The cryptocurrency ETF market has undergone a seismic shift in 2025, fuelled by regulatory breakthroughs, institutional adoption, and a maturing investor base. As soon as considered as speculative and fringe, crypto ETFs—significantly spot Bitcoin ETFs—have develop into a central asset class for each conventional buyers and digital-native portfolios.

With over $120 billion in property underneath administration (AUM) and big inflows in simply over a 12 months, crypto ETFs have emerged as one of many largest monetary tales of the last decade. However what’s actually behind the increase? And what does it imply for the value of Bitcoin, Ethereum, and the broader digital asset market?

A Snapshot of Crypto ETF Panorama in 2025

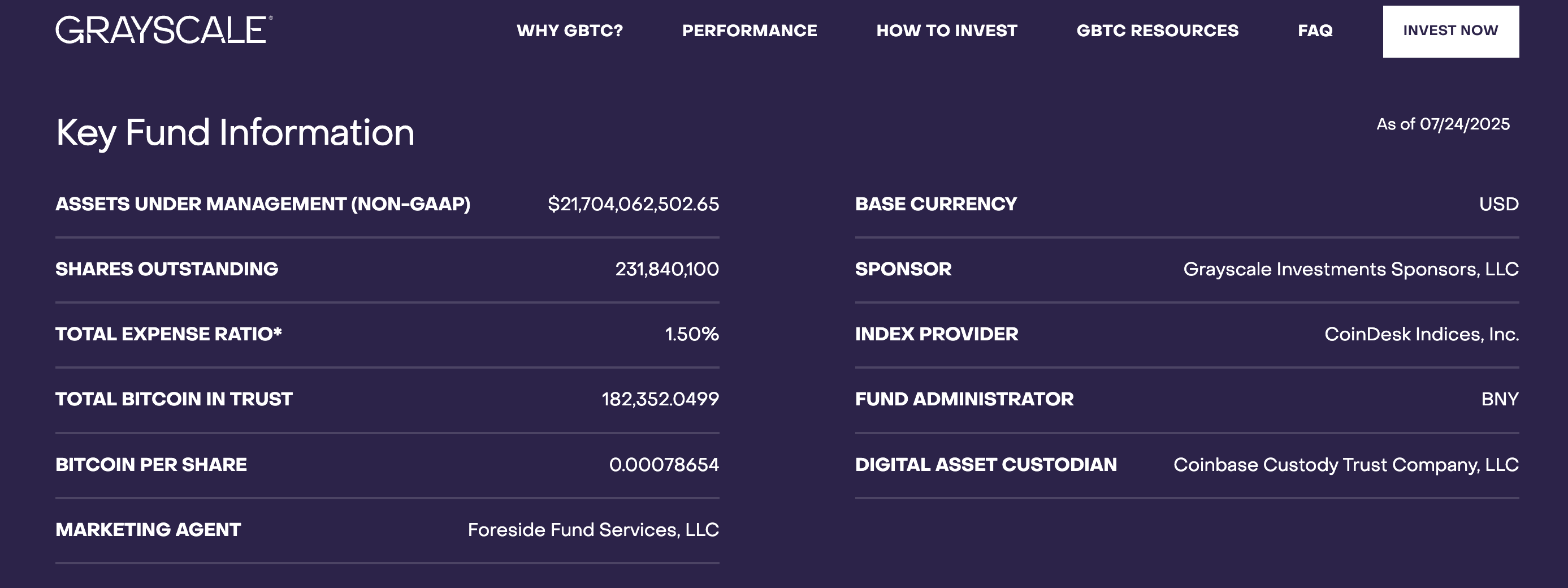

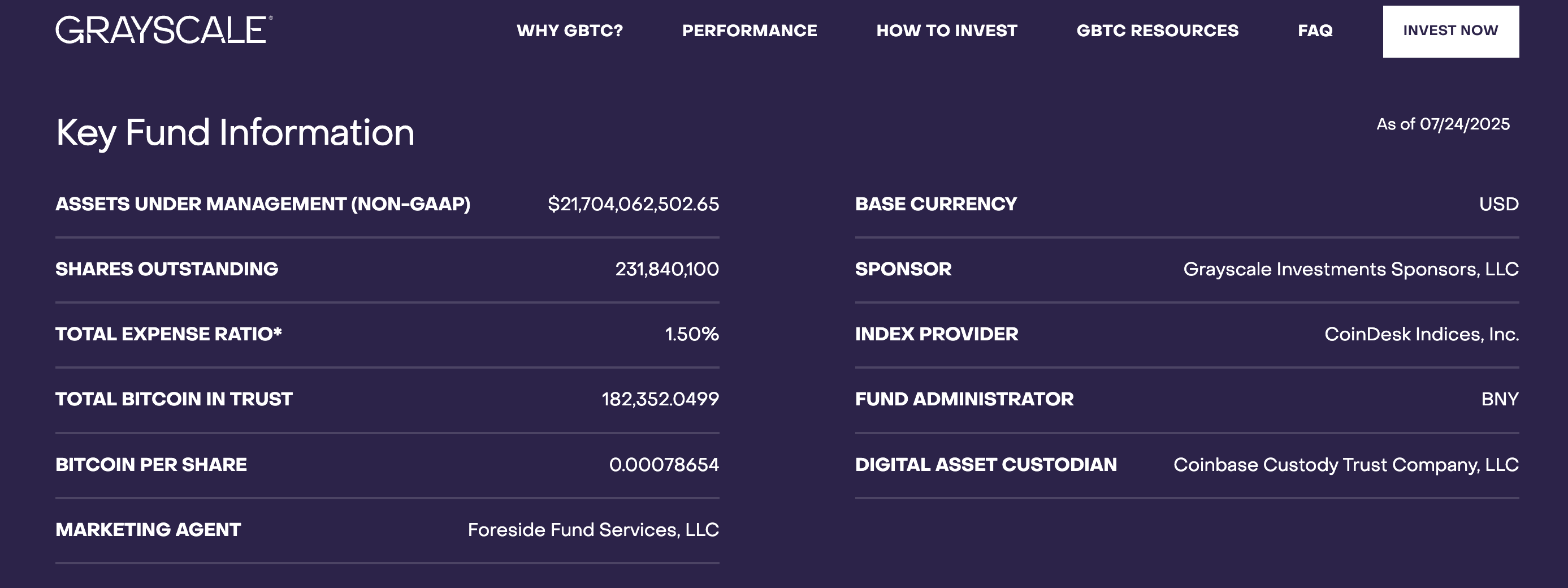

The rise of spot Bitcoin ETFs over the previous 18 months has been staggering in each scale and velocity. BlackRock’s iShares Bitcoin Belief (IBIT) at present holds the highest place with an AUM of over $76 billion, carefully adopted by Constancy’s FBTC, which has an AUM of roughly $20 billion. Grayscale’s GBTC, regardless of its excessive 1.5% administration price, retains over $18 billion however has seen declining each day inflows as a result of aggressive stress. In the meantime, low-fee entrants like Bitwise BITB and VanEck’s HODL are quickly gaining traction with retail buyers looking for cost-efficient publicity.

Day by day inflows supply a good clearer image of the momentum behind these funds. On July 17, 2025 alone, IBIT introduced in almost $395 million in new capital—greater than your entire weekly influx of the most important bond ETF on the time. In distinction, Constancy’s FBTC noticed zero influx that day, which analysts attributed to a quick custody adjustment. Bitwise, Grayscale, VanEck and different companies recorded inflows starting from $7 to $13 million, demonstrating constant investor curiosity that extends past the 2 market leaders.

For extra: 8 Finest Bitcoin ETFs to Purchase Proper Now

ETF CategoryYTD Inflows ($B)Common Return (%)Spot Bitcoin ETFs74.2+52.5Ethereum ETFs11.3+46.2Crypto Baskets (High 10)4.9+41.8Blockchain Fairness ETFs7.7+22.4

Though Bitcoin stays the dominant asset, 2025 has seen the emergence of Ethereum ETFs, that are following an identical trajectory. Constancy and ARK 21Shares launched spot ETH ETFs in Q2, shortly gathering $3.5 billion in AUM throughout the first three months. These funds, with common returns above 46%, are positioning Ethereum because the second pillar of institutional crypto adoption.

