After a 100x dash, COAI, as soon as hyped as the very best crypto to purchase now, slumps over -52% in a day as euphoria cools and on-chain scrutiny grows.

ChainOpera AI’s token, COAI, tumbled practically -52% up to now 24 hours after every week of speedy positive aspects that pushed it into the multi-billion-dollar vary.

(Supply:Coingecko)

By Saturday night ET, COAI was buying and selling round $10-$11 with about $295 million in every day quantity on main exchanges.

The drop follows rising dialogue about heavy earnings amongst high wallets and attainable coordinated promoting.

The correction got here quickly after COAI’s explosive rally from about $0.14 on Sept. 26 to an all-time excessive close to $44.90 on Oct. 12, a surge of greater than 100x in simply over two weeks.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

What Did Bubblemaps Uncover About COAI’s Suspicious Pockets Exercise?

Coingecko knowledge exhibits a 24-hour vary between $9.79 and $25.12, placing the stay market cap round $1.9–$2.1 billion primarily based on an estimated circulating provide of 188–200 million tokens.

CoinGecko lists COAI on Bitget and Gate.io, every dealing with tens of tens of millions in trades as we speak.

The token had been one of many high performers of the week, rising greater than 300% earlier than volatility hit.

On Saturday, DEX Screener knowledge from the BNB Chain pair confirmed COAI down about -52% over 24 hours, mirroring the pullback seen throughout each centralized and decentralized markets.

Bubblemaps has raised questions on a cluster of wallets tied to Chain Opera AI (COAI) after uncovering strikingly uniform buying and selling habits.

In its investigation shared on X, the analytics platform recognized 60 wallets that executed 1000’s of automated trades below near-identical situations.

In accordance with Bubblemaps, every pockets acquired an preliminary 1 BNB switch from Binance round 11:00 a.m. UTC on March 25 earlier than utilizing the Binance Alpha platform to hold out synchronized trades.

BREAKING: One entity controls HALF of the highest incomes $COAI wallets

Complete revenue: $13M

What's happening with ChainOpera? pic.twitter.com/CF4AAA9ReY

— Bubblemaps 泡泡地图 (@bubblemaps) October 16, 2025

The sample factors to attainable central management or a tightly coordinated technique behind these addresses.

In the meantime, contemporary knowledge from Nansen suggests merchants are turning cautious. COAI tokens held on centralized exchanges rose from 47.48 million to 55 million up to now week, an influx that always indicators potential promoting or portfolio rotation into different altcoins.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

COAI Value Prediction: Can COAI Maintain Its Key Crypto Assist Between $8.65 and $7.17?

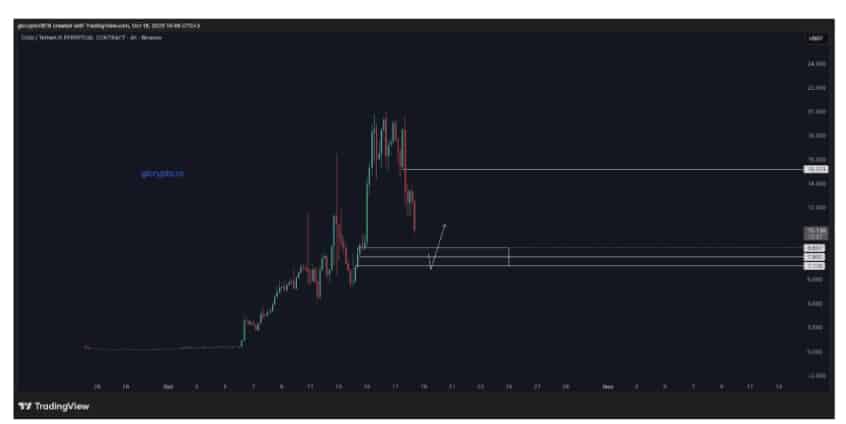

Technically, the four-hour COAI/USDT chart displays that temper.

After a pointy 10× bounce from the $1.737 stage to about $24, the token has slipped right into a sequence of decrease highs and decrease lows a textbook signal of profit-taking and waning momentum.

$COAI

10X transfer up from the extent given at $1.737 (quoted submit).

Now an aggressive pullback. If it goes instantly into the vary proven within the image and doesn’t see a response, that’s not good for the coin…

https://t.co/8nJRjyLYar pic.twitter.com/LEx3YIfFSg

— GL Crypto (@glcrypto1618) October 18, 2025

Whether or not this marks a brief pause or the top of COAI’s explosive run stays unsure, however merchants look like shifting extra cautiously as scrutiny across the mission deepens.

COAI is now buying and selling round $10.13, edging nearer to a key help space between $8.65 and $7.17.

The chart outlines two main demand zones: the primary between $8.65 and $7.93, and the second round $7.17, the place earlier accumulation befell.

In accordance with the analyst, how the value reacts right here will decide the subsequent course.

A bounce from these zones may present that consumers are stepping again in, organising a short-term rebound towards the $15.21 resistance.

(Supply:X)

Nevertheless, there is a sign of hazard represented by the projection line on the chart.

When COAI goes to this help space and fails to present any indication of a turnaround or excessive buying and selling amount, then the construction is prone to turn into weaker. That might spell the doom of its sharp rise and show an extra correction.

Merely, the long-term course of COAI will probably be decided by how this pullback will probably be consolidated right into a wholesome pullback or it’ll degenerate right into a collapse under the numerous help ranges.

DISCOVER: 9+ Finest Memecoin to Purchase in 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

The submit COAI Crypto Drops After Sprinting 100X: Is Chain Opera AI Run Completed? appeared first on 99Bitcoins.