On-chain knowledge suggests the trail to $2,500 may very well be open for Ethereum now that the asset has managed to cross the $2,100 mark.

Ethereum Has No Main Resistance Ranges Till $2,500

In a brand new put up on X, the market intelligence platform IntoTheBlock has offered an replace on how the Ethereum ranges are trying when it comes to on-chain assist and resistance. In on-chain evaluation, ranges are outlined as assist or resistance primarily based on what number of buyers acquired their cash inside them.

The under chart reveals the density of addresses at varied ranges above and under the present spot value of the cryptocurrency:

The quantity of holders that acquired their cash at every of the completely different ETH value ranges | Supply: IntoTheBlock on X

Typically, at any time when the Ethereum value retests the fee foundation of an investor, they could be extra prone to present some type of transfer. When this retest occurs from above, the holder could also be inclined to consider the value will go up once more quickly so they could see the retest as a “dip” and thus, would possibly resolve to purchase extra.

Associated Studying: Polygon (MATIC) Jumps One other 6% As Whales Present Excessive Exercise

However, the investor might wish to exit the market if the retest is from under, as they may concern the value would go down once more sooner or later, and by promoting on the break-even mark, they’d at the least keep away from incurring any losses.

A couple of buyers displaying such habits is clearly not sufficient to trigger any seen results in the marketplace, but when numerous buyers share the identical value foundation, the asset might very effectively really feel a sizeable response.

From the chart, it’s seen that there are some massive value foundation facilities under the present Ethereum ranges, suggesting the presence of sturdy potential assist ranges.

Earlier, when the asset had nonetheless been under $2,000, the $2,000 to $2,100 vary posed because the final main resistance boundary to interrupt. Because the coin has now risen above these costs, it’s potential that the vary can be switching its function in the direction of being assist as an alternative.

Following this newest rally, about 75% of the holders are actually in revenue (that’s, their value foundation is within the ranges under). As is seen within the graph, there aren’t any value ranges with a excessive density of buyers within the upcoming value ranges, till the $2,500 mark.

“Does this imply it’s a clear run to a brand new ATH? Not essentially,” explains IntoTheBlock. “Traditionally, profit-taking at these ranges is widespread and results in pullbacks. Nevertheless, that is unlikely to considerably affect Ethereum’s long-term trajectory.”

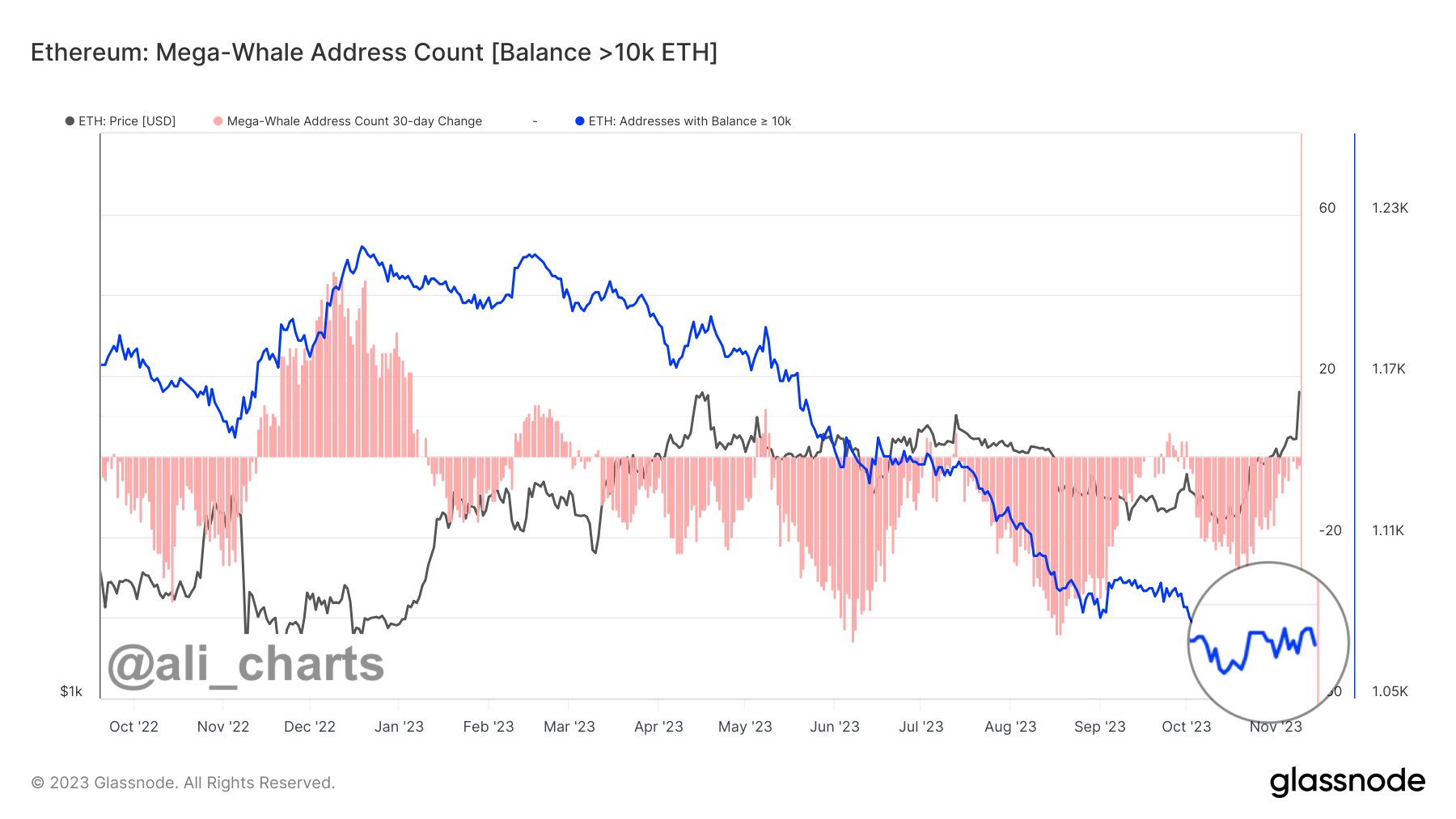

Analyst Ali Martinez has additionally identified one thing attention-grabbing in an X put up as we speak. He revealed that the most recent rally in ETH has occurred with out the assist of the biggest of the Ethereum whales (carrying a steadiness larger than 10,000 ETH), the so-called “mega whales.”

Appears like the worth of the metric has been transferring sideways just lately | Supply: @ali_charts on X

As highlighted within the graph, the full variety of addresses owned by the Ethereum mega whales has been flat just lately. “Ethereum has reclaimed the $2,000 threshold, and intriguingly, that is all taking place earlier than whales have even began shopping for ETH!” notes Ali.

ETH Worth

After a surge of greater than 9% prior to now 24 hours, Ethereum has arrived on the $2,100 stage for the primary time since April.

The asset’s value seems to have exploded in the course of the previous day | Supply: ETHUSD on TradingView

Featured picture from DrawKit Illustrations on Unsplash.com, charts from TradingView.com, Glassnode.com, IntoTheBlock.com