The next is a visitor article from Vincent Maliepaard, Advertising Director at IntoTheBlock.

As Bitcoin surpassed its all-time excessive earlier this yr, pushed by institutional curiosity, many anticipated the same surge within the decentralized finance (DeFi) area. With DeFi surpassing $100 billion in whole worth locked (TVL), it was the right time for establishments to leap on board. Nevertheless, the anticipated flood of institutional capital into DeFi has been slower than predicted. On this article, we’ll discover the important thing challenges hindering institutional DeFi adoption.

Regulatory Hurdles

Regulatory uncertainty is maybe probably the most vital roadblock for establishments. In main markets just like the U.S. and the EU, the unclear classification of crypto property—particularly stablecoins—complicates compliance. This ambiguity drives up prices and deters institutional involvement. Some jurisdictions, equivalent to Switzerland, Singapore, and the UAE, have embraced clearer regulatory frameworks, which has attracted early movers. Nevertheless, the shortage of world regulatory consistency complicates cross-border capital allocation, making establishments hesitant to enter the DeFi area with confidence.

Furthermore, regulatory frameworks like Basel III impose stringent capital necessities on monetary establishments that maintain crypto property, additional disincentivizing direct participation. Many establishments are choosing oblique publicity by means of subsidiaries or specialised funding automobiles to sidestep these regulatory constraints.

Nevertheless, Trump’s workplace is anticipated to prioritize innovation over restrictions, probably reshaping U.S. DeFi laws. Clearer tips might decrease compliance limitations, entice institutional capital, and place the U.S. as a pacesetter within the area.

Structural Limitations Past Compliance

Whereas regulatory points usually dominate the dialog, different structural limitations additionally stop institutional DeFi adoption.

One outstanding problem is the shortage of appropriate pockets infrastructure. Retail customers are well-served by wallets like MetaMask, however establishments require safe and compliant options, equivalent to Fireblocks, to make sure correct custody and governance. Moreover, the necessity for seamless on-and-off ramps between conventional finance and DeFi is essential for decreasing friction in capital stream. With out sturdy infrastructure, establishments battle to navigate between these two monetary ecosystems effectively.

DeFi infrastructure requires builders with a extremely particular skillset. The skillset required usually differs from conventional finance software program growth and also can fluctuate blockchain by blockchain. Establishments which can be solely trying to deploy in probably the most liquid methods, will probably should deploy into a number of blockchains which may enhance overhead and complexity.

Liquidity Fragmentation

Liquidity stays one among DeFi’s most persistent points. Fragmented liquidity throughout numerous decentralized exchanges (DEXs) and borrowing platforms poses dangers equivalent to slippage and dangerous debt. For establishments, executing massive transactions with out considerably affecting market costs is important, and shallow liquidity makes this tough.

This could create conditions the place establishments should execute transactions over a number of blockchains to carry out one commerce, including to complexity and growing threat vectors on the technique. To draw institutional capital, DeFi protocols should create deep and concentrated liquidity swimming pools able to supporting very massive trades.