With Ethereum ETFs holding actual ETH in custody, the identical provide compression dynamics seen in Bitcoin are beginning to take form. Moreover, Ethereum’s staking yield—at present round 3.8% yearly—provides ETH a singular attraction as a yield-bearing asset, which isn’t straight mirrored in ETF merchandise however contributes to long-term investor confidence.

Past single-asset funds, multi-asset crypto ETFs are starting to achieve traction, providing publicity to a basket of prime digital property like Bitcoin, Ethereum, and Solana. Whereas these stay a small share of the market with lower than $5 billion AUM, they symbolize a future development phase as buyers search for diversified crypto publicity.

The surge in crypto ETF adoption shouldn’t be merely a retail phenomenon. Institutional capital now dominates crypto ETF inflows. Pension funds, hedge funds, and wealth managers are allocating to ETFs as a result of they provide compliance with present regulatory frameworks, audited custodianship, and seamless integration with conventional brokerage programs.

For extra: The Impression of Bitcoin ETFs on BTC Value – Actual Information Evaluation

Key Drivers Behind the 2025 Crypto ETF Increase

Regulatory Readability Opens the Doorways

The only most vital driver has been regulatory approval. After years of pushback, the SEC greenlit the primary spot Bitcoin ETFs in January 2024. These ETFs maintain precise BTC, in contrast to the futures-based funds that struggled with roll prices and monitoring errors.

Supply: SEC

Following the U.S. lead, Singapore, the UK, and Switzerland have additionally moved ahead with frameworks for regulated crypto ETFs. This wave of worldwide approval has legitimized digital property as a core funding class.

Spot crypto ETFs now function the first entry level for establishments, bypassing the necessity for direct custody or offshore crypto exchanges.

Institutional Flows Gas Value and Demand

Institutional buyers—as soon as skeptical of crypto—have begun embracing ETFs as a compliant, liquid, and clear entry level.

