Fast Info:

1️⃣ BlackRock’s spot Bitcoin ETF IBIT surpassed $100B lower than two years after its launch on January 11, 2024.2️⃣ Larry Fink introduced a long-term plan to tokenize all belongings, from funds to shares and money.3️⃣ Fink argues that bubbles don’t affect long-term traders and that point out there outweighs opportunistic buy-ins.4️⃣ Bitcoin’s Layer 2 mission, Bitcoin Hyper ($HYPER) reaches $23.9M in presale and eyes a Q1 2026 launch.

BlackRock’s spot Bitcoin ETF (IBIT) simply surpassed $100B in belongings below administration (AUM), which prompted CEO Larry Fink to announce the corporate’s tokenization plans.

Fink made the feedback throughout a CNBC interview, the place he mentioned:

I do consider we’re simply initially of tokenization of all belongings, from actual property to equities to bonds, throughout the board.

—Larry Fink, CNBC Interview

This comes over a yr and a half after BlackRock launched its first tokenized fund, BUIDL, on the Ethereum community by partnering with Securitize.

Within the official press launch, Securitize’s co-founder and CEO, Carlos Domingo, mentioned that BUIDL proves that tokenization is basically unstoppable and that it’ll rework the capital market.

With over $1T in AUM, BlackRock’s resolution to spend money on tokenization tech stems from Bitcoin’s and Ethereum’s success, particularly amid 2025’s rampant adoption wave.

This spells excellent news for Bitcoin Hyper’s ($HYPER) $23.9M presale which feeds Bitcoin’s coming Layer 2 with a projected Q1 2026 public launch.

How BlackRock Might Rework the Capital Market

Fink believes that asset tokenization is imminent and the important thing step to attracting digital traders into the TradFi market, which pack extra unpopular merchandise like retirement funds.

The overarching objective is to permit traders to carry a number of belongings collectively, together with funds, money, and cryptos, which might characterize a turning level for the capital market as a complete.

To that finish, Fink pushes for ‘time out there,’ versus opportunistic buy-ins, as an anti-bubble technique. As he sees it, it’s solely opportunistic consumers who push the notion of economic bubbles as a consequence of their brief time out there.

This doesn’t occur with long-term traders who experience the bubbles to observe the bigger development.

In case you put cash to work on January 1st, 2000, a yr later you had the Dot Com crysis, six years later you had the monetary disaster, you had the COVID crysis; you continue to would’ve made 8% compound curiosity over your entire 25 years.

It’s not about if our markets are going up or down […] it’s about being out there for your entire cycle.

