As BlackRock accelerates its growth into digital belongings in 2025, the divergence between Bitcoin and Ethereum in institutional adoption has change into more and more pronounced. In a interview on the Empire podcast, Samara Cohen, Senior Managing Director and Chief Funding Officer of ETF and Index Investments at BlackRock, supplied a uncommon window into how the world’s largest asset supervisor views the 2 largest crypto belongings — and why Bitcoin stands decisively forward of Ethereum in consumer demand and portfolio integration.

BlackRock’s historic launch of the iShares Bitcoin Belief (IBIT) marked a pivotal second within the agency’s digital asset technique. “It was all three of these issues,” Cohen stated, referring to the components that drove the Bitcoin product launch. “However it actually did begin with the funding thesis and consumer demand to market construction and readiness to clearly the regulatory backdrop.” Cohen emphasised that earlier than any regulatory greenlight, BlackRock’s choice was rooted within the robust want from buyers to entry Bitcoin as a part of diversified portfolios.

The launch of IBIT was not BlackRock’s first transfer into Bitcoin. In 2022, the agency launched a personal Bitcoin belief for institutional shoppers, a crucial inner milestone. “We didn’t get hands-on to precise Bitcoin till we launched that institutional product in 2022,” Cohen defined. “That was an important institutional second for us to only get comfy with the workflows and the chance administration and the techniques.”

The demand for Bitcoin was each broader and deeper than many had anticipated. IBIT has change into probably the most profitable ETP launch in historical past, a reality Cohen attributes partially to a beforehand untapped phase of buyers. “Broadly talking, about half of IBIT’s holders proper now are what we name self-directed buyers,” she famous. “For 3/4 of that inhabitants, they arrange a brokerage account in some circumstances and purchased their first ETP as a result of they needed their Bitcoin within the ETP wrapper.”

Bitcoin Vs. Ethereum

This stands in sharp distinction to Ethereum, the place Cohen’s tone was notably extra cautious. Whereas BlackRock has additionally launched Ethereum-based ETPs, demand has been far much less sturdy. “Ethereum continues to be a distant second,” she stated when discussing institutional investor curiosity. Not like Bitcoin, which is more and more considered as a possible retailer of worth and a diversifying asset class, Ethereum’s funding thesis has but to solidify on the institutional degree.

Cohen elaborated on the complexity establishments face when evaluating Ethereum. “You is likely to be actually bullish on the utility of the general public Ethereum blockchain however not understand how that interprets into worth accrual to the native token,” she stated. This uncertainty complicates the case for broad-based adoption. Whereas Bitcoin’s narrative as a “borderless retailer of worth” is comparatively simple, Ethereum’s positioning stays extra opaque, intertwining technological utility with questions on token economics, competitors, and long-term market dynamics.

Past the narrative hole, Cohen recognized a extra structural impediment: crypto’s common lack of standardized information and metrics. “Crypto does broadly have a knowledge and requirements drawback,” she said. Drawing comparisons to conventional markets, Cohen emphasised that metrics like money circulate, governance, and crew transparency — crucial parts for fairness investing — are largely absent or inconsistent throughout most crypto belongings. “If I take into consideration indexing basically as an organizing know-how for a market, how do you carry out that activity in crypto proper now?” she requested rhetorically, highlighting how foundational requirements stay lacking even in main crypto ecosystems.

Bitcoin’s adoption, in contrast, is supported by clearer metrics round its shortage, issuance schedule, and market infrastructure maturity, making it simpler to suit into conventional portfolio fashions. Cohen confirmed that BlackRock recommends a 1–2% Bitcoin allocation for buyers searching for publicity, rooted in detailed evaluation of threat contribution to portfolios. “In the event you transcend 2%, the incremental contribution to total portfolio volatility will get exponentially larger,” she warned.

Whereas Ethereum continues to make technological strides — significantly in decentralized finance and onchain functions — BlackRock’s view, a minimum of for now, displays the fact that establishments require readability, standardization, and well-defined valuation fashions earlier than committing significant capital. As Cohen summarized, “Understanding tips on how to create a valuation framework for Ethereum or every other token will get extra sophisticated.”

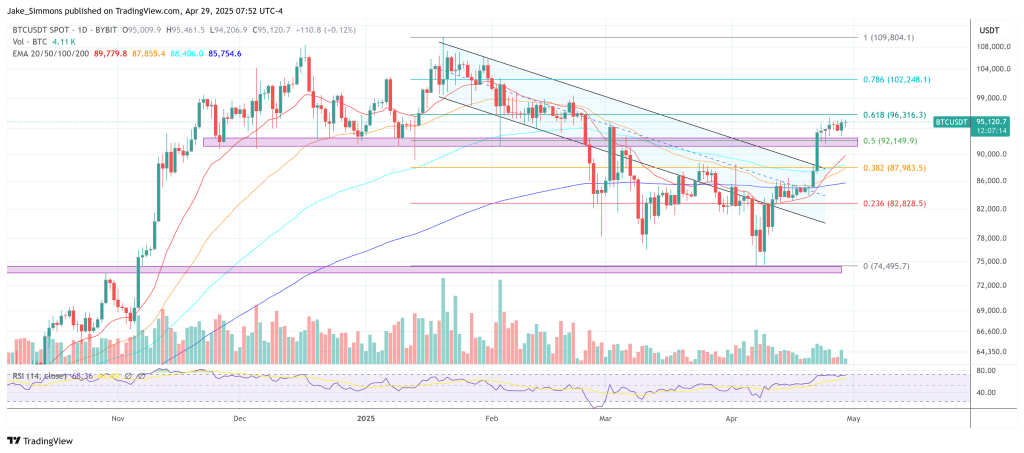

At press time, BTC traded at $95,120.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.