Bitcoin’s current worth volatility has led many to surprise if large-scale bitcoin hodlers are benefiting from worth dips to build up extra bitcoin. Whereas some metrics might initially counsel a rise in long-term holdings, a more in-depth examination reveals a extra nuanced story, particularly after the present extended interval of uneven consolidation.

Are Lengthy-Time period Holders Accumulating?

Upon preliminary statement, long-term Bitcoin holders are seemingly growing their holdings. In accordance with the Lengthy Time period Holder Provide, since July thirtieth, the quantity of BTC held by long-term holders has elevated from 14.86 million to fifteen.36 million BTC. This surge of round 500,000 BTC has led some to consider that long-term holders are aggressively shopping for the dip, probably setting the stage for the subsequent vital worth rally.

Nevertheless, this interpretation may be deceptive. Lengthy-term holders are outlined as wallets which have held BTC for 155 days or extra. This week we’ve simply surpassed 155 days since our most up-to-date all-time excessive. Subsequently, it’s probably that many short-term holders from that interval have merely transitioned into the long-term class with none new accumulation occurring. These buyers are actually holding onto their BTC, hoping for increased costs. So in isolation, this chart doesn’t essentially point out new shopping for exercise from established market members.

Coin Days Destroyed: A Contradictory Indicator

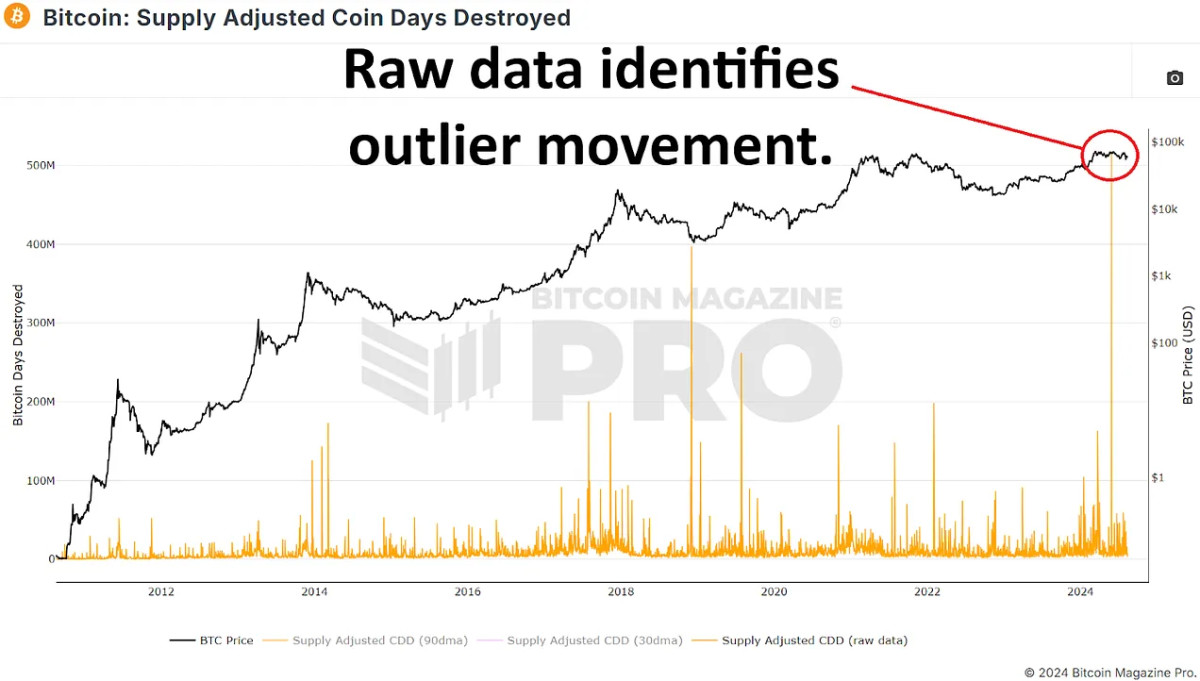

To additional discover the habits of long-term holders, we will look at the Provide Adjusted Coin Days Destroyed metric over the current 155-day interval. This metric measures the rate of coin motion, giving extra weight to cash which were held for prolonged durations. A spike on this metric may point out that long-term holders possessing a considerable quantity of bitcoin are shifting their cash, probably indicating extra promoting versus accumulating.

Not too long ago, we now have seen a major improve on this information, suggesting that long-term holders may be distributing fairly than accumulating BTC. Nevertheless, this spike is primarily skewed by a single large transaction of round 140,000 BTC from a identified Mt. Gox pockets on Might 28, 2024. Once we exclude this outlier, the information seems way more typical for this stage out there cycle, corresponding to durations in late 2016 and early 2017 or mid-2019 to early 2020.

