The profitable debut of the REX-Osprey Solana ETF and the rising likelihood of a spot Solana ETF approval have intensified discussions about what comes subsequent. As Solana climbs the institutional ladder, the highlight turns to different altcoins that would observe its path into the ETF area. XRP, Cardano (ADA), and Avalanche (AVAX) are among the many high contenders.

The Ripple Impact: Why Solana Opens the Door

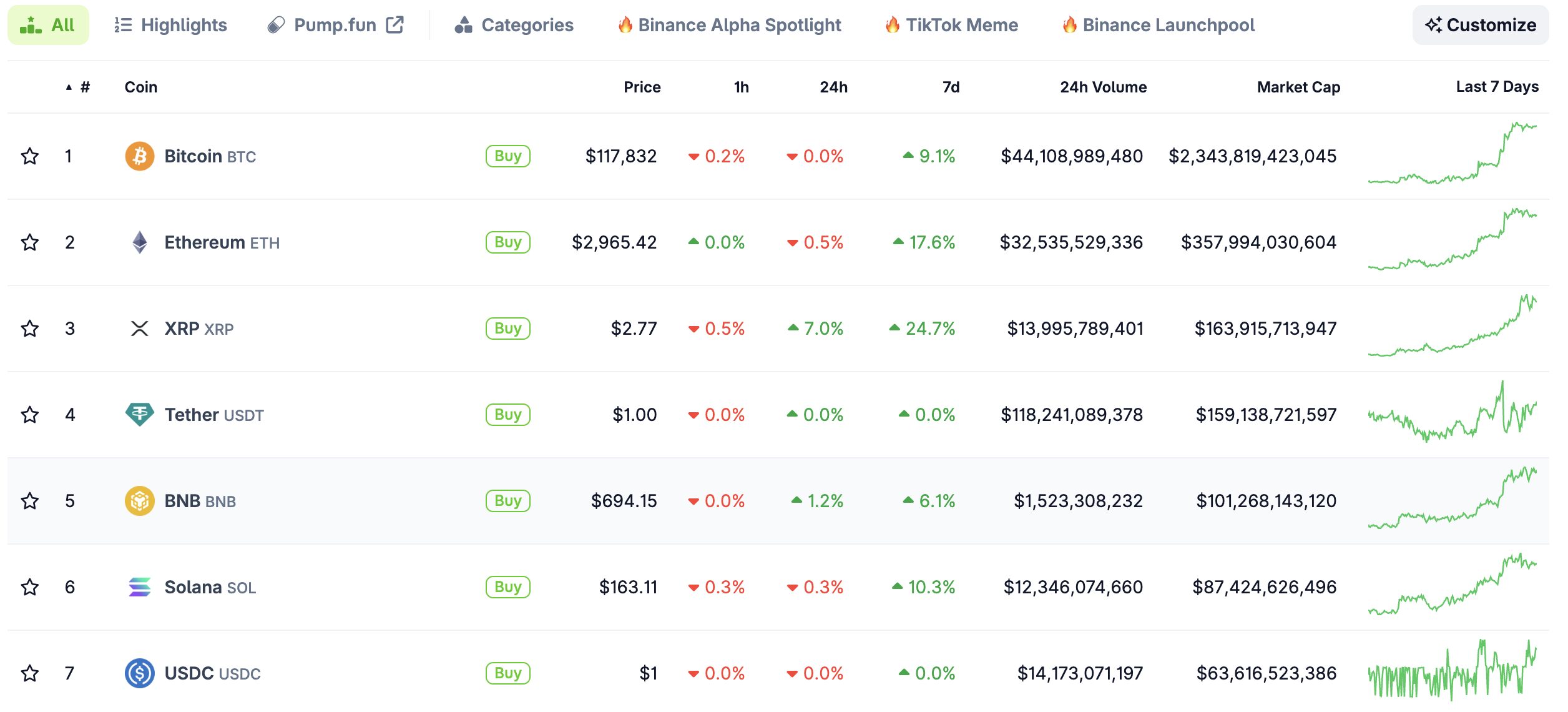

Solana’s ETF breakthrough isn’t just a win for its ecosystem — it units a starting step for different altcoins. After Bitcoin and Ethereum ETFs had been permitted primarily based on their commodity-like standing and deep liquidity, Solana turned the primary altcoin past the “Huge Two” to satisfy the dialog threshold. As of July 2025, Solana ranks #6 by market cap at over $67 billion, with each day buying and selling volumes averaging $2.5 billion throughout main exchanges.

Supply: Coingecko

Furthermore, with over 2,400 energetic validators and excessive throughput, at as much as 65,000 TPS as introduced, have made Solana a great consideration within the eyes of institutional buyers. The SEC’s current request for amended S-1 filings for spot Solana ETFs — with a comfortable deadline of July 31 — indicators the regulatory door is opening wider, doubtlessly establishing a framework that altcoins like XRP, ADA, and AVAX might observe.

