Analyst Weekly, July 28, 2025

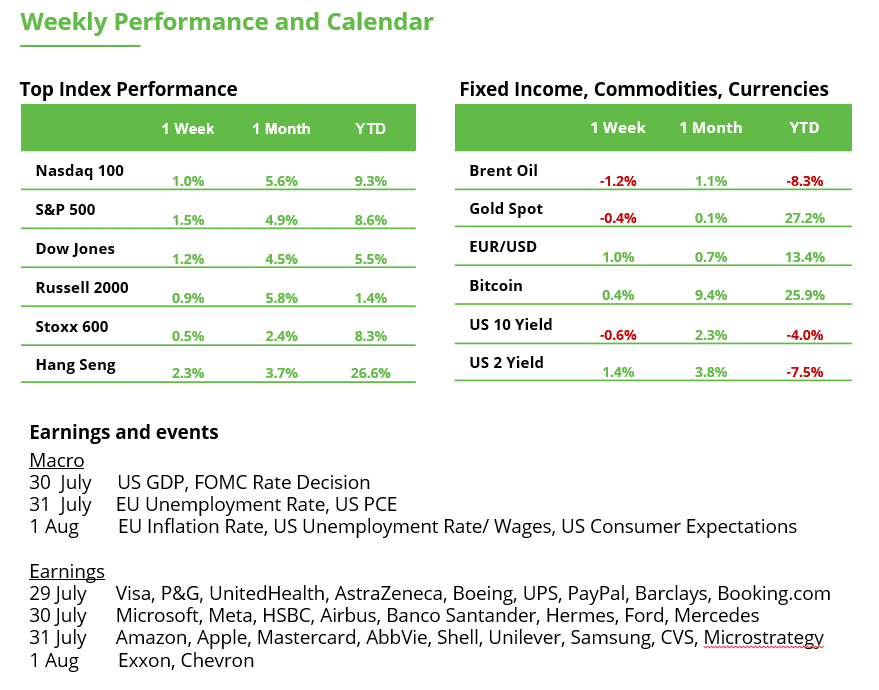

Markets simply obtained a breather: the US and EU inked a last-minute commerce deal that dodges a tariff warfare and unlocks $1.3 trillion in cross-border commitments.In the meantime, July’s rotation rally picked up steam, with homebuilders, supplies, and mid-caps breaking out, and now all eyes are on Huge Tech, Huge Oil, and Huge Pharma as a stacked earnings week kicks off.

The US-EU Commerce Pact: 15% Tariff, $1.3 Trillion in Commitments

The US and EU have reached a high-stakes commerce settlement that averts a dangerous transatlantic tariff escalation simply days earlier than a crucial August 1 deadline.

Right here’s what we all know:

Key Deal Particulars

Tariff Avoidance: The EU avoids a possible 30–50% tariff hike by accepting a 15% blanket tariff on most exports to the US, together with vehicles.

US Features:

$750 billion in EU power purchases

$600 billion in EU investments within the US

Zero-tariff entry to pick EU markets for American items

Giant navy gear gross sales to Europe

Sectoral Exemptions & Ambiguities: Prescribed drugs and metals (metal, aluminum) stay unsure:

The US says they’re excluded.

The EU says they’re included within the 15% fee, with a quota system being developed for metals.

Quotas in Play: Metal and aluminum could fall below volume-based tariff quotas, however phrases are nonetheless evolving.

Stability Final result: Either side emphasize this deal avoids a doubtlessly market-disrupting commerce warfare over $1.7 trillion in bilateral commerce.

Our tackle it:

In our view, the brand new US-EU commerce settlement is a political and financial win for Washington, and a practical retreat by Brussels. Whereas the 15% tariff on most EU exports is decrease than the threatened 30%, it’s nonetheless a pointy bounce from pre-2025 ranges when many items confronted tariffs below 3%, and will add to inflationary pressures within the months forward relying on whether or not corporations handle to pass-through value will increase to customers (with the influence on inflation figures additionally depending on whether or not charges keep at restrictive ranges). That stated, markets will welcome the lowered uncertainty and the avoidance of an all-out commerce warfare. The actual winners listed below are US sectors: power, protection, and infrastructure are set to profit from the EU’s pledges to purchase $750 billion in American power and make investments $600 billion into the US financial system. However we nonetheless don’t know whether or not sectors reminiscent of metal, autos, chemical compounds could face tighter quotas or future exemptions. Till these particulars emerge, the long-term influence for these sectors stays unsure and will create divergence in sectoral efficiency in Europe.

