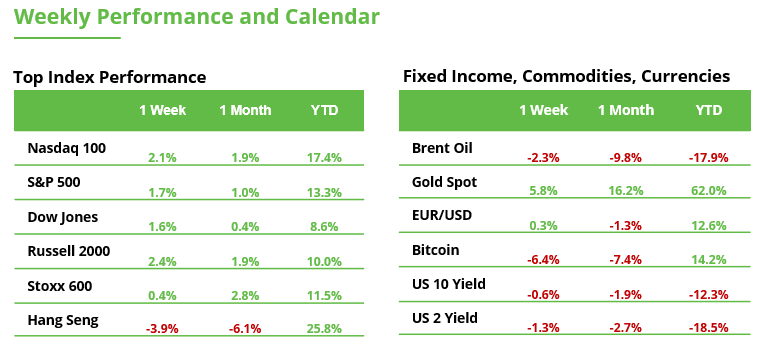

Analyst Weekly, October 19, 2025

Personal Credit score Flashpoint: What Simply Occurred?

Two high-profile borrower failures, Tricolor (subprime auto lender) and First Manufacturers (leveraged auto-parts agency), shook confidence within the personal credit score advanced and led to fairness market volatility (distinct from current regional-bank fraud headlines). Each used layered and opaque financing buildings, together with off-balance-sheet receivables funding and duplicated collateral. The fallout hit a number of regional and huge banks, prompting >$300M in charge-offs and renewed scrutiny on “hidden” exposures. JPMorgan’s Jamie Dimon known as it a “cockroach” second, hinting at extra surprises lurking in shadow lending.

Our View: Threat, Sure, However Not Systemic (But)

We see the October credit score occasions as idiosyncratic blowups, not systemic fractures. Each corporations operated in slender, high-risk corners of the market: deep subprime, over-leveraged roll-ups. Losses have been actual, however concentrated.

Critically, most regional banks confirmed restricted or absolutely reserved publicity, with no indicators of widespread credit score deterioration. This was a wake-up name on layered lending threat however not a repeat of SVB or 2008, in our view. That stated, opaque funding buildings, rising use of PIK curiosity, and fund interlinkages want nearer monitoring into 2026. The excellent news is, we’re in a reducing fee setting, and never in a tightening cycle.

Q3 2025: Regional Banks Present Their Muscle

Regardless of headline fears, regional banks delivered a powerful Q3. Themes:

High-Line Power: Mid- to high-single digit income development at most companies, led by price earnings rebound and steady NII. PNC, USB, Truist all noticed document or near-record income.

NII and Margin Well being: Web curiosity earnings held up effectively; a number of banks posted margin growth (USB NIM +9bps). Mortgage demand stayed strong, and deposit prices started to plateau.

Capital Markets Rebound: Advisory and buying and selling roared again. Funding banking charges rose >35% YoY in some instances. Wealth administration and capital markets income surged throughout Residents, Truist, USB.

Credit score: Resilient with Pockets of Stress: NPLs have been flat or falling; charge-offs modest. First Manufacturers exposures have been addressed by way of reserves. Banks like M&T, Residents emphasised tight underwriting and excessive ACL protection (>200% ACL/NPL ratios frequent).

Shopper Pulse: Secure and Spending: Card delinquencies improved QoQ at USB. Deposit flows have been agency; spending ranges wholesome.

Personal Credit score: Contained, With Warnings: Most regionals had minimal or well-managed personal credit score publicity. Residents (with ~$3.3B in personal lending) emphasised diversified buildings. M&T avoids NAV-based lending. Truist had no Tricolor publicity.

Q3 2025: Huge Banks Are Again in a Huge Method

US large-cap banks simply posted their strongest collective quarter since 2021. The catalyst? A resurgent deal-making setting, buoyed by resilient client exercise and sharp value self-discipline. Funding banking staged a broad-based comeback, fairness markets rallied, and earnings development shifted from rate-driven to fee-led. With the Fed easing right into a still-firm financial system, banks are getting into 2026 in measured development mode, leaning on scale, capital, and shopper engagement.

Earnings Snapshot: High-Line Acceleration

Income Development: Most main banks (JPM, MS, GS, BAC) posted high-single to low-double digit YoY income features. Charge earnings restoration and strong NII drove the upside.

