In a 12 months already saturated with market rallies and speculative euphoria, few tokens have stolen the highlight fairly like ZORA in 2025. Inside mere weeks, ZORA skyrocketed by over 900%, igniting fervent curiosity throughout the crypto ecosystem. As soon as considered a quiet infrastructure protocol on Ethereum Layer 2, ZORA unexpectedly advanced into the centerpiece of a resurging SocialFi motion.

What catalyzed this explosive transfer? Was it merely one other hype-fueled rally, or does it symbolize a deeper structural shift towards decentralized media, creator monetization, and Web3-native social engagement?

From Coinbase Pockets to SocialFi Engine

The turning level got here when Coinbase rebranded its pockets because the “Base App,” shifting its objective from a normal self-custodial answer to an built-in social software embedded throughout the Ethereum Layer 2 ecosystem. On the coronary heart of this transformation was a strong innovation: Creator Cash—on-chain tokens minted for particular person posts, tradable straight by customers.

The Creator Cash operate helps permissionless minting, content material possession, and buying and selling. The mixture of Zora and Farcaster—a decentralized social community—supercharged consumer exercise. Based on information from The Block and Bankless, day by day token creations soared from roughly 4,000 to over 38,000 in simply three weeks.

ZORA, the protocol’s native token, grew to become the implicit index guess for this whole pattern. With Coinbase backing the Base ecosystem, investor confidence skyrocketed, resulting in a surge in spot and futures quantity and a 10x value enhance in below a month.

Based on CoinGecko, ZORA gained 21.6% on July 17 alone following its integration with Base App.

NEWS: $ZORA is up 21.6% after its integration with the rebranded @baseapp app. pic.twitter.com/Oldeqlt3I1

— CoinGecko (@coingecko) July 17, 2025

SocialFi Momentum Meets Market Hypothesis

The rise of ZORA matches inside a broader 2025 pattern: the resurgence of SocialFi. After a lull post-2021, the SocialFi sector has re-emerged, bolstered by low-cost Layer 2 infrastructure and the rise of decentralized social platforms like Farcaster. Zora’s financial mannequin straight capitalized on this revival.

For extra: Every thing You Want To Know About NFT Artwork Market Zora

The mechanics have been easy however highly effective. A consumer creates content material; that content material is minted right into a token; merchants purchase and promote these tokens on Uniswap or built-in social DEXs. Merchants speculate on publish recognition, whereas creators earn transaction charges on every commerce. On this context, ZORA grew to become greater than a governance token. It changed into the “de facto platform token” for a brand new type of creator monetization—incomes on consideration, not advert clicks.

