Since Bitcoin reclaimed the $90K degree on Tuesday, market sentiment has began to shift dramatically. After weeks of uncertainty and sideways motion, Bitcoin’s sturdy value restoration is bringing a wave of optimism again into the crypto house. Value motion is signaling the potential begin of a serious restoration rally, with bulls gaining momentum and eyeing increased resistance ranges.

Nonetheless, traders should stay cautious. World tensions, notably the continued commerce struggle between the US and China, proceed to solid a shadow over monetary markets. These geopolitical elements may closely affect Bitcoin’s trajectory within the coming months—and even years—relying on how negotiations evolve.

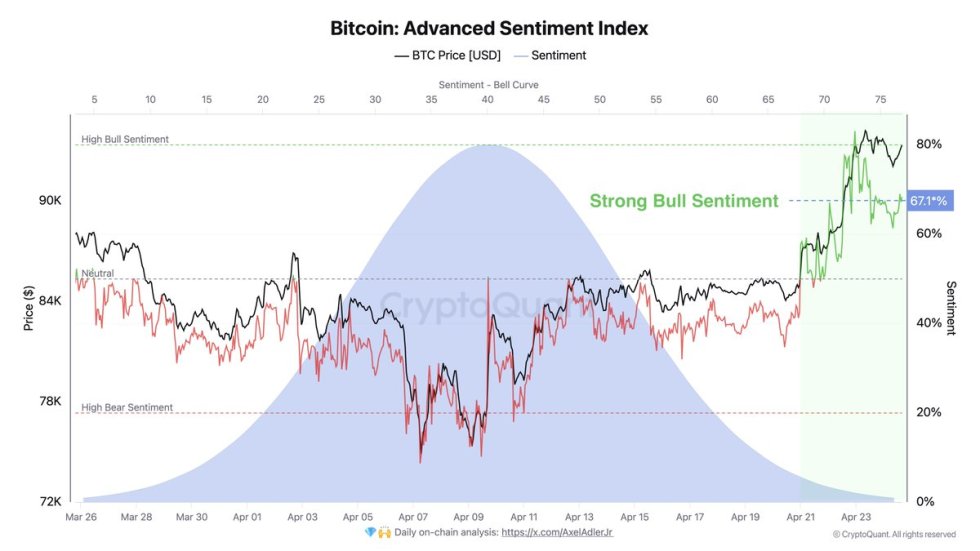

Regardless of these dangers, new information from CryptoQuant helps the rising bullish narrative. The Bitcoin Superior Sentiment Index has climbed to a robust studying of 67%, suggesting that confidence is returning amongst market individuals. Traditionally, such elevated sentiment ranges have been linked with sustained bullish tendencies, particularly when strengthened by stable technical breakouts.

Bitcoin Faces Turning Level As Bulls Achieve Brief-Time period Management

Bitcoin is getting into a pivotal second that would form the following part of the market. After reclaiming key resistance ranges and pushing above $90K, bulls at the moment are in charge of short-term value motion. The query is whether or not this momentum may be sustained, or if a deeper correction nonetheless lies forward.

World instability, particularly the continued commerce tensions between the US and China, continues to cloud the outlook. Provide chain dangers, unsure financial coverage, and geopolitical pressures are protecting markets on edge. Whereas crypto has usually been seen as a hedge towards such macroeconomic stress, it stays weak to shifts in world sentiment.

Regardless of the dangers, some analysts are assured. High analyst Axel Adler acknowledged on X: “I don’t suppose bears within the futures market have any probability.” Referencing the overwhelming bullish positioning in derivatives markets. Futures open curiosity and funding charges are each rising, indicating rising confidence amongst merchants.

Nonetheless, this sort of surge have to be supported by spot market demand to maintain the rally. If consumers are concentrated solely in leveraged markets, the value could lack the actual backing wanted for a long-term breakout. With out regular spot accumulation, promoting strain may finally overtake momentum.

BTC Value Pushes Ahead, However Key Resistance Looms

Bitcoin is buying and selling at $94,200 after a short dip to $91,000 earlier at this time, displaying resilience as bulls proceed to dominate short-term momentum. The bounce from the decrease ranges reinforces the concept consumers are stepping in rapidly to defend key assist zones. Nonetheless, the actual problem lies simply forward.

To substantiate the sustainability of this restoration rally, BTC should decisively reclaim the $95,000–$96,000 vary. This zone stays a vital resistance space, and a breakout above it might seemingly set off the following leg up towards $100,000. Nonetheless, analysts warning that this transfer won’t occur instantly.

As an alternative, Bitcoin may enter a consolidation part beneath $95,000 for a number of days and even weeks because the market absorbs latest features. This is able to permit sentiment and construction to reset with out invalidating the general bullish pattern. Holding above the $90K–$91K zone throughout any retests shall be important to keep up bullish confidence.

For now, bulls stay in management, however the subsequent breakout wants sturdy quantity and continued demand to keep away from one other rejection. Till then, merchants ought to be ready for uneven value motion as BTC navigates this key resistance area.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.