Plus: UK thinks crypto is dangerous for the economic system (…okay then)

GM. We’re the banana bread of crypto – turning overripe market moments into one thing tremendous good.

🤔 Can gold-backed stablecoins take over?

🍋 Information drops: crypto taxes within the UK, Sonic brings again Terra-type PTSD + extra

🍍 Market taste right this moment

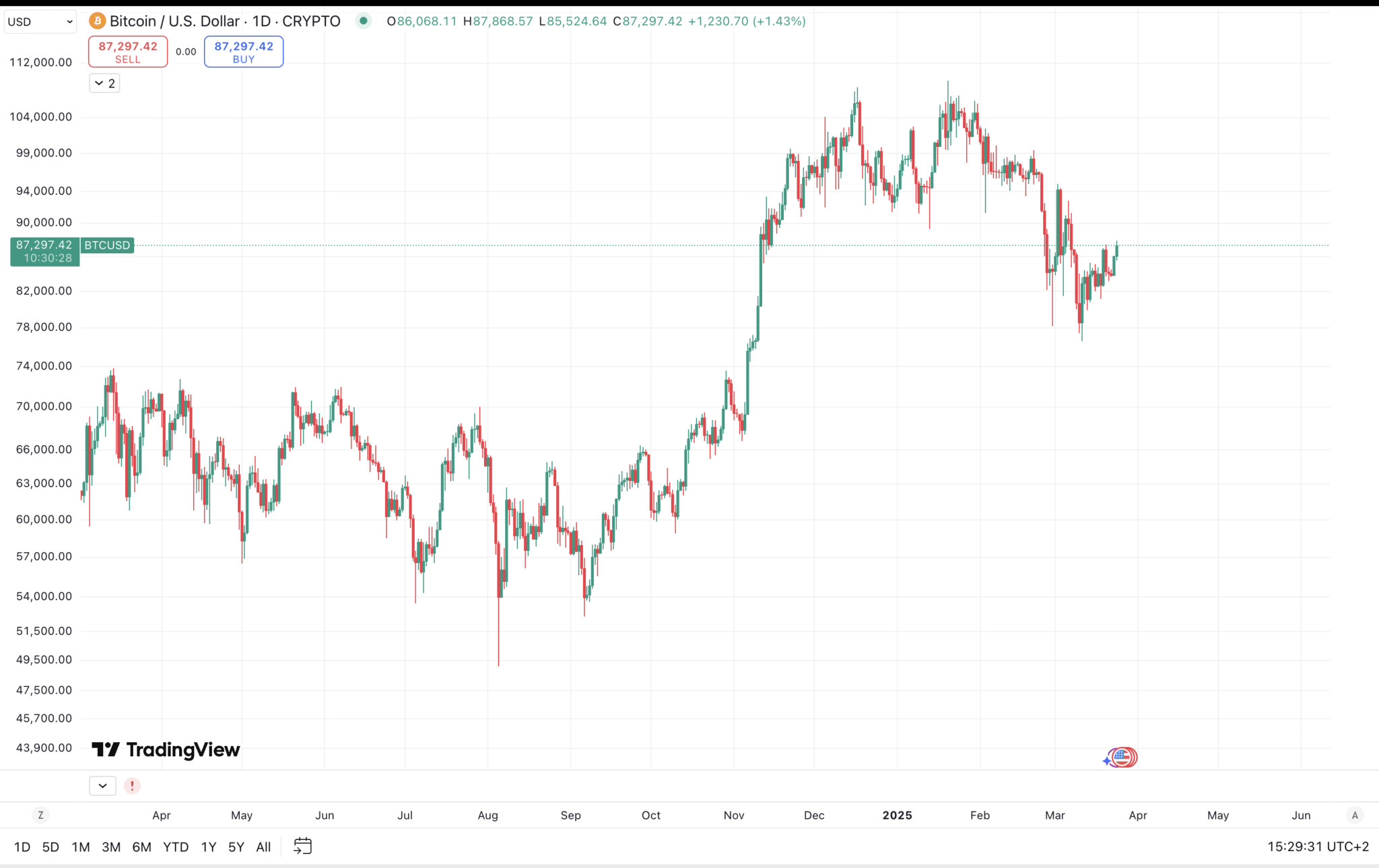

After spending the weekend stress-eating in Concern, the market has calmed down sufficient to hit Impartial right this moment.

And Bitcoin managed to seek out assist at $84K over the weekend.

10x Analysis thinks BTC is likely to be forming a backside right here – and it is not purely hopium-driven:

Donald Trump appears to be softening up on the entire tariff factor. He’s now speaking about concentrating on particular industries as a substitute of the across-the-board tariffs he initially threatened;

Additionally, the Fed did not overreact to the latest US inflation report.

All that’s helped cut back uncertainty within the markets, which is often factor for crypto.

10x famous that their technical indicators – which have predicted previous rallies – are flashing bullish alerts once more.

BUT they imagine there’s nonetheless no robust catalyst but to ship Bitcoin skyrocketing instantly.

Daan Crypto Trades says that issues might flip extra optimistic if BTC can climb again into its previous worth vary between $90.8K and $108.4K – this could probably enhance sentiment and open the door to new highs.

If not, we would see it fall again to the summer season 2024 assist zone – someplace round $73K – $74K.

