An alarming sample of XRP whale exercise has been famous, posing a number of questions in regards to the sustainability of the cryptocurrency’s progress. Among the many a number of questions presently being requested, one is extra demanding of an instantaneous response: Is an XRP whale sell-off on its manner?

XRP Provide Surges Throughout Main Exchanges

In an October third put up on the social media platform X, market analyst CryptoOnchain highlighted a latest shift within the habits of XRP’s largest holders, the whales.

The net pundit’s report was based mostly on the Alternate Provide Ratio indicator, which tracks the proportion of XRP tokens on exchanges relative to its whole circulating provide.

Associated Studying

This metric can be utilized to derive insights on potential promoting stress for a crypto asset (XRP, on this case), seeing as larger values would recommend elevated availability of tokens on the trade on the market.

In accordance with CryptoOnchain, there was a spike in XRP provide throughout main exchanges, suggesting that whales is perhaps positioning for a big sell-off. The info shared displays the rise in promoting stress throughout these exchanges, together with Bithumb, Bitget, Bitfinex, and Binance, placing the XRP worth at an elevated danger of a pointy correction.

XRP Shows Bearish Divergence As Sellers Dominate Futures Market

In a separate put up made on the CryptoQuant platform, CryptoOnchain additionally revealed a budding unfavorable divergence throughout the XRP futures market.

The related indicator right here is the Taker Purchase Promote Ratio metric, which displays the steadiness between aggressive purchase and promote orders within the futures market. This metric is often used to evaluate whether or not patrons or sellers are dominating the market within the quick time period.

The analyst famous that whereas the value of XRP has been principally round $3 after its latest rise, the ‘Taker Ratio’ throughout exchanges has fallen to its lowest stage since November 2024. Apparently, information from Binance, the world’s largest crypto trade, additional helps this bearish sign, as patterns just like these seen on different exchanges have additionally been surfacing.

Associated Studying: Ethereum Matches Bitcoin In Annual Positive factors: What This Means For The Market

CryptoOnchain defined that this case may both imply that the market members are reserving earnings or anticipating a worth decline within the close to future. Nonetheless, the spike in XRP provide throughout main crypto exchanges, alongside the clear dominance of sellers within the perpetual futures market, strongly suggests the imminence of a worth correction.

It’s subsequently advisable to observe the psychological $3 stage carefully earlier than market choices are made. As of this writing, XRP is hovering across the $3 mark, reflecting an almost 2% decline up to now 24 hours.

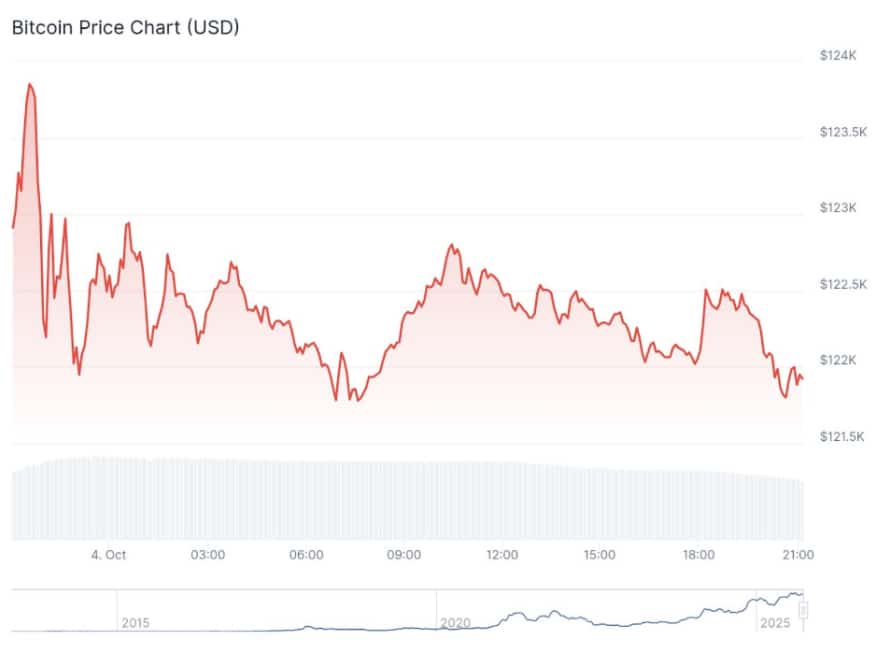

Featured picture from iStock, chart from TradingView