Selecting the very best crypto indicators can considerably enhance your buying and selling success by revealing hidden market traits, essential help and resistance zones, and attainable shifts in momentum. Whether or not you’re a newbie testing your first technique or a seasoned dealer refining superior strategies, understanding the basics of technical evaluation is an important step. In contrast to elementary evaluation, which digs right into a crypto’s underlying undertaking or tokenomics, technical evaluation focuses on historic value knowledge, buying and selling quantity, and chart patterns.

This method is particularly helpful within the crypto market, identified for dramatic value fluctuations and unprecedented volatility. The next information showcases a number of high-impact indicators—each easy and sophisticated—and gives a basis on the way to combine them right into a worthwhile, adaptable buying and selling technique. By monitoring indicators tailor-made to cost actions you may create extra knowledgeable buying and selling choices concerning the very best instances to enter or exit a place. Let’s get into it.

What’s Technical Evaluation?

Technical evaluation focuses on assessing particular historic knowledge, like buying and selling quantity or value actions, to raised predict upcoming value actions. By deciphering recurring patterns in candlestick charts, development traces, and numerous oscillators, merchants achieve a clearer view of market momentum or potential reversals.

In contrast to elementary evaluation, which examines a crypto undertaking’s core know-how or partnerships, technical evaluation primarily hones in on chart patterns and statistical metrics. Merchants will incessantly mix a number of indicators to refine their methods, mitigate false indicators, and adapt to market volatility.

For example, a shifting common may spotlight a development’s path, whereas an oscillator just like the relative power index (RSI) will help spotlight overbought or oversold circumstances. However when mixed, these instruments are able to reducing by way of the market noise so you may make extra goal, well timed choices. That mentioned, no chart or formulation can utterly eradicate threat, and each single commerce will nonetheless require considerate threat administration and private self-discipline.

Forms of Indicators for Crypto Buying and selling

Now we’re going to check out a variety of technical indicators and chart ideas essential for recognizing value actions, gauging market momentum, and planning a well-rounded buying and selling technique. Every software helps you interpret historic value knowledge otherwise, so combining a number of indicators can cut back false indicators and refine entries or exits.

1. Line Charts

A line chart shows a crypto’s closing value over time, forming a steady line that helps visualize the general development. As a result of it solely tracks one knowledge level (usually the shut value), it gives a transparent, uncluttered view of market path. Merchants typically begin with line charts to determine broad traits earlier than diving deeper.

Supply: CoinMarketCap

2. Bar Charts

:max_bytes(150000):strip_icc():format(webp)/BTCBarChart-47451c53e9e746958f52c9dac2e4d07a.jpg)

Supply: TradingView

Bar charts broaden on line charts by exhibiting every interval’s open, excessive, low, and shut (OHLC). Every bar represents a time interval, displaying intraday fluctuations extra exactly. The left tick marks the open value, whereas the best tick exhibits the shut. By seeing highs and lows, you may gauge shopping for and promoting stress extra precisely.

3. Candlestick Charts

Candlestick charts present a visible snapshot of open, excessive, low, and shutting costs, however with color-coded “candles” reflecting bullish or bearish motion. Inexperienced or white candles point out the next shut vs. open, whereas purple or black present a drop. Candlesticks highlight patterns that may reveal potential development reversals or market sentiment shifts.

Supply: CoinMarketCap

4. Help ranges

Help ranges are value factors the place downward traits typically pause or bounce upward. They kind when shopping for curiosity overpowers promoting stress at particular value zones. Merchants watch help for potential low-risk entry factors, inserting stop-loss orders slightly below in case the asset breaks decrease. Failing to carry help could recommend an additional decline.

:max_bytes(150000):strip_icc():format(webp)/BTCSupportandResistance-a7002ab381634b48b1848e1ece7a9993.jpg)

Supply: TradingView

5. Resistance ranges

Resistance is the alternative of help. Often costs will stall or reverse downward after they attain a significant resistance line. Sellers are likely to dominate at these ranges, hindering the asset from shifting larger. As soon as the worth breaches robust resistance and holds above it, that zone can turn out to be a brand new help space, indicating potential bullish momentum.

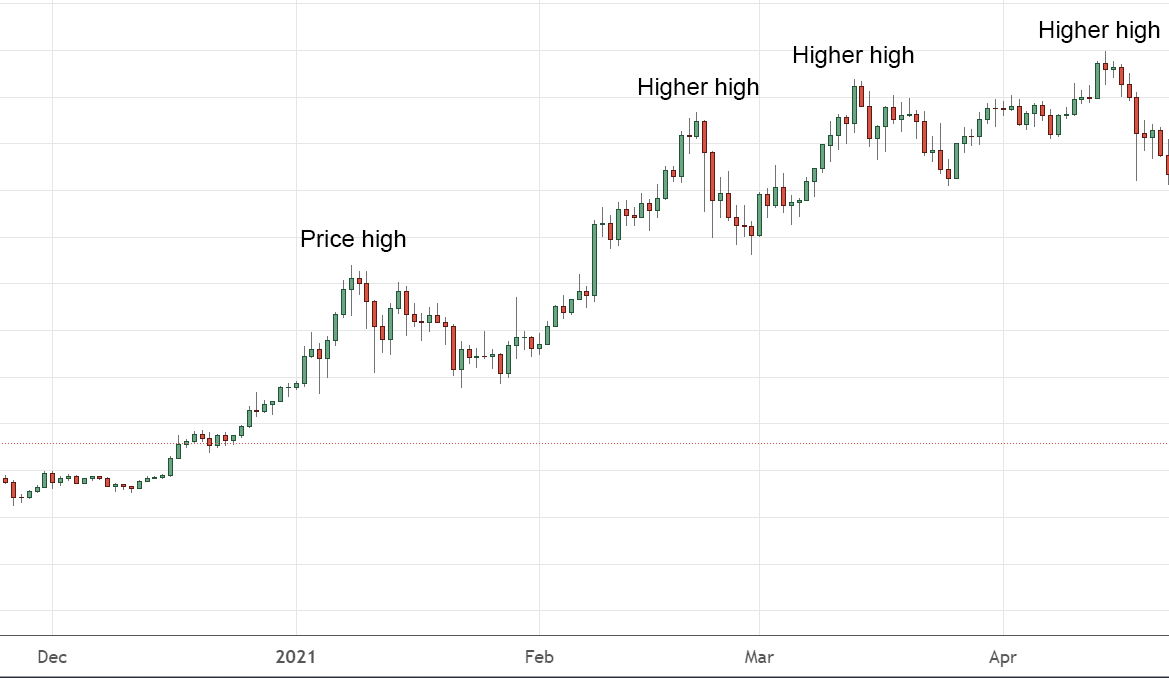

6. Upward Developments

Supply: Swyftx Be taught

An upward development is characterised by larger highs and better lows, indicating robust shopping for exercise. Merchants could comply with this development till it visibly breaks help or types a reversal sample. In a sustained bullish market, you should utilize further indicators, like shifting averages, to validate momentum and try to journey the development profitably.