Nonetheless, he’s not too involved until Bitcoin begins closing beneath $70K with out a clear cause. Till then, he stays bullish.

In actual fact, Stockmoney Lizards say everybody yelling “bear market” proper now could be simply noise, as a result of the present dip appears completely regular.

BTC has a behavior of occurring massive runs after which coming again to check its common worth.

(It did it at $30K, once more at $72K, and now it’s taking place another time.)

They estimate the underside zone might be round $76K, give or take just a few thousand. And even when issues dip decrease (worst case: $72K), it doesn’t break the bull development.

So yeah, it’s principally a ready sport for now… yesss, I do know, that is not thrilling – however it’s higher than panic-selling on the backside.

🥝 Memecoin harvest

From “who requested?” to “why didn’t I purchase?” in 24 hours 📈

Knowledge as of 07:30 AM EST.

Try these memecoins and many extra right here.

Everybody is aware of that the coldest dawg within the stablecoin yard is the US greenback. Simply test the worldwide high 10 stablecoins: they’re all using the USD practice.

Even Trump’s observed the facility play right here. One in every of his important missions is to maintain the greenback king of world finance – and he’s planning to make use of stablecoins because the software to make that occur.

However wait… Max Keiser has entered the chat.

(And he is not just a few opinionated rando on X. He is really the crypto advisor to President Nayib Bukele in El Salvador – aka the man who made Bitcoin authorized tender there.)

His spicy take: a gold-backed stablecoin would possibly really beat the USD-based one on world markets.

Let’s break down his pondering.

First off, the US greenback is consistently shedding worth due to inflation = you’re assured to lose buying energy.

Now, you would possibly say, “What about Bitcoin then? Isn’t that deflationary?” Positive, however let’s be sincere – it’s approach too risky for this use case.

Gold, tho’? In line with Max, it is the blissful center floor:

Doesn’t swing like Bitcoin;

Doesn’t get slowly destroyed by inflation just like the greenback;

Normally rises when costs on the earth go up – which makes it a strong inflation hedge.

And right here’s the place it will get geopolitical. Max says international locations like Russia, China, Iran, or Saudi Arabia aren’t more likely to settle for a USD-backed stablecoin – cuz it might simply hand extra energy to the US.

They’d moderately construct one thing impartial of US management, and gold suits the invoice: it’s impartial, international, and sanction-proof.

Plus, Max claims China and Russia would possibly secretly maintain as much as 50K tonnes of gold – far more than reported. If true, they’d have the facility to launch a gold-backed stablecoin (…or a minimum of scare the US by hinting at it).

Whereas his argument does have legs, the logic will get a bit wobbly once you actually give it some thought:

Scaling a gold-backed stablecoin isn’t nearly proudly owning gold – you want huge infrastructure to retailer, audit, and show it’s actual. If folks don’t belief it, it gained’t work;

Transferring gold is gradual and costly. Tokenizing helps, however you continue to should again each token with precise gold – and belief stays a problem;

Even when Russia or China launches one, US allies prolly gained’t contact it. And with out huge adoption, it’s laborious to grow to be “the” international stablecoin.

However you realize what is the enjoyable half? Even when this principle does play out, it’d nonetheless be good for crypto 😎

Stablecoins are the bridge between crypto and TradFi – and proper now, that bridge is owned by the US greenback (= you’re nonetheless locked into the US monetary system, laws, and insurance policies).

But when international locations begin dropping their very own gold-backed stablecoins, that would shake issues up. Instantly, we’ve obtained a number of bridges. Extra choices. Much less dependency on US methods. And fewer methods for governments to dam, freeze, or management your funds.

It additionally opens up new markets. A number of international locations don’t vibe with the greenback (for political causes, sanctions, or simply beef) – so a gold-backed stablecoin might be their ticket to hitch crypto.

This opens doorways for adoption – and extra adoption = stronger ecosystem = extra worth in the long term.

So, are you workforce greenback or workforce gold? Actually, would not matter – we’re all workforce crypto right here, and crypto’s successful both approach.

Now you are within the know. However take into consideration your mates – they in all probability don’t know. I ponder who might repair that… 😃🫵

Unfold the phrase and be the hero you realize you’re!

🍋 Information drops

🇬🇧 Lisa Gordon, chair of funding financial institution Cavendish, thinks the UK ought to tax crypto purchases to push Brits towards investing in native shares as a substitute. Why? As a result of she says that crypto is principally ineffective for the economic system – in contrast to shares.

💰 US officers wanna return $7M to victims of a crypto rip-off. The scammers earned their belief after which pointed them to pretend websites that appeared like legit funding platforms.

🎬 Think about watching a overseas film, however the actors’ mouths transfer completely in English. That’s what’s taking place in Watch the Skies – a Swedish movie dubbed utilizing AI to make it appear to be the solid is definitely talking English.

🤔 Sonic’s cooking up a brand new yield-generating algorithmic stablecoin with as much as 23% APR. However the co-founder’s nonetheless traumatized from the Terra catastrophe and isn’t positive in the event that they’re able to unleash it.

⚖️ John Reed Stark, former SEC official, argues that digital belongings ought to nonetheless depend as securities underneath present legal guidelines. He stated crypto patrons aren’t collectors – they’re traders, and that’s who the SEC is supposed to guard.