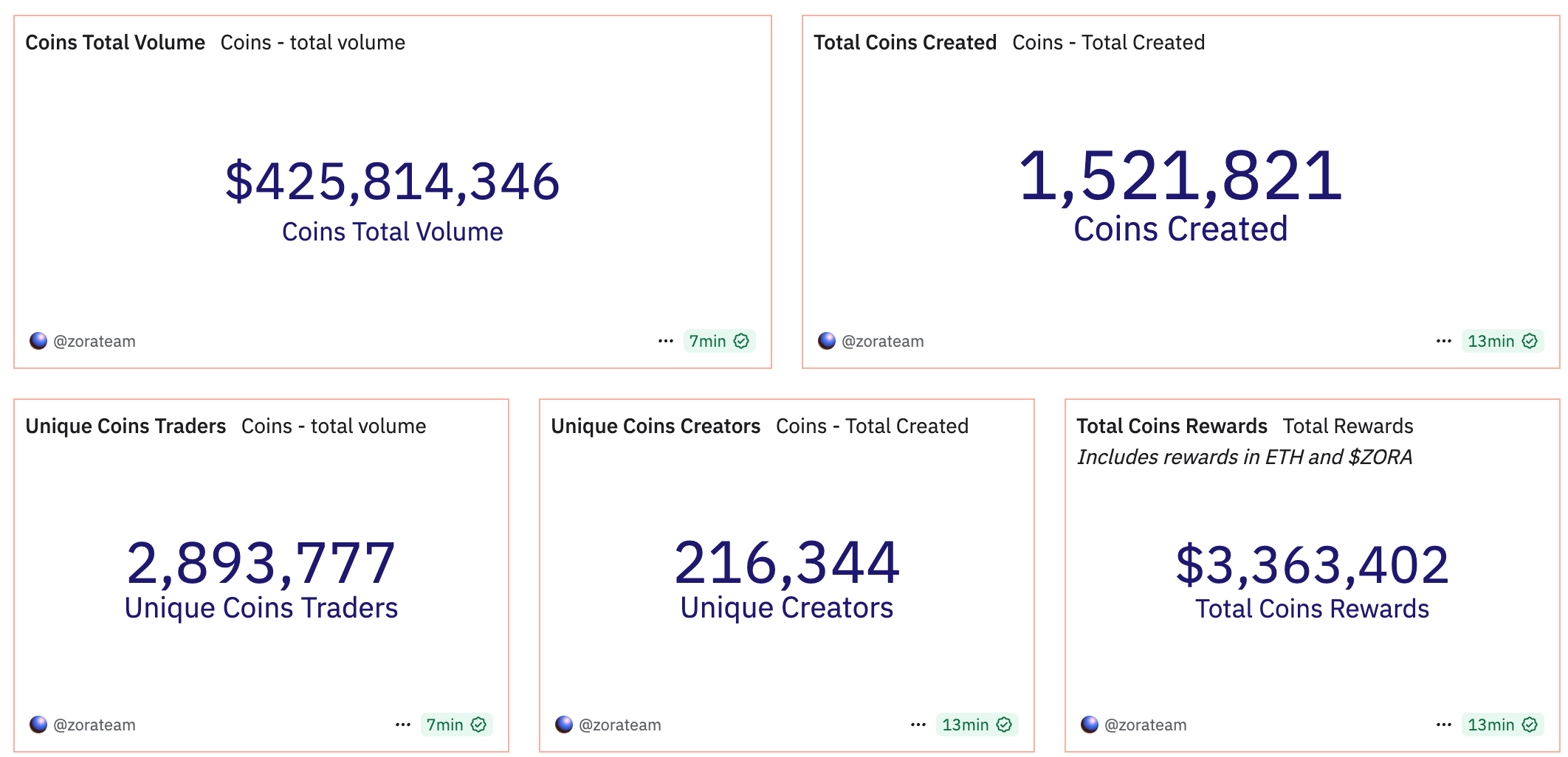

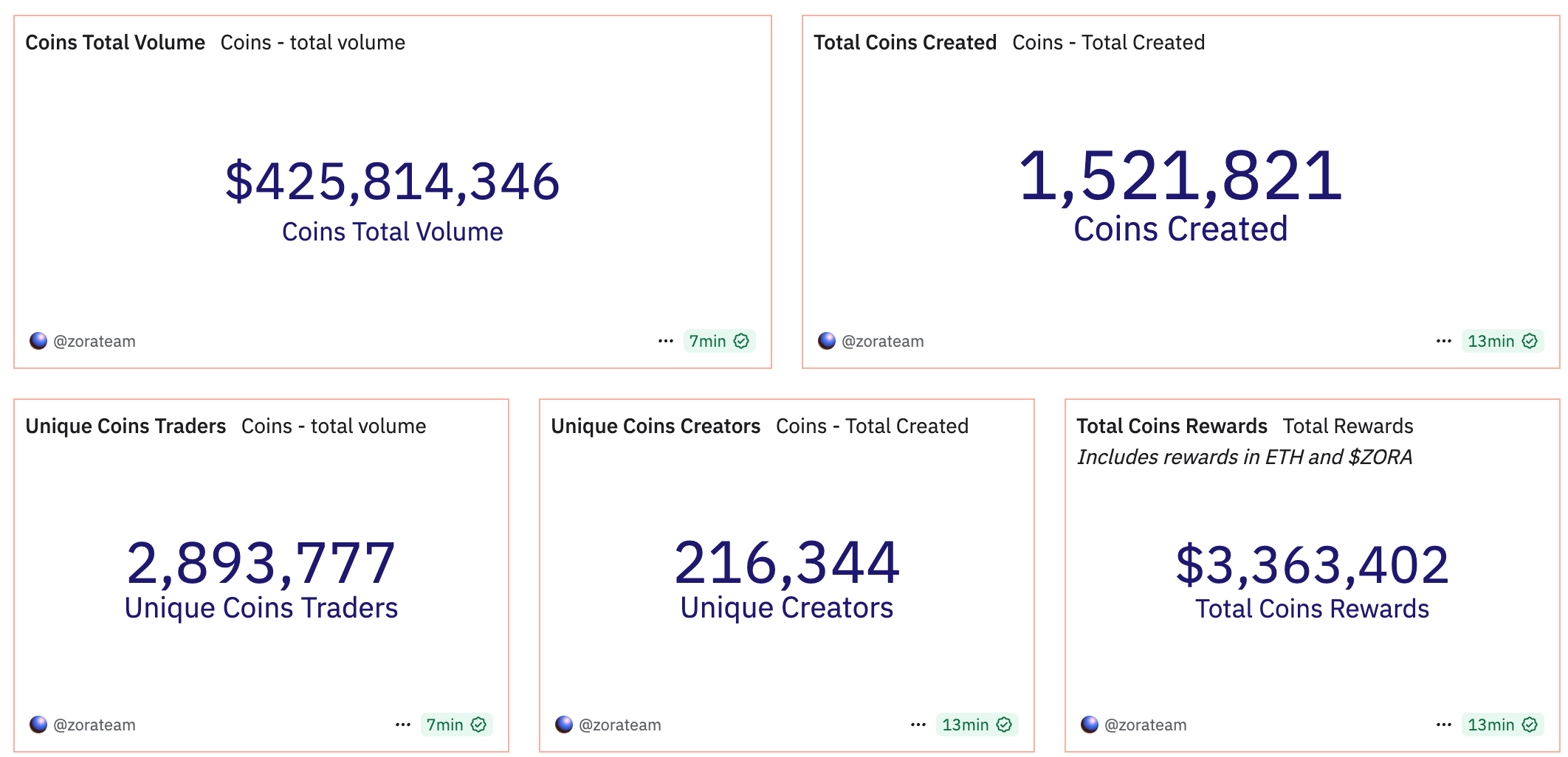

Supply: Dunes

Based mostly on information from DeFiLlama and CoinGlass, over 1.5 million Creator Cash have been minted between June and July 2025. SocialFi-linked contracts noticed $425 million in cumulative buying and selling quantity, and ZORA futures open curiosity surpassed $100 million simply days after the Base App integration.

Supply: Coinglass

Technical and On-Chain Affirmation

Market conduct wasn’t purely speculative. On-chain and change metrics confirmed a shift in investor profile. Based on CoinGlass, ZORA token balances throughout centralized exchanges dropped from over 6 billion to below 4.5 billion in the course of the rally. On the similar time, whale pockets focus elevated by 8%, indicating accumulation by giant holders.

Supply: Coinglass

Such metrics sometimes point out accumulation by giant holders, suggesting confidence within the token’s long-term utility. In the meantime, ZORA’s MACD and RSI indicators flipped bullish simply earlier than the foremost breakout above $0.01, a key resistance degree.

Furthermore, Binance’s itemizing of ZORA perpetual futures with 50x leverage amplified momentum. The derivatives itemizing introduced liquidity and allowed merchants to take giant directional positions on ZORA’s value, serving to the token to rise extra quickly and draw extra consideration.

The outcome was a flywheel: extra quantity led to extra curiosity, which drove extra quantity, additional tightening the token’s obtainable provide and accelerating the rally.

Zora Liquidation Heatmap. Supply: Coinglass

Is the Pump Justified?