The Conduct of Whale Wallets

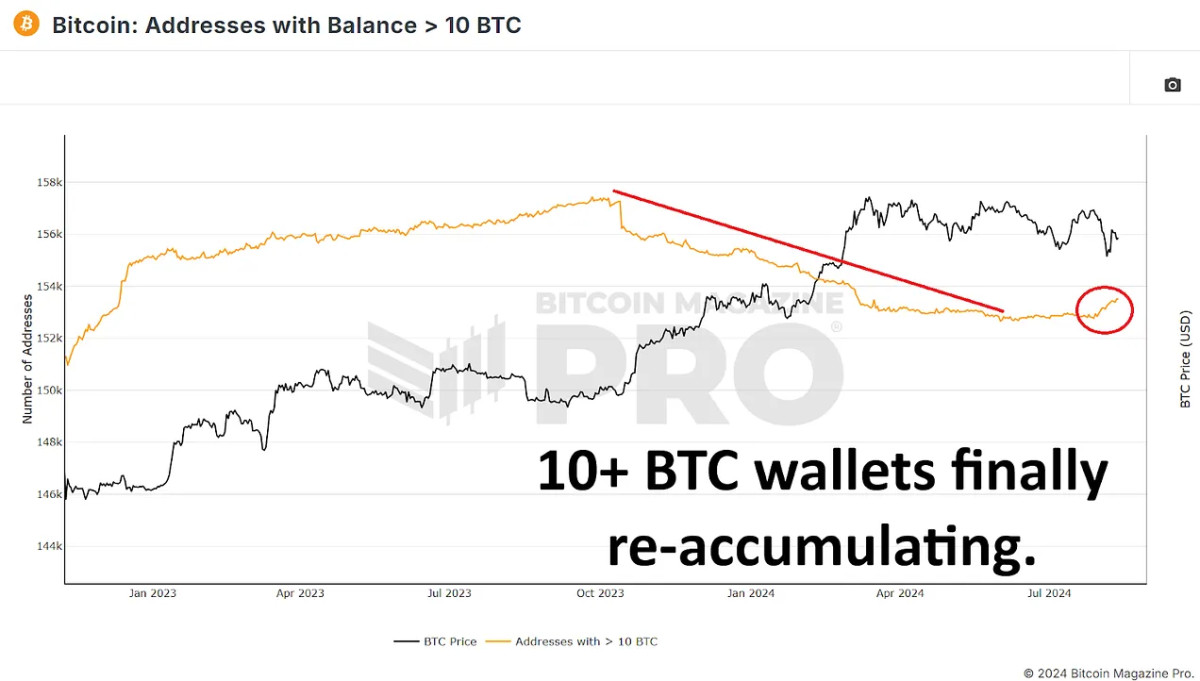

To find out whether or not whales are shopping for or promoting bitcoin, analyzing wallets holding substantial quantities of cash is essential. By analyzing wallets with no less than 10 BTC (minimal of ~$600,000 at present costs), we will gauge the actions of serious market members.

Since Bitcoin’s peak earlier this 12 months, the variety of wallets holding no less than 10 BTC has barely elevated. Equally, the variety of wallets holding 100 BTC or extra has additionally seen a modest rise. Contemplating the minimal threshold to be included in these charts, the quantity of bitcoin collected by wallets holding between 10 and 999 BTC may account for tens of 1000’s of cash purchased since our most up-to-date all-time excessive.