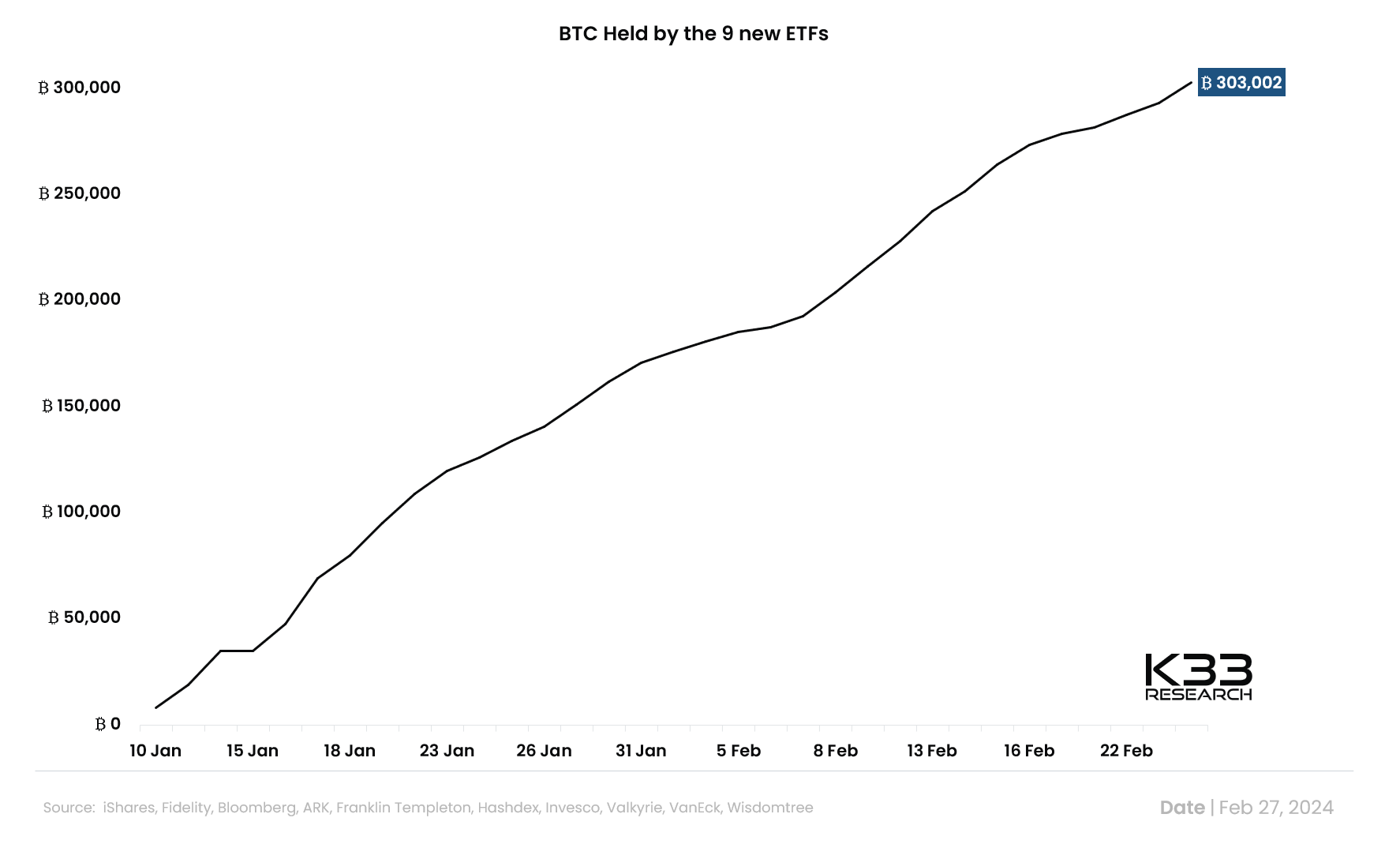

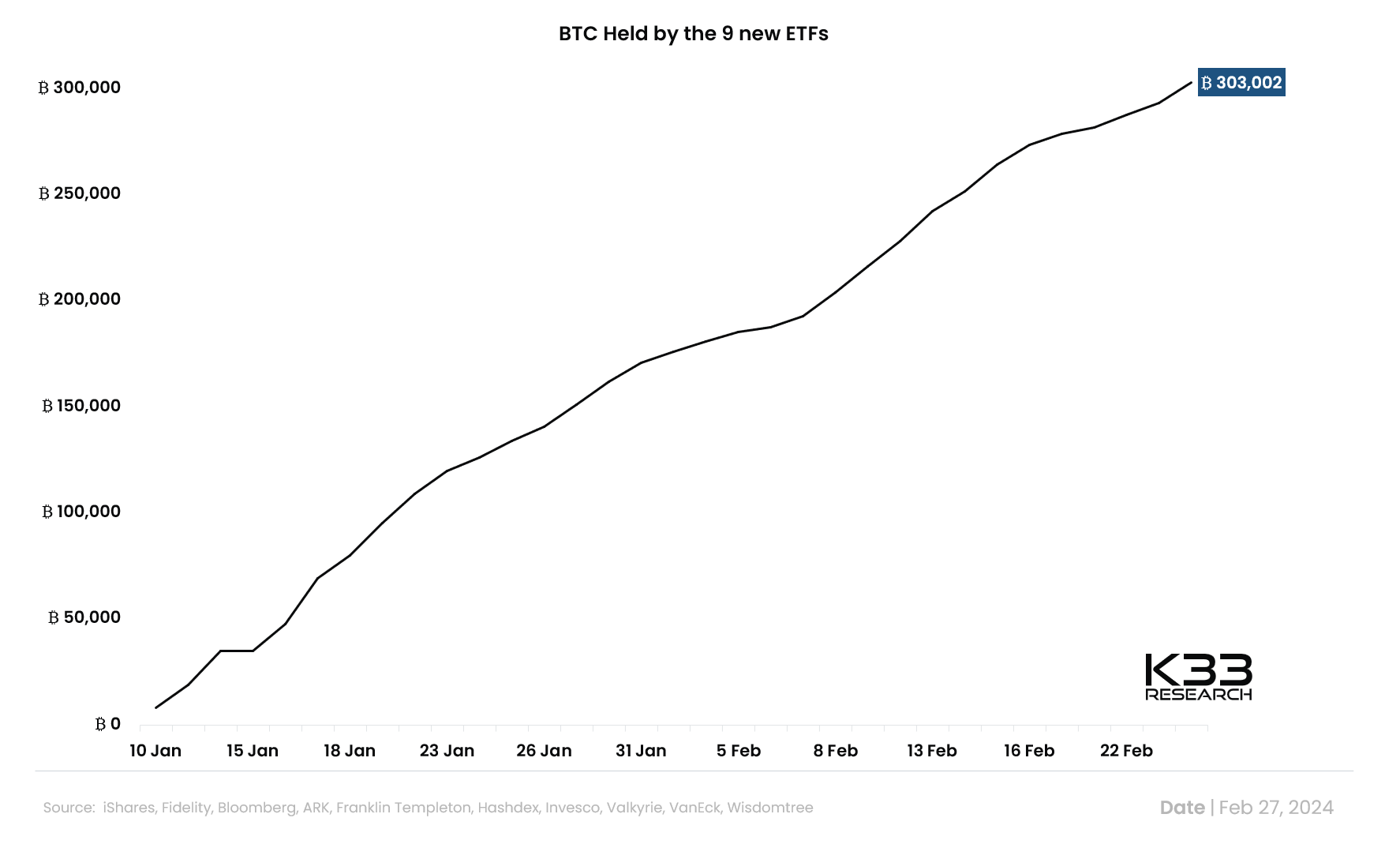

In simply 18 months, spot Bitcoin ETFs have absorbed greater than 300,000 BTC, representing over 1.5% of whole BTC provide. Main inflows have come from:

Registered Funding Advisors (RIAs)Company treasuriesPension and sovereign funds401(ok) platforms (by way of accepted brokerages)

Supply: K33 Analysis

These inflows usually are not short-term speculative bets however are more and more a part of long-term strategic allocations. Based on JPMorgan’s Q2 2025 crypto report, ETF-driven demand accounted for almost half of Bitcoin’s worth appreciation within the first half of 2025.

Retail Reawakens, However Extra Educated

Retail participation has additionally rebounded, however with extra sophistication. In contrast to the 2021 bull run, buyers in 2025 will favour regulated ETF autos over high-risk tokens.

Platforms like Robinhood, SoFi, and Constancy have built-in Bitcoin and Ethereum ETFs into their tax-advantaged accounts, making crypto publicity as accessible as shopping for an S&P 500 ETF.

Bitwise’s BITB, identified for publishing real-time BTC pockets holdings and proof-of-reserves, has attracted youthful buyers who demand transparency and blockchain-native accountability.