For extra: Solana ETF: VanEck, REX-Osprey & the Highway Forward

XRP: The Darkish Horse with Authorized Readability

XRP may very well be seen as probably the most notable case when referring to altcoin ETFs. It’s the most legally clarified asset within the altcoin ETF dialogue. In July 2023, a U.S. federal court docket dominated that XRP gross sales on secondary markets don’t represent securities transactions, a partial victory that Ripple Labs capitalized on. Whereas the ruling didn’t absolutely absolve Ripple from regulatory scrutiny, it successfully eliminated one of many greatest authorized boundaries to institutional merchandise primarily based on XRP.

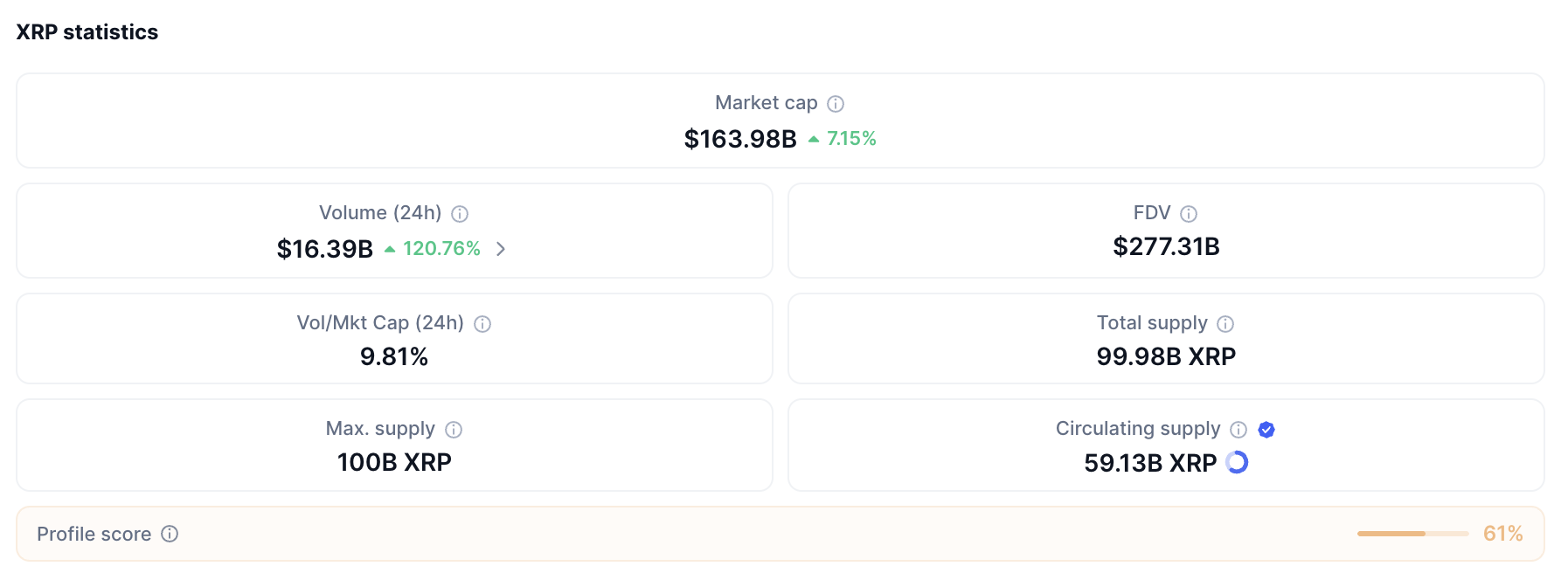

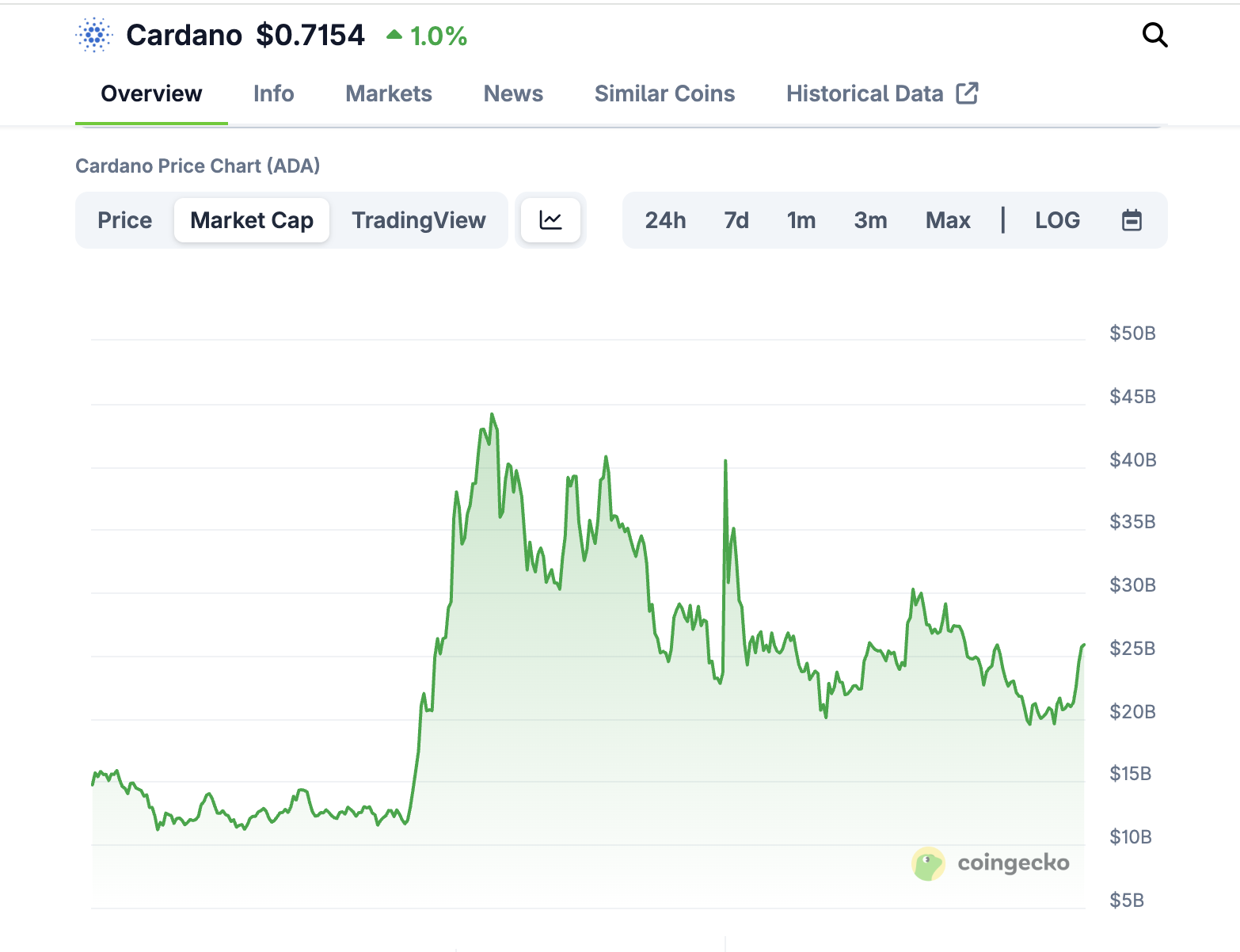

Supply: CoinMarketcap

XRP’s liquidity metrics are sturdy. As of Q2 2025, XRP sees each day volumes exceeding $1.2 billion and is listed on over 100 exchanges globally. Its use case in cross-border funds continues to be validated, with RippleNet processing over $15 billion in remittance quantity yearly throughout areas like Asia and Latin America, in response to the Ripple Transparency Report.

With its authorized readability, deep liquidity, and present institutional footprint, XRP is arguably probably the most ETF-ready altcoin — pending a shift in SEC posture towards post-Solana altcoin merchandise.

