Key Takeaways:

Arizona Senate revives HB2324, a invoice that will create a state-managed Bitcoin reserve fund.The fund would deal with digital belongings seized in prison investigations, with choices to carry or promote them.The invoice faces unsure prospects within the Home and potential veto by Governor Katie Hobbs, who has rejected comparable laws.

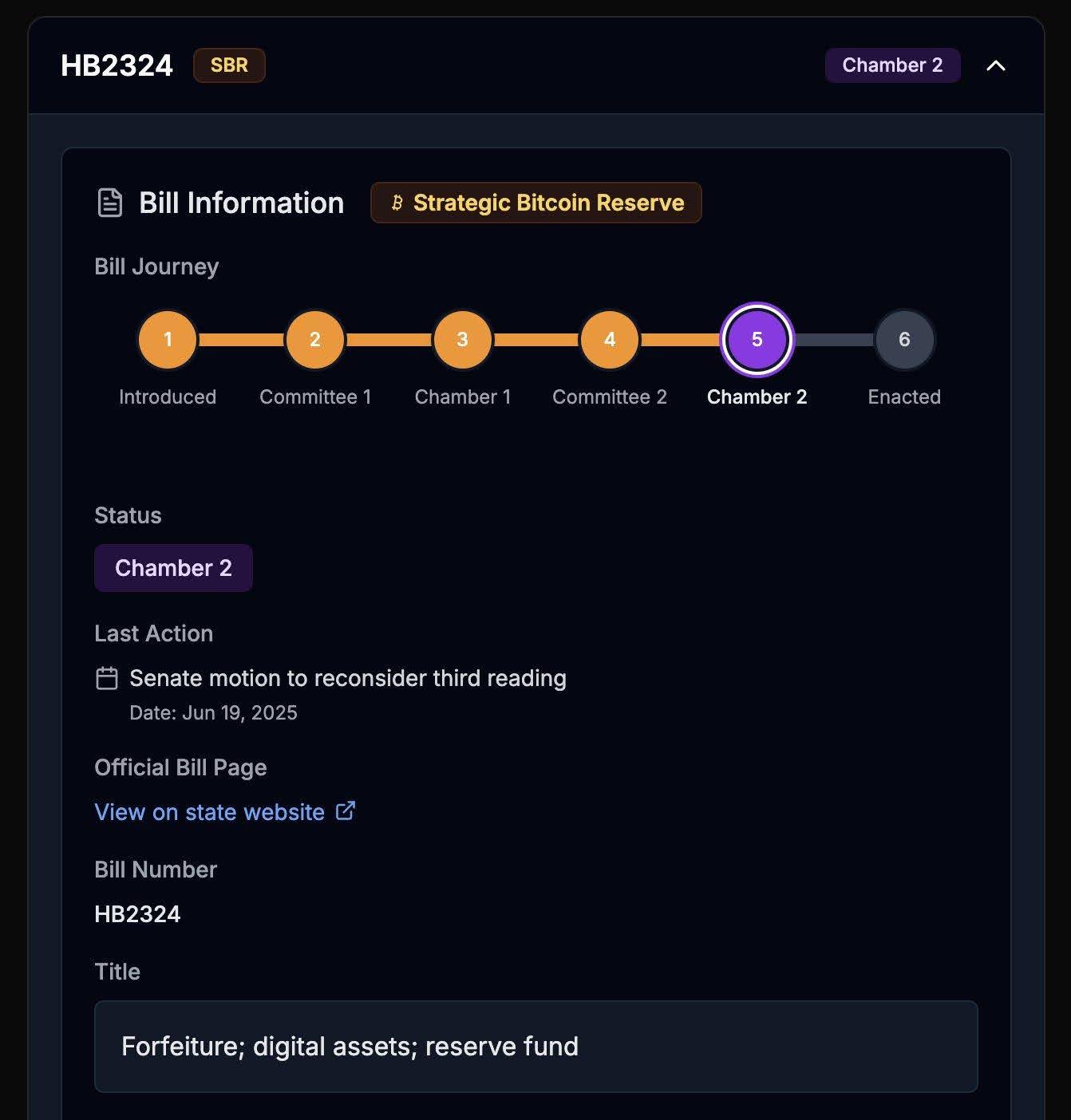

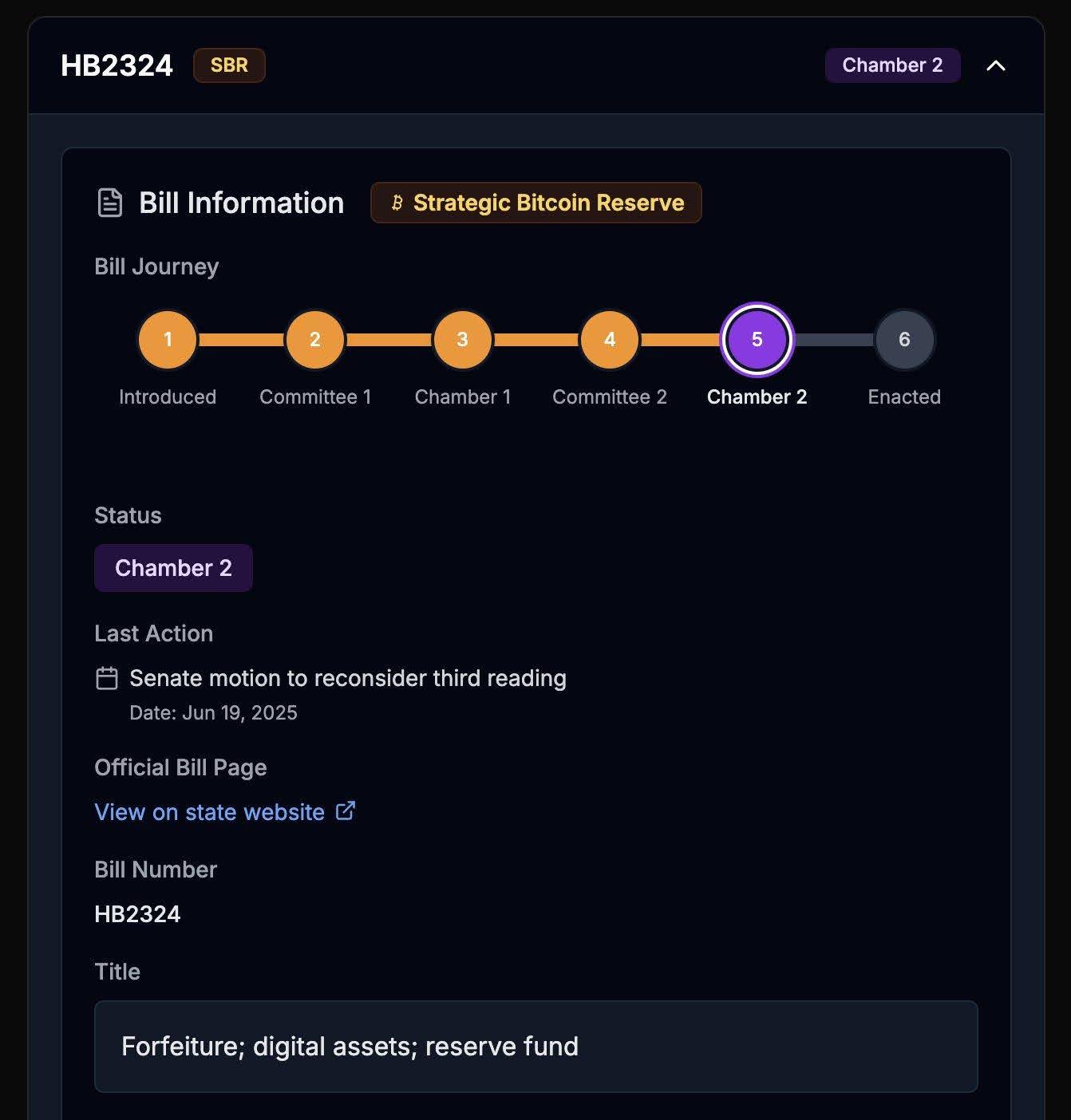

Arizona is as soon as once more on the middle of U.S. crypto laws as its Senate voted to rethink and revive Home Invoice 2324—an bold proposal that will set up a Bitcoin and Digital Belongings Reserve Fund. The invoice, which failed in a Home vote final month, has returned to the legislative highlight after a slim 16-14 Senate vote introduced it again to life.

Learn Extra: Arizona Strikes Nearer to Crypto Milestone with Bitcoin Reserve Payments Accepted by Home

Inside HB2324 — Arizona’s Daring Crypto Play

HB2324 goals to modernize Arizona’s dealing with of seized digital belongings by making a fund managed by the state treasury. This “Bitcoin and Digital Belongings Reserve Fund” would obtain, maintain, and probably get rid of cryptocurrencies confiscated by means of prison forfeiture.