What to Watch This Week – Earnings Season

Huge Tech:

Microsoft (July 30)

What to observe: AI Monetization: Income from Copilot (Workplace 365 AI) and Azure AI workloads. Azure Progress Charge: Particularly vs. AWS and Google Cloud.Working Margins: Affected by rising capex and AI infrastructure investments.Steerage: FY26 income and margin outlook tied to enterprise IT budgets.

Meta (July 30)

What to observe: AI Spending and Capex: Meta has ramped AI infrastructure spend; updates on returns are key. Promoting Progress: Tendencies in core advert income, particularly Instagram and Reels. Actuality Labs Losses: Buyers proceed to observe the dimensions of metaverse investments. Consumer Engagement: Month-to-month and every day energetic person progress in key areas.

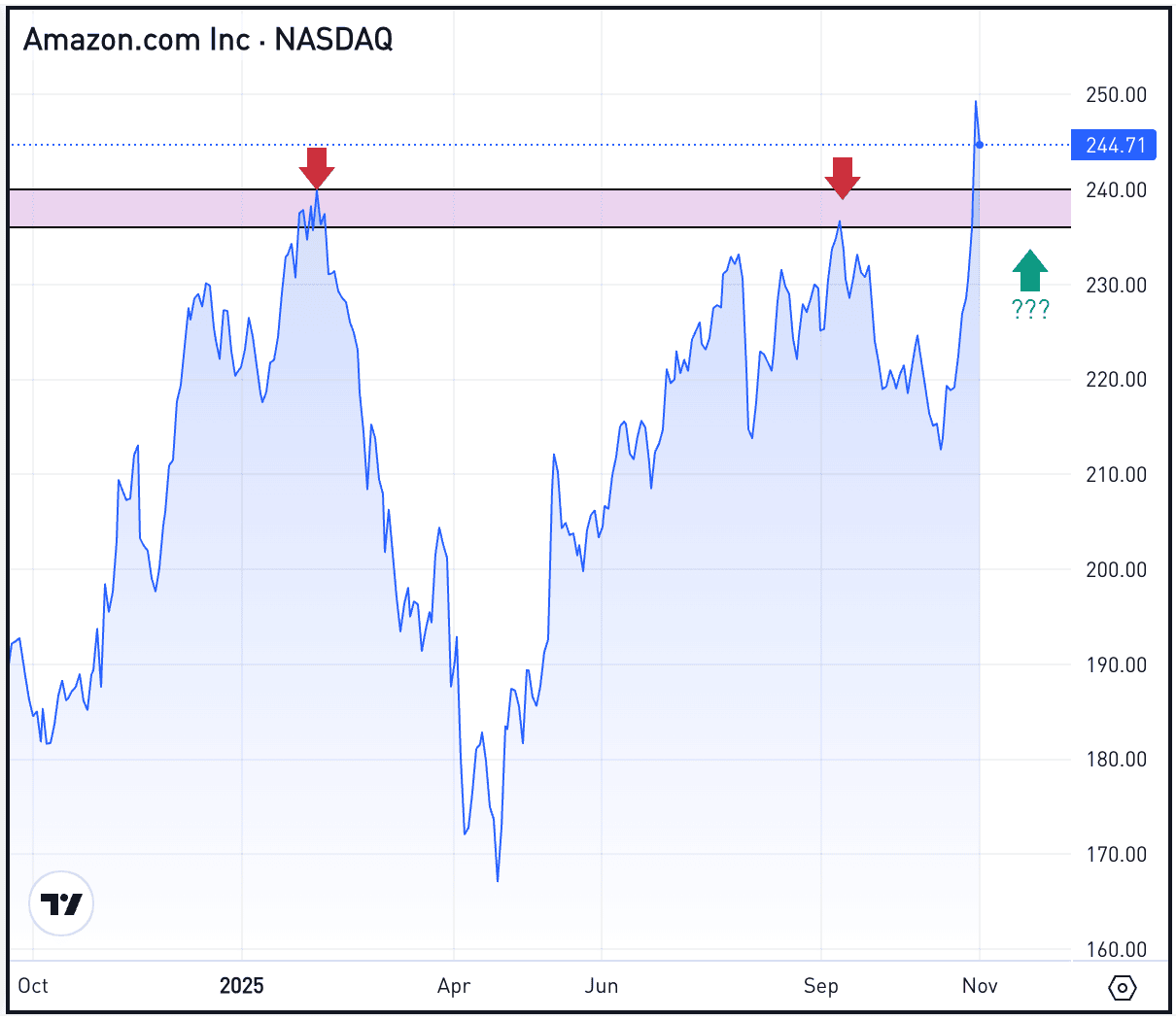

What to observe: AWS Progress and Margins: Indicators of reacceleration or margin compression. Promoting Income: Quickest-growing phase; alerts shopper demand. Capex Steerage: Particularly AI infrastructure spend and logistics investments.

What to observe: iPhone Gross sales in China: Significantly post-tariff numbers and regulatory stress influence. AI Technique: Whether or not Apple is catching up in AI/edge computing. Companies Income: Apple Music, App Retailer, iCloud, i.e. margin-rich segments. Gross Margins: Look ahead to any influence from element prices and FX.

Power:

Exxon (Aug 1) and Chevron (Aug 1)

What to observe: manufacturing volumes & combine, capital return methods, whether or not they’re effectively positioned to seize upside from EU-US commerce deal and EU’s dedication to purchase US power.

Shopper & healthcare resilience:

Studies from Mastercard (July 31), Visa (29 July), P&G (29 July), and healthcare names reminiscent of AstraZeneca (29 July), CVS (31 July), AbbVie (31 July), will assist traders assess demand and margin stress in gentle of tariffs and inflation.

July Exhibits Indicators of Rotation Returning

One of many clearest themes in July has been the return of a rotational market, the place management is shifting throughout sectors reasonably than being concentrated in just some mega-cap names. A standout instance: homebuilders, which have proven robust momentum, particularly after names like D.R. Horton ($DHI) broke above their 200-day shifting averages in a significant method. These technical breakouts counsel additional upside, notably on any short-term pullbacks.

This energy in homebuilders is a part of a broader enchancment inside Shopper Discretionary, which has been lagging however is now catching up. Whereas some traders have apprehensive in regards to the market being too slender, July’s bounce in beforehand underperforming sectors helps ease these considerations. Notably, the S&P 500 Equal Weight is near reaching new cycle peaks.

Supplies are additionally collaborating within the rotation, with the sector exhibiting its strongest technical breadth (shares above their 200-day) in almost a 12 months. There are early indicators that relative efficiency in supplies is starting to show up, one more optimistic improvement.