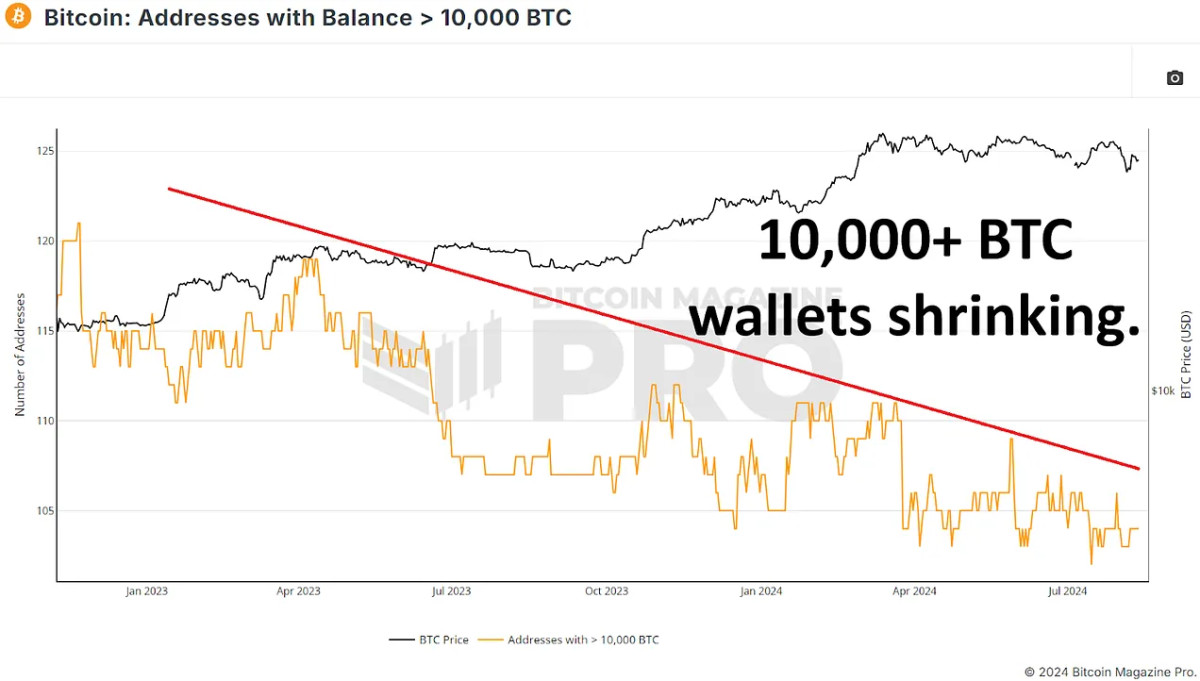

Nevertheless, the pattern reverses once we have a look at bigger wallets holding 1,000 BTC or extra. The variety of these massive wallets has decreased barely, indicating that some main holders may be distributing their BTC. Probably the most notable change is in wallets holding 10,000 BTC or extra, which have decreased from 109 to 104 up to now months. This implies that a number of the largest bitcoin holders are probably taking some revenue or redistributing their holdings throughout smaller wallets. Nevertheless, contemplating most of those extraordinarily massive wallets will sometimes be exchanges or different centralized wallets it’s extra probably these are a set of dealer and investor cash versus anyone particular person or group.

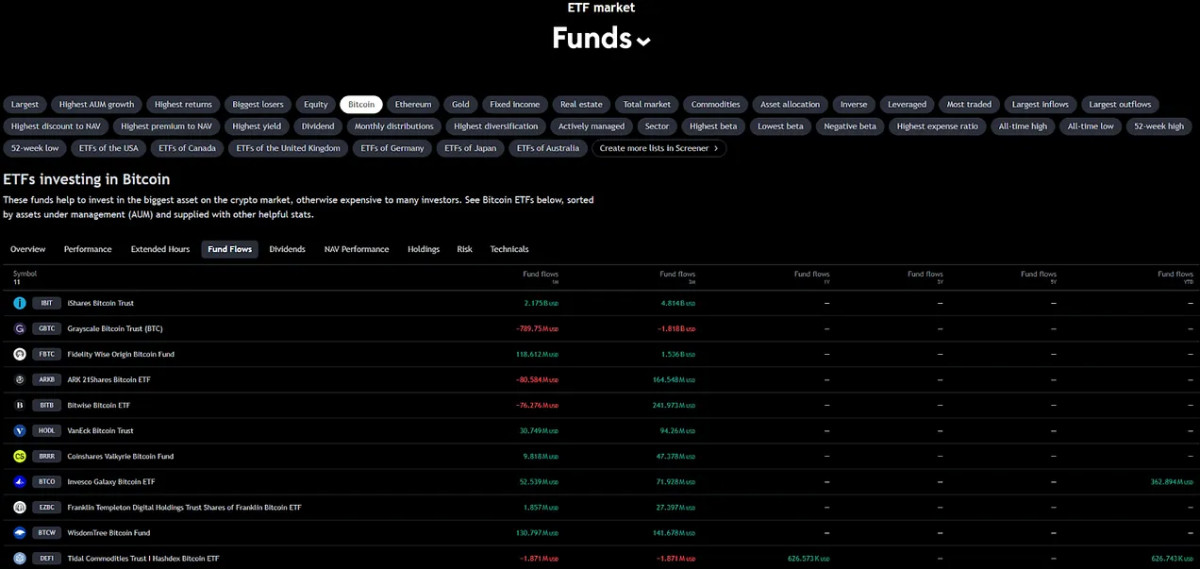

The Position of ETFs and Institutional Inflows

Since reaching a peak of $60.8 billion in belongings beneath administration (AUM) on March 14th, the BTC ETFs have seen an AUM lower of round $6 billion, nonetheless when taking into consideration the worth lower of bitcoin since our all-time excessive, this roughly equates to a rise of roughly 85,000 BTC. Whereas that is constructive, the rise has solely negated the quantity of newly mined Bitcoin throughout the identical interval, additionally 85,000 BTC. ETFs have helped scale back promoting stress from miners and probably from massive holders however have not considerably collected sufficient to affect the worth positively.