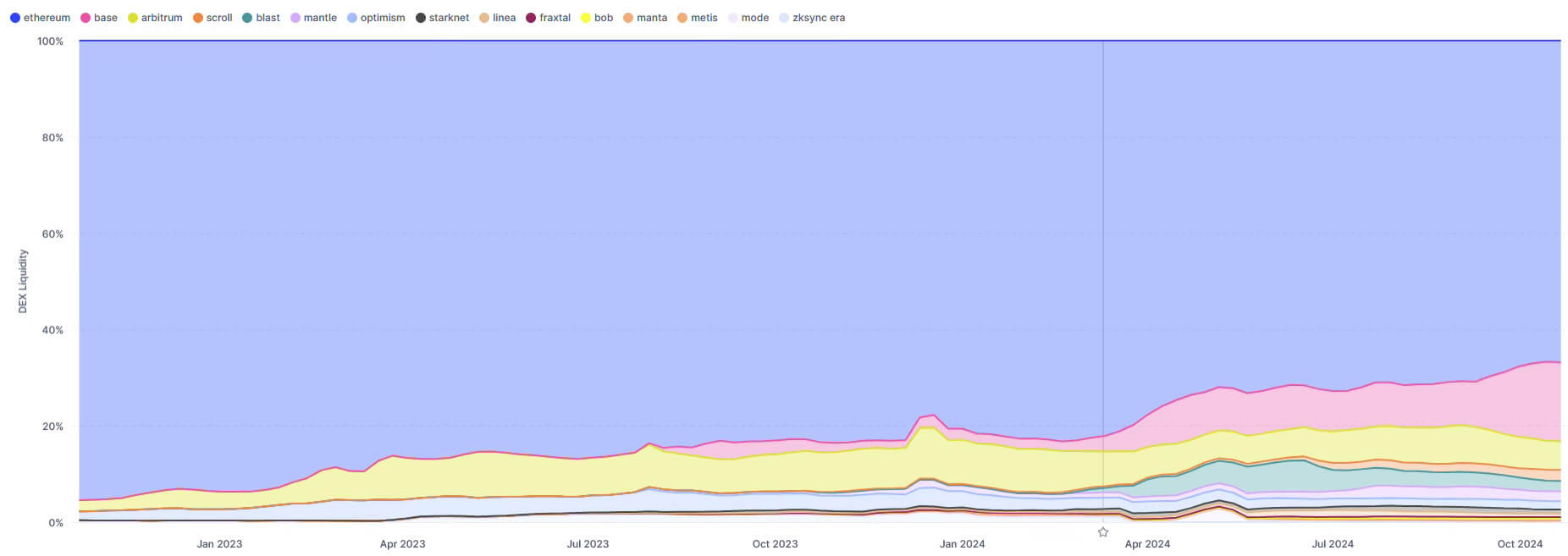

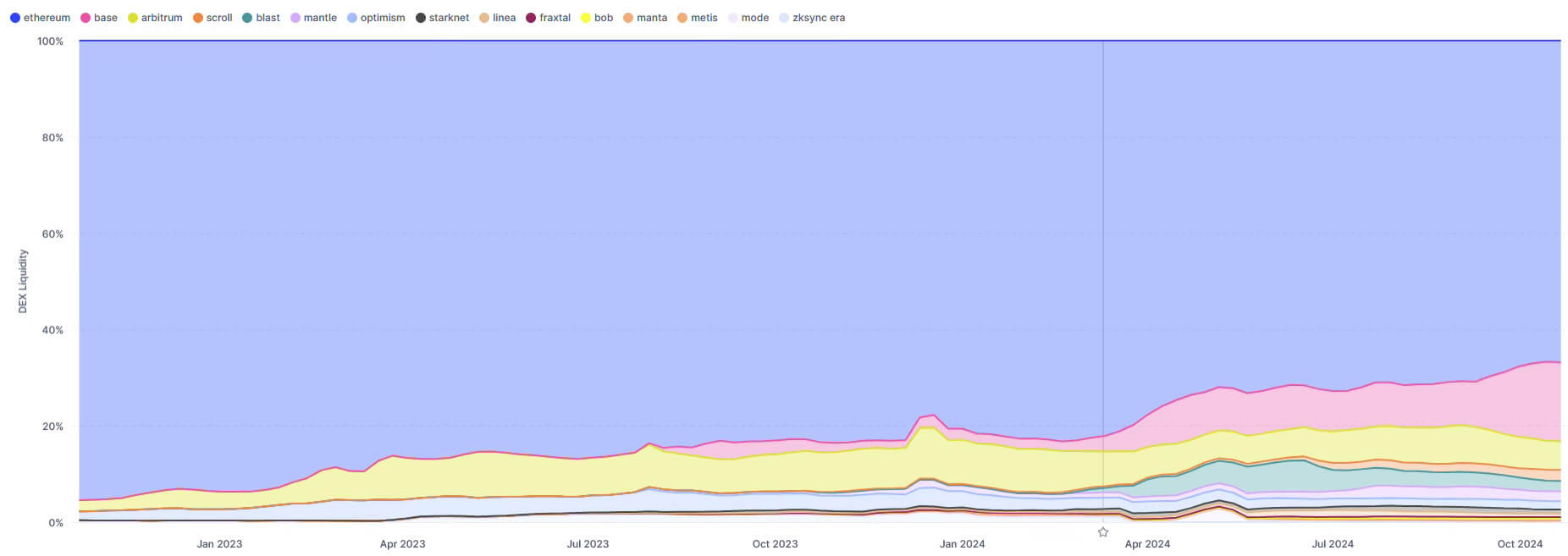

A superb instance of liquidity fragmentation may be seen with the evolution of the Layer 2 (L2) blockchain panorama. Because it turns into cheaper to construct and transact on L2 blockchains, liquidity has migrated away from Ethereum mainnet. This has diminished liquidity on mainnet for sure property and trades, due to this fact decreasing the scale of deployment that establishments could make.

Whereas applied sciences and infrastructure enhancements are in growth to resolve many liquidity fragmentation points, this has been a key blocker for institutional deployment. That is very true for deployments onto L2s the place liquidity and infrastructure points are extra pronounced than on mainnet.

Danger Administration

Danger administration is paramount for establishments, particularly when participating with a nascent sector like DeFi. Past technical safety, which mitigates hacks and exploits, establishments want to grasp the financial dangers inherent in DeFi protocols. Protocol vulnerabilities, whether or not in governance or tokenomics, can expose establishments to vital dangers.

To compound these complexities, the shortage of insurance coverage choices at institutional dimension to cowl massive loss occasions like a protocol exploit, usually implies that solely the property earmarked for top R/R get allotted to DeFi. Which means decrease threat funds that is likely to be open to BTC publicity aren’t deploying into DeFi. Moreover, liquidity constraints—equivalent to the shortcoming to exit positions with out triggering main market impacts—make it difficult for establishments to handle publicity successfully.

Establishments additionally want refined instruments to evaluate liquidity dangers, together with stress testing and modeling. With out these, DeFi will stay too dangerous for institutional portfolios, which prioritize stability and the flexibility to deploy or unwind massive capital positions with minimal publicity to volatility.

The Path Ahead: Constructing Institutional-Grade DeFi

To draw institutional capital, DeFi should evolve to satisfy institutional requirements. This implies growing institutional-grade wallets, creating seamless capital on-and-off ramps, providing structured incentive packages, and implementing complete threat administration options. Addressing these areas will pave the best way for DeFi to mature right into a parallel monetary system, one able to supporting the size and class required by massive monetary gamers.

By constructing the suitable infrastructure and aligning with institutional wants, DeFi has the potential to rework conventional finance. As these enhancements are made, DeFi is not going to solely entice extra institutional capital but in addition set up itself as a foundational part of the worldwide monetary ecosystem, ushering in a brand new period of economic innovation.

This text relies on IntoTheBlock’s newest analysis paper about the way forward for institutional DeFi.

Talked about on this article