For extra: XRP Deep Dive: A Complete Evaluation of Ripple Impact

Cardano (ADA): A Lengthy-Time period Guess on Fundamentals

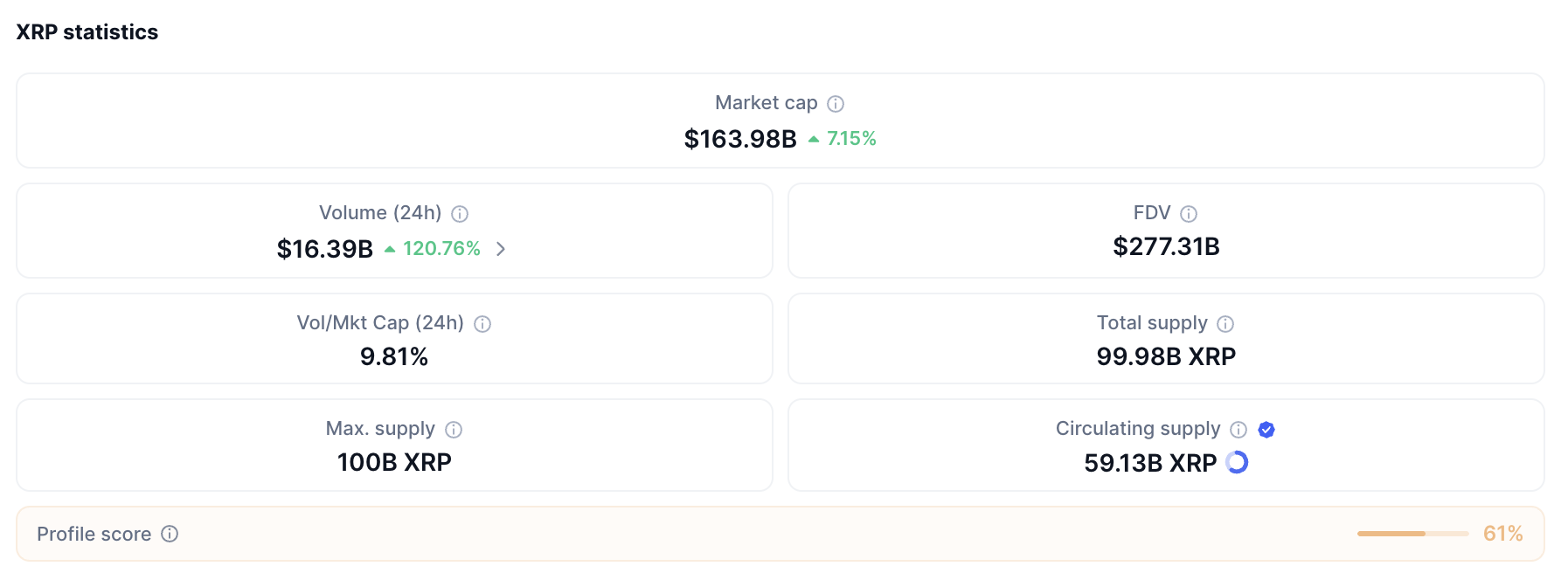

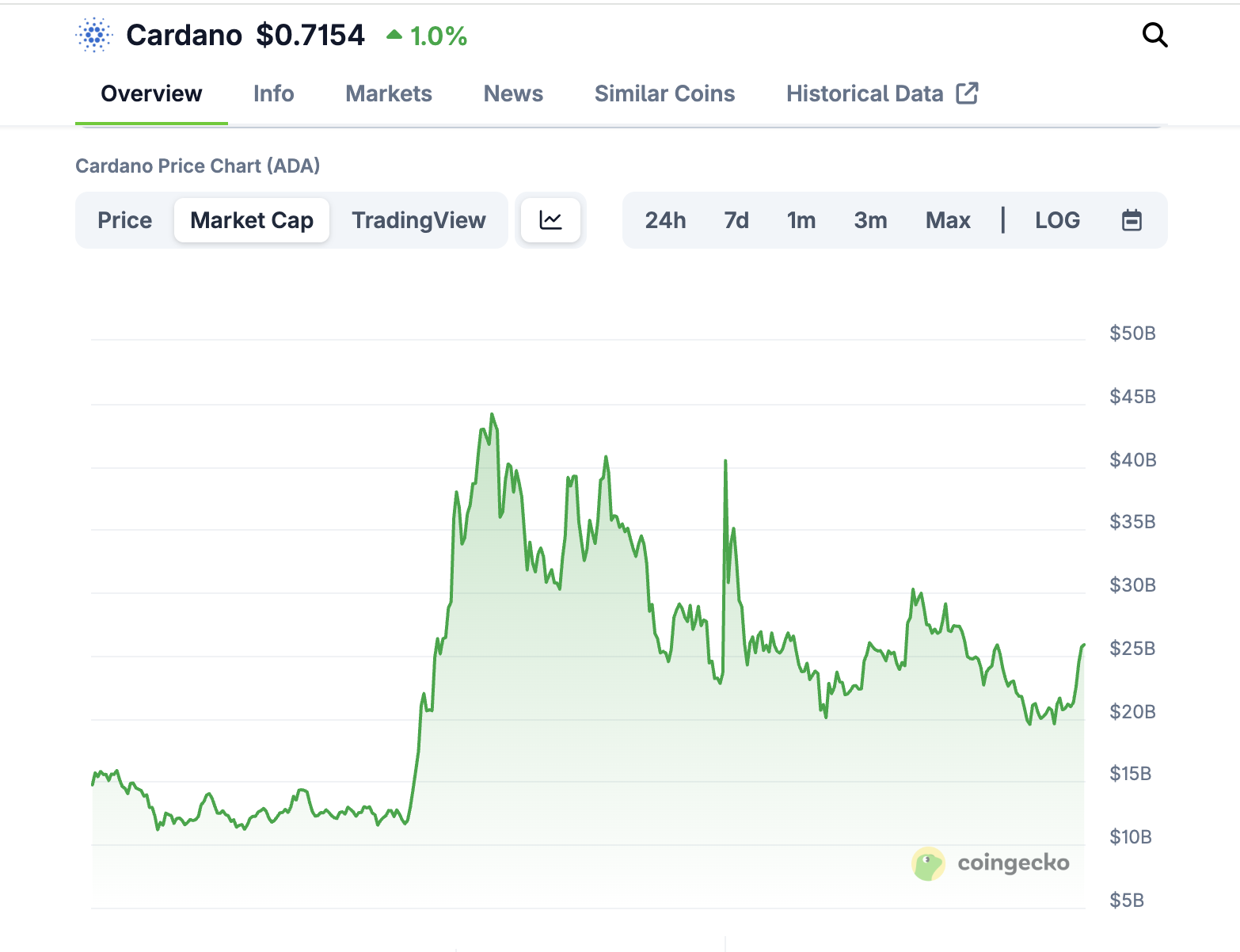

Cardano is a powerful identify on this checklist. It’s seen because the “sluggish and regular” contender. Its research-first philosophy, rooted in peer-reviewed educational papers and formal verification, makes it interesting to institutional buyers searching for technical rigor. With a present market cap of $25 billion, ADA ranks among the many high 20 cryptocurrencies, and its staking ecosystem contains over 3,200 stake swimming pools, highlighting sturdy decentralization.