Expense Management: Working leverage was a theme: tight value administration allowed income features to movement by way of.

Standouts: Morgan Stanley and JPMorgan cited robust shopper exercise and broader market participation, fairly than simply volatility spikes.

NII: Nonetheless a Pillar, However Much less Dominant

Web curiosity earnings held agency, supported by wholesome mortgage development and improved deposit combine.

Banks are guiding for continued NII energy into 2026, however with better reliance on price earnings as fee tailwinds flatten.

Mortgage demand is rising once more, and client deposit conduct has stabilized — key inputs for ahead NII development.

Charge Engines Firing: M&A, Buying and selling, Advisory

IB Revival: Deal movement rebounded throughout sectors, with most banks seeing double-digit features in funding banking charges.

Fairness Buying and selling Surge: Q3 equity-trading income hit a 5-year excessive throughout the highest six banks ($15.4B vs. $12.4B in Q2).

Volatility eased, however shopper engagement stayed excessive, an indication of optimistic conviction fairly than fear-based positioning.

Broad Capital Markets Momentum: FICC and equities each delivered excessive single-digit development at JPM, GS, MS, and BoA, as shoppers repositioned portfolios round fee paths and geopolitics.

Credit score High quality: Sturdy, Orderly, and Predictable

Credit score normalization continues in an orderly style.

Citi and PNC highlighted steady delinquencies and robust family stability sheets.

No main cracks in industrial actual property (CRE) or non-bank lending (NBFI) have emerged.

Provisioning stays disciplined, no indicators of panic or credit score dislocation.

Strategic Themes: Effectivity, Tech, and Coverage Tailwinds

AI & Automation: Each main CEO referenced AI productiveness features, throughout underwriting, compliance, and repair supply.

Financial View: Macro is “resilient however late-cycle.” Customers are nonetheless spending; corporates are cautiously re-leveraging.

Key Dangers: Inflation and financial coverage stay prime issues (highlighted by BoA, GS).

Regulation: Enjoying Subject Might Be Leveling

CEOs (Dimon, Scharf, Solomon) cheered the Fed’s extra balanced tone on regulation.

Basel III Endgame could also be softened; G-SIB surcharge recalibration anticipated.

Implication: Properly-capitalized giant banks might have extra room to deploy capital, scale IB/buying and selling capability, and return capital to shareholders.

“Leveling the taking part in area” was a recurring phrase, signaling optimism about aggressive positioning into 2026.

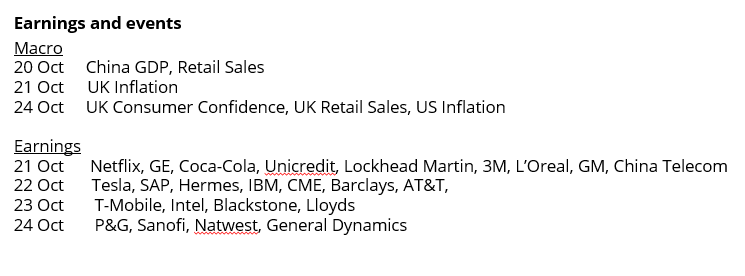

Excessive Valuation, Excessive Threat: Are Tesla and Netflix Reaching Their Restrict?

The US earnings season is now getting into its scorching section, with the primary main tech corporations reporting outcomes. Netflix on Tuesday and Tesla on Wednesday. Each are thought-about investor favorites. Their enterprise fashions couldn’t be extra completely different, however they share one factor in frequent: a excessive valuation.

That creates stress to ship and makes each shares weak to cost corrections. Moreover, Tesla is at present valued about 5 instances increased than Netflix (ahead P/E: 208.6 vs. 41.7), which makes issues notably attention-grabbing. Traders will likely be watching intently.

Expectations For Q3 Outcomes

The outcomes are anticipated to point out that Netflix stays on monitor for achievement, persevering with to develop strongly with strong fundamentals:

Netflix expects income to rise 17.3% 12 months over 12 months to $11.52 billion.

Analysts forecast an earnings leap of 27.6% to $6.89 per share.

Tesla, then again, is scuffling with declining profitability:

Analysts anticipate earnings to drop 27.8% to $0.52 per share.

Income doubtless rose solely 4.3% to $26.67 billion.

