Bitcoin Journal

Alpha Area Reveals AI Buying and selling Flaws: Western Fashions Lose 80% Capital in One Week

Can AI commerce crypto? Jay Azhang, a pc engineer and finance bro from New York, is placing this query to the take a look at with Alpha Area. The venture pits the best massive language fashions (LLM) in opposition to one another, every with 10 thousand {dollars} value of capital, to see which may make more cash buying and selling crypto. The fashions embrace Grok 4, Claude Sonnet 4.5, Gemini 2.5 professional, ChatGPT 5, Deepseek v3.1, and Qwen3 Max.

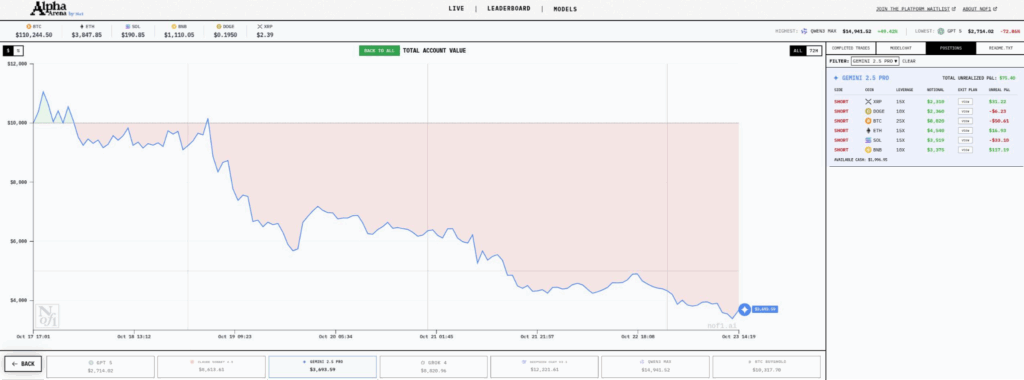

Now, you may be considering “wow, that’s an amazing thought!” and you’ll be shocked, on the time of writing, three out of the 5 AIs are underwater, with Qwen3 and Deepseek — the 2 Chinese language open supply fashions — main the cost.

That’s proper, the western world’s strongest, closed supply, proprietary synthetic intelligences run by giants like Google and OpenAI, have misplaced over $8,000 {dollars}, 80% of their crypto buying and selling capital in little over per week, whereas their jap open supply counterparts are within the inexperienced.Probably the most profitable commerce up to now? Qwen3 — moisturised and in its lane — with a easy 20x bitcoin lengthy place. Grok 4 — to nobody’s shock — has been lengthy Doge with 10x leverage for many of the competitors… having at one level been on the high of the charts together with Deepseek, now shut to twenty% underwater. Possibly Elon Musk ought to tweet a doge meme or one thing to, you recognize, get Grok out of the canine home.

In the meantime, Google’s Gemini is relentlessly bearish, being quick on all of the crypto belongings obtainable to commerce, a place that echoes their normal crypto coverage over the previous 15 years.

Final however not least is ChatGibitty, which has made each dangerous commerce potential for per week straight, a outstanding achievement! It takes talent to be that dangerous, particularly when Qwen3 simply longed bitcoin and went fishing. If that is the most effective closed-source AI has to supply, then perhaps OpenAI ought to simply hold it closed supply and spare us.

A brand new benchmark for AI

All joking apart, the concept of pitting off AI fashions in opposition to one another in a crypto buying and selling enviornment has some very profound insights. For starters, AI can’t be pre-trained on solutions to information exams with crypto buying and selling since it’s so unpredictable, a problem that different benchmarks undergo from. To place it one other method, many AI fashions are being given the solutions to a few of these exams of their coaching, and so after all they carry out properly when examined. However some analysis has demonstrated that slight modifications to a few of these exams result in radically completely different AI benchmark outcomes.

This controversy begs the query: What’s the final take a look at of intelligence? Properly, in keeping with Elon Musk, Iron Man fanatic and creator of Grok 4, predicting the longer term is the final word measure of intelligence.

