Welcome to Slate Sundays, CryptoSlate’s new weekly characteristic showcasing in-depth interviews, skilled evaluation, and thought-provoking op-eds that transcend the headlines to discover the concepts and voices shaping the way forward for crypto.

Lyn Alden is an distinctive human.

Broadly acknowledged as one of many prime minds in macroeconomics, throughout a dialog with Lyn, you possibly can really feel a few of her huge mind rubbing off on you; I swear my IQ elevated a number of factors by the point our chat was over.

Even navigating heavy matters just like the fiscal deficit and the onset of AI, she does so with a smile on her face and extra eloquence and poise than an Olympic gymnast executing a triple backflip.

Founding father of Lyn Alden Funding Technique and basic accomplice at enterprise agency Ego Loss of life Capital, alongside different trade heavyweights like Jeff Sales space and Preston Pysh, Lyn has earned her stripes through the years as one of the revered macro analysts within the area.

She’s additionally one of the solicited for interviews, because of her razor-sharp insights and depth of market information.

As a prolific content material creator, Lyn affords a free investing e-newsletter and frequents the digital corridors of Crypto Twitter day by day, amassing three-quarters of 1,000,000 followers who depend on her well timed commentary and finely-edged wit: past the plain phrases of knowledge and funding recommendation, Lyn’s one thing of a grasp in terms of memes.

Nothing stops this practice

Lyn is probably finest recognized for her ebook Damaged Cash, which gives a complete view of the historical past of cash and a well-illustrated critique of the worldwide financial system. She’s additionally extremely vocal about her thesis on the U.S. fiscal deficit, AKA, ‘Nothing stops this practice’.

Sky-high ranges of U.S. spending are rising at a tempo that far outstrips the federal government’s potential to pay for it, creating what Lyn dubs a “slow-motion runaway practice.” She explains:

“Giant U.S. fiscal deficits are going to proceed for the foreseeable future, 5, 10 years, any kind of investable time horizon. There are a bunch of the explanation why, and lots of them should do with political polarization. It’s very exhausting to both massively elevate taxes or massively lower spending in a really polarized scenario, in addition to mechanically the type of debt ranges they discover themselves in.”

The overall amount of cash the U.S. authorities owes to its lenders at present quantities to an eye-watering $36.9 trillion, representing over 120% of GDP, and rising by round $1 trillion each quarter.

Even essentially the most extremely expert ringmaster with smoke and mirrors would wrestle to obfuscate such an alarming stage of federal debt. With a diminishing potential to pay it off, I ponder, if nothing stops this practice, can something gradual it down? She replies:

“There are many issues that may gradual it down a bit of bit. Tariffs are one of many issues that may gradual it down as a result of they bypass a few of that polarization. Tariffs are principally actually large tax hikes that go round Congress due to an emergency authorization government order, in order that they briefly bypass a few of the frictions in opposition to them.”

Whereas tariffs could serve to fill the federal government coffers a bit of greater, Lyn says the numbers don’t add up sufficient to make a major influence: the deficit is round $2 trillion, and the earnings from tariffs on the present stage solely equates to roughly 1 / 4 of it at round $500 billion a yr. Plus, “we’re already seeing exemptions.” She provides:

“The final line for the ‘Nothing stops this practice’ view is that the U.S. could be very financialized, which means that our authorities’s tax receipts are very correlated with asset costs. Any makes an attempt at austerity at this level are inclined to fail to deal with the issue since you both decelerate the inventory market or decelerate the economic system. Subsequently, with a lag, you weaken your different tax receipts and make deficit discount on a sustained foundation exhausting.”

I nod, considering the enormity of the scenario and the inevitable collision course the economic system is on. She continues:

“Simply structurally, it’s rising above goal nearly with none technique to cease it.”

The outlook for Bitcoin and broader crypto markets

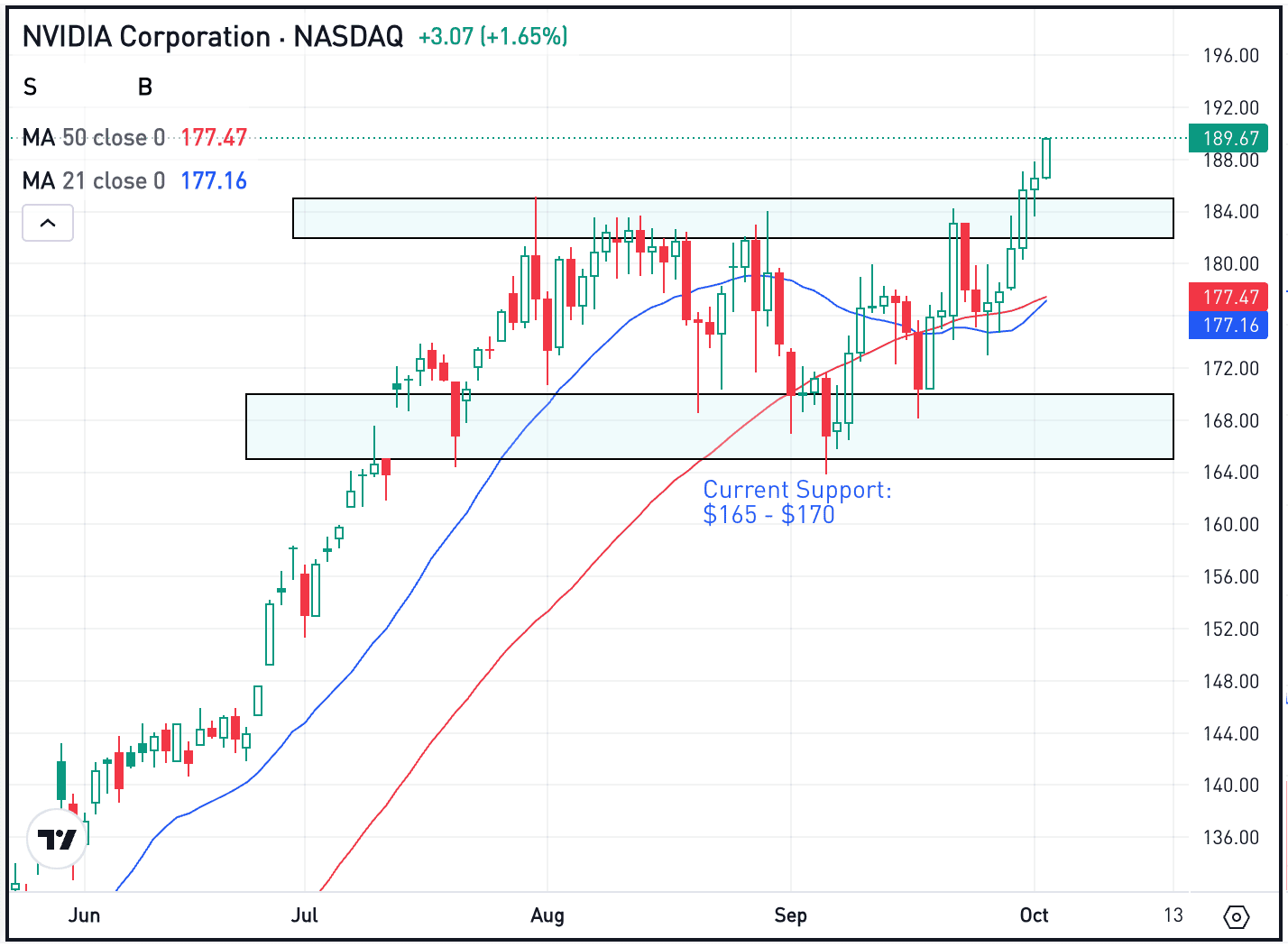

We flip the dialog to final week’s market stoop following a weaker-than-expected jobs report that triggered former BitMEX CEO Arthur Hayes to dump a piece of his crypto holdings. I ask Lyn how important the roles report is and whether or not she echoes Hayes’ bearish near-term views on international liquidity.

