The bitcoin worth dropped to the $118,000s vary right now after President Trump introduced plans to lift tariffs on Chinese language items in response to China’s export controls on uncommon earth metals.

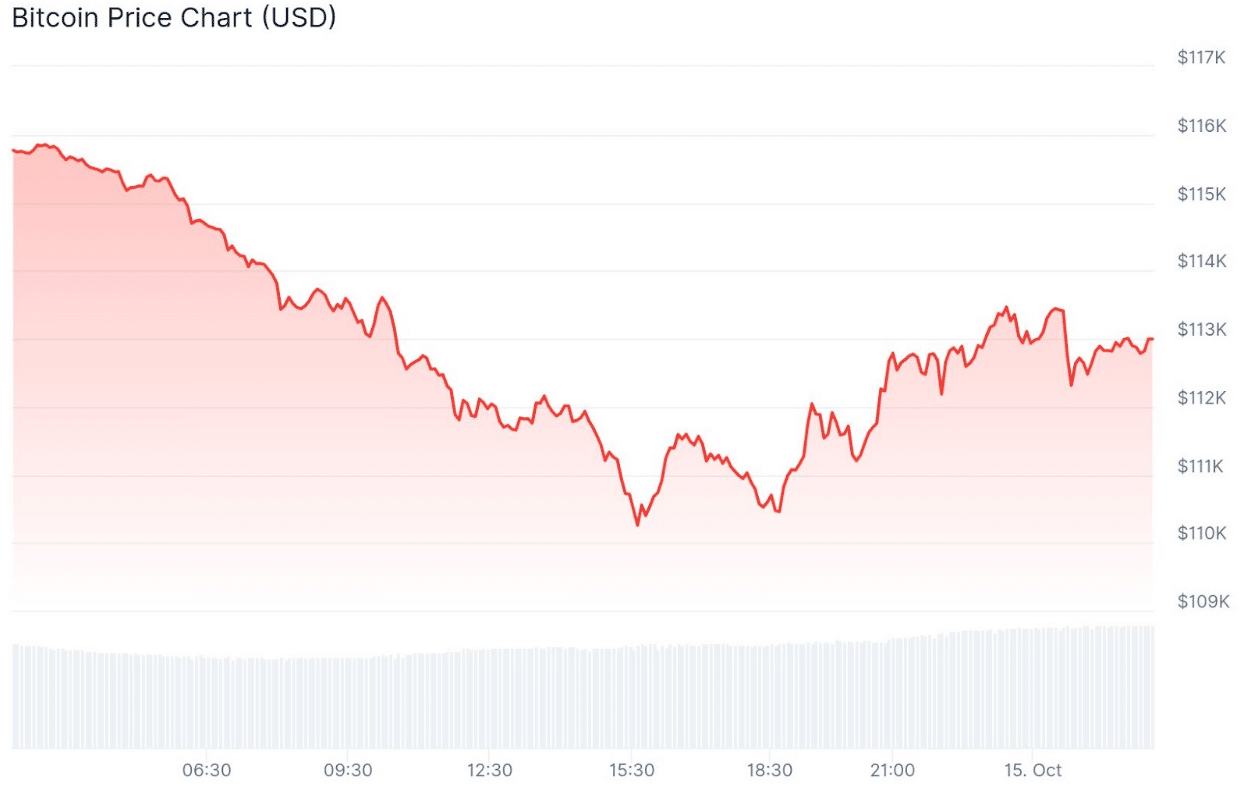

Bitcoin worth is down roughly 2.3% previously 24 hours and about 6% since reaching a file excessive above $126,000 simply 4 days in the past.

President Trump threatened a “large” improve in tariffs on Chinese language items, signaling a pointy escalation within the U.S.-China commerce tensions and casting doubt on a deliberate APEC assembly with President Xi. This got here after China imposed new limits on uncommon earth and associated expertise commerce.

“I used to be to fulfill President Xi in two weeks, at APEC, in South Korea, however now there appears to be no motive to take action,” Trump mentioned on Fact Social.

China requires international corporations to acquire particular approval to export merchandise containing even hint quantities of Chinese language uncommon earth components, that are important for gadgets starting from jet engines and electrical autos to laptops and telephones.

Commerce talks between China and the U.S. this yr have addressed uncommon earths, TikTok, and tariffs, with over three rounds held to date. Following Could talks in Geneva, the U.S. mentioned China had agreed to ease a few of its uncommon earth export restrictions.

All markets reacted negatively, echoing the sentiment from April when President Trump’s ‘Liberation Day’ tariffs rattled markets. The tariffs in April, by way of Government Order 14257, declared a commerce deficit emergency, imposing sweeping U.S. import duties.

Bitcoin worth response

Bitcoin kicked off October with a surge, reaching all-time highs above $126,000 within the first week. Up to now few days, the value had pulled again to the $121,000 vary.

Some analysts level to indicators that the bitcoin market has entered what many describe because the “euphoria section” of the present bull cycle.

If the historic sample holds, bitcoin’s present euphoria section could carry it towards the $180,000–$200,000 zone earlier than sentiment shifts.

Bitcoin has surged greater than 30% because the begin of the yr, buoyed by sustained inflows into U.S.-listed Bitcoin exchange-traded funds, renewed investor confidence in digital belongings, and expectations that the Federal Reserve will transfer towards slicing rates of interest.

Crypto-related shares, like Circle (CRCL), Robinhood (HOOD), Coinbase (COIN), and MicroStrategy (MSTR), declined 3%-6% at instances all through the day.