Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

As Bitcoin (BTC), the market’s main cryptocurrency, continues to development decrease, current insights from business specialists spotlight essential elements influencing BTC’s trajectory.

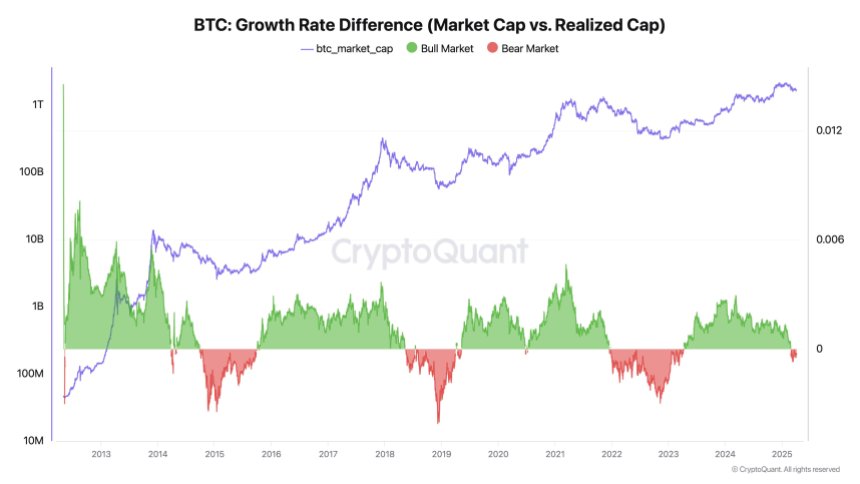

In response to Ki Younger Ju, CEO of market intelligence agency CryptoQuant, the present Bitcoin bull cycle could also be coming to an finish. This assertion is grounded within the idea of Realized Cap, a metric that quantifies the precise capital getting into the BTC market by means of on-chain exercise.

Insights From Ki Younger Ju

For context, the Realized Cap metric operates on a simple premise: when Bitcoin enters a pockets, it represents a purchase order, and when it leaves, it signifies a sale.

By calculating the common value foundation for every pockets and multiplying it by the quantity of BTC held, Ju derives the whole Realized Cap. This metric displays the whole capital that has genuinely entered the BTC ecosystem, contrasting sharply with market capitalization, which is decided by the final traded value on exchanges.

Associated Studying

A standard false impression, in accordance to Ju, is {that a} small buy, similar to $10 value of Bitcoin, solely will increase market capitalization by that very same quantity. In actuality, costs are influenced by the steadiness of purchase and promote orders on the order e-book.

Low promote strain signifies that even modest buys can considerably elevate costs and, consequently, market cap. This phenomenon was notably exploited by MicroStrategy (MSTR), which issued convertible bonds to accumulate Bitcoin, thereby inflating the paper worth of its holdings far past the preliminary capital deployed.

Key Worth Ranges For Bitcoin

Presently, Bitcoin seems to be in a difficult place, dropping beneath the important thing $80,000 mark. When promote strain is excessive, even substantial purchases fail to have an effect on costs, as seen when Bitcoin traded close to its all-time excessive of practically $100,000. Regardless of huge buying and selling volumes, the worth remained stagnant.

Ju factors out that if Realized Cap is growing however market cap is both flat or declining, it alerts a bearish development. This means that whereas capital is getting into the market, it’s not translating into value appreciation—a trademark of a bear market.

Conversely, if market capitalization is rising whereas Realized Cap stays steady, it means that even minimal new funding is driving costs up, indicative of a bull market.

Presently, information means that Bitcoin is experiencing the previous situation: capital is flowing in, however costs will not be responding positively. Traditionally, important market reversals require at the very least six months to manifest, making a short-term rally appear unlikely.

Associated Studying

Including to the complexity, market professional Ali Martinez has recognized key resistance ranges that Bitcoin should overcome to regain upward momentum.

Notably, there’s a main resistance cluster at $87,000, the place the 50-day transferring common, 200-day transferring common, and a descending trendline from the all-time excessive converge.

For Bitcoin to renew its upward trajectory, the professional asserts that BTC should break by means of essential resistance factors at $85,470 and $92,950. Moreover, assist at $80,450 stays very important; failure to carry this degree may result in additional declines.

As of now, the main cryptocurrency trades at $78,379, recording a 6% decline on Sunday.

Featured picture from DALL-E, chart from TradingView.com