She frowns, declaring that Hayes is extra of a frequent dealer than she is, nevertheless:

“The roles report was fairly important. It was the most important downward revision in fairly some time, and it’s corroborated by different issues as properly. The ISM Buying Managers’ indices are additionally displaying the same directional weak point.”

The ISM Manufacturing PMI is a key indicator of the state of the U.S. economic system because it indicators the extent of demand for merchandise by measuring the quantity of ordering exercise at U.S. factories. Lyn continues:

“Now, whether or not that impacts Bitcoin and broader crypto, I’m extra hesitant to say. Whereas it might probably decelerate earnings that may impair the economic system in varied methods, it additionally typically means extra Fed dovishness, which, across the margins, is nice for Bitcoin and crypto.”

Regardless of not making short-term buying and selling selections like Hayes, Lyn provides some credence to his outlook over the approaching quarters based mostly on a few parameters:

Tariffs could make a dent within the deficit and serve to take the wind out of crypto’s sails (“barely slower the practice for a few quarters”), and the treasury is making an attempt to refill its basic money account (the TGA) after the debt ceiling was handed. Which means sucking liquidity out of the system, which may negatively influence danger property. Lyn explains:

“Sarcastically, debt ceilings, once they’re a problem, are literally good for liquidity as a result of they pressure all these pockets of liquidity to return into the market, however then afterward, once they refill their money ranges, they’re pulling money out of the system.

They [the treasury] anticipate to do this by means of the remainder of this quarter, to Arthur’s level, which is traditionally not wonderful for asset costs throughout the board.”

In distinction, Lyn isn’t too nervous a few broader tightening of worldwide liquidity. She says:

“I might say liquidity’s in a middling place as a result of the greenback is not falling because it was earlier this yr, and the greenback is a very large variable for liquidity, typically. A falling greenback is total good for international liquidity. On the different finish of the spectrum, China’s credit score impulse is on the upswing, which is nice for international liquidity. So it’s type of impartial on the present time.”

Bitcoin cycles will likely be longer and fewer excessive

Whereas it’s not the proper setup for a million-dollar Bitcoin, issues may undoubtedly be worse. Lyn affirms:

“I don’t suppose this cycle’s over but. I believe we’re going to see greater highs in Bitcoin this cycle. That may very well be later this yr. That may very well be early subsequent yr. There are many little variables that may have an effect on that, however thus far, we don’t see any indicators that appear to be a multi-year prime.”

In truth, she explains that we’re “nowhere close to multi-year tops” based mostly on varied indicators that monitor market worth in comparison with on-chain value foundation, a “type of a measure of euphoria.”

“I believe liquidity nonetheless seems respectable, possibly not nice for 1 / 4, nevertheless it’s not an acute headwind per se, for my part, and going into subsequent yr, I nonetheless suppose we’re going to see more than likely greater Bitcoin costs.”

How excessive is that?

Lyn pauses and says she has no agency view. In contrast to different personalities within the area, she doesn’t win over extra followers by making outlandish predictions. As a substitute, she merely says:

“I believe we’re going over $150k this cycle. Now the quantity may very well be a lot greater than that, however I all the time attempt to begin conservatively, and it relies on market circumstances at the moment.”

She believes that Bitcoin cycles are altering, and we must always anticipate this one to be longer and “possibly much less excessive” than earlier runs. We must also put together to see robust strikes upward adopted by durations of consolidation, “quite than going to the moon and collapsing.”

“For those who have a look at what was once referred to as FANG shares, and now it’s the Mag7 shares, principally large-cap U.S. tech shares, they stored grinding up longer than folks thought. Worth traders have been all the time shocked that this stuff simply stored rising.

