With a Solana Spot ETF now available in the market, distinguished figures and corporations are considerably pushing for an XRP Spot ETF, contemplating it the subsequent huge factor for the crypto panorama. Because the approval date attracts nearer, a number of firms, equivalent to Grayscale, are refining their regulatory method.

Grayscale Sharpens Its XRP ETF Technique

Given the wave of recent functions, the race for an XRP Spot Trade-Traded Fund (ETF) continues to warmth up within the crypto sector. One of the vital current strikes to make sure that the funds safe an approval from the USA Securities and Trade Fee (SEC) is being carried out by Grayscale, a number one asset administration agency.

Grayscale has formally reignited a frenzy within the funding panorama after submitting an up to date modification for its proposed XRP Spot ETF. John Squire, a crypto influencer and investor, reported that daring transfer, which means that it’s actively enhancing its regulatory technique. Squire added that “the partitions are closing in, and mainstream adoption is inevitable” for the altcoin.

Regardless of the heightened business scrutiny across the SEC’s cryptocurrency-related judgments, the amended proposal signifies firms are making a powerful effort towards the fund. It’s value noting that the US SEC is anticipated to move its determination concerning the fund inside this month.

Whereas an approval from the regulatory physique is actually not assured but, the transfer to file for an modification underscores Grayscales’ conviction that the spot ETF launch is just not a query of if, however relatively when.

The submission states that the belief’s objective is to supply traders with publicity to XRP by means of shares that comply with the market worth of the digital asset. In response to the submitting, the belief is about up in accordance with Delaware legislation and, topic to regulatory permission, intends to record on NYSE Arca below the image GXRP.

In reference to the formation and redemption of Baskets, the Belief is now allowed to just accept Money Orders (as outlined above), below which an Approved Participant will deposit money into or settle for money from the Money Account. Moreover, XRP will probably be obtained or acquired in trade for money in reference to such an order by a 3rd occasion (a Liquidity Supplier) that’s not an agent of or working in some other capability on behalf of such an Approved Participant.

A Recreation-Altering Initiative For The Altcoin

At present, the thought of an XRP Spot ETF is sending shockwaves all through the neighborhood. A number of crypto fans now consider that the US SEC will grant approval to the anticipated fund by this month, a transfer that may change the course of the token.

In accordance to Ripple Bull Winkle, the XRP Spot ETF goes stay 100% on November 13. “The wait is over, the floodgates are opening,” the skilled added. Ripple Bull Winkle highlighted that institutional capital is about to pour into the altcoin in an unprecedented method, which is what the market has been ready for.

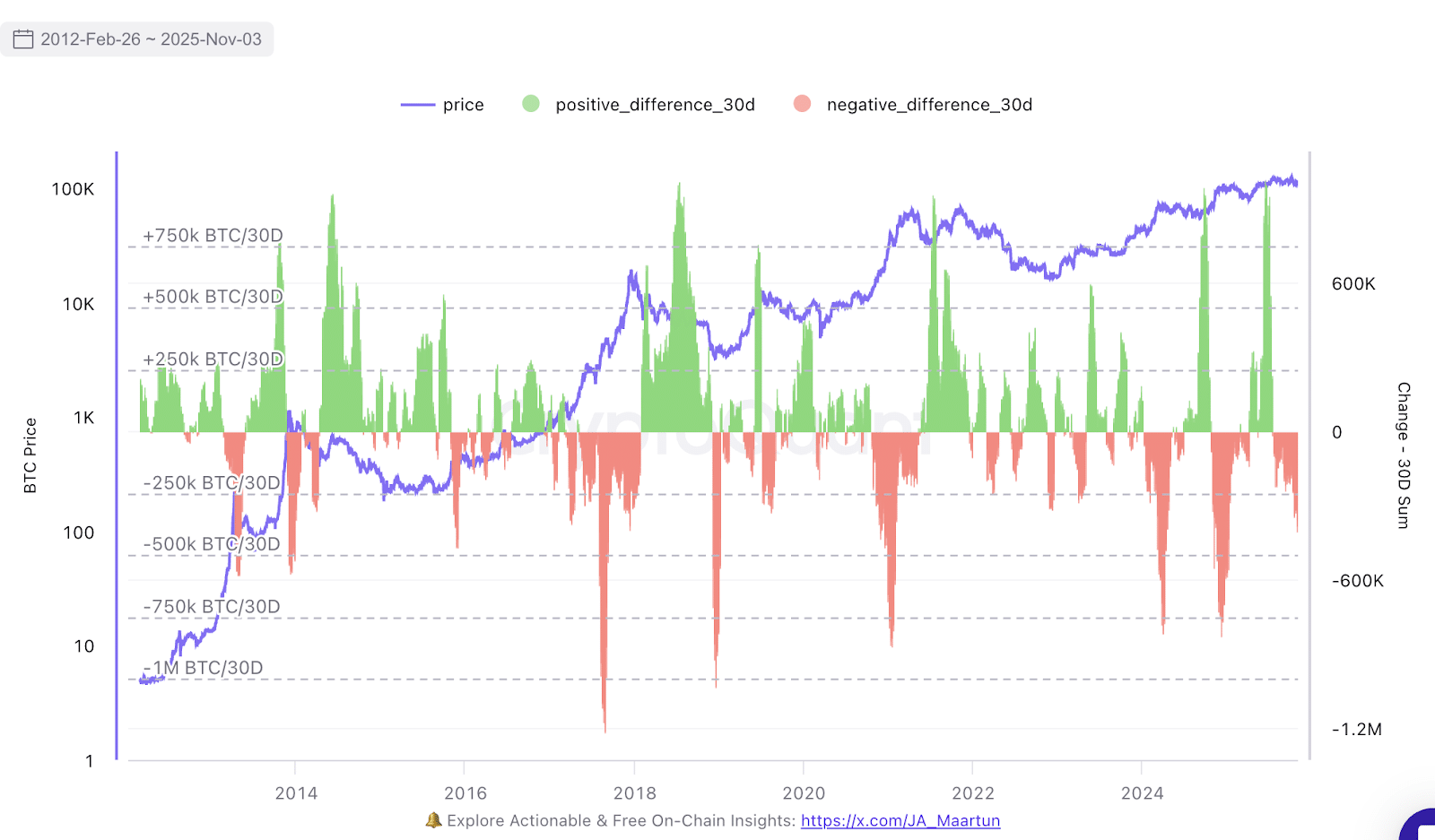

Featured picture from Getty Photographs, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.