Coinbase has launched x402 Bazaar for AI agent-powered x402 micropayments.

The catalog exposes a machine-readable index of companies that settle for pay-per-request USDC funds and is positioned as a discovery layer for brokers and builders integrating the x402 protocol.

Coinbase says Bazaar is in early growth, and immediately, it indexes endpoints that settle by way of its hosted facilitator.

x402 revives the HTTP 402 “Cost Required” standing code and a repeat-request circulate by which the consumer attaches a signed cost payload.

Coinbase’s hosted facilitator verifies and settles the cost, so sellers don’t want blockchain infrastructure, and the corporate states it costs no facilitator payment for USDC on Base.

Per Coinbase’s docs, present community help is USDC on Base mainnet and Base Sepolia, with extra belongings on the roadmap. See the x402 overview, the facilitator documentation, and HTTP 402 background on MDN.

The whitepaper frames the economics round sub-second confirmations and negligible fuel. It compares “x402 (on Base)” with a 200 millisecond settlement path and nominal fuel far beneath one ten-thousandth of a greenback, contrasting card charges and batch settlement.

Bazaar’s record endpoint returns structured JSON for every useful resource, together with accepted asset, community, vacation spot deal with, and the utmost quantity required, expressed within the token’s atomic models.

The instance exhibits a maxAmountRequired of 200 for USDC on Base, equal to $0.000200 at 6-decimal precision, illustrating the system’s meant worth granularity for per-call funds.

On the execution path, Base’s Flashblocks function provides 200-millisecond preconfirmations that shorten the perceived affirmation time for interactive apps.

As soon as community latency is included, infrastructure suppliers report typical end-to-end acknowledgments nearer to 300–500 ms, whereas Base’s commonplace block time stays two seconds.

For metered APIs, this latency price range could make priced retries sensible with out degrading consumer expertise. See Base Flashblocks and a supplier explainer on Chainstack.

Underneath the hood, most present implementations depend on EIP-3009’s authorization-based transfers, which permit a consumer to signal an authorization that the facilitator submits on-chain.

3 Seconds Now. Good points That Compound for Years.

Act quick to affix the 5-day Crypto Investor Blueprint and keep away from the errors most traders make.

Dropped at you by CryptoSlate

Coinbase’s API exposes /confirm and /settle endpoints to course of these flows, and group libraries mirror the sample. For the usual, see EIP-3009, and for an instance implementation see this GitHub repository. For protocol code and contribution steerage, see the x402 GitHub repo.

Regulation opens door for digital cost infrastructure

The coverage backdrop now tilts towards clearer stablecoin guidelines in the USA. In July, Congress handed and the President signed the GENIUS Act, a federal framework for cost stablecoins that mandates full backing in money or short-term Treasuries and creates licensing and supervision.

Europe’s Markets in Crypto-assets regime already applies to e-money tokens and asset-referenced tokens. The European Banking Authority has clarified that issuers should maintain the related authorization and has revealed technical requirements, with transitional aid for some ART issuers however not for EMTs. That blend means any EU-facing x402 settlement in fiat-pegged tokens finally will depend on EMT compliance and supervision.