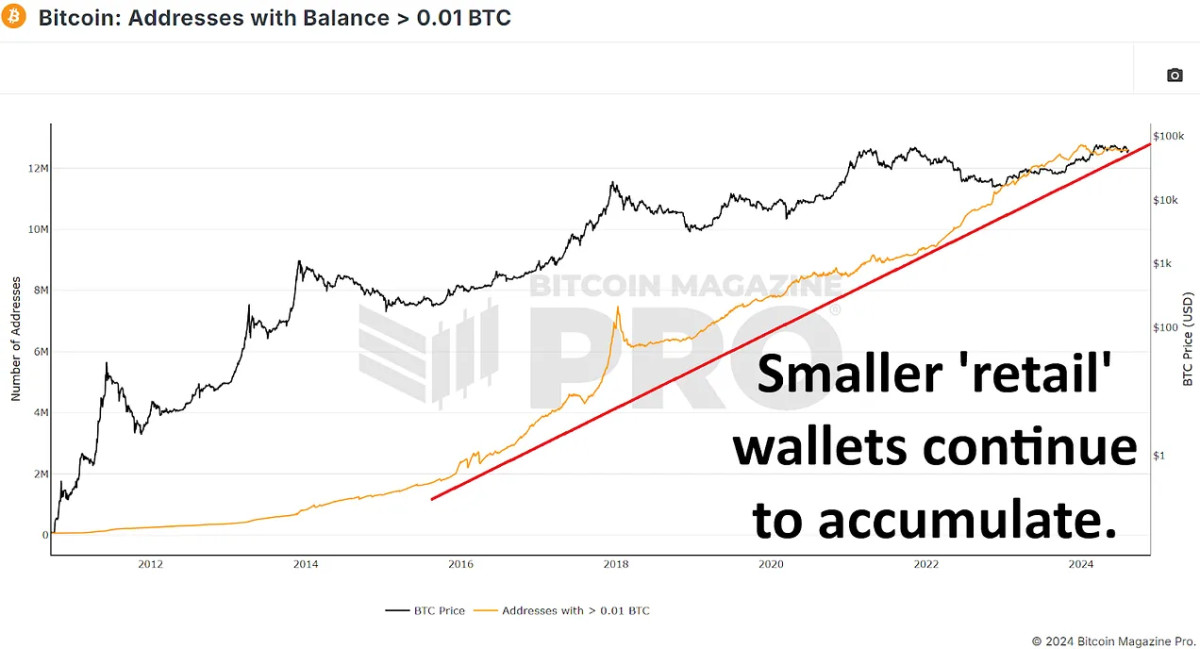

Retail Curiosity on the Rise

Apparently, whereas huge holders look like promoting BTC, there was a major improve in smaller wallets – these holding between 0.01 and 10 BTC. These smaller wallets have added tens of 1000’s of BTC, exhibiting elevated curiosity from retail buyers. There’s been a internet change of round 60,000 bitcoin from 10+ BTC wallets to smaller than 10 BTC. This may occasionally appear alarming, however contemplating we sometimes see tens of millions of bitcoin swap from massive and long-term holders to new market members all through a complete bull cycle, this isn’t at the moment any trigger for concern.

Conclusion

The narrative that whales have been accumulating bitcoin on dips and all through this era of chopsolidation doesn’t appear to be the case. Whereas long-term holder provide metrics initially seem bullish, they largely mirror the transition of short-term holders into the long-term class fairly than new accumulation.

The rise in retail holdings and the stabilizing affect of ETFs may present a powerful basis for future worth appreciation, particularly if we see renewed institutional curiosity and continued retail inflows publish halving, however is at the moment contributing little to any Bitcoin worth appreciation.

The true query is whether or not the present distribution part seizes and units the stage for a brand new spherical of accumulation, which may propel Bitcoin to new highs within the coming months, or if this circulate of previous cash to newer members continues and certain suppresses the potential upside for the rest of our bull cycle.

🎥 For a extra in-depth look into this subject, try our current YouTube video right here: Are Bitcoin Whales Nonetheless Shopping for?

And don’t overlook to take a look at our different most up-to-date YouTube video right here, discussing how we will probably enhance among the best bitcoin metrics: