Be part of Our Telegram channel to remain updated on breaking information protection

Norway’s Norges Financial institution, the world’s largest sovereign wealth fund with $1.7 trillion in property, has boosted its Bitcoin holdings by virtually 84% within the second quarter, primarily by shopping for shares in Michael Saylor’s Technique and Japan-based Metaplanet.

That’s in line with Commonplace Chartered, which says Norges Financial institution raised its whole oblique holdings to 11,400 BTC from 6,200 BTC through the interval.

Commonplace Chartered’s head of digital asset analysis Geoffrey Kendrick described the surge as a “proactive place,” reflecting a broader development of sovereign wealth funds and authorities entities boosting oblique Bitcoin publicity through treasury-focused corporations.

Kendrick reached his conclusions by analyzing 13F filings with the US Securities and Alternate Fee (SEC) by corporations with holdings in BTC ETFs (exchange-traded funds), Technique, and Metaplanet.

Kendrick not too long ago raised his year-end BTC goal to $200K, aligning with Canary Capital CEO Steven McClurg, which predicts BTC may hit $140K–$150K this 12 months even amid anticipated Federal Reserve fee cuts.

Norges Financial institution Ups Bitcoin Publicity To 11,4K BTC

Norges Financial institution has constructed its BTC publicity by primarily holding shares in Technique. With the newest evaluation, nonetheless, Kendrick famous that the fund has diverted from this development considerably and has additionally purchased shares in Metaplanet, which is usually seen as “Japan’s Technique.”

Whereas Norges Financial institution could look like diversifying its holdings in Bitcoin treasury corporations, Kendrick stated the fund nonetheless has a heavy focus in direction of Technique. At present, the fund’s holdings in Metaplanet account for an equal of 200 BTC.

Norges Financial institution Funding Administration, which oversees Norway’s sovereign wealth fund, doubles down on bitcoin by means of $MSTR and $MTPLF. https://t.co/wiQna2YnHD pic.twitter.com/17kc5zfQX0

— Dylan LeClair (@DylanLeClair_) August 15, 2025

Technique and Metaplanet have been among the many most lively Bitcoin treasury corporations in latest months.

Technique (MSTR) is presently the most important company Bitcoin holder with 628,946 BTC on its steadiness sheets, in line with knowledge from BitcoinTreasuries. In the meantime, Metaplanet is ranked at quantity 7 with its holdings of 18,113 BTC.

Kendrick Adjusts 12 months-Finish Goal To $200K By The Finish Of The 12 months

The evaluation by Kendrick follows an commentary made earlier within the 12 months, when he stated that sovereign wealth funds and authorities entities have been boosting their oblique publicity to Bitcoin within the first quarter by primarily shopping for shares in Technique. He additionally predicted that this development will proceed all year long.

Simply final month, the Commonplace Chartered analyst raised his Bitcoin value goal to $135K by Sept. 30. He additionally reiterated a $200K value goal for the top of the 12 months.

These targets are in step with ones shared by Canary Capital CEO Steven McClurg.

Talking to CNBC on Aug. 15, he stated that there’s nonetheless the chance that BTC will soar to the $140K-$150K vary “this 12 months earlier than the bear market subsequent 12 months.”

McClurg added that he’s not assured within the present macroeconomic outlook, and warned of a broader bear market forward.

He argued that there ought to have already been an rate of interest reduce within the US, including that he expects cuts to be introduced in September and October.

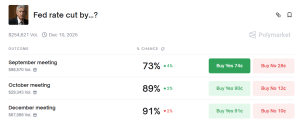

Polymarket bettors additionally consider that rate of interest cuts might be introduced someday quickly. A contract on the decentralized betting platform asking when the earliest Federal Reserve rate of interest reduce might be exhibits elevated odds for September and October.

Fed fee reduce odds by month (Supply: Polymarket)

As of two:03 a.m. EST, odds that the subsequent reduce might be in September stand at 73% after a 4% rise within the final 24 hours, whereas odds of an October reduce stand at 89% after a 2% enhance.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection

![[LIVE]BTC’s Post-High Bull Trap, $12B BlackRock Bet Rattles ETH Supply: Best Crypto To Buy Now? [LIVE]BTC’s Post-High Bull Trap, $12B BlackRock Bet Rattles ETH Supply: Best Crypto To Buy Now?](https://www.ajoobz.com/wp-content/themes/jnews/assets/img/jeg-empty.png)