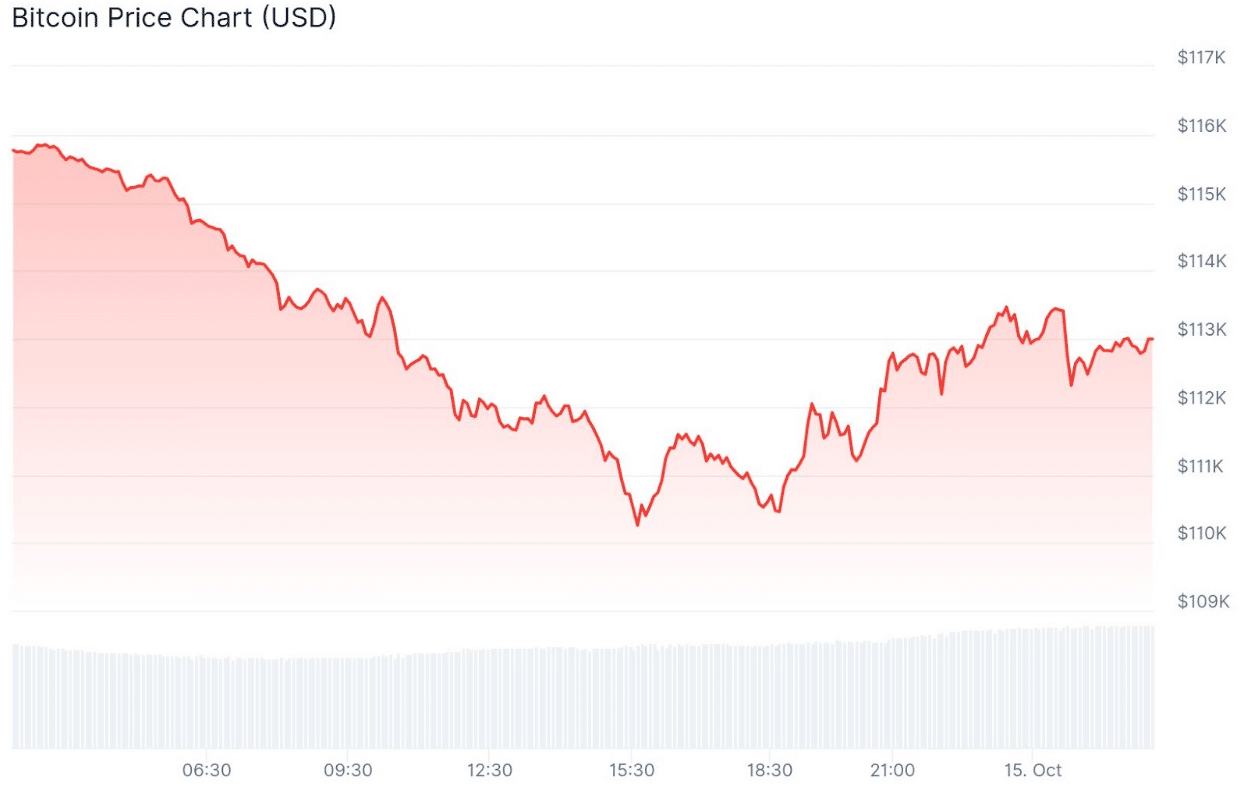

The crypto market suffered a devastating $19 billion wipeout as XRP and Bitcoin (BTC) had been caught in a brutal sell-off that shocked merchants worldwide. Inside minutes, XRP worn out over 50% of its worth, dropping down to $0.77 earlier than partially rebounding, marking certainly one of its steepest intraday losses in historical past. Whereas early stories blamed political tensions following US President Donald Trump’s sudden tariff on Chinese language imports, information now means that the crash was amplified by a significant glitch in Binance’s inside pricing system, and different contributing technical components.

Catalysts Behind The XRP Worth Crash And Crypto And Bitcoin Meltdown

Between October 10 and 11, XRP skilled a violent flash crash on Binance, plunging over 54% in a single 30-minute candle. In lower than 24 hours, over 1,000,000 merchants had been additionally liquidated. This unprecedented drop got here throughout what analysts are actually calling “the worst crypto liquidation occasion in crypto historical past,” with almost $19.3 billion in open positions worn out in a single day.

At first, a lot of the blame was directed at Trump’s announcement of 100% tariffs on Chinese language tech imports, which triggered a wave of panic throughout international danger property. Nonetheless, the XRP and broader market collapse went far past regular macro-driven volatility. On-chain analysts traced the sequence to a $60 million spot market dump on Binance, which set off an inside pricing malfunction. Binance’s oracle system, which marks collateral values similar to wBETH, BNSOL, and USDe, momentarily failed, probably resulting in compelled liquidations throughout XRP and different main crypto property.

This oracle mispricing allegedly turned a $60 million order right into a $19 billion loss. XRP, being certainly one of Binance’s most closely leveraged property, absorbed a major quantity of the influence as margin calls liquidated hundreds of positions inside minutes. A whale had reportedly opened $1 billion briefly positions simply earlier than the Trump tariff announcement, including extra suspicion and gas to the collapse. Binance later confirmed irregular pricing and paid $283 million in restitution, however the harm to XRP and the broader market was already achieved.

A Deeper Dive Into The Market-Extensive Crash

Analysts say that the basis reason behind the $19 billion crypto market crash was Binance’s “Unified Account” system, which priced collateral utilizing inside information as an alternative of decentralized oracles. Between October 6 and 14, Binance was transitioning to oracle-based pricing, creating an exploitable 8-day hole. Throughout that interval, coordinated actors reportedly dumped $60 million to $90 million in USDe completely on Binance, driving its worth to $0.65 whereas it stayed close to $1 on different exchanges.

This synthetic depeg inside Binance’s system triggered widespread panic, as attackers had been mentioned to carry $1.1 billion in Bitcoin and Ethereum shorts on decentralized exchanges, profiting about $192 million as costs plunged. Analysts famous that Ethena’s USDe remained absolutely collateralized on all different exchanges, proving that the difficulty allegedly stemmed from Binance’s infrastructure, not the stablecoin.

The mixture of technical flaws, alleged manipulation, and tariff-driven worry reworked a contained exploit right into a market-wide disaster. Regardless of the chaos, analysts stay cautiously optimistic about XRP’s restoration, predicting a powerful rally to new ATHs quickly.

Featured picture from Adobe Inventory, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.