In a current submitting on December 27, bankrupt cryptocurrency change FTX unveiled its reimbursement plan, triggering buyer outrage and discontent. The plan, which values prospects’ digital belongings on the time of FTX’s collapse, provides a worth considerably decrease than prevailing market costs.

FTX Beneath Hearth

The submitting by FTX said that the reimbursement plan goals to make substantial progress in the direction of confirming a Chapter 11 plan and returning the worth of the belongings to prospects and different collectors.

Nonetheless, the distinctive nature of those Chapter 11 circumstances, involving claims based mostly on digital belongings, has posed challenges in figuring out truthful and affordable values for these unliquidated claims.

Based on the submitting, to estimate the worth of the digital belongings owed to prospects, FTX compiled a knowledge set that included coin and token costs from Coin Metrics, a extensively used supply of price-related data within the cryptocurrency trade.

As well as, the submitting states that changes had been made to account for components similar to orderly liquidation of belongings, non-marketable belongings, and equity-like belongings.

Nonetheless, as mirrored within the Digital Property Conversion Desk, the proposed valuation has left prospects dissatisfied, notably as a result of vital discrepancy between the proposed values and present market costs.

For instance, Bitcoin (BTC) is valued at $16,871.63, roughly 61% decrease than its present value of $42,800. Comparable discrepancies exist for different belongings similar to Ethereum (ETH), Solana (SOL), and Lido (LDO), which FTX values at $1,258, $16.247, and $1,176, respectively.

FTX Prospects Rally Towards Compensation Plan

The information of the reimbursement plan has brought on discomfort amongst prospects who stand to lose substantial worth on their holdings.

Many purchasers have voiced their considerations and frustrations, stating that the proposed valuation would considerably drawback them. Some prospects have sought steering on easy methods to file objections or reject the FTX reimbursement plan.

FTX has set a deadline of January 11 for purchasers to object to the reimbursement plan. If prospects disagree with the proposed valuation, they’re inspired to take the mandatory steps to voice their considerations throughout the specified timeframe.

Because the chapter case of FTX progresses, prospects and trade observers await additional developments and potential resolutions to handle the considerations raised by prospects relating to the reimbursement plan and the valuation of their digital belongings.

It stays unsure what additional actions prospects will take to safe the anticipated reimbursement for his or her belongings held on the now-defunct change. The response from the corporate to those claims and their plans for the subsequent steps of reimbursement are but to be seen.

At the moment, the native token of the change, FTT, is buying and selling at $3.1047. Over the previous 30 days, it has skilled a major decline of greater than 26%, with an extra lower of 8.6% within the final 24 hours.

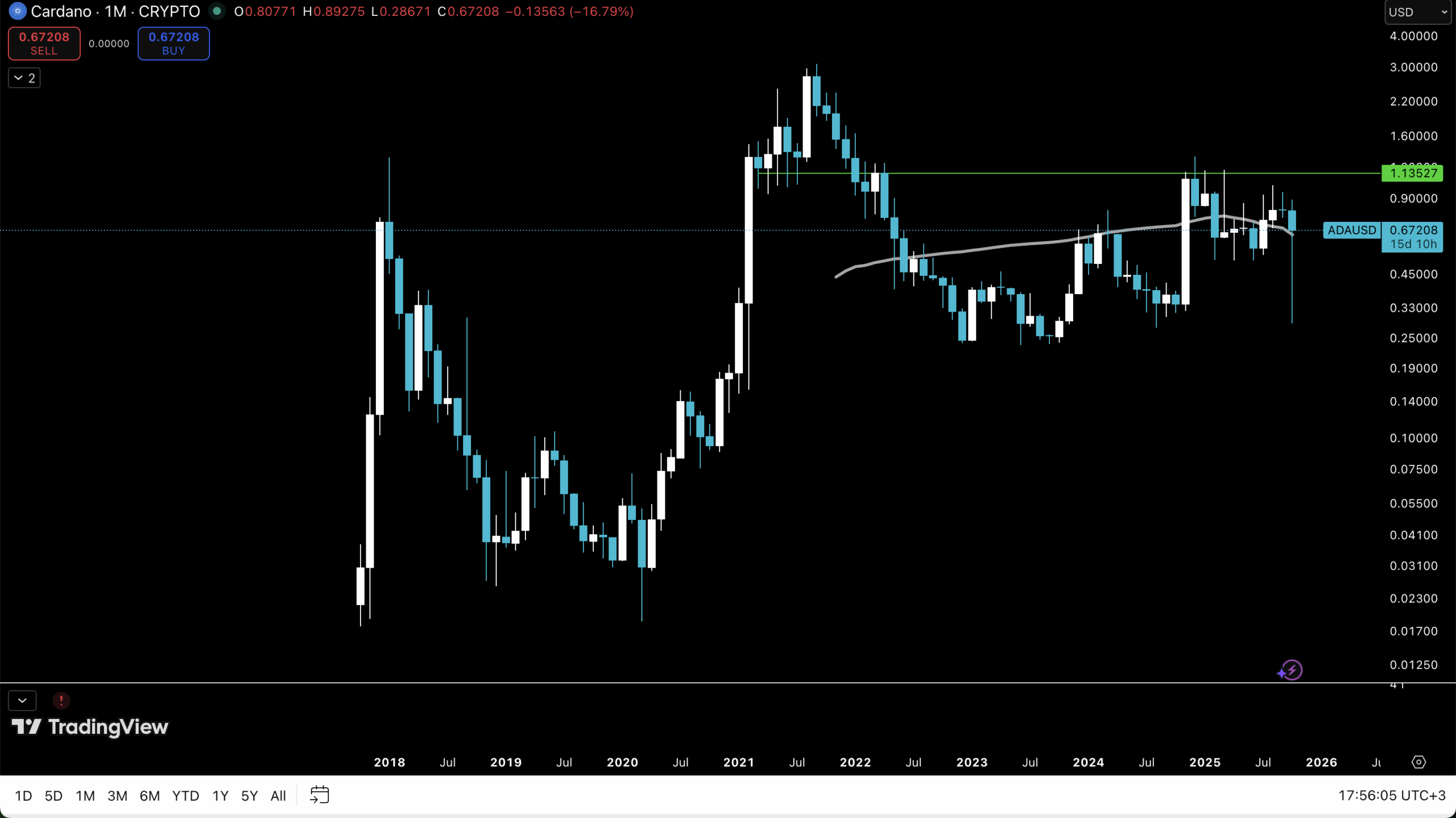

Featured picture from Shutterstock, chart from TradingView.com