Spurce: Coingecko

Nevertheless, Cardano’s on-chain exercise lags behind Solana and Ethereum. In response to Coingecko metrics, each day transaction quantity for ADA in June 2025 was roughly $2.6 billion, roughly to Solana’s $2.5 billion. Its DeFi TVL stays modest at simply over $400 million, limiting its case for monetary utility in comparison with faster-growing chains.

Supply: DefiLlama

But, within the eyes of conservative allocators, ADA’s long-term imaginative and prescient for governance, scalability (through Hydra), and interoperability might function a basis for ETF viability — notably as broader altcoin rules mature.

Avalanche (AVAX): The Enterprise-Pleasant Contender

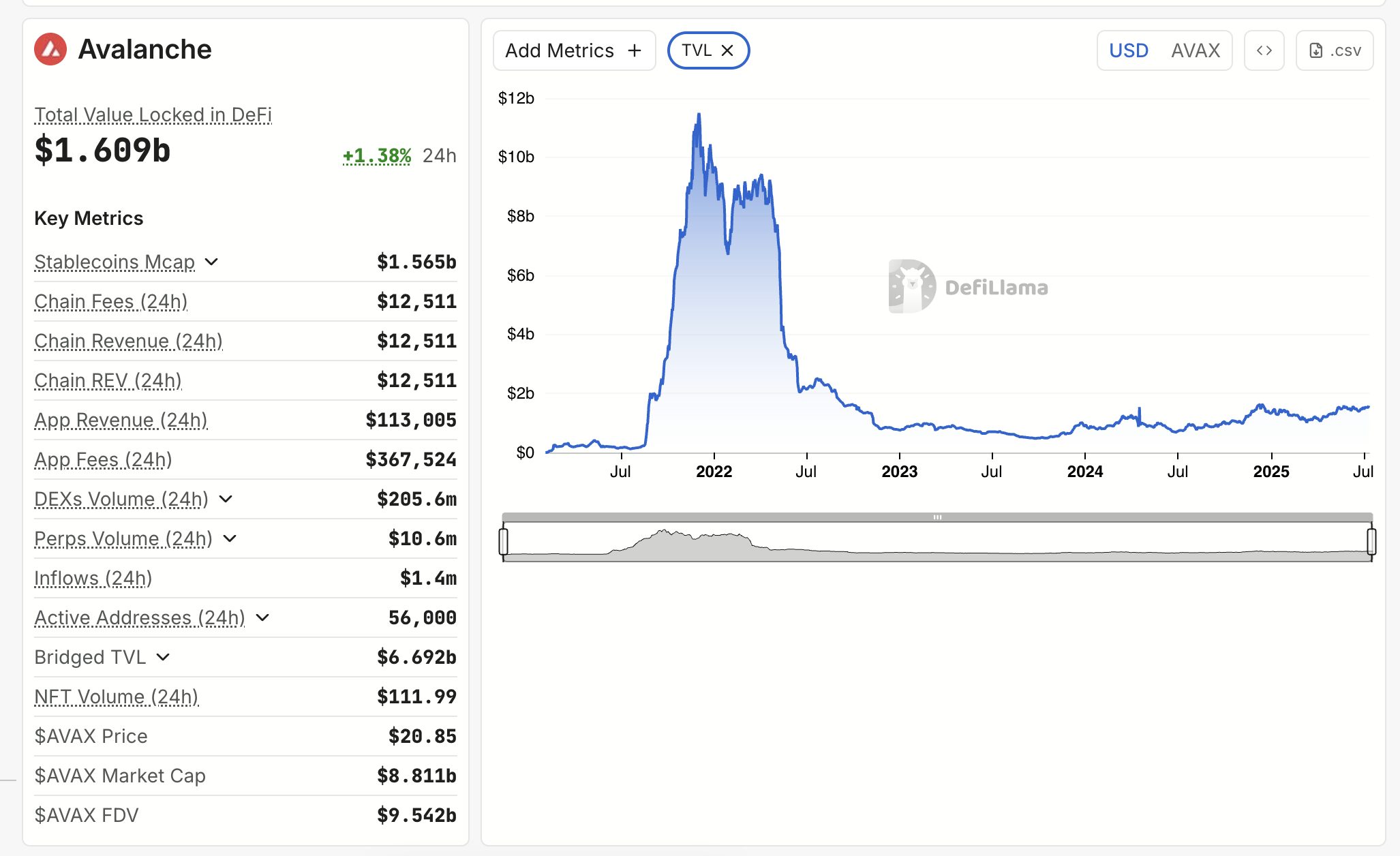

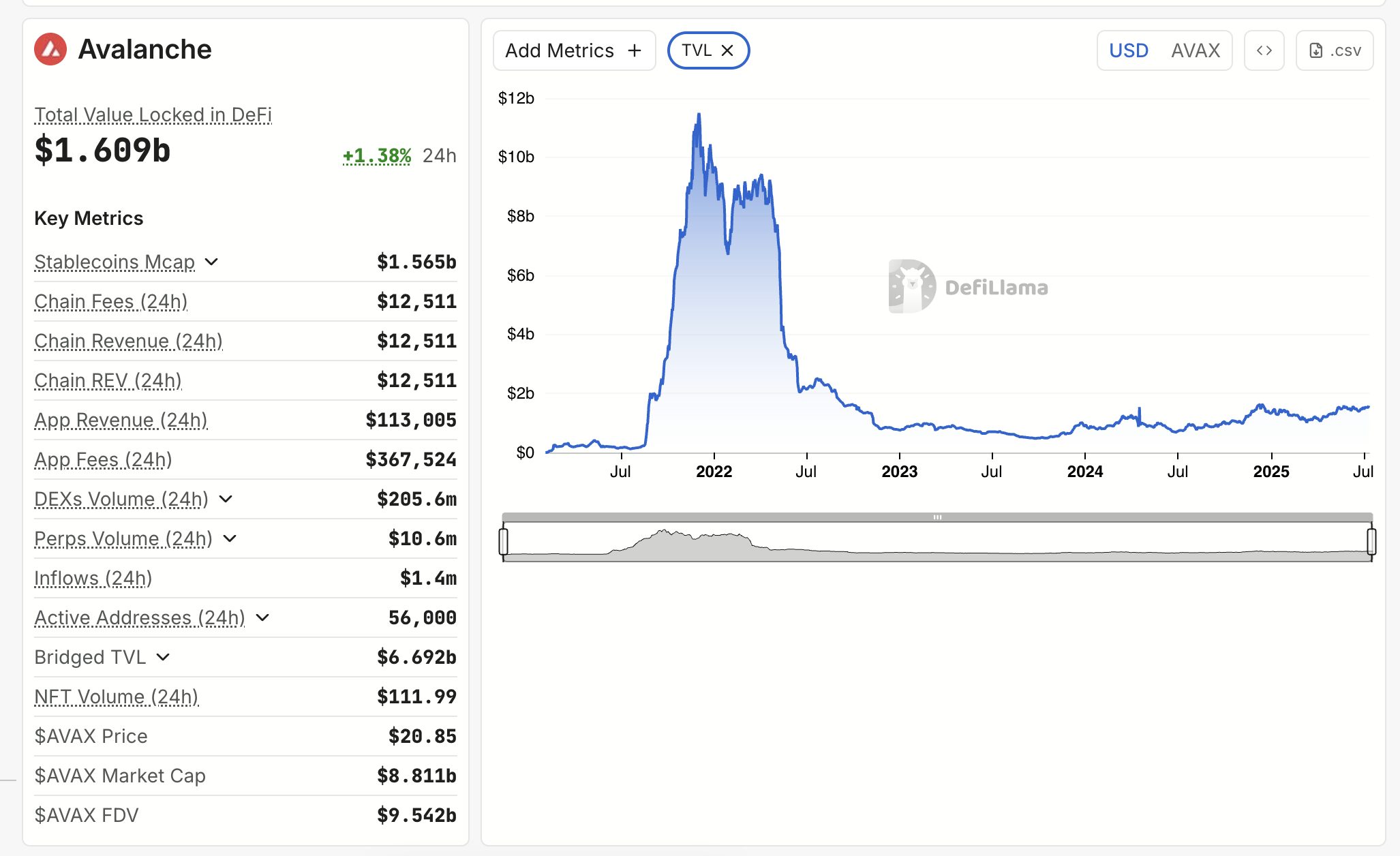

Last within the checklist, Avalanche stands out for its modular design and enterprise enchantment. With its distinctive subnet structure, AVAX allows establishments to create customized, permissioned chains — a key differentiator in discussions round compliance-ready blockchain infrastructure. As of July 2025, Avalanche helps over 120 subnets and has partnered with corporations like Amazon Net Companies and JPMorgan on blockchain pilots.