“Typically they recover from their skis and have a 30% correction, generally worse. Typically they’ve a flattish, uneven yr, however then they hold grinding greater after they work out some steam. I believe Bitcoin may resemble that mannequin to some extent. Perhaps it’s nonetheless extra risky than that, however I do suppose we must always anticipate possibly longer and fewer excessive cycles on common.”

Bitcoin treasury firms: bear market catalyst?

For anybody who’s been flushed out by a Mt. Gox, China ban, or FTX-style black swan occasion that abruptly reversed most of Bitcoin’s good points, Lyn’s prediction could present some reduction. However is there any potential catalyst for the top of the cycle quietly chirping away like a canary in a coal mine? Bitcoin treasury firms, for instance?

Lyn factors out that now that Bitcoin is a multitrillion-dollar asset, it’s inevitable that good cash flows in. She says:

“There’s no world wherein solely people personal Bitcoin and magically no massive swimming pools of capital need to personal it. That solely is sensible when Bitcoin is a tiny market.”

She’s not involved in regards to the centralization menace to Bitcoin posed by entities like Technique gobbling up BTC prefer it’s going out of favor (Technique’s BTC holdings at present stand at over 628,791, simply shy of three% of the whole provide). She merely shrugs and says it’s no completely different from earlier cycles:

“At one level, Mt. Gox supposedly had over 800,000 cash, and there have been fewer cash again then. In order that was an even bigger proportion of cash than, say, BlackRock or Technique has now. So whereas there’s all the time some extent of centralization issues, it’s actually not worse now than it was at durations of occasions up to now. So, no. I’m probably not nervous about that from a centralization perspective.”

What’s essential to be looking out for, Lyn explains, is the quantity of leverage within the system, since “any diploma of euphoria and leverage is what causes the following downward cycle.” Bitcoin wants upward volatility to go from zero to trillions of {dollars} of worth and change into related on a worldwide scale; and upward volatility, Lyn warns, breeds euphoria and leverage.

“That’s while you recover from your skis and also you get consolidations and draw back volatility. There are clearly different liquidations that occur on occasion, in order that they definitely may feed the following downturn, however I don’t view it as basically completely different from prior cycles, and the present leverage within the treasury area is just not that top.

MicroStrategy has fairly low leverage relative to their Bitcoin. Metaplanet has comparatively low leverage relative to their Bitcoin. We’ll see how the others come as they go. I definitely suppose that we’ll see a washout. We’ll see lots of altcoin treasury firms get washed out, and a few Bitcoin ones which are poorly managed are going to be in danger within the subsequent downturn.”

The roaring 20s and the decade-long inflation

It was someday through the COVID lockdowns that Lyn started discussing the persistent inflation that may stem from shuttering the world and inflating the cash provide. She would later characterize the 2020s as the last decade of inflation, as governments wrestle to rein in rising prices. Does Lyn anticipate this pattern to proceed?

“To some extent, I imply, we’re in 2025. We’re nonetheless above the best way the Fed measures inflation. We’re nonetheless above their official goal though it has come down. Now, whether or not or not we’ve got one other dramatic spike comes partially down as to if vitality is constrained or not. It’s fairly exhausting to have main inflation with out vitality suppression, so something that retains the availability of vitality excessive is a approach of maintaining inflation down.”

In contrast to earlier many years, she says, the place we have been in a position to print cash and offset it with productiveness good points from automating manufacturing, she sees the 2020s as “stickier” by way of common inflation; except we notice a significant productiveness improve by means of a know-how similar to AI, though even that gained’t deliver down the price of store-of-value property. She says:

“The issues which are really scarce, like waterfront property, gold, high quality artwork, high-quality shares, and issues like that, all go up dramatically as a result of it’s exhausting to extend these issues. So I believe going ahead, AI making, say, white collar sorts of providers cheaper can suppress not directly CPI and sure wages and expenditures that folks have.

This may very well be offset by ongoing cash printing, greater gold, greater Bitcoin, greater status properties, and simply really scarce issues. So I do suppose that we’re nonetheless in a sticky inflation setting, though it’s exhausting to get dramatic inflation with out vitality shortages.”