Bitcoin ETF Mechanics Create a Provide Squeeze

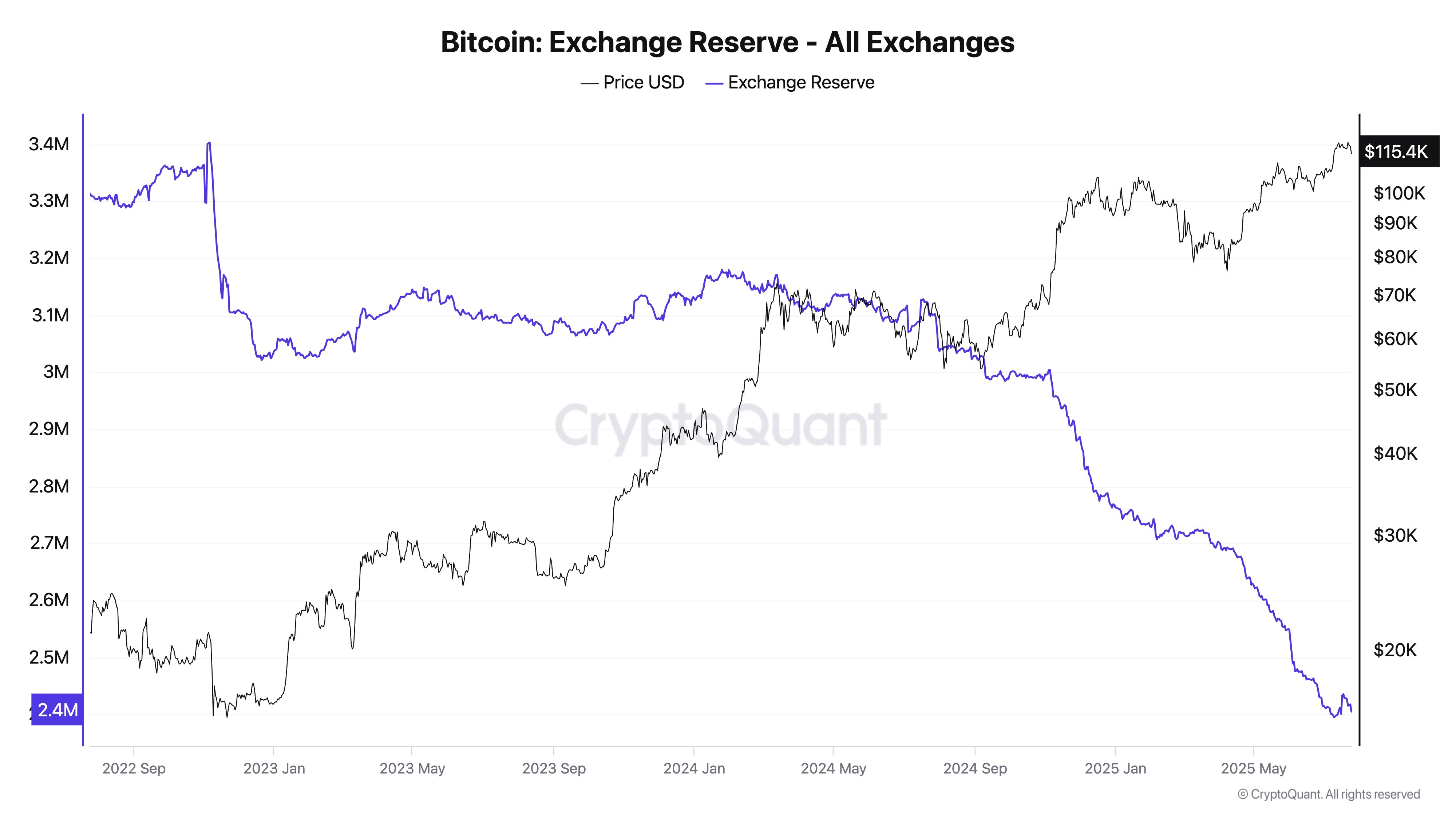

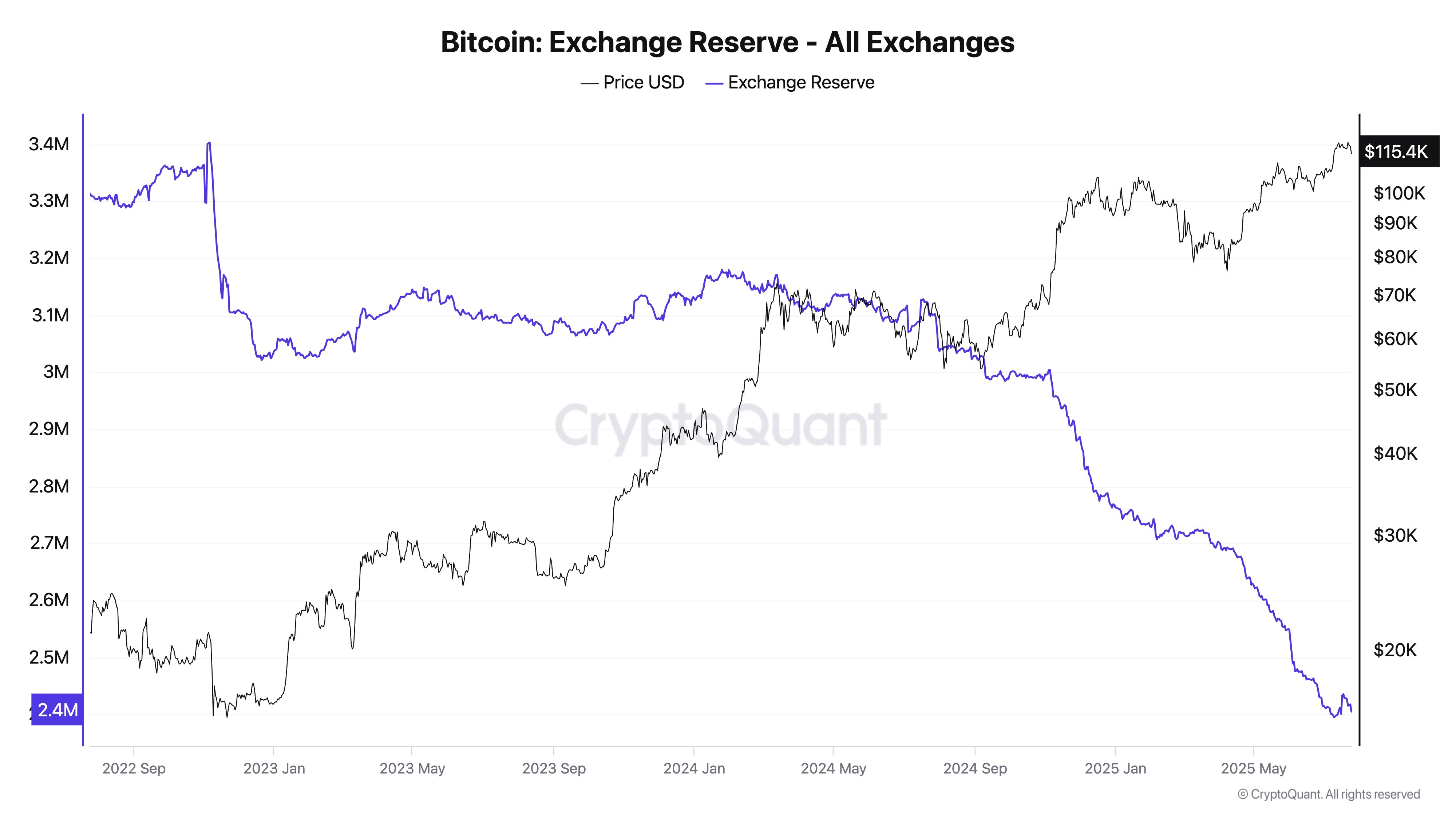

The operational design of spot Bitcoin ETFs contributes to supply-side stress. Every time an investor buys ETF shares, the fund should purchase precise Bitcoin—eradicating it from circulation and locking it into chilly storage.

Supply: CryptoQuant

As these ETFs scale, the accessible float of BTC on public exchanges shrinks. This tight provide dynamic helps upward worth momentum and reduces volatility brought on by short-term speculators.

Through the April 2025 market correction, whereas altcoins dropped sharply, spot Bitcoin ETFs continued to see inflows, indicating the rising position of those autos as stabilizers within the crypto ecosystem.

For extra: Bitcoin ETFs Attain All-Time Excessive with Over $41 Billion in Inflows

Dissecting Return Effectivity and Charge Dynamics

ETF buyers in 2025 are extra fee-sensitive and performance-focused than in earlier cycles. That has made price construction an important aggressive differentiator. BlackRock’s IBIT fees a modest 0.12%, whereas Bitwise’s BITB holds at 0.20%. In distinction, Grayscale GBTC continues to cost a 1.5% annual price, a legacy from its pre-ETF construction.

When measured when it comes to return-to-fee effectivity, the variations are stark. IBIT, with a 12-month return of 54.5% and a price of 0.12%, gives over 450 items of return for each 1% in charges. GBTC, by comparability, gives simply 32 items per 1% price. This ratio helps clarify why GBTC, regardless of its measurement, has skilled persistent outflows since changing to an ETF.

