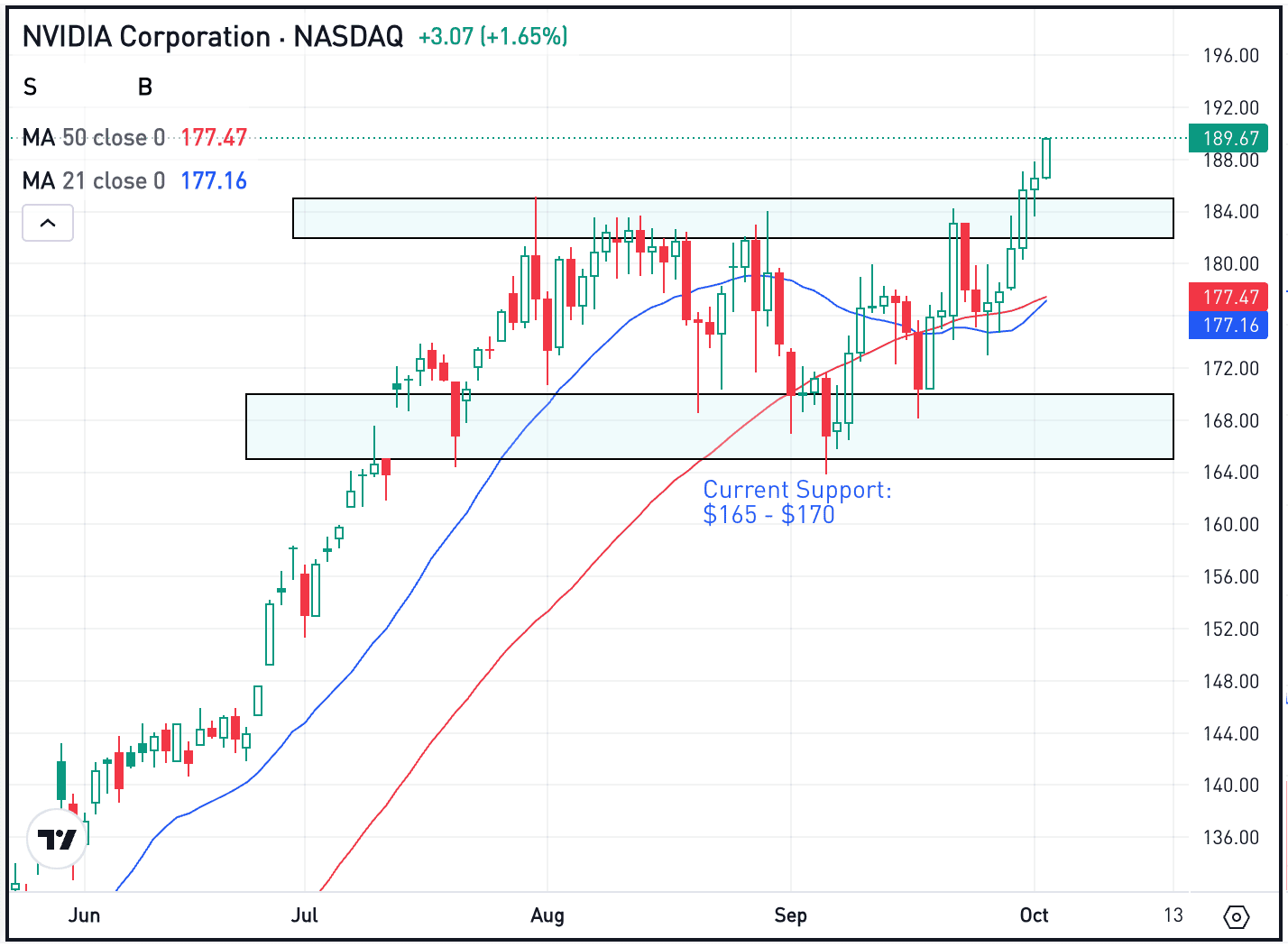

September is traditionally thought-about the worst month for the inventory market. On common, the S&P 500 loses round 1% of its worth throughout this month, which has created the superstition that after summer time, traders ought to promote their shares and await a downturn. However this 12 months, the precise reverse occurred. The inventory market rose by greater than 3.5% in September. This reminds us that markets are pushed by financial fundamentals and company outcomes, not by dates on the calendar.

The so-called September impact is predicated on statistics. It has historically been the weakest month of the 12 months for fairness markets — the one month through which markets have traditionally ended decrease greater than half the time (about 55%).

There are a number of theories as to why this can be the case. Some clarify the impact by pointing to fund managers getting back from holidays, rebalancing portfolios, or taking income. Others attribute it to monetary market cycles — for instance, hedge funds closing their fiscal 12 months in September, which results in portfolio changes and tax-loss harvesting. One other rationalization is the revival of the bond market, which may drain capital from equities.

Regardless of the purpose, this 12 months clearly confirmed that blindly following such seasonal results could be harmful for retail traders. The market can transfer within the actual wrong way. September is without doubt one of the particularly harmful months for making an attempt to time the market. The others are October, November, December, January, February, March, April, Could, June, July, and August.

The place is the market actually heading?

Regardless of ongoing uncertainty, the long-term development pattern stays robust. In September, the U.S. Federal Reserve minimize rates of interest for the primary time in practically a 12 months and plans to proceed doing so — traditionally a clearly optimistic sign for equities. As well as, many multibillion-dollar investments, particularly within the AI trade, have been introduced, together with comparatively encouraging financial information. All of this supported continued inventory development, making September among the best months of the 12 months.

September is proof that timing the market doesn’t repay. The true path to success lies in investing often, with endurance and a long-term horizon.