From a elementary standpoint, ZORA’s 10x pump seems each overblown and underappreciated—relying on one’s perspective. On one hand, the token’s utility remains to be comparatively undefined. It serves governance functions within the Zora DAO and is not directly tied to the Creator Coin financial system, but it surely doesn’t confer direct rights to income or transaction charges. We clearly see the dearth of direct financial seize weakens the token’s valuation base.

However, ZORA represents an rising coordination asset within the SocialFi stack. If SocialFi is right here to remain—and metrics point out that it is perhaps—then ZORA may develop into the ETH of a brand new Layer 3 ecosystem targeted on consideration, creators, and post-based property. Comparable coordination property—ETH for DeFi, SOL for high-speed sensible contracts, ARB for scaling—grew exponentially as soon as their ecosystems matured. If ZORA continues integrating with Farcaster, Base, and new Layer 3 experiments, its function could broaden dramatically.

What Can We Study From This Rally?

The rise of ZORA gives a number of insights into the present state of crypto markets. First, narratives nonetheless matter—lots. ZORA didn’t change its protocol in a single day, nor did it out of the blue add new income streams. What modified was the narrative round social media, possession, and tokenized content material. Coinbase’s involvement gave the ecosystem credibility, and that was sufficient to catalyze a wave of hypothesis and funding.

