Metaplanet, a Tokyo-listed lodge group, is making waves by aggressively beefing up its Bitcoin reserves, a transfer that’s shaking up conventional company finance.

The corporate simply added 103 extra Bitcoin to its stash, a purchase order price round $11.8M. This brings its complete holdings to a whopping 18,991 $BTC, valued at over $2.14B.

This places Metaplanet in an elite membership, rating because the seventh-largest public firm holding Bitcoin globally, an enormous leap since they launched their Bitcoin Treasury Operations simply final yr.

Metaplanet’s technique is fairly simple however daring: they’re elevating capital by way of share gross sales and bond choices and funneling it straight into Bitcoin. This isn’t a facet venture; they’re positioning the digital asset as a core a part of their company treasury.

President Simon Gerovich sees this as a long-term play, particularly with the corporate’s upcoming inclusion within the FTSE Japan Index, which additional hyperlinks Bitcoin to mainstream Japanese equities.

The semi-annual overview by FTSE Russell, confirmed in September 2025, upgraded Metaplanet from small-cap to mid-cap, with the inclusion efficient after market shut on September 19.

Regardless of a current dip in its inventory, Metaplanet’s shares have proven spectacular year-to-date progress, underscoring investor confidence in its daring, forward-thinking method.

The Larger Image: Metaplanet’s Market Affect

Metaplanet’s aggressive Bitcoin accumulation isn’t nearly its personal steadiness sheet; it’s an enormous signal of a broader shift in how firms view crypto.

The corporate’s fast climb up the worldwide Bitcoin treasury rankings, holding the tenth spot on CoinGecko, reveals how outstanding they’ve develop into. This technique is clearly working, drawing consideration from each conventional finance and crypto traders.

