President Donald Trump’s sudden go to to the Federal Reserve (FED) headquarters has hinted at a potential shift within the US rate of interest coverage. Throughout his tour of the central financial institution’s renovation website with FED Chair Jerome Powell, Trump criticized the rising value of the mission however made it clear that his fundamental concern stays the central financial institution’s reluctance to decrease charges.

Trump Presses FED Chair Powell For Charge Lower

On Friday Trump instructed reporters that he had a productive assembly with Powell, leaving the impression that the FED could also be open to slicing charges. In keeping with a Bloomberg report, President Trump and Powell toured the FED’s headquarters renovation mission in Washington on July 24, discussing the escalating prices and, extra importantly, the course of US fee lower coverage.

Though Trump voiced concern over the estimated $25 billion renovation price ticket, calling it extreme, he used the go to to reiterate his demand for speedy fee cuts, stressing that decrease rates of interest are important for financial development. Regardless of months of publicly criticizing the FED Chair, Trump’s face-to-face assembly with him ended with out the political drama many had anticipated.

As an alternative, the uncommon go to appeared to ease the long-simmering tensions between the 2 figures, although Trump made clear his expectations of a fee lower stay excessive. The US President additionally urged that he’s not at present planning to fireside Powell, no matter ongoing frustrations over rates of interest and a controversial renovation mission that has drawn scrutiny from the administration.

Although Powell’s time period as Chair ends in Could 2026, there’s no indication he plans to step down early. In the meantime, Trump continues to press for decrease charges, stating, “I simply wish to see one factor occur—rates of interest have come down.” He has framed financial coverage as a high concern for his administration transferring ahead, signaling that stress on the FED to decrease charges is unlikely to settle down quickly.

Trump Repeats Charge Calls for With UK Chief

Following his latest high-profile go to to the Federal Reserve, Trump escalated his marketing campaign for decrease rates of interest throughout a closed-door session with United Kingdom (UK) Prime Minister Keir Starmer. In a pointed critique of Powell, Trump instructed Starmer and assembled international leaders that US charges should be lower to 1%, describing it as each an financial necessity and a private frustration with the FED Chair’s management.

He emphasised the potential monetary impacts of lowered charges, stating that they need to be at the least 3% factors decrease than they’re now. He claimed this distinction quantities to almost $1 trillion in potential financial savings for the US economic system, estimating that every proportion level equals roughly $360 billion in lowered prices. By elevating this difficulty in a diplomatic setting, the US President signaled his willingness to problem central financial institution coverage on a world stage.

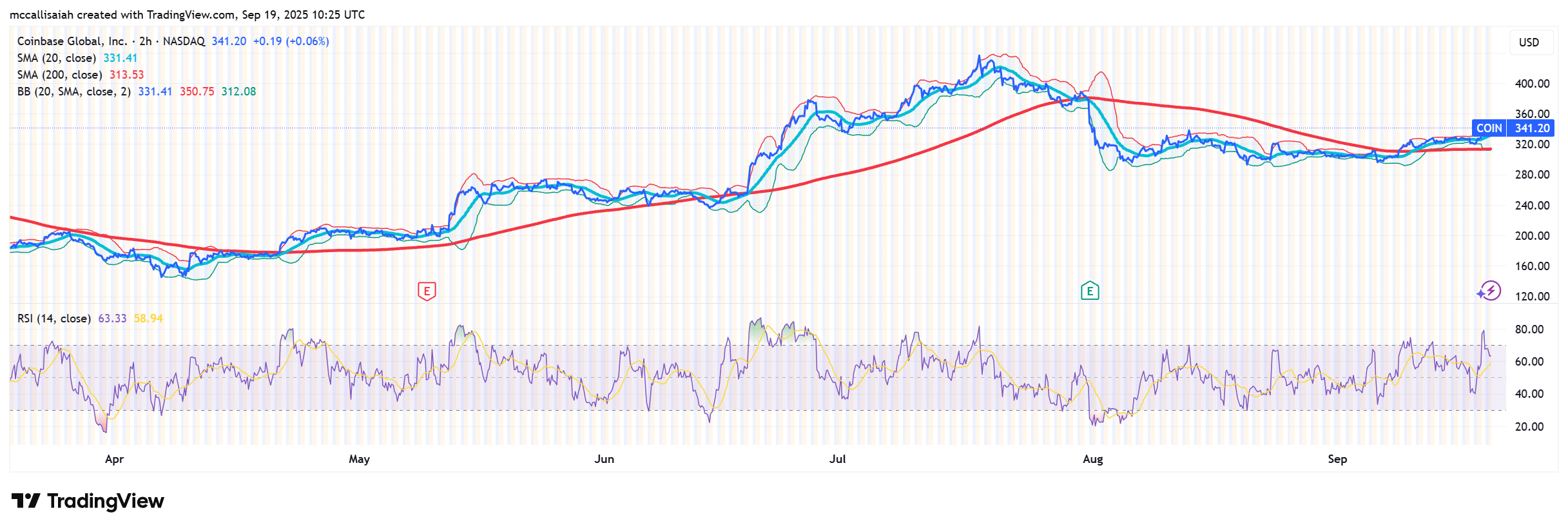

Notably, many within the crypto group see a possible fee lower as a serious catalyst for digital belongings. Drawing comparisons to 2021, when decrease charges triggered an altcoin explosion, crypto analyst ’Grasp of Crypto’ urged in an X social media publish the present market may very well be on the verge of the same breakout, probably triggering the beginning of the anticipated altcoin season.

Featured picture from Shutterstock, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.