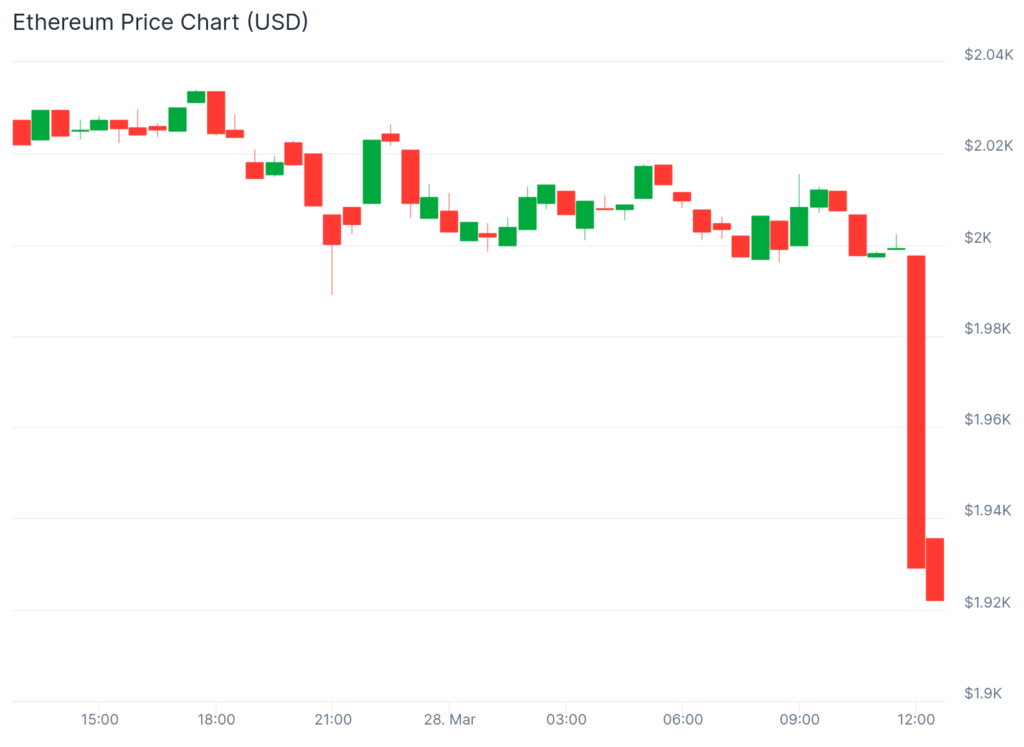

Just lately, ETH supporters witnessed a sudden plunge beneath $1,900, triggering market panic together with hypothesis and doubts concerning the latest efficiency of the world’s second-largest cryptocurrency.

ETH Unexpectedly Plummets to $1,900, Dragging Down the Crypto Market

In the present day, Ethereum ETH has all of a sudden skilled a pointy decline, dropping to $1,900. It is a degree that has despatched shockwaves by the cryptocurrency market. This transfer has sparked widespread buzz amongst ETH holders and the crypto market as an entire.

Supply: Coingecko

This sudden plunge has not occurred in isolation. It has triggered a domino impact, knocking down main altcoins’ costs, together with Ripple XRP, Solana SOL, and Cardano ADA. Even Bitcoin BTC, the market chief, has not been proof against this downward stress, recording a noticeable dip in its worth. The deep fall in ETH’s value has left traders and merchants scrambling to evaluate the state of affairs, elevating questions on what might have sparked this dramatic sell-off.

Supply: Coingecko

Analysts level to a mixture of things which will have contributed to ETH’s steep decline. Market sentiment has been shaky in latest weeks attributable to macroeconomic uncertainties, regulatory issues, and profit-taking after a interval of relative stability.

The cascading impact on altcoins highlights Ethereum’s pivotal position within the crypto ecosystem, as its actions typically dictate tendencies for smaller tokens. Bitcoin, although extra resilient, has additionally felt the pressure, underscoring the interconnected nature of the market. For now, the crypto neighborhood is on edge, watching carefully for indicators of stabilization or additional drops.

Market Predictions and Liquidity Issues

Wanting forward, the instant way forward for ETH and the broader crypto market stays unsure, significantly over the weekend. Virtually, ETF funds and institutional gamers, which regularly inject important liquidity into the market, don’t function throughout weekends. This lack of exercise usually leads to decrease buying and selling volumes and lowered liquidity, which means the market might stay stagnant or unstable with out contemporary capital inflows.

Consequently, consultants counsel that any main value restoration or shift—whether or not upward or downward—is unlikely to materialize till the next week when buying and selling exercise resumes in full drive.

For ETH holders and crypto lovers, this might imply a interval of cautious statement. The $1,900 degree might act as a psychological assist zone, but when it fails to carry, additional declines may very well be on the horizon. Conversely, a resurgence of shopping for curiosity early subsequent week might spark a rebound. Till then, the market’s subsequent massive transfer hinges on exterior catalysts and the return of institutional participation, leaving merchants to brace for a tense few days forward.

Learn extra: What’s Ethereum?