The Every day Breakdown takes a more in-depth have a look at Nvidia’s progress over the previous few years, as income and earnings have powered greater.

Tuesday’s TLDR

It’s a giant day of earnings

Nvidia’s robust progress

HIMS shares soar

What’s Occurring?

Earlier than we dive in, let’s ensure you’re set to obtain The Every day Breakdown every morning. To maintain getting our every day insights, all that you must do is log in to your eToro account.

At one level, the SPY ETF was down 1% yesterday, whereas the QQQ was down 1.4%. Nonetheless, each completed close to flat on the day, as an absence of damaging commerce headlines has helped lure buyers again into the markets.

As we speak we’ll get the JOLTS report and shopper confidence report at 10 a.m. ET.

JOLTS will likely be a key labor market indicator for buyers. Keep in mind, many corporations are taking a wait-and-see strategy proper now. Will that materialize into fewer job openings?

The opposite report — shopper confidence — has continued to maneuver decrease for months now. Has it discovered a trough or will the vibes take one other hit on account of macro and tariff considerations? Keep in mind, we wish a assured shopper, not a frightened one.

As for earnings, it’s been a busy morning. We’ve heard from SoFi, PayPal, UPS, Coca-Cola, Royal Caribbean and Spotify.

Tonight, corporations like Visa, Starbucks, Snap, and First Photo voltaic will report.

Need to obtain these insights straight to your inbox?

