Apple’s WWDC occasion didn’t appear to excite traders very a lot, as they had been hoping for extra updates on the corporate’s AI efforts.

Earlier than we dive in, let’s be sure to’re set to obtain The Every day Breakdown every morning. To maintain getting our each day insights, all it’s worthwhile to do is log in to your eToro account.

Tuesday’s TLDR

Apple’s WWDC disappointment

ETH jumps greater

GME earnings in focus

What’s Occurring?

Apple’s WWDC occasion kicked off yesterday. I keep in mind 10 or 15 years in the past, this occasion was a giant deal. For one thing not tied to jobs, the Fed, or earnings, Apple’s iPhone occasion (often in September) and its WWDC occasion had been necessary.

There was some hype main as much as Apple’s kickoff this 12 months, notably with its plans for AI — Apple Intelligence. Whereas the corporate unveiled some cool software program gadgets, traders had been left wanting extra on the AI entrance. Per Bloomberg:

“Apple Inc. unveiled probably the most sweeping software program redesign in its historical past, aiming to make the corporate’s machine lineup extra cohesive and helpful, even whereas doing little to improve its struggling synthetic intelligence platform.”

And per Morning Brew: “AI, who? Apple kicked off the convention by admitting Apple Intelligence wasn’t fairly as much as its excessive “high quality bar” whereas saying a brand new basis mannequin for builders.”

The inventory solely fell 1% in response to the information, however with its lackluster efficiency thus far this 12 months — it’s the second-worst performing Magazine 7 inventory in 2025 and over the previous 12 months, and the one one beneath its 50-day or 200-day transferring common — and with Apple caught within the crossfire of US-China tariff talks, traders had been hoping for one thing a little bit extra thrilling.

Need to obtain these insights straight to your inbox?

Join right here

The Setup — ASML

ASML doesn’t appear to get a lot fanfare right here within the US, however speak to any tech analyst based mostly in Europe and ASML is a key speaking level. The corporate builds the machines which are used to make chips which are used for, amongst others issues, AI functions.

Nonetheless, export restrictions, tariffs, and escalating geopolitical issues have weighed on orders and investor sentiment. Currently although, the inventory has been clawing again from its latest decline, just lately climbing again above the 200-day transferring common.

Discover how ASML has regained its 200-day, nevertheless it’s additionally discovering assist alongside its rising 21-day transferring common — a shorter-term measure typically utilized by merchants in search of uptrends and downtrends.

Extra notably although, is the $775 to $780 space.

This zone has been resistance all 12 months, with ASML unable to interrupt by this zone. If the inventory can clear this space, it may set off extra upside. That’s notably true with how properly chip shares have been buying and selling recently, led by Nvidia, Broadcom, and Taiwan Semi.

Nonetheless, if resistance holds agency, promoting strain may ensue — particularly if the general market loses traction. On this state of affairs, let’s see if the $735 to $740 space acts as assist, which is the place the 21-day and 200-day transferring averages at present come into play. Beneath that and $720 shall be in focus, which marks the latest lows.

Choices

One draw back to ASML is its share worth. As a result of the inventory worth is so excessive, the choices costs are extremely excessive, too. This will make it troublesome for traders to strategy these firms with choices.

In that case, many merchants could choose to only commerce just a few shares of the widespread inventory — and that’s effective. Nonetheless, one different is spreads.

Name spreads and put spreads enable merchants to take choices trades with a a lot decrease premium than shopping for the calls outright. In these circumstances, the utmost threat is the premium paid.

Choices aren’t for everybody — particularly in these situations — however spreads make them extra accessible. For these trying to be taught extra about choices, contemplate visiting the eToro Academy.