Supply: DefiLlama

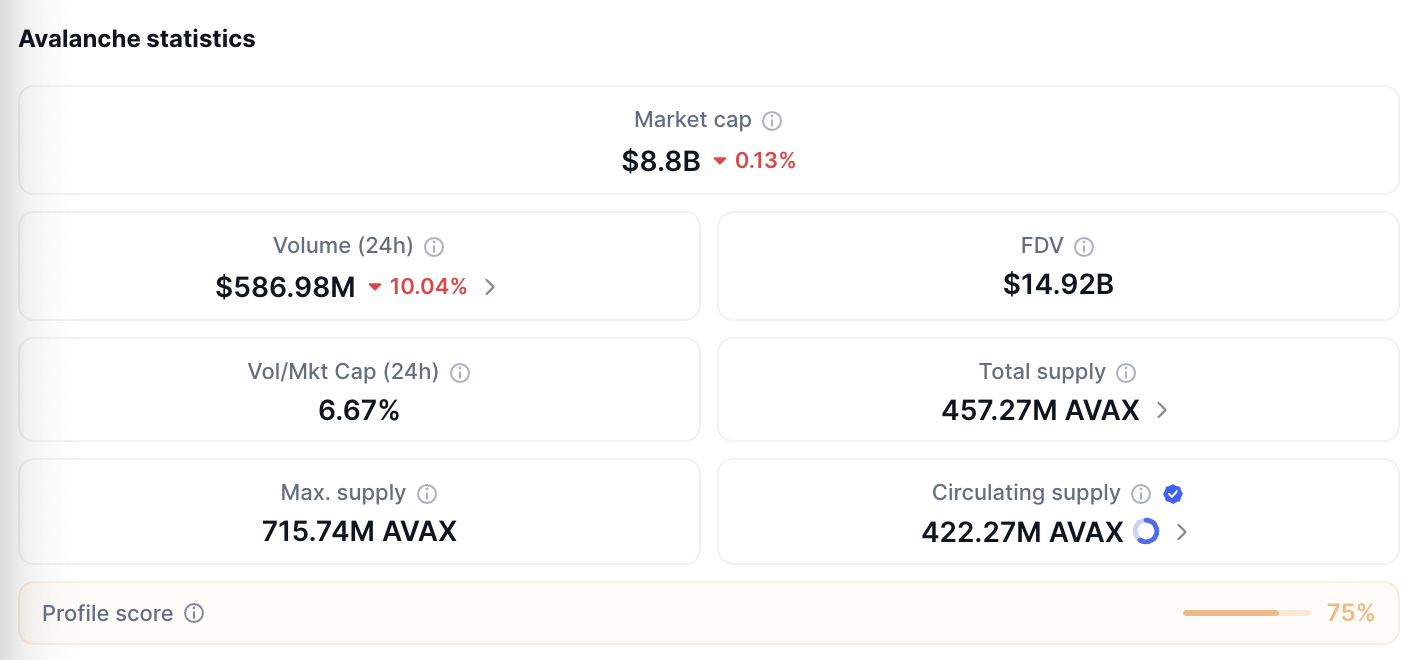

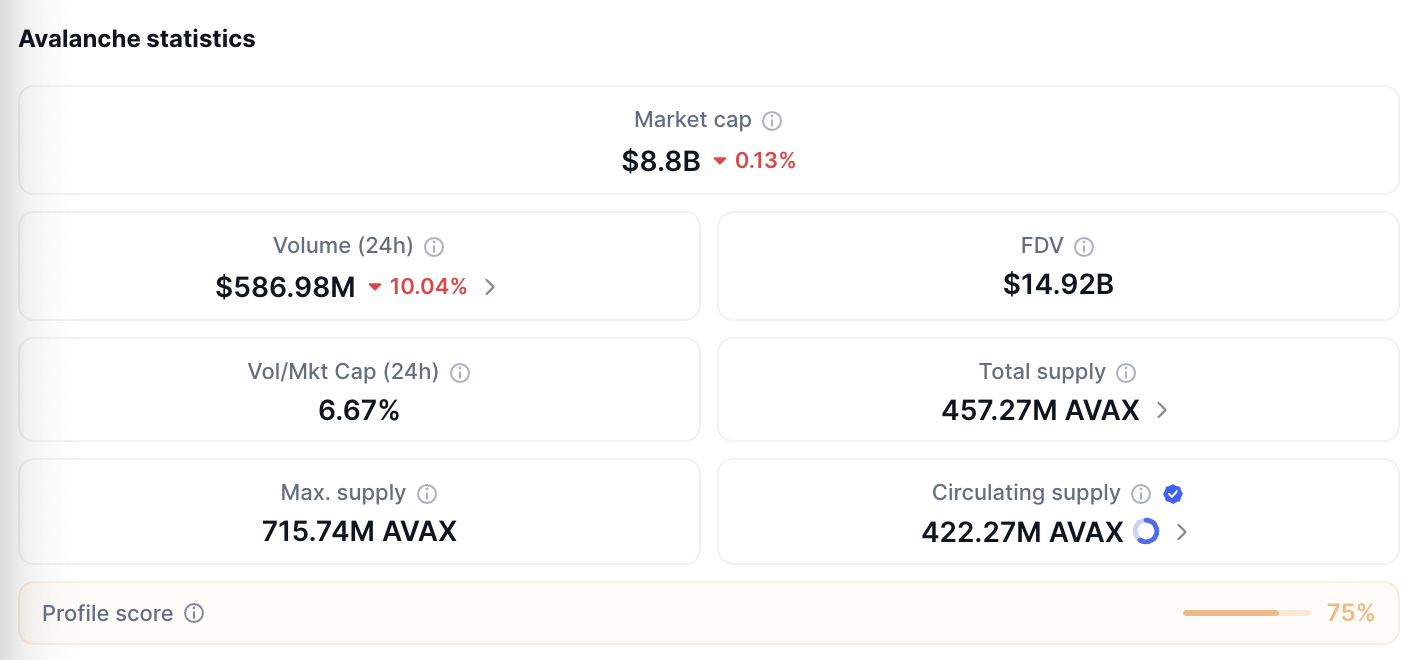

By way of metrics, AVAX instructions a market cap of $8.8 billion, with a DeFi TVL of $1.6 billion, rating it inside the high 6 within the DeFi area. Each day transaction quantity throughout Avalanche’s C-Chain averages $600 million. Its concentrate on real-world asset tokenization — such because the initiative with Intain and JPM — locations it in a primary place for institutional traction.

Supply: CoinMarketcap

Whereas AVAX doesn’t but have the authorized readability of XRP or the retail cult standing of Solana, its enterprise-first narrative might match properly into multi-asset ETF merchandise or bespoke institutional autos in regulated markets.

What the SEC Seems to be For

The SEC’s strategy to ETF approvals has traditionally centered on market maturity, investor safety, and surveillance sharing agreements. For altcoins to qualify, they have to meet a number of unwritten standards:

Adequate buying and selling quantity on regulated U.S. exchangesDemonstrable decentralization and safetyReadability on token classification (i.e., not a safety)Potential for value discovery and arbitrage throughout venues

At the moment, not one of the altcoins talked about have CFTC-regulated futures markets, which was a pivotal issue within the approval of Bitcoin and Ethereum ETFs. This stays the most important hurdle. Nevertheless, a profitable Solana ETF might recalibrate the SEC’s benchmarks, notably if it contains staking, on-chain rewards, or DeFi interactions.

Would love to listen to immediately from Atkins, however all good likelihood of occurring. Right here’s our newest odds of approval for all of the dif spot ETFs through @JSeyff https://t.co/nLhYJJmO9U pic.twitter.com/4AcJVwhics

— Eric Balchunas (@EricBalchunas) April 30, 2025

In response to Bloomberg Intelligence, the percentages of a Solana ETF approval by the tip of 2025 are above 90%. If that approval materializes, it will nearly actually set off a reassessment of XRP, ADA, and AVAX ETF proposals by each issuers and regulators.

The Position of Multi-Asset Crypto ETFs

One other possible growth post-Solana is the approval of diversified crypto ETFs that embody a number of altcoins. These might supply publicity to a basket of digital property, weighted by market cap or ecosystem power. Companies like Constancy and Bitwise have explored such ideas, proposing index-style ETFs that scale back single-asset danger whereas complying with SEC necessities.