Ethereum ETFs, although newer, are anticipated to face comparable scrutiny. As these merchandise mature and compete for inflows, buyers will more and more demand real-time transparency, decrease charges, and integration with staking or yield-generating mechanisms—options at present missing in most ETH ETFs.

Analyzing ETF Affect on Value Formation

ETF inflows are now not passive. They actively form worth route and investor conduct. Prior to now, Bitcoin’s worth was closely influenced by sentiment cycles on crypto-native platforms. In 2025, capital flows from ETFs have taken the lead.

A compelling evaluation from Amberdata’s July 11, 2025 report titled “Spot ETFs: The Basis of the Present Bull Run” underscores the structural significance of those inflows. Based on Amberdata, spot Bitcoin ETFs at the moment are main market movers, constantly supporting upward worth momentum by way of cumulative inflows that tighten provide and improve liquidity uncertainty. Structural demand from ETF capital flows now operates independently of sentiment swings, appearing as a stabilizing power quite than a speculative driver.

Ethereum is following an identical path. Whereas nonetheless extra unstable than Bitcoin, ETH is stabilizing as ETF inflows deepen. The presence of Ethereum ETFs on institutional platforms has additionally decreased the dominance of offshore exchanges and elevated the significance of regulated U.S. custodians.

A Structural Shift in Investor Demographics

The 2025 ETF increase has introduced new contributors into the crypto ecosystem. Registered funding advisors (RIAs), pension funds, and household workplaces—beforehand hesitant to interact with crypto exchanges—now allocate to Bitcoin and Ethereum by way of ETF wrappers. For instance, over 60% of latest ETF inflows in Q2 2025 got here from managed portfolios and retirement accounts. These buyers usually are not in search of 10x positive factors. They’re concentrating on low-volatility, inflation-resistant, diversifying property—and they’re doing so by way of regulated buildings.

Retail conduct has additionally shifted. As talked about above, platforms like Robinhood, Charles Schwab, and SoFi now supply Bitcoin and Ethereum ETFs alongside fairness and bond funds, permitting youthful buyers so as to add crypto publicity with out venturing into unregulated markets. This normalization of entry is increasing crypto’s footprint throughout generational and institutional strains.

Crypto ETF Challenges and Issues

The emergence of crypto ETFs has precipitated a blurring of boundaries between conventional finance (TradFi) and the realm of digital property. For institutional buyers, ETFs supply a strategy to achieve publicity to crypto with out the dangers of self-custody, personal keys, or unregulated exchanges. ETFs present the crypto ecosystem with capital stability and introduce new sources of demand that had been beforehand absent.

Regardless of their success, crypto ETFs face challenges that would form their long-term evolution. One difficulty is the focus of custody. Most main Bitcoin ETFs use Coinbase Custody (Prime or Belief) or Constancy Digital Property Companies as custodians, elevating questions on systemic threat. One other problem lies in price buildings, as competitors is forcing issuers to compress prices additional, doubtlessly decreasing margins for ETF suppliers.

There’s additionally an ongoing debate throughout the crypto neighborhood about whether or not ETFs undermine Bitcoin’s decentralized ethos. By concentrating possession in giant, regulated entities, ETFs might shift governance affect away from particular person holders.

For extra: Altcoin ETFs After Solana – XRP, ADA, AVAX Subsequent in Line

The ETF-Led Transformation of Crypto

The increase in crypto ETFs throughout 2025 isn’t only a pattern—it marks a everlasting change in how digital property are purchased, held, and priced. These autos have develop into gateways for These embody critical capital, instruments for retirement planning, and constructing blocks for long-term portfolio development.

The system now contains Bitcoin and Ethereum. They’re reshaping crypto and conventional finance from the within out by way of ETFs.

The query now shouldn’t be whether or not crypto ETFs will succeed. It’s how far their affect will attain—and what comes subsequent in a market that’s lastly discovered its bridge between code and capital.