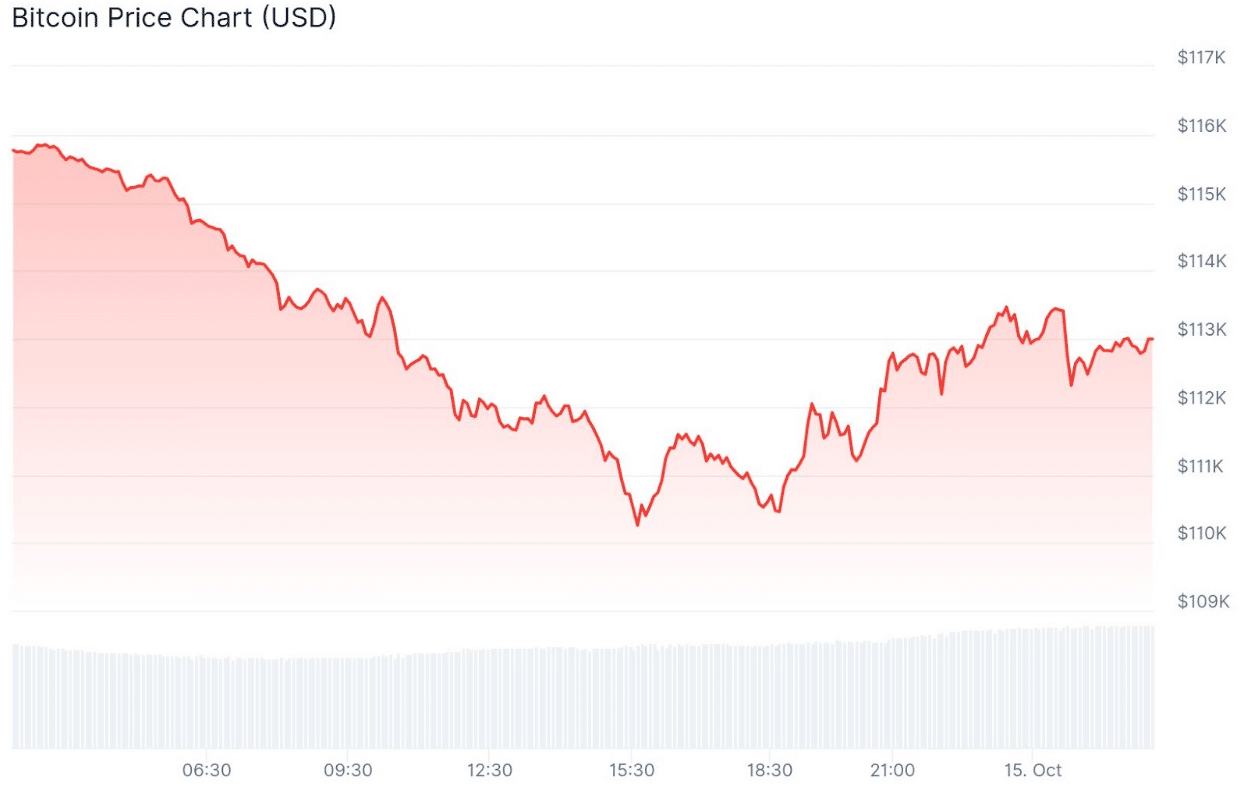

The newest Bitcoin buy occurred with $BTC was buying and selling at a dip of $111,484, which reveals the corporate’s ‘purchase the dip’ philosophy in motion.

This energetic method, mixed with the truth that its inventory rose over 8% on the information, suggests the market is more and more rewarding a long-term, Bitcoin-first technique. CEO Simon Gerovich has made it clear that they’ll maintain searching for other ways to fund extra Bitcoin buys.

This ongoing dedication, plus its new standing as a mid-cap inventory in a significant index, solidifies Metaplanet as a key participant in bridging the hole between old-school finance and the evolving world of digital property.

A New Frontier for Bitcoin: Why $HYPER is the Subsequent Huge Factor

Whereas firms like Metaplanet are stacking Bitcoin, a brand new wave of innovation is making the OG digital asset extra helpful than ever.

Enter Bitcoin Hyper ($HYPER), a game-changing Layer-2 answer designed to resolve Bitcoin’s greatest issues: sluggish speeds, excessive charges, and an absence of sensible contract performance.

There’s no query that Bitcoin is the king of digital gold, and it’s safe and dependable, nevertheless it’s not constructed for the modern-day world. Bitcoin Hyper goals to vary that by appearing as a rocket booster for the Bitcoin community.

The venture is integrates the Solana Digital Machine (SVM) expertise, which implies it brings Solana’s lightning-fast speeds and low-cost transactions straight to Bitcoin. It’s a brand new layer that permits builders to construct dApps, DeFi platforms, and even NFTs on high of Bitcoin’s safe basis.

And the way precisely do you switch to this new layer and again once more? That’s due to the Canonical Bridge, enabling easy strikes.

In case you imagine in Bitcoin’s long-term worth and wish to see it develop into a extra dynamic and purposeful asset, Bitcoin Hyper ($HYPER) is precisely what you’ve been ready for.

Why You Ought to Be Paying Consideration to $HYPER

The hype round Bitcoin Hyper isn’t only a flash within the pan; it’s backed by actual utility. In a market typically pushed by fleeting tendencies, Bitcoin Hyper stands out as a result of it solves an actual downside.

It’s not simply one other meme coin; it’s a chunk of important infrastructure that would remodel Bitcoin from a passive retailer of worth into a really programmable asset. The fusion of Bitcoin’s model energy with Solana’s pace and effectivity may very well be the following main market narrative.

$HYPER’s presale has already raised over $12M displaying huge investor confidence that this venture may very well be the important thing to unlocking Bitcoin’s true potential.

With its mainnet launch on the horizon and its presale nearing its remaining phases, the window for early participation is closing. Don’t miss your likelihood to get in now and obtain 91% staking rewards.

Bitcoin: From Digital Gold to a Dynamic Ecosystem

If you see main firms like Metaplanet betting massive on Bitcoin, it’s a transparent sign that the world of finance is altering.

We’ve moved past digital gold and are taking a look at a foundational asset that pioneering initiatives like Bitcoin Hyper ($HYPER) are constructing on high of.

$HYPER is a bridge to a future the place Bitcoin is a dynamic on a regular basis asset. The convergence of company adoption and technological innovation is unstoppable.

Ensure you do your individual analysis and make knowledgeable choices on this fast-moving market. Bear in mind, this isn’t meant as monetary recommendation.

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.