Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

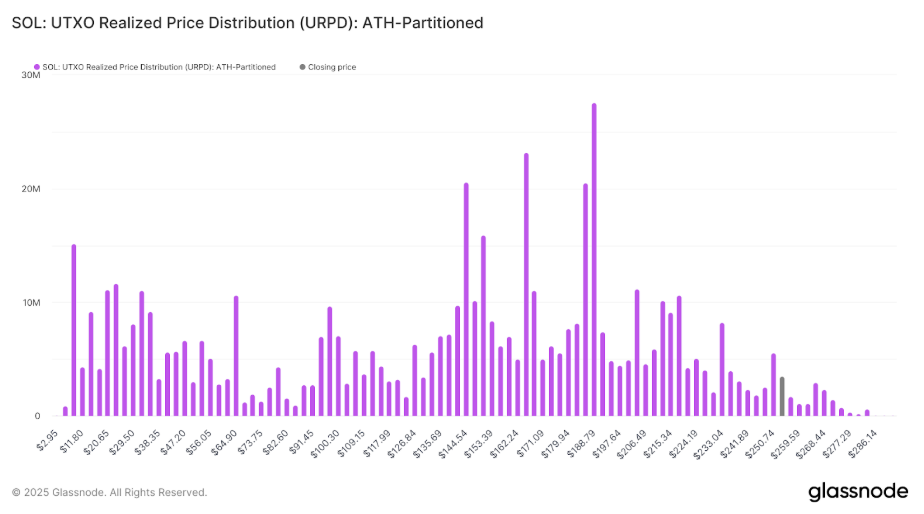

Solana’s value motion is being formed by investor habits at key value ranges, as revealed by new on-chain knowledge from Glassnode. Massive clusters of merchants have fashioned at each ends of the present buying and selling vary, which at the moment are taking part in a central position in how Solana strikes within the brief time period. That is very true as total Solana buying and selling exercise and market participation proceed to decelerate.

$144 Resistance Builds As Break-Even Sellers Line Up

In accordance with Glassnode’s URPD chart, Solana’s provide distribution reveals a pointy cluster of holdings at $144, the place 27 million SOL, shut to five% of the whole provide, is presently concentrated. This stage has now develop into a take a look at of resistance for Solana’s value motion up to now few days.

Associated Studying

What makes this zone significantly important is its historic context. On January 19, when SOL reached its all-time excessive, this similar stage already held 20.6 million tokens. The rise in holdings since then signifies that many buyers are sitting close to their entry factors and could also be inclined to promote as soon as costs revisit $144 to interrupt even. This creates a psychological barrier that might stall and even reverse rallies if bullish momentum proves too weak to overpower profit-taking at this zone.

Beneath this resistance lies one other main provide wall at $135, the place 26.6 million SOL is presently held. Taken collectively, these two zones are prone to cap upward motion until quantity surges dramatically or there are new bullish occasions that can appeal to stronger demand.

Picture From X: Glassnode

Lengthy-Time period Holders Reinforce Positions To Kind Robust Help At $112

A Solana value help can also be forming with notable power, particularly across the $112 area. Glassnode’s knowledge exhibits that 9.7 million SOL, roughly 1.67% of the provision, is now positioned at this stage. Again on January 19, solely 4 million SOL tokens had been held right here.

Due to this fact, the rise to 9.7 million SOL tokens signifies that long-term buyers have doubled down and strengthened their price foundation after the decline in current weeks. This alerts a excessive likelihood of value protection within the face of promoting strain, as these holders are seemingly dedicated to sustaining their positions slightly than slicing losses.

Beneath $112, nonetheless, the protection web begins to skinny. The $94 to $100 vary collectively holds practically 21 million SOL, however beneath that, there’s a large void. Between $94 and $56, provide thins out dramatically, indicating a possible “air pocket” in value motion. If the $100 mark collapses, Solana might expertise a powerful drop because of the absence of sturdy purchaser curiosity on this decrease vary.

Additional complicating the outlook is Solana’s steadily declining velocity, which has now sunk to its lowest level in 5 months. This metric, which tracks how usually SOL adjustments arms, has reverted to ranges final seen in October 2024.

Such a pointy decline in circulation displays a transparent drop in investor engagement. This dwindling exercise exacerbates bearish sentiment, suggesting that even with help at $112, a muted market response could restrict restoration efforts.

SOL: Velocity. Picture From Glassnode

Associated Studying

On the time of writing, Solana is buying and selling at $131. Solana has spent the previous seven days buying and selling between the higher finish of $135 and the decrease finish of $122.

Featured picture from Cash.ph, chart from TradingView