—Larry Fink, CNBC interview

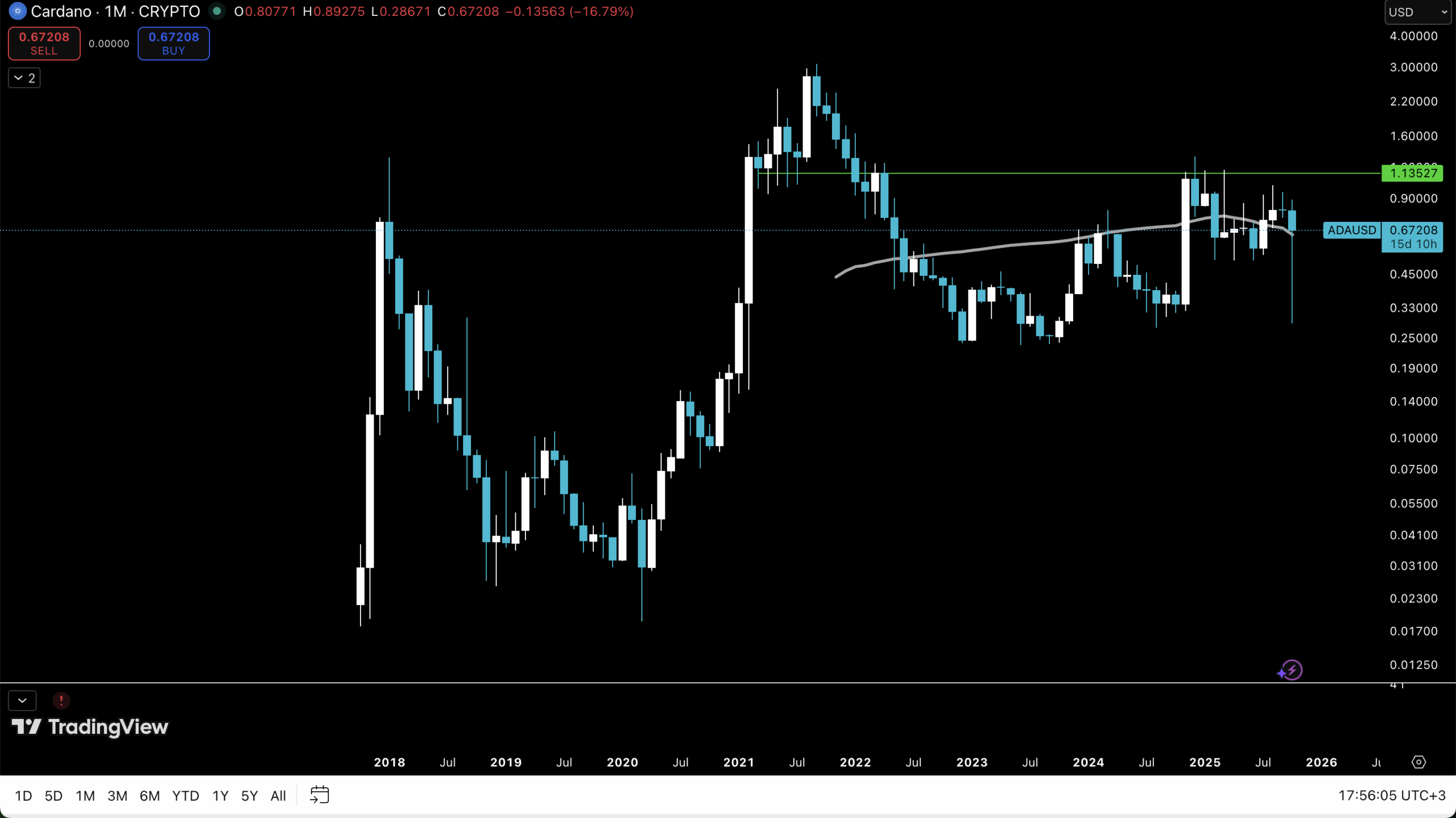

The identical mindset applies to the digital market and Bitcoin is the dwelling proof of that. Whereas opportunistic snipers typically discover themselves in sizzling waters – final Friday’s market crash anybody? – long-term traders who purchased $BTC in 2011 are actually up 169,000,000%.

Bitcoin’s current efficiency solely provides to that. $BTC now trades at slightly below $106K after a 13.7% drop during the last week, which is painful for leverage merchants, however impartial for long-term traders, as a result of Bitcoin will finally bounce again.

Particularly with Bitcoin Hyper simply across the nook.

How Bitcoin Hyper Guarantees to Change the Bitcoin Ecosystem

Bitcoin Hyper ($HYPER) goals to deal with Bitcoin’s most urgent downside: its efficiency limitation.

With a tough cap of seven transactions per second (TPS), Bitcoin presently ranks twenty second on the listing of the quickest blockchains by TPS. This interprets to gradual affirmation occasions, excessive charges, and lack of scalability.

Hyper depends on instruments just like the Solana Digital Machine (SVM) and the Canonical Bridge to vary that.

Whereas SVM will increase the community’s efficiency, unlocking the ultra-fast execution of DeFi apps and good contracts, the Canonical Bridge addresses Bitcoin’s lengthy affirmation occasions instantly.

As soon as the Bitcoin Relay Program confirms incoming transactions in milliseconds, the Bridge then mints the bitcoins on the Hyper layer, permitting you to make use of the wrapped belongings with near-instant finality inside the Layer 2 ecosystem.

Lengthy-term, Hyper goals to show Bitcoin right into a extra possible possibility for institutional traders by making the community quicker, cheaper, and extra scalable.

The mission is seeing excellent investor assist, managing to achieve $23.9M since its starting and it’s nonetheless rising quick.

$HYPER is on the market proper now on the presale value of $0.013125, which could possibly be the bottom you might ever purchase the token at.

Lengthy-term investments, bear in mind?

If you wish to get in when you nonetheless can, test our information on the best way to purchase $HYPER and go to the presale web page at this time.

Be a part of the $HYPER presale right here.

This isn’t monetary recommendation. Do your personal analysis (DYOR) earlier than investing.

Authored by Bogdan Patru, Bitcoinist: https://bitcoinist.com/blackrock-tokenization-bitcoin-etf-100b-hyper-surges

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

![[LIVE] Crypto News Today, October 17 – After Trump’s Speech, Crypto Market Crashes Further: Gold Price Hits ATH, Bitcoin Falls to $104K, ETH Below $3.7K — Is This the Best Crypto to Buy Opportunity? [LIVE] Crypto News Today, October 17 – After Trump’s Speech, Crypto Market Crashes Further: Gold Price Hits ATH, Bitcoin Falls to $104K, ETH Below $3.7K — Is This the Best Crypto to Buy Opportunity?](https://www.ajoobz.com/wp-content/themes/jnews/assets/img/jeg-empty.png)