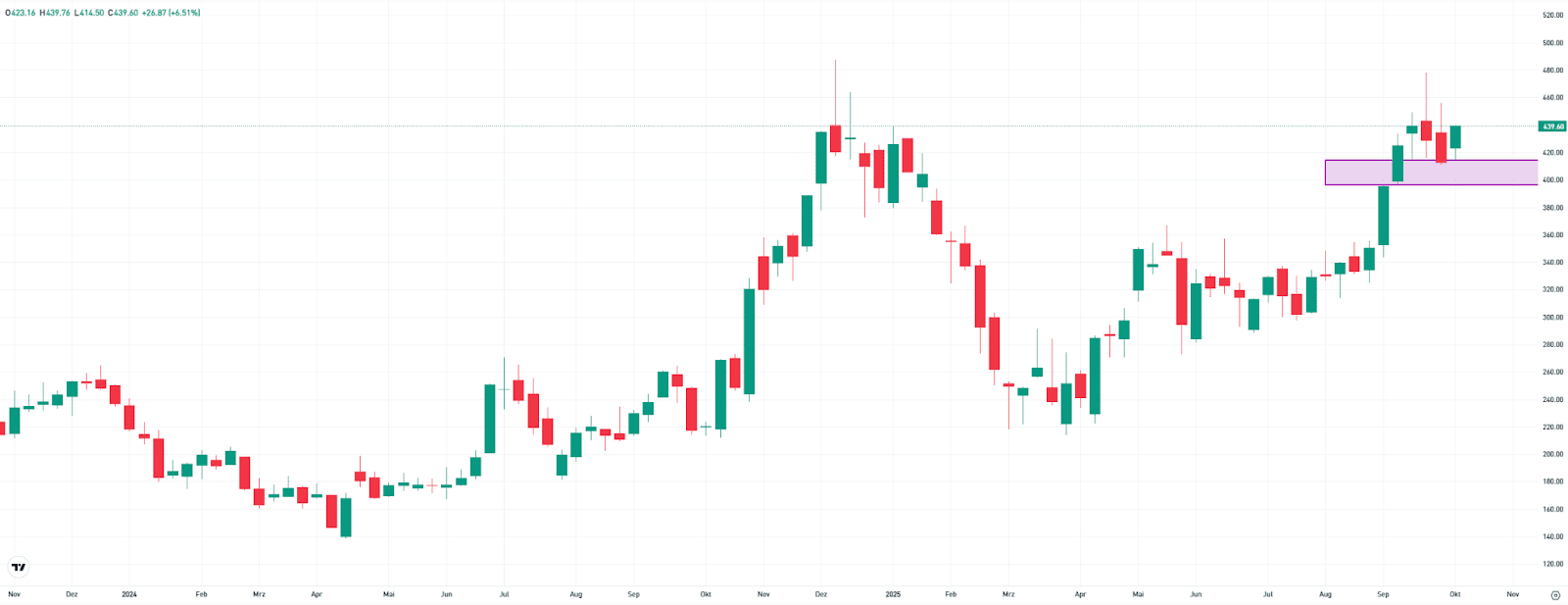

Technical Image

The Netflix inventory stays up 34% 12 months thus far, regardless of the correction in June. About two and a half instances stronger than the S&P 500. Since August, buying and selling has been calmer, with the inventory transferring sideways. It at present holds above a medium-term assist zone between $1,164 and $1,172, giving it a small buffer. Final week, the inventory closed 1.5% decrease at $1,199.

Netflix, Weekly Chart. Supply: eToro

Tesla additionally has short-term assist, offering technical tailwind within the $396–414 vary. Final week, the inventory closed 6.4% increased at $439. Tesla has spent many of the 12 months recovering losses from the primary quarter. At one level, the share value had practically halved, however it’s now up nearly 9% 12 months thus far. The hole to the December document excessive stays within the double digits.

Tesla, Weekly Chart. Supply: eToro

Volatility Is Virtually Assured

We’ll doubtless see some warning available in the market forward of the upcoming quarterly outcomes. To this point, there have been no main sell-offs, and buyers seem to stay assured. Each Netflix and Tesla are holding above key assist ranges, indicating technical energy. For now, issues are quiet. However that would change shortly if the outcomes or steering fall wanting expectations.

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any specific recipient’s funding targets or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product are usually not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.