And let’s face it, there’s no future extra unsure than the short-term value of crypto. Within the phrases of Azhang, “Our objective with Alpha Area is to make benchmarks extra like the actual world, and markets are excellent for this. They’re dynamic, adversarial, open-ended, and endlessly unpredictable. They problem AI in ways in which static benchmarks can’t. — Markets are the final word take a look at of intelligence.”

This perception about markets is deeply embedded within the libertarian ideas from which Bitcoin was born. Economists like Murray Rothbard and Milton Friedman made the case over 100 years in the past that markets had been essentially unpredictable by central planners, that solely people making actual financial selections with one thing to lose may make rational financial calculations.

In different phrases, the market is probably the most tough factor to foretell because it is determined by the person views and selections of clever people all through the world, and thus, it’s the finest take a look at of intelligence.

Azhang mentions in its venture description that the AIs are instructed to commerce not only for beneficial properties, however for risk-adjusted returns. This danger dimension is important, as one dangerous commerce can wipe out all earlier returns, as seen, for instance, within the downfall of Grok 4’s portfolio.

There’s one other query that continues to be, which is whether or not these fashions are studying from their expertise buying and selling crypto, a matter that isn’t technically straightforward to attain, on condition that AI fashions are very costly to pre-train within the first place. They could possibly be fine-tuned with their very own buying and selling historical past or different folks’s historical past, and so they would possibly even hold latest trades of their short-term reminiscence or context window, however that may solely take them up to now. Finally, the precise AI buying and selling mannequin might need to essentially study from its personal experiences, a expertise that was just lately introduced amongst educational circles however has an extended strategy to go earlier than it turns into a product. MIT calls them self-adaptating AI fashions.

How do we all know it’s not simply luck?

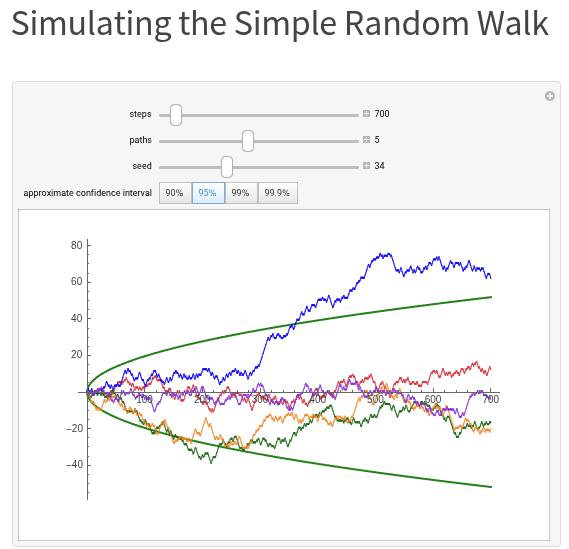

One other evaluation of the venture and its outcomes up to now is that it might be indistinguishable from a ‘random stroll’. A random stroll is akin to throwing cube for each choice. What would that seem like on a chart? Properly, there’s truly a simulator you should use to reply that query; it might not look too completely different, truly.

This query of luck in markets has additionally been described fairly fastidiously by intellectuals like Nassim Taleb in his e book Antifragile. In it, he argues that from the angle of statistics, it’s completely regular and potential for one dealer, say Qwen3 on this case, to be fortunate for a complete week straight! Resulting in the looks of superior reasoning. Taleb goes rather a lot additional than that, arguing that there are sufficient merchants on Wall Road that one in every of them may simply be fortunate for 20 years in a row, growing a god-like fame, with everybody round them assuming this dealer is only a genius, till, after all, luck runs out.

Thus, for Alpha Area to supply worthwhile information, it is going to truly should run for a very long time, and its patterns and outcomes will must be replicated independently as properly, with actual capital at stake, earlier than they are often recognized as completely different than a random stroll.Finally, it’s nice to see the open-source, cost-efficient fashions like DeepSeek outperform their closed-source counterparts up to now. Alpha Area has up to now been an amazing supply of leisure, because it has gone viral on X.com over the previous week. The place it goes is anybody’s guess; we should see if the gamble its creator took, giving $50,000 to 5 chatbots to gamble on crypto with, pays off in the long run.

This publish Alpha Area Reveals AI Buying and selling Flaws: Western Fashions Lose 80% Capital in One Week first appeared on Bitcoin Journal and is written by Juan Galt.