The web3 gaming token market has been driving excessive on a wave of pleasure about blockchain tech, however 2024 has lastly thrown it a curveball. The sector has hit a serious velocity bump after beginning the 12 months with combined worth reactions and a flurry of curiosity. Huge-name gaming tokens with giant market caps have taken a nosedive, leaving buyers and fans scratching their heads over what went flawed.

The joy of early success has pale, revealing a fancy internet of challenges. From stricter rules and a flood of latest initiatives to shifting investor priorities and market saturation, there’s lots to unpack. Understanding these dynamics is essential for navigating the present storm and anticipating the long run for gaming tokens.

Market Efficiency of Gaming Tokens in 2024

The primary quarter of 2024 felt like a high-stakes poker sport for brand spanking new gaming tokens—some gained large, whereas others fell quick. The $XAI token from the L3 Xai gaming mission had a powerful launch, however the $PORTAL gaming memecoin fizzled out. Whereas some tokens confronted challenges, others like Treasure DAO’s $MAGIC, Discover Satoshi Lab’s $GMT, Wemade’s $WEMIX, The Sandbox’s $SAND, Axie Infinity’s $AXS, and Apecoin’s $APE confirmed solely minor features, barely transferring the needle in worth.

However it wasn’t all doom and gloom—newcomers just like the $RON token from Ronin, the revamped $BEAM token from Benefit Circle’s $MC, and Parallel Studios’ $PRIME token had their second within the highlight throughout Q1 2024.

Whereas some gaming tokens have been having a tough patch, Treasure DAO’s $MAGIC, Discover Satoshi Lab’s $GMT, Wemade’s $WEMIX, The Sandbox’s $SAND, Axie Infinity’s $AXS, and Apecoin’s $APE barely moved the needle, displaying solely minor bumps in worth.

However it wasn’t all unhealthy information! Some newcomers have been on fireplace, reaching new highs. The $RON token from Ronin, the revamped $BEAM token from Benefit Circle’s $MC, and Parallel Studios’ $PRIME token all had their second within the highlight throughout Q1 2024.

By the second quarter, the blockchain gaming trade confronted even more durable instances. Prices of most main gaming tokens declined, with only some—Ronin Community’s $RON, SuperVerse’s $SUPER, Legendary Chain’s $MYTH, and Yield Guild Video games’ $YGG—closing the quarter within the inexperienced for 2024. These tokens managed to remain afloat due to robust features in Q1, which helped offset the losses in Q2.

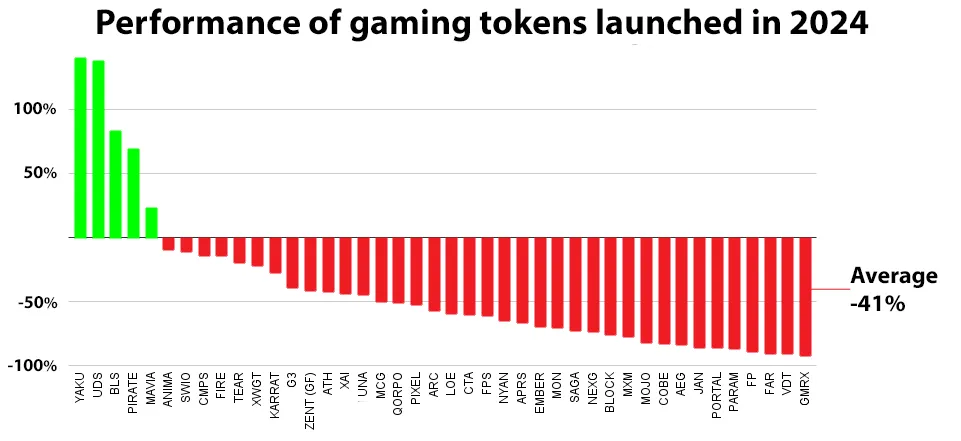

In whole, 42 gaming tokens have been launched within the first half of 2024, however solely 5—Yaku ($YAKU), Undead Video games ($UDS), BloodLoop ($BLS), Pirate Nation ($PIRATE), and Heroes of Mavia ($MAVIA)—ended up growing in worth in comparison with their launch costs. Nevertheless, the common efficiency of those tokens confirmed a major 41% lower by the top of June 2024.

What Occurred to Gaming Tokens in 2024?

Ranging from the plain, the USA Securities and Change Fee (SEC)’s elevated scrutiny of the crypto trade has created a difficult surroundings for gaming tokens. This has made buyers cautious and in addition pressured builders to attempt to discover an virtually not possible stability between innovation and compliance with unclear guidelines. The SEC’s view that ICOs (Preliminary Coin Choices) are vulnerable to misconduct with out strict regulation led to most gaming token pre-sales attracting little consideration.

Nevertheless, a extra refined cause is the desperation and greed amongst blockchain sport firms and buyers. Restricted token launches in 2023 created a backlog of initiatives ready for beneficial circumstances. When profitable initiatives like Heroes of Mavia and Pixels launched in early 2024, a rush of underdeveloped and inexperienced initiatives flooded the market, oversaturating it. Many of those gaming tokens, launched with minimal regulatory oversight, have been bought to inexperienced buyers, leading to speculative buying and selling and fast sell-offs post-launch, which drove down the worth of gaming tokens.

Greed wasn’t simply on the builders’ facet. Crypto retail buyers, Key Opinion Leaders (KOLs), and crypto funds additionally contributed to the issue, shopping for tokens at launch costs and shortly flipping them for income. This speculative behaviour triggered fast declines in token values, undermined long-term mission growth and eroded investor confidence.

The already weak funding within the gaming sector solely worsened the scenario. Whereas there have been 77 new offers in Q2 2024, bringing the full for the primary half of the 12 months to 153, the mixed worth of those investments dropped. Q2 2024 noticed $296 million in introduced investments, down from $324 million in Q1 2024, with the half-year whole of $620 million marking a 5% lower from the second half of 2023.

This decline in funding meant many initiatives struggled to safe the assets wanted for growth, resulting in underdeveloped video games and an absence of person curiosity. Investor enthusiasm waned because the market matured—early success tales had initially pushed curiosity, however as extra tokens entered and did not ship, buyers shifted focus to initiatives with confirmed utility and stable fundamentals, additional impacting gaming tokens.

What Consultants are saying in regards to the Way forward for Gaming Tokens

Regardless of a difficult 2024, consultants are optimistic about the way forward for gaming tokens, predicting substantial development within the years forward. In line with Customized Market Perception, the blockchain gaming market, valued at $10.2 billion in 2024, is anticipated to develop at a compound annual development fee (CAGR) of 67.7%, reaching $304.3 Billion by 2033. This development is anticipated to be pushed by growing blockchain adoption and demand for decentralized platforms.

The Zipdo Training Report forecasts that the marketplace for blockchain-based video games will attain $3.6 billion by 2025 and this development is anticipated to spice up the worth and use of gaming tokens. Notably, the market capitalization of the play-to-earn section was projected to hit $20 billion by 2026.

In line with Fortune Enterprise Insights, the worldwide blockchain gaming market will surpass $614 billion inside the subsequent seven years. The market is forecasted to develop with a CAGR of 21.8%, reaching substantial ranges by 2030. The prediction was primarily based on the truth that conventional sport builders are more and more adopting blockchain for play-to-earn fashions and digital property. In consequence, the gaming token market is anticipated to expertise accelerated development.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein ought to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of monetary loss. All the time conduct due diligence.

If you want to learn extra market analyses like this, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

“Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”