Be part of Our Telegram channel to remain updated on breaking information protection

Google Cloud is launching its personal layer-1 blockchain for monetary establishments, taking over Ripple, Circle, and Stripe in funds.

Google Cloud’s Web3 Head of Technique, Wealthy Widmann, shared new particulars concerning the blockchain, known as the Google Cloud Common Ledger (GCUL), in an Aug. 26 submit on Linkedin.

“GCUL brings collectively years of R&D at Google to supply monetary establishments with a novel Layer 1 that’s performant, credibly impartial and permits Python-based sensible contracts,” Widmann wrote.

“Moreover bringing to bear Google’s distribution, GCUL is a impartial infrastructure layer,” Widmann added. “Tether gained’t use Circle’s blockchain – and Adyen most likely gained’t use Stripe’s blockchain. However any monetary establishment can construct with GCUL.”

By transferring into blockchain funds infrastructure, Google Cloud is positioning itself to compete over the monetary rails that would form the way forward for funds. At stake could also be who finally controls the spine of digital finance: established tech giants or crypto pioneers.

Google Cloud additionally wrote in an official weblog submit that GCUL “simplifies the administration of economic financial institution cash accounts and facilitates transfers through a distributed ledger, empowering monetary establishments and intermediaries to fulfill the calls for of their most discerning shoppers and compete successfully.”

Rising Quantity Of Corporations Launching Their Personal Blockchains Amid The Rising Regulatory Readability

Google Cloud is the newest firm to announce that it’s working by itself layer-1 blockchain community. USD Coin (USDC) issuer Circle, and funds big Stripe, are amongst others which have introduced comparable developments in latest months.

That’s because the Web3 business positive factors extra regulatory readability within the US below the Trump Administration.

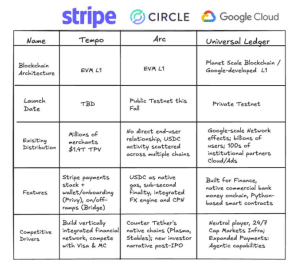

Widmann additionally shared a desk evaluating Google Cloud’s GCUL with Circle’s Arc and Stripe’s Tempo blockchains.

Desk evaluating GCUL with Arc and Tempo (Supply: Linkedin)

Based on the desk, Google Cloud’s blockchain community will faucet into the tech big’s present consumer base of “billions of customers” and “100s of institutional companions.”

Its fundamental aggressive purpose is to change into a 24/7 infrastructure supplier for the worldwide capital markets. The group will even look to increase funds and allow agentic capabilities with its chain.

Google Cloud described its blockchain as a non-public and “permissioned system” in its weblog submit. It did, nonetheless, say that it would make the community “extra open as laws evolve.”

That closed-off nature has drawn criticism from crypto and Web3 purists who argue that the community’s rules go in opposition to the decentralized and permissionless values the group is constructed on.

“It’s a permissioned chain, ran by an American company with shut ties to the federal government,” one X consumer stated. ”I don’t assume these individuals perceive what ‘credibly impartial’ means within the context of blockchains, as a result of that is actually the precise reverse of ‘credibly impartial’.”

Starknet CEO Eli Ben-Sasson additionally commented on the venture. Responding to an X submit concerning the blockchain, he stated he thinks that firms creating their very own layer-1 chains will not be going to make it.

I feel firms doing L1s is ngmi. Together with base. I do know this can be a contentious opinion. However reminding you I stated the identical about Diem (for individuals who bear in mind it).

— Eli Ben-Sasson | Starknet.io (@EliBenSasson) August 27, 2025

Google Cloud Will Allow Python-Based mostly Sensible Contracts

Ethereum has loved a first-mover benefit out there since its inception again in July 2015, being the primary distributed ledger to make it attainable for programmers to create decentralized functions (dApps) on a blockchain community.

A number of monetary establishments have utilized that functionality to discover how it may be used to create new monetary merchandise.

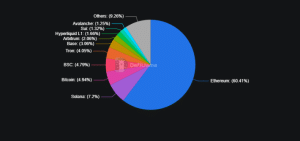

Based on DeFillama, Ethereum nonetheless accounts for almost all of the worth that’s locked up within the blockchain area. With round $94.261 billion in complete worth locked (TVL), Ethereum at the moment has a 60.41% share of the market.

TVL breakdown by blockchain (Supply: DeFiLlama)

The subsequent largest market share goes to Solana, with its $11.231 billion TVL accounting for 7.2% of the worth at the moment locked up on blockchains.

Nevertheless, Ethereum’s sensible contracts function on a brand new programming language known as Solidity. Many software program builders have realized the way to write sensible contracts utilizing Solidity, however the necessity to study a brand new software program does current an impediment for adoption.

Google Cloud will tackle that concern by making it attainable for builders to jot down sensible contracts utilizing Python, which is likely one of the hottest and extensively used programming languages globally.

Based on a Statista survey, Python was the third hottest programming language as of July 2024, with 51% of the survey’s 60,171 respondents exhibiting a desire for Python, whereas just one.1% most well-liked Solidity.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection