Fast Take

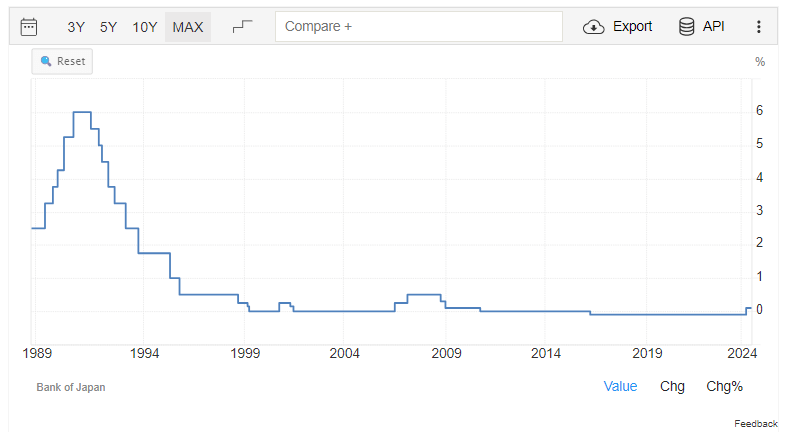

As reported by Buying and selling Economics, the Financial institution of Japan (BoJ) has raised its rate of interest to 0.25%, up from 0.1% in March. That is the very best price since 2008. From 2016 till early 2024, the BoJ maintained unfavorable rates of interest at -0.1%.

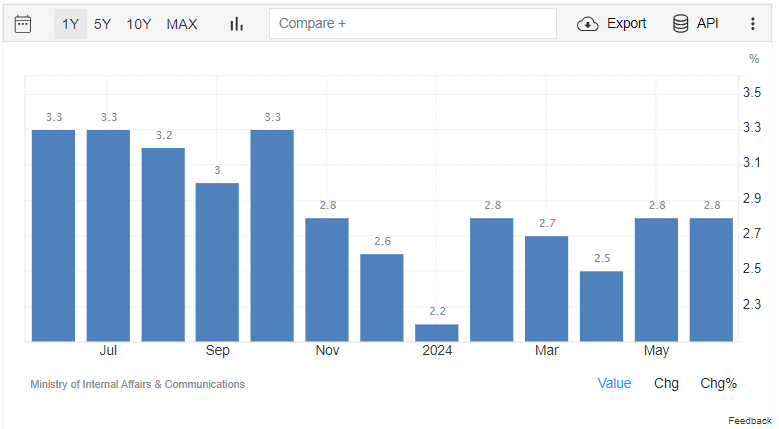

In accordance with Buying and selling Economics, the BoJ has indicated a plan to scale back its month-to-month bond purchases, aiming to shrink its substantial steadiness sheet, at present round $5 trillion. This transfer aligns with the central financial institution’s efforts to tighten financial coverage amidst inflation larger than the two% goal.

Traditionally, the BoJ’s rate of interest hikes have preceded or coincided with official recessions since 1990, with notable will increase in March 2007, September 2000, and September 1990, adopted by recessions in March 2001, December 2007, and July 1990, respectively. The newest hike on July 31, 2024, might echo this sample, elevating considerations about potential financial slowdowns.

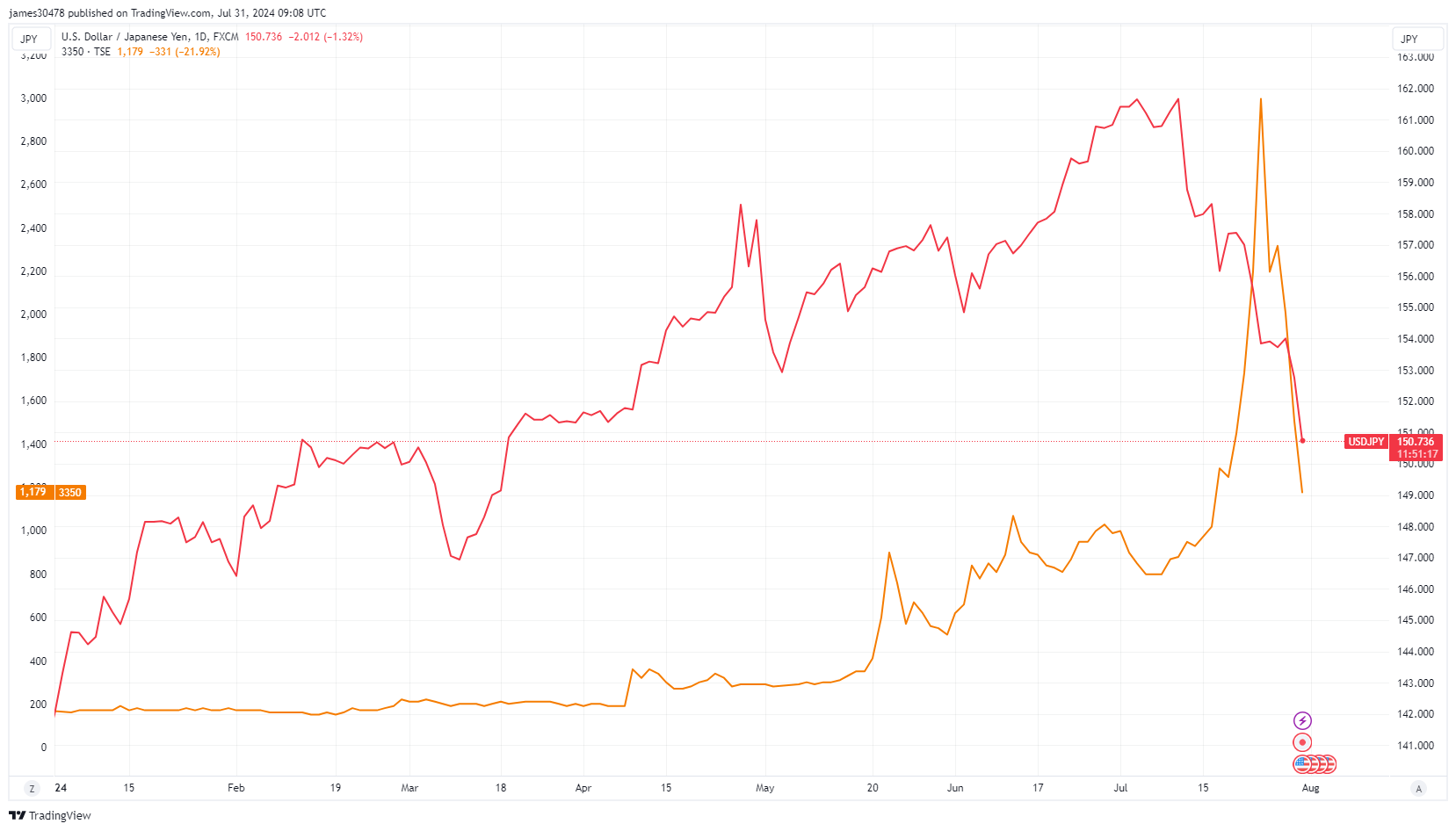

The USD/JPY trade price has additionally skilled important fluctuations, at present at 150, down from 162 in the beginning of the month. Moreover, Metaplanet has seen its inventory plummet by 22% on July 31, now buying and selling at 1,179 JPY, lower than half its peak worth of three,000 JPY.

The submit Financial institution of Japan’s price hike hits highest since 2008, Metaplanet shares drop 22% appeared first on CryptoSlate.