AI and the economics of white-collar work

Since she’s introduced up AI for its productiveness good points, I ask if she’s involved about job losses and whether or not she believes it’s a web constructive for humanity, being one thing of an AI skeptic myself. Lyn’s markedly extra optimistic. Identical to the runaway fiscal deficit practice, she says AI is inevitable.

“At this stage, if you happen to attempt to ban it in a single nation, one other will do it, and it will likely be open-sourced in some capability. Like all know-how, it may be disruptive when it hits; lots of people can lose their jobs without delay.”

She likens AI to social media in the best way the latter disrupted social interplay, and warns that it have to be used fastidiously to keep away from doing extra hurt than good. I recall studying an MIT examine, to her level, that discovered AI to be an incredible studying instrument; so long as folks didn’t change into so depending on it that their intelligence drained away like blood from an open wound.

Lyn continues:

“It’s a great factor that we discover methods to make repetitive white-collar work cheaper and extra inexpensive as a result of that enables these folks or future generations to do different sorts of work, which is true for any time we automated textiles or farming with tractors and hydrocarbons and issues like that. It’s the identical factor besides it’s faster.”

She factors out that transportable AI is completely different from information middle AI and marvels on the mechanics of the human mind: our potential to course of advanced ideas and feelings, “very excessive bandwidth senses,” and “self-healing” functionality run on simply 20 watts of energy. She enthuses:

“It’s exceptional. It’s lower than an incandescent mild bulb. The equal quantity of processing in a knowledge middle runs on megawatts of energy, so hundreds of thousands of watts of energy…

I don’t suppose we’re wherever close to the extent the place there’s nothing people may do so as to add worth over silicon. I believe it’s extra a case of disruption that then places extra folks into doing different issues.”

I nod, questioning whether or not my metaphorical lightbulb requires as a lot vitality as Lyn Alden’s big mind.

Inflation, disruption, damaged cash… oh my!

With persistent inflation, societal disruption, and damaged cash, besides, this period bears all of the hallmarks of a fourth turning, and I wrestle to really feel constructive about the place all of it ends. I ponder what Lyn thinks. Is that this a great time to be alive? She ponders:

“I believe so. Fewer folks die from avoidable issues than nearly ever earlier than globally. It’s not an accident that the inhabitants bubble is occurring now… For essentially the most half, I take into account it good, nevertheless it goes by means of waves of getting an excessive amount of, like when folks get lower off from social connections. Individuals have far more melancholy now than hunter-gatherers, though in most capacities, we dwell longer and are much less prone to die from one thing random…

Expertise is polarizing as a result of, in some methods, it turns into like a winner-take-most, and to the extent that we get by means of this entire factor efficiently, I believe we’ve got to be taught to make use of know-how in a extra pure approach than be so reliant on it. I believe finally that would be the case.”

Lyn additionally believes that AI gained’t proceed to develop and enhance advert infinitum, however will finally hit a plateau, identical to aviation did: progress inside that trade has been pretty stagnant for years, following its mind-blowing takeoff within the twentieth Century. She says:

“We went from the Wright brothers to folks on the moon in a single human lifetime. However then, as soon as we hit the 70s, we slowed down. We nonetheless don’t have a jet sooner than the Blackbird. We nonetheless don’t have business aviation sooner than the Concorde. We don’t even have that anymore…

I believe in time, comparable issues will occur to electronics the place we’ll attain sure densities which are exhausting to maintain dramatically bettering on, and it’ll permit us extra time to soak up what we have already got.”

Observe Lyn Alden on X or try lynalden.com for in-depth evaluation and insights.

![Best Altcoins Under $1 in 2025 [October] – Top Crypto Picks for High Growth Best Altcoins Under $1 in 2025 [October] – Top Crypto Picks for High Growth](https://changelly.com/blog/wp-content/uploads/2025/10/best-altcoins-under-1-dollar-October.png)