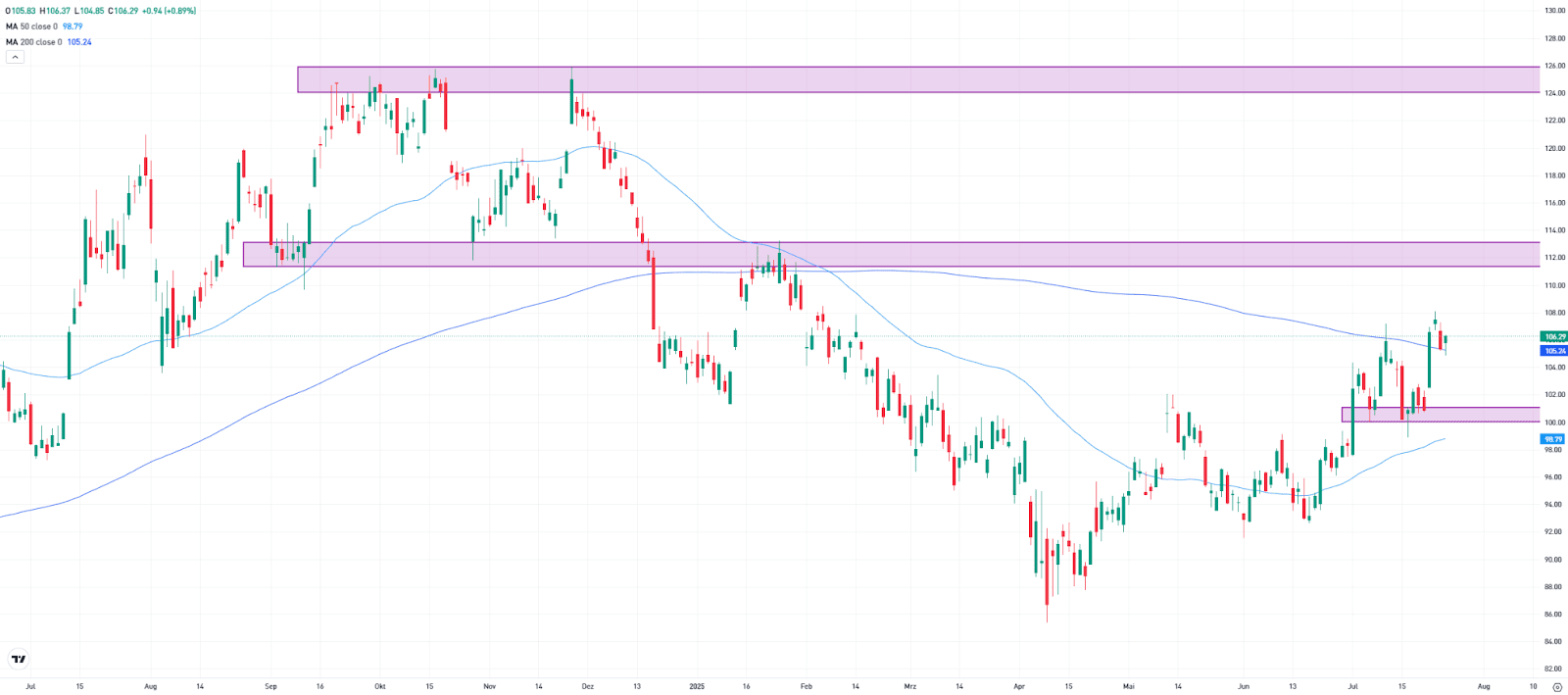

SPDR S&P Homebuilders ETF ($XHB)

The XHB rose by 5% final week, closing at 106.29. It additionally marked the fourth consecutive every day shut above the carefully watched 200-day shifting common, providing hope for a possible long-term development reversal. A robust resistance zone lies across the 112 stage, as this space noticed a number of touchpoints all through 2024 and early 2025. On the draw back, the 100 stage serves as short-term assist, the place the ETF shaped a backside final week. Just under that stage runs the 50-day shifting common, which additional reinforces the assist space.

“Made for Germany”: A Purchase Sign for Mid and Small Caps?

An intense race for funding and site competitiveness has damaged out amongst international locations such because the USA, China, and EU member states. The launch of the “Made for Germany” initiative is a direct response. It was based by 61 corporations with the objective of sustainably strengthening Germany as an funding location. The initiative goals to finish the financial stagnation that has now lasted for 3 years. Alongside German companies reminiscent of BASF, SAP, and Volkswagen, US giants like Nvidia, BlackRock, and Blackstone are additionally concerned.

Nevertheless, one crucial level stays: the entire funding quantity is a mixture of already deliberate and new capital commitments. The precise share of recent investments continues to be unclear. Studies counsel {that a} three-digit billion euro quantity in recent capital is on the desk. For context: 100 billion euros characterize round 2.3 % of Germany’s GDP. If this capital is actually extra and used effectively, it might be an vital step, however additional measures would nonetheless be vital.

MDAX as a sentiment indicator: It additionally stays unsure which sectors, areas, or tasks will particularly profit from the “Made for Germany” investments. Up to now, there’s a lack of transparency and readability round implementation. Many corporations within the MDAX and SDAX are extremely depending on the German home financial system. An enchancment in Germany’s financial framework situations may open up above-average return potential for these shares.

Over the previous three years, the MDAX has gained simply 16%, and on a five-year foundation, the rise is simply 15 %. The index at present trades round 14% beneath its all-time excessive. Those that don’t put money into all the index ought to remember the fact that not each inventory is prone to profit equally. Buyers must be selective and concentrate on high quality corporations with robust stability sheets, innovation capabilities, and stable market positioning.

Bottomline: If giant companies stay dedicated to Germany, mid-sized companies, suppliers, and regional ecosystems alongside the worth chain can even profit. Nevertheless, with out complete structural reforms, there’s a threat that the invested capital will fail to ship its supposed influence.