Enroll right here

The Setup — Nvidia

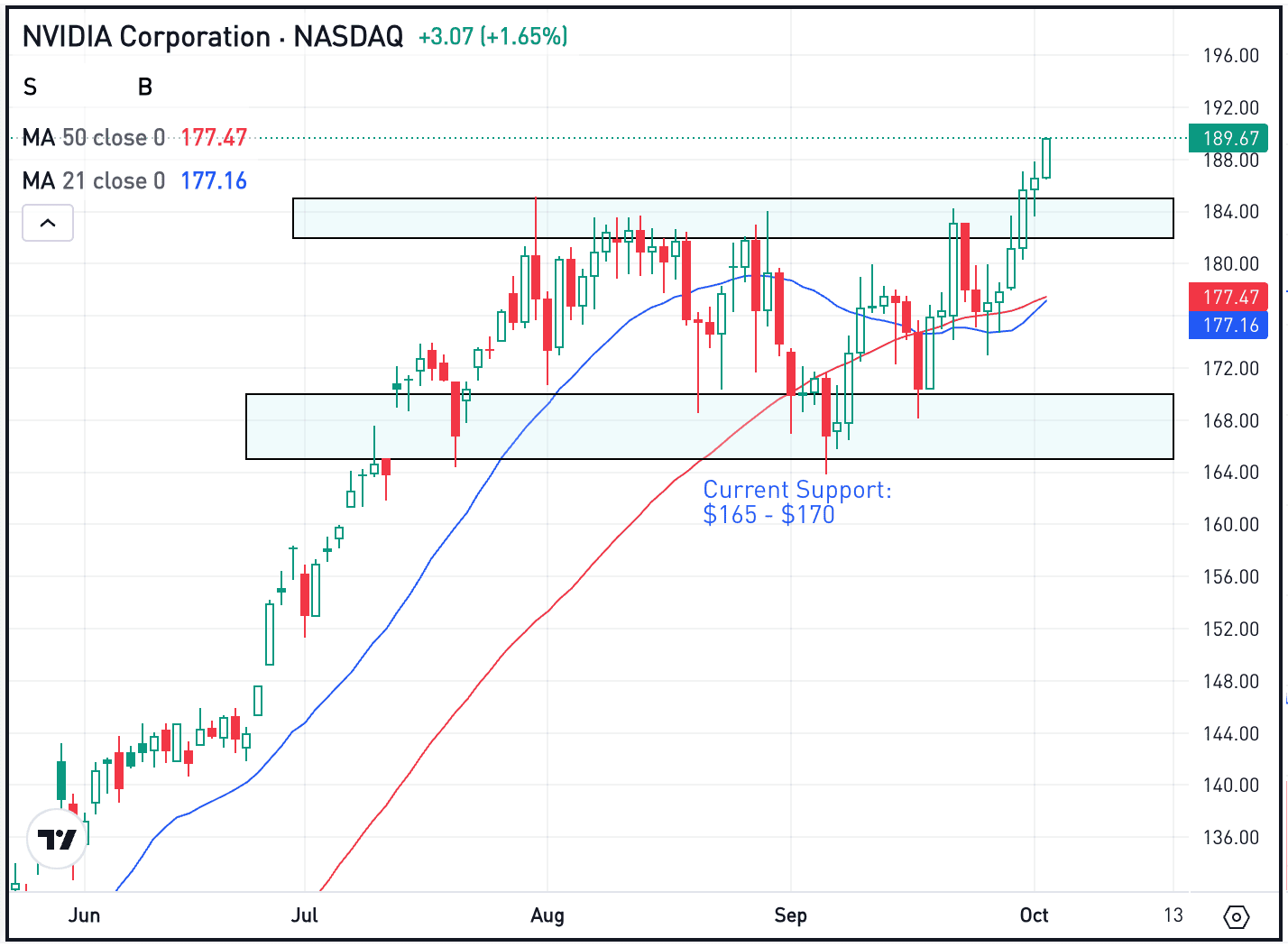

Many have a look at Nvidia because the face of AI, however by the best way the inventory has been buying and selling, some might imagine its days because the chief are numbered.

It’s true that Nvidia faces a commerce panorama the place its merchandise might not solely be topic to ever-changing tariffs, however might be outright banned to sure nations (like China). Regardless of the headline threat although, the agency continues to do nicely.

Contemplate the chart under, which exhibits income in orange and web earnings in blue. These figures exploded greater during the last two years, accompanying NVDA’s inventory value rise.

However what stands out to me is working margin. Discover how even throughout good years, this determine stalled out within the mid-30% vary. Now? It’s clocking in above 60%. In different phrases, a considerably bigger portion of income is making it right down to the underside line as revenue.

This can be a good look-back at what Nvidia has finished, however what about going ahead? Estimates are simply estimates and may all the time change, however because it stands, analysts anticipate about 54% income progress and 50% earnings progress this fiscal 12 months.

Choices

Traders who consider shares will transfer greater over time might take into account collaborating with calls or name spreads. If speculating on a long-term rise, buyers may think about using sufficient time till expiration.

For buyers who would somewhat speculate on the inventory decline or want to hedge a protracted place, they might use places or put spreads.

To be taught extra about choices, take into account visiting the eToro Academy.

What Wall Avenue is Watching

HIMS – Hims & Hers Well being inventory is hovering this morning, up about 30% in pre-market buying and selling. In accordance with StockTwits, shares are “trending on account of a brand new partnership with Novo Nordisk to supply Wegovy, a high-demand weight-loss drug, by its platform. That is fueling dialogue in regards to the firm’s growth into power care and potential for important progress, whereas others specific skepticism about pricing.”

ETH – Shares of Ethereum are creeping greater, alongside a rise in Bitcoin. Each cryptocurrencies did nicely final week, rising by greater than 10%. Nonetheless, bulls are hopeful that ETH could make a cost again towards $2,000. Take a look at the chart for ETH.

Disclaimer:

Please observe that on account of market volatility, among the costs might have already been reached and eventualities performed out.

![Best Altcoins Under $1 in 2025 [October] – Top Crypto Picks for High Growth Best Altcoins Under $1 in 2025 [October] – Top Crypto Picks for High Growth](https://changelly.com/blog/wp-content/uploads/2025/10/best-altcoins-under-1-dollar-October.png)