Key Takeaways:

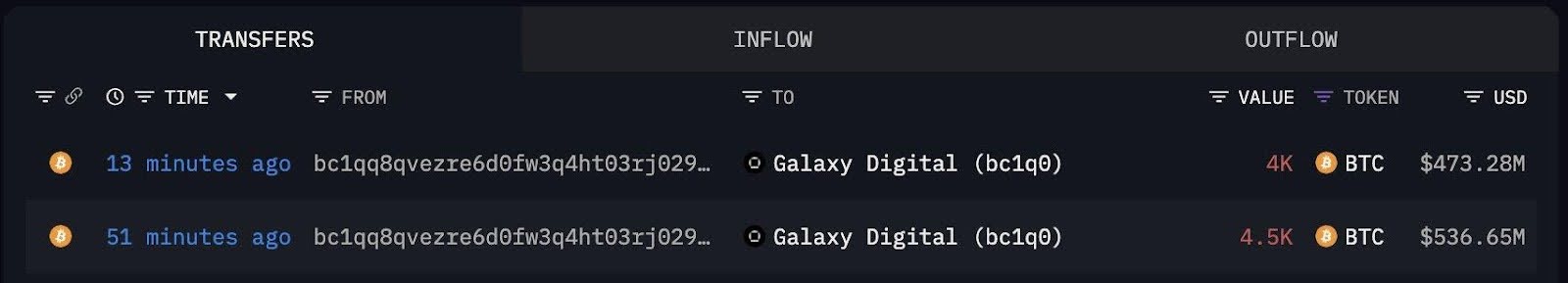

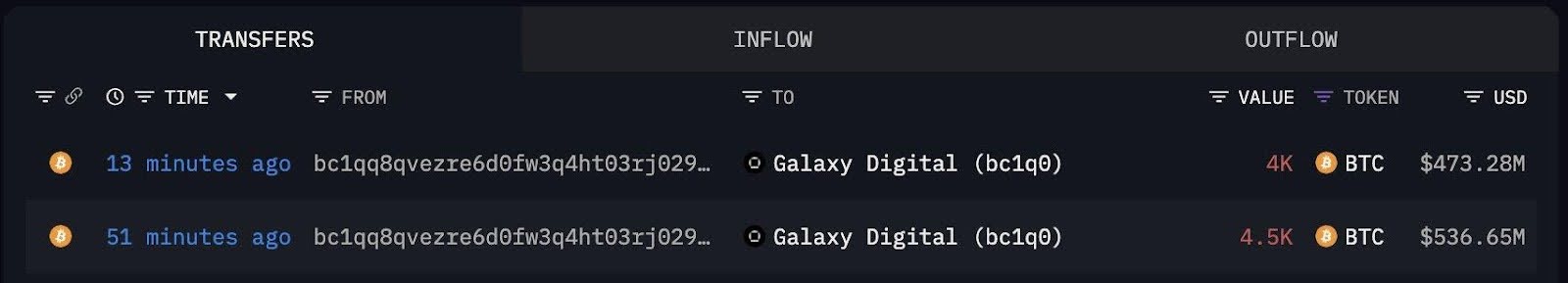

A dormant whale pockets holding Bitcoin since 2010 has simply transferred 8,500 BTC (≈ $1 billion) to Galaxy Digital.That is the primary identified motion of funds from this tackle in over 14 years, sparking intense hypothesis throughout the crypto group.The large switch, possible an OTC deal, coincides with heightened market volatility and renewed consideration on long-lost Satoshi-era wallets.

A sleeping big within the crypto world has stirred. A whale pockets, untouched since Bitcoin’s earliest days, has made its first transaction in over a decade, sending $1 billion value of BTC to Galaxy Digital. This sudden transfer is fueling debate about market implications, possession origin, and potential shifts in institutional crypto technique.

Whale Pockets Sends Shockwaves By way of the Market

On July 15, blockchain analytics platform Spot On Chain flagged an enormous on-chain switch: 8,500 BTC (roughly $1 billion) was despatched from a Satoshi-era pockets to Galaxy Digital, a widely known crypto funding agency based by Mike Novogratz.