What Wall Avenue Is Watching

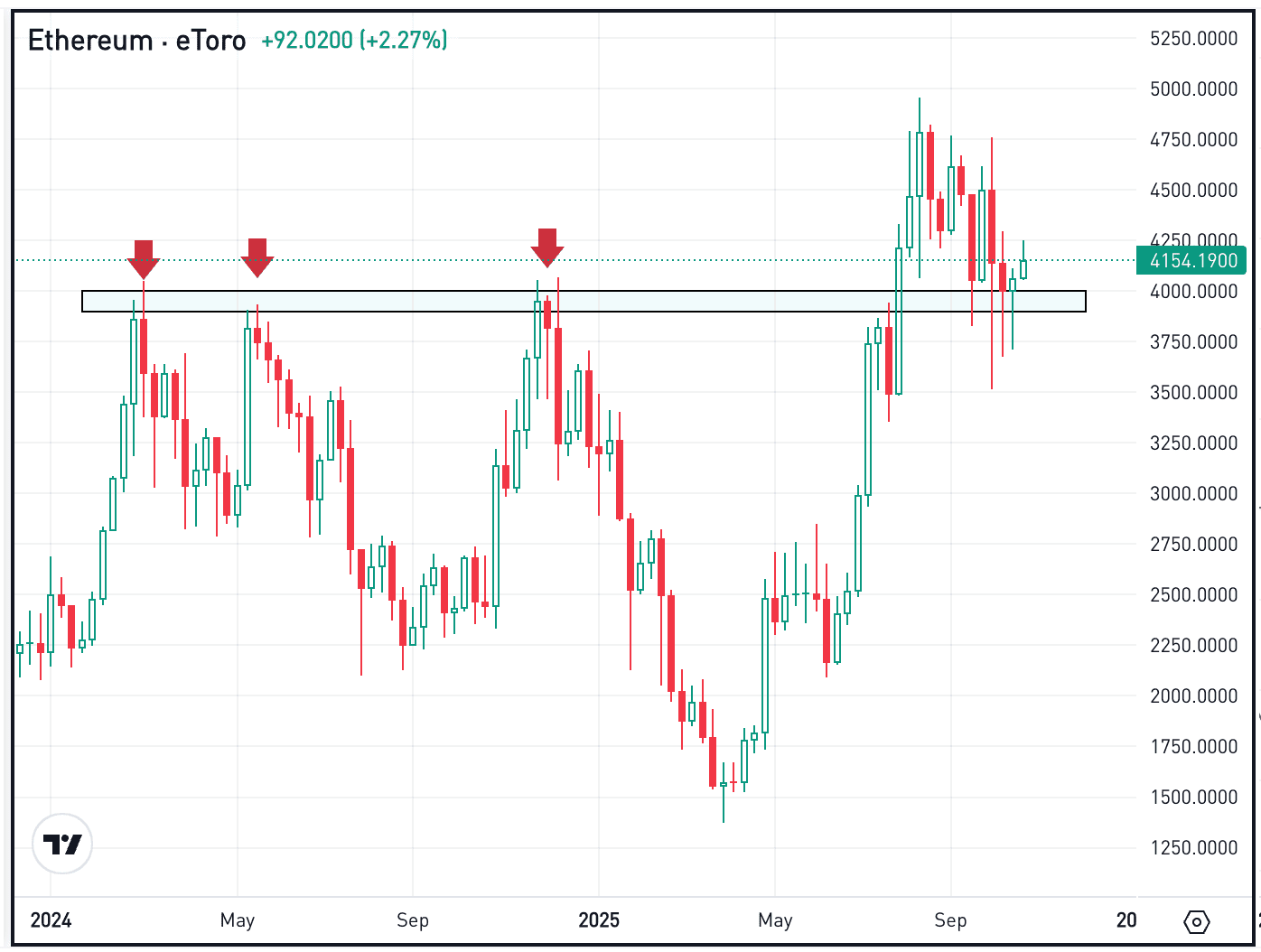

ETH

Yesterday we talked about Bitcoin gaining steam and now we’re seeing some follow-through in Ethereum immediately. Now hitting multi-month highs, bulls are questioning if ETH can garner extra momentum and push by the $3,000 stage. Take a look at ETH and the numerous crypto choices eToro just lately added to the platform on the crypto discovery web page.

SOFI

Shares of SoFi traded properly final week, rising greater than 7%. Now although, the inventory is bumping into resistance round $14.50. Bulls are hoping for a breakout, realizing its 2025 highs are above $18. Bears are hoping resistance holds, realizing the inventory was just lately beneath $10. What do you assume? Take a look at the chart for SoFi.

GME

GameStop shall be in focus this afternoon with the corporate set to report earnings. Shares erupted greater in late Might, climbing 25% in a three-day span as the corporate acquired over 4,700 Bitcoin. The inventory has since retreated a bit, however traders shall be watching this one carefully because it reviews.

Disclaimer:

Please observe that as a consequence of market volatility, among the costs could have already been reached and situations performed out.