might soar to $88,000 and $90,000 in November.

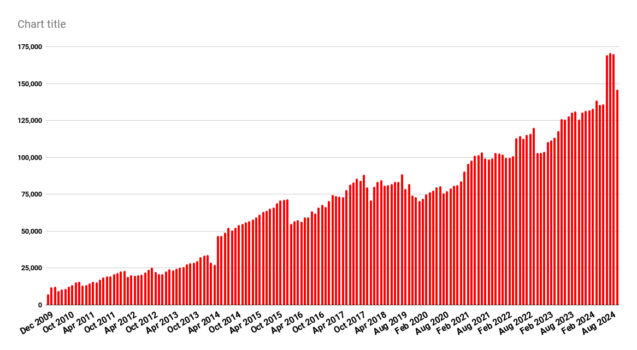

Featured picture from Unsplash, chart from Tradingview.com