The invoice units three central approaches for taking good care of these assets:

Retain them as they’re in state-approved wallets.Promote them on registered crypto exchanges.Retailer them beneath custody necessities comparable to blockchain-based entry and third-party administration.

If enacted, the laws would direct the primary $300,000 of any digital asset liquidation to the Arizona Legal professional Basic’s Workplace. Any extra funds can be divided:

50% to the Legal professional Basic25% to the state’s normal fund25% to the Bitcoin and Digital Belongings Reserve Fund

That construction is an try to bolster legislation enforcement in addition to to shore up public funds and maintain crypto long-term — and do it with out utilizing taxpayer cash.

A Partisan Push with Nationwide Implications

HB2324 has turn out to be the epicenter of Arizona’s more and more political dispute over methods to regulate crypto. Although it accepted the invoice by a razor-thin margin, the vote was nearly completely alongside celebration traces. Notably, one Republican senator, Jake Hoffman, dissented, suggesting not all conservatives stand collectively on the invoice’s risks and potential advantages.

The invoice’s sponsor, Republican Jeff Weninger, has positioned it as a sensible transfer given the rising quantity of prison circumstances tied to crypto belongings and a step ahead by way of monetary independence and modernization. However opponents say the state’s transfer to retain belongings vulnerable to wild swings in worth might pose undue monetary danger to New Jersey, notably with out clear route from the federal authorities.

Arizona’s not the one state going for it with crypto legal guidelines. Texas, Wyoming, and Florida have every proposed or enacted laws affecting custody, mining, or blockchain infrastructure. The nationwide dialog, particularly in opposition to the backdrop of a Trump-branded Republican revival, has emboldened states to strive monetary experiments on the state stage.

Governor Hobbs’ Crypto File Casts Doubt

Regardless of the Senate’s vote to revive HB2324, the invoice nonetheless faces a steep climb within the Home and even steeper odds on the Governor’s desk. Arizona Governor Katie Hobbs has constantly vetoed comparable crypto-related payments, citing issues over market volatility and fiduciary duty.

In Might 2024, Hobbs vetoed:

SB 1025, a invoice that known as for as much as 10% of state pension and treasurer funds to be invested in Bitcoin.SB 1373, which might have established a broader “Digital Belongings Strategic Reserve Fund” with seized belongings or legislative appropriations.

In each his vetoes, Hobbs identified that “untested and risky” belongings, like cryptocurrency, had been too dangerous for public funds and retirement methods.

But, Hobbs has already signed extra modest crypto payments together with:

HB 2749, which permits the state to retain unclaimed crypto with out liquidating it.HB 2387, which imposes shopper safety guidelines on crypto ATMs in Arizona.

These aren’t the actions of somebody who’s anti-crypto, however in opposition to reckless use of taxpayer funds within the sector.

Learn Extra: Landmark Invoice Defending Bitcoin Mining Rights Passes in Arizona

Crypto within the State Treasury: An Worldwide Development on the Rise

The sample of HB2324 in Arizona is in step with a rising worldwide development. Nations together with Ukraine, El Salvador and Pakistan have made strikes to combine digital belongings into the nationwide cohort of reserves or public infrastructure.

Probably the most excessive case to date is El Salvador, which made Bitcoin authorized tender and owns BTC on its steadiness sheet.State in wartime Ukraine accepts cryptocurrency donations, state-controlled crypto reserve mannequin thought of by authorities.Within the U.S., Wyoming has handed a legislation permitting the state to ascertain a crypto custody framework for stablecoins and different digital belongings.

Supporters of Arizona’s invoice argue that having the choice to retain digital belongings—as an alternative of changing them into fiat—permits for long-term worth appreciation and hedging in opposition to inflation. Critics, nonetheless, preserve that state governments shouldn’t act as speculative traders, notably with no federal regulatory framework.

What Occurs Subsequent?

For HB2324 to maneuver ahead:

It should obtain no less than 31 votes within the 60-member Arizona Home.If handed, it will likely be despatched to Governor Hobbs for closing approval.

Given the Governor’s previous crypto vetoes and her cautious stance, the invoice’s future stays extremely unsure. Nonetheless, its revival signifies rising political will in Arizona to outline a crypto coverage path—one that might affect different U.S. states watching intently.

If HB2324 passes and is signed into legislation, Arizona would turn out to be one of many first U.S. states to create a proper digital asset reserve fund utilizing seized cryptocurrencies—probably making a new authorized and monetary precedent in American crypto governance.