This construction may very well be a workaround for altcoins which might be individually not prepared for standalone ETFs. It additionally displays rising investor curiosity in broad-based crypto publicity with out the complexity of managing a number of wallets and exchanges.

For extra: Tokenized Shares: The Way forward for Equities on the Blockchain

Last rating for ETF potential (as of mid-2025)

Based mostly on accessible information and regulatory issues, XRP at present seems to have the strongest likelihood of receiving ETF approval following Solana. The partial court docket ruling in 2023 established that XRP, when traded on secondary markets, just isn’t thought-about a safety—granting it a degree of authorized readability that almost all different altcoins lack. XRP additionally advantages from deep liquidity, constant trade assist, and a well-established use case in cross-border funds.

Avalanche (AVAX) is one other sturdy contender, providing modular structure, excessive developer exercise, and rising adoption amongst enterprise customers. Though AVAX lacks the identical authorized readability as XRP, its real-world integrations and sturdy ecosystem make it engaging for diversified or thematic ETF merchandise.

Cardano (ADA), whereas extremely decentralized and academically rigorous, faces challenges in each day transaction quantity, DeFi exercise, and community utilization, that are metrics usually scrutinized by regulators. In consequence, ADA could also be seen as a longer-term candidate. In abstract, XRP leads on authorized readability and infrastructure, AVAX stands out in innovation and enterprise readiness, whereas ADA stays sturdy on fundamentals however might require additional market maturity earlier than ETF consideration.

Last rating for ETF potential (as of mid-2025):

RankAltcoinETF ViabilityPrimary StrengthMain Impediment1XRPExcessiveAuthorized readability & liquidityHistoric regulatory baggage2AVAXMediumEnterprise adoption & TVLNo authorized readability or futures3ADALow–MediumDecentralization & governanceLow exercise & TVL

Conclusion

Solana’s breakthrough into the ETF area has created a ripple impact throughout the altcoin market. XRP, ADA, and AVAX every supply compelling—but distinct—instances for changing into the following ETF-approved asset. Whereas regulatory and structural hurdles stay, momentum is clearly constructing. Whether or not by means of single-asset autos or multi-asset crypto ETFs, the post-Solana period might lastly unlock a brand new part of altcoin accessibility for institutional and retail buyers alike.