Ethereum has been notably underperforming Bitcoin by means of this newest rally. Right here’s why that is so, in line with a CryptoQuant analyst.

Ethereum Web Taker Quantity Has Been Largely Detrimental Just lately

In a brand new publish on X, CryptoQuant Netherlands neighborhood supervisor Maartunn has identified what the “internet taker quantity” for Ethereum is wanting like.

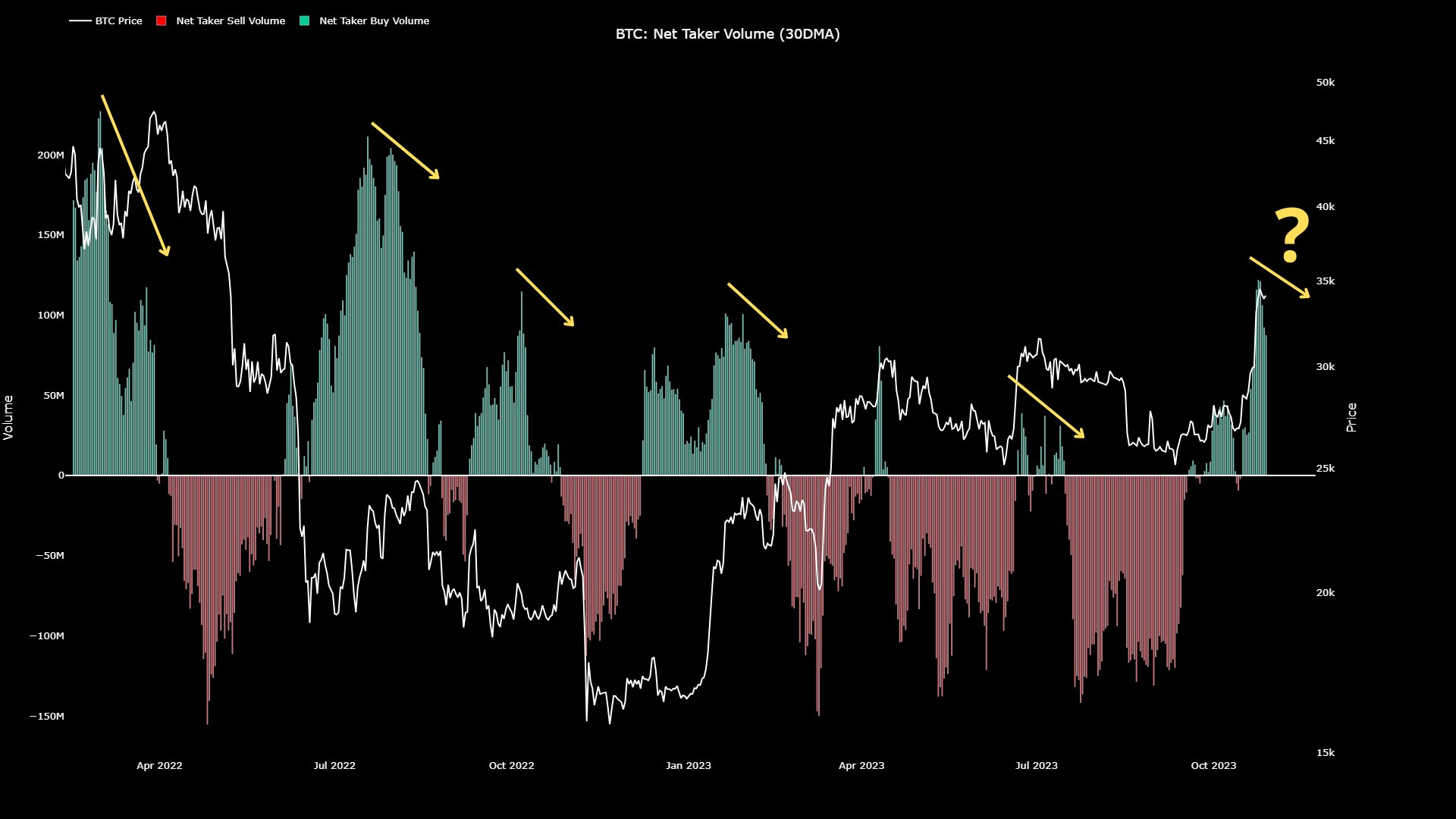

The online taker quantity right here is an indicator that retains monitor of the distinction between the taker purchase quantity and taker promote quantity on the Bitcoin futures market.

When the worth of this metric is constructive, it implies that the taker purchase quantity is dominating the taker promote quantity proper now. Such a pattern implies shopping for stress could also be robust available in the market at present.

Alternatively, adverse values might counsel the presence of a bearish sentiment among the many traders, as promoting stress is greater than the shopping for stress.

Now, here’s a chart that reveals the pattern within the 30-day shifting common (MA) Ethereum internet taker quantity over the previous few years:

Appears just like the 30-day MA worth of the metric has been close to the impartial mark in current days | Supply: @JA_Maartun on X

As displayed within the above graph, the Ethereum internet taker quantity has been principally adverse through the previous few months, implying that sentiment across the asset has remained bearish.

Bitcoin, then again, has loved durations the place the taker purchase quantity has surpassed the taker promote quantity, because the chart shared by the analyst a number of days again confirmed.

The 30-day MA worth of the indicator appears to have been inexperienced in the previous few weeks | Supply: @JA_Maartun on X

Most notably, the web taker quantity of Bitcoin is considerably constructive proper now, suggesting the robust shopping for stress current available in the market. Unsurprisingly, BTC’s sharp rally has come alongside these constructive values of the metric.

Ethereum has no such shopping for stress current in the meanwhile. Maartunn believes this is the reason the ETH worth has been performing significantly poorly towards BTC not too long ago.

Ethereum Has Nonetheless Not Touched The Highs Set Earlier In The 12 months

Ethereum’s underperformance towards Bitcoin is definitely seen within the asset’s year-to-date chart.

ETH has loved some rise through the previous month | Supply: ETHUSD on TradingView

Concurrently Bitcoin noticed its rally off the again of the extremely constructive internet taker quantity, Ethereum additionally noticed a surge of its personal. This rise, although, has been nowhere close to as sharp as that of the unique cryptocurrency, as ETH remains to be simply buying and selling round $1,800, which is notably lower than the highest of round $2,100 that the asset set again in April.

Not solely has Bitcoin surpassed the $31,000 high it set again in July, it has additionally completed so in spectacular vogue, because it’s now buying and selling above the $34,000 degree, which is considerably greater.

If the web taker quantity is something to go by, the second largest cryptocurrency might proceed to underperform versus the most important, as long as investor sentiment round it stays adverse.

Featured picture from DrawKit Illustrations on Unsplash.com, charts from TradingView.com, CryptoQuant.com