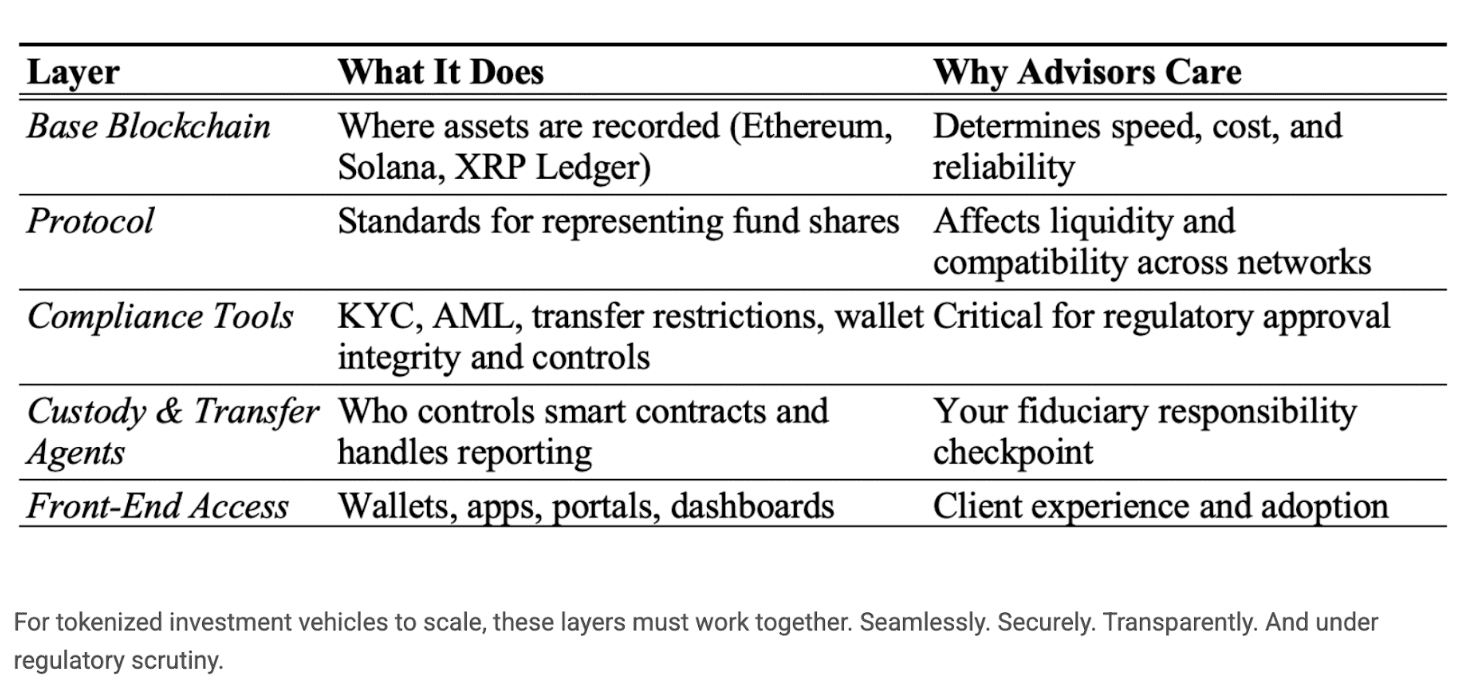

What You Ought to Know Earlier than Investing in Tokenized Belongings

On the subject of investing in tokenized belongings, there are 5 key layers working behind the scenes to make the system safe, quick, and simple to make use of. The bottom blockchain (like Ethereum or Solana) is the place belongings are saved: it impacts how briskly and inexpensive transactions are. The protocol layer units the principles for a way digital funds are created and traded. Compliance instruments deal with issues like ID checks and fraud prevention, serving to platforms keep authorized and protected. Custody and switch brokers handle who holds your belongings and the way they’re reported, key for safeguarding your investments. Lastly, the front-end entry, like apps and dashboards, is what you really see and use to handle your investments. When all 5 layers work effectively collectively, you get a clean, safe, and reliable investing expertise.

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any specific recipient’s funding aims or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product are usually not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.