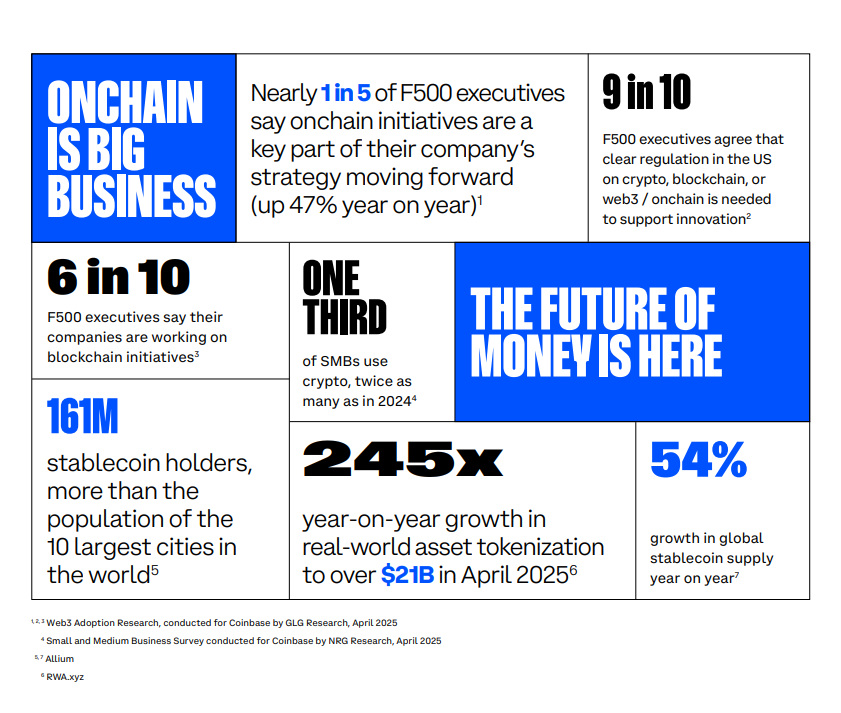

US companies are warming as much as stablecoins at a tempo we haven’t seen earlier than. Curiosity jumped from 8% in 2024 to 29% this 12 months amongst 100 executives at Fortune 500 firms. That’s greater than thrice the extent of a 12 months in the past.

And small ones aren’t far behind. A recent take a look at the numbers exhibits stablecoins are shifting from fringe tech speak into boardroom discussions.

Rising Curiosity Amongst Massive Corporations

In response to Coinbase’s State of Crypto report launched Tuesday, 29% of surveyed executives say their firm plans to work with stablecoins or is interested in them.

Final 12 months solely 8% felt the identical method. But simply 7% of these companies have truly began utilizing or holding stablecoins. It’s clear that many leaders are nonetheless in a testing part. Gradual financial institution transfers and steep charges on common funds have pushed them to search for alternate options.

Supply: Coinbase State of Crypto Report.

Small Companies Be a part of The Pattern

Based mostly on reviews from the identical examine, 251 monetary decision-makers at small and medium companies took half within the survey. Now 81% say they’re focused on stablecoins, up from 61% a 12 months in the past.

Virtually half—46%—count on to make use of crypto within the subsequent three years. And greater than 82% suppose crypto can sort out no less than one actual price or cash-flow concern for his or her enterprise. Whether or not it’s slicing cost charges or rushing up cross-border transfers, smaller outfits see strong causes to experiment.

Supply: Coinbase State of Crypto Report.

Transactions Hit New Heights

Crypto flows are already big. Natural stablecoin transfers hit $719 billion in December 2024 and $717 billion in April 2025—the 2 highest months on document to this point.

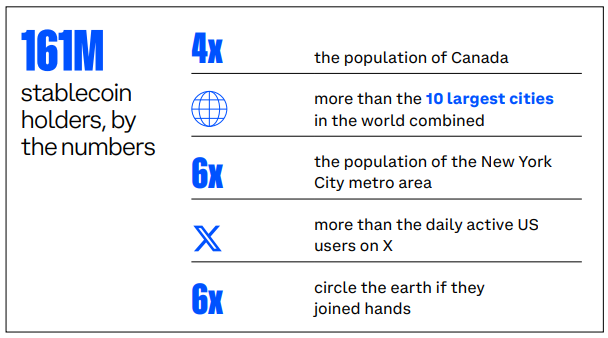

General, whole stablecoin volumes reached over $27 trillion in 2024, beating the mixed volumes of Visa and Mastercard by almost 8%. Holder counts climbed previous 160 million in Could.

Early Movers And Experiments

Even massive names are taking notes. At a Bloomberg Tech Summit on June 5, Uber’s CEO Dara Khosrowshahi mentioned the ridesharing large is in a examine part for stablecoin funds.

The purpose is straightforward: decrease prices when shifting cash across the globe. And on Could 14, Fireblocks reported that 90% of institutional gamers they surveyed are exploring stablecoin use in some a part of their operations. That would imply something from prompt remittances to extra environment friendly payroll in nations the place banks are sluggish or costly.

Featured picture from Fortune, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.