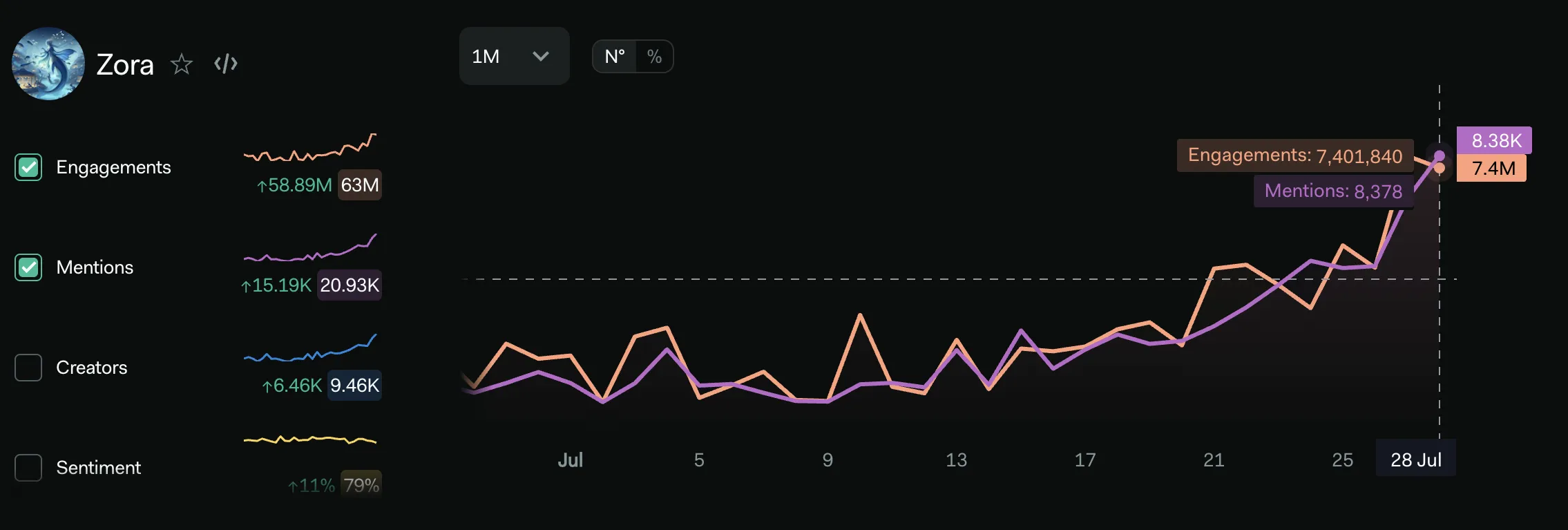

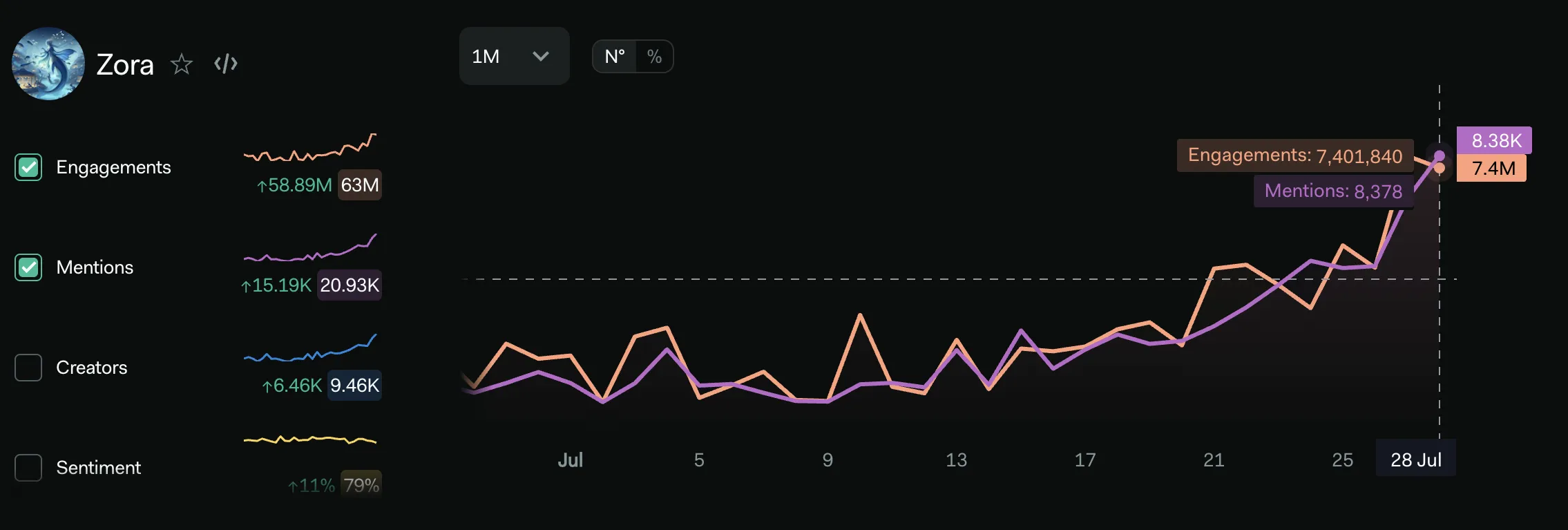

About Zora Engagements and Mentions. Supply: LunarCrush

Second, infrastructure tokens with robust cultural resonance are outperforming extra “technically sound” however much less partaking alternate options. ZORA benefited not solely from the Base community results but additionally from its model positioning amongst creators, artists, and open-source advocates. Its pump is a reminder that crypto is as a lot a tradition market as it’s a capital market.

For extra: The Base Ecosystem is Dealing with a Main Progress Alternative

Lastly, the pump highlights that composability is the killer function of Web3. Zora’s success wasn’t remoted. It was composable with Base, Farcaster, Uniswap, and different instruments. The mixture allowed new use circumstances to emerge with out permission and worth to accrue in sudden methods. Initiatives that allow this sort of open experimentation will proceed to be rewarded.

Structural Sign or Non permanent Hype?

ZORA’s 10x rally in 2025 could appear speculative on the floor—and to a big diploma, it’s. However beneath that volatility lies a strong sign: crypto is evolving past cash and finance into tradition and content material. Zora Protocol sits on the intersection of this evolution, providing creators the flexibility to personal, commerce, and revenue from their work in real-time, on-chain.

The worth could appropriate, and the euphoria could fade. However the mechanics, instruments, and narratives that drove ZORA’s rise are right here to remain. As crypto strikes into a brand new section outlined by identification, media, and social capital, ZORA will be the first of many tokens to capitalize not simply on code, however on tradition.