Learn Extra: Galaxy Raises $175M to Supercharge Early-Stage Crypto Startups Amid Market Headwinds

The pockets tackle out of which they have been transferred has been inactive greater than 14 years, which suggests that the cash had been obtained or mined on the first years within the lifespan of Bitcoin. Spot On Chain says that that is the first-time this tackle ever despatched out any Bitcoin because it was activated.

The transaction appears to be included in OTC (over-the-counter) deal, because it has a construction and path. Whales and establishments therefore often use OTC trades to forestall slippage, and hold their footprint available in the market small. This enables massive transactions to be performed with out transferring market costs abruptly.

Satoshi-Period Cash: Why It Issues

Dormant Wallets and Market Psychology

The Satoshi period Bitcoin dormant wallets courting again to earlier than 2011 have a legendary mark within the crypto. Anytime they do that, the suspicions rise about who truly created Bitcoin within the first place, with rumors of Satoshi Nakamoto and his or her enigmatic persona or the priority that outdated insecure storage techniques have had their keys hacked into.

Though there is no such thing as a direct testimony to the truth that this pockets belonged to Satoshi, himself, the actual fact that it was left unspoiled after over 14 years has given it the cloak of thriller. The cash of the pockets have been little doubt mined when the worth of Bitcoin was lower than $0.10 and it’s a good reminder of the fortunes that early fanatics have earned

Comparable exercise was lately noticed in Coinbase government Conor Grogan who stated that deserted wallets of greater than a billion {dollars} may very well be attributable to stolen keys. However right here, a direct motion to Galaxy Digital signifies the organized in all probability authorized sale as an alternative of felony exercise.

Who Is Behind the Switch?

Though the precise proprietor of the pockets remains to be not identified, there are indications that the proprietor is very succesful and linked affair. Engagement of a licensed and professional-grade crypto firm, Galaxy Digital, means that this was not an on-the-fly determination by some unknown early crypto fanatic, however a deliberate attractor of liquidity.

Galaxy Digital Galaxy Digital, based by ex-hedge fund supervisor Mike Novogratz, is making extra strikes within the OTC Bitcoins markets and caretaking endeavors. This sale might be a sign that Galaxy may very well be a liquidity supplier to these holders of legacies who wish to exit or rebalance their portfolio.

Learn Extra: Galaxy Digital acquires crypto custody and asset infrastructure supplier BitGo

At this level, analysts consider that the whale is promoting out of crypto, after a protracted interval of appreciation, or preparing of one other vital funding cycle.

Market Alerts from a Dormant Large’s Transfer

The timing of this transfer is critical. Bitcoin has been buying and selling within the $115,000 – $123,000 vary, and up to date inflows and outflows from whale wallets have been carefully tied to short-term worth volatility.

Whereas this switch didn’t occur on a public change, thus not instantly impacting order books, it nonetheless holds psychological weight. The crypto market usually reacts strongly to old-wallet exercise, particularly when it includes such massive volumes.

If extra dormant wallets grow to be lively, it might result in:

Elevated promote strain if massive holders determine to money out at present valuations.Renewed narratives round long-term holders exiting the market.Heightened safety considerations if there’s any suspicion of personal key compromise.

Up to now, nevertheless, Bitcoin has remained comparatively secure following the switch, indicating restricted panic, and presumably even rising confidence that these cash are being absorbed by institutional patrons.

The Dormant Pockets Nonetheless Holds $1.3 Billion

The opposite pockets collaborating within the transaction proceed to have greater than 11,000 BTC, which is value over $1.3 billion, based mostly on the on-chain information supplied by Arkham Intelligence. This implies the $1B switch pun supposed, truly would possibly simply be the start.

That creates a possibility if the holder desires to money out their complete place, doubtlessly a multi-billion-dollar liquidity occasion. However, if the transfer was merely for strategic relocation (like for custody, property planning, or an make investments partnership) the remainder of the fortune is probably not touched in the intervening time.