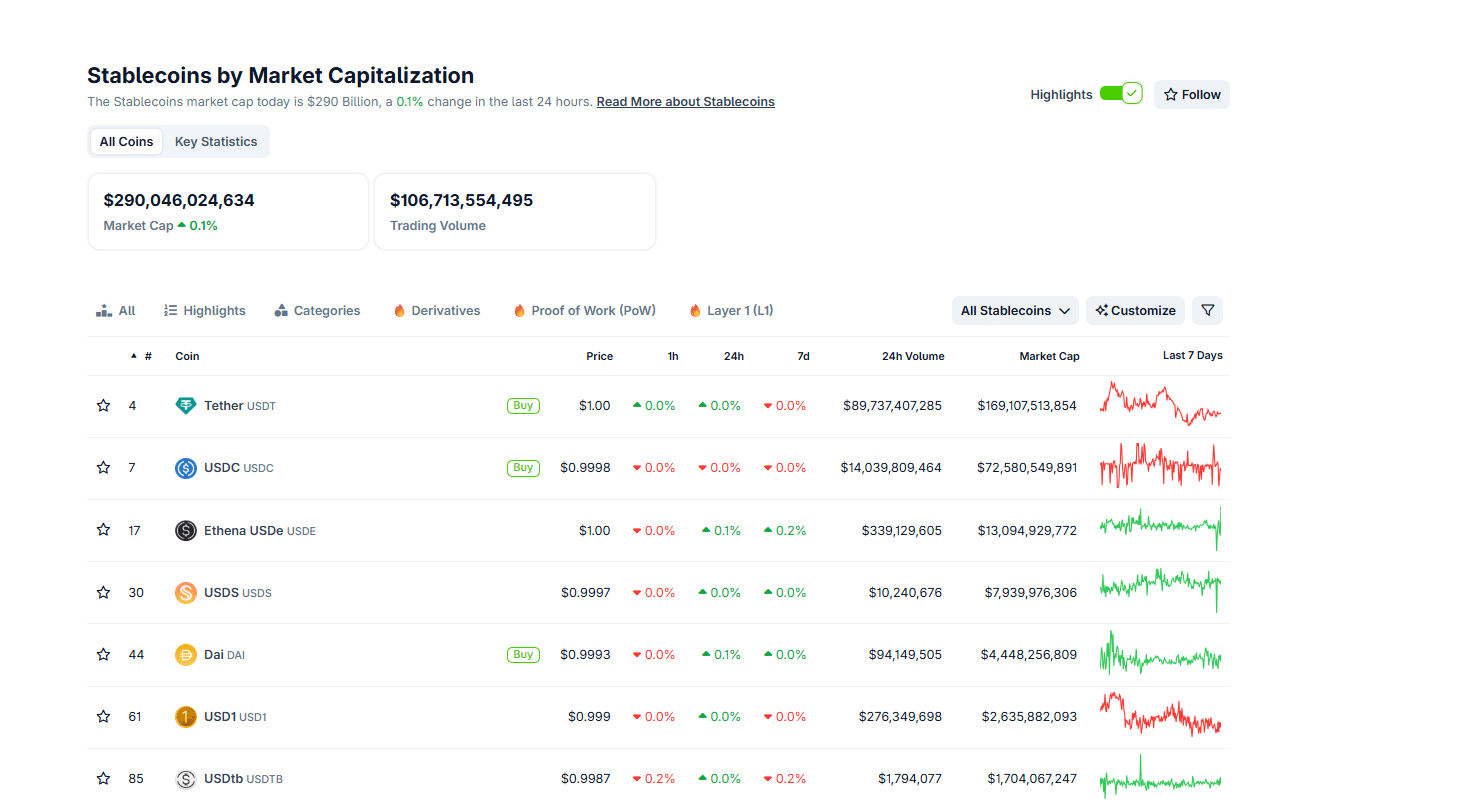

Macro context round demand is shifting as dollar-stablecoins scale. The market worth has roughly doubled in 18 months to close $280 billion, with projections reaching into the trillions beneath supportive coverage, and the IMF’s Finance & Growth discusses how USD-backed stablecoins can affect Treasury demand and greenback primacy.

A easy vary illustrates how Bazaar may monetize agentic workloads if technical and regulatory items maintain.

Utilizing the whitepaper’s minimal worth level as a reference, costs between $0.001 and $0.01 per name throughout 100 to 1,000 listed endpoints and 100,000 to 10 million paid calls per day would suggest every day gross cost quantity of $100 to $100,000 on the low finish of adoption, scaling to $1,000,000 on the excessive finish.

Settlement prices and facilitator charges are the principle variables, and Coinbase states the facilitator provides zero payment on Base, leaving nominal fuel because the constraint.

The commerce tie-in issues for distribution. Coinbase and Shopify introduced USDC funds on Base inside Shopify Funds, and Shopify’s personal communications describe Base as a quick, low-cost community built-in at checkout.

If on-chain retail flows normalize in mainstream ecommerce, x402’s pay-per-use sample can lengthen from human checkout into machine-to-machine API consumption utilizing the identical stablecoin rails.

Open questions stay, Bazaar at present lists companies settling in USDC on Base, and Coinbase’s FAQ factors to extra chains and belongings later.

Last adoption will rely upon how rapidly builders record price-disclosed endpoints and whether or not Flashblocks-level latency interprets to dependable, low-variance cost acknowledgment at manufacturing scale.

For now, Bazaar’s discovery API is stay, the facilitator is fee-free on Base, and the coverage atmosphere is firming round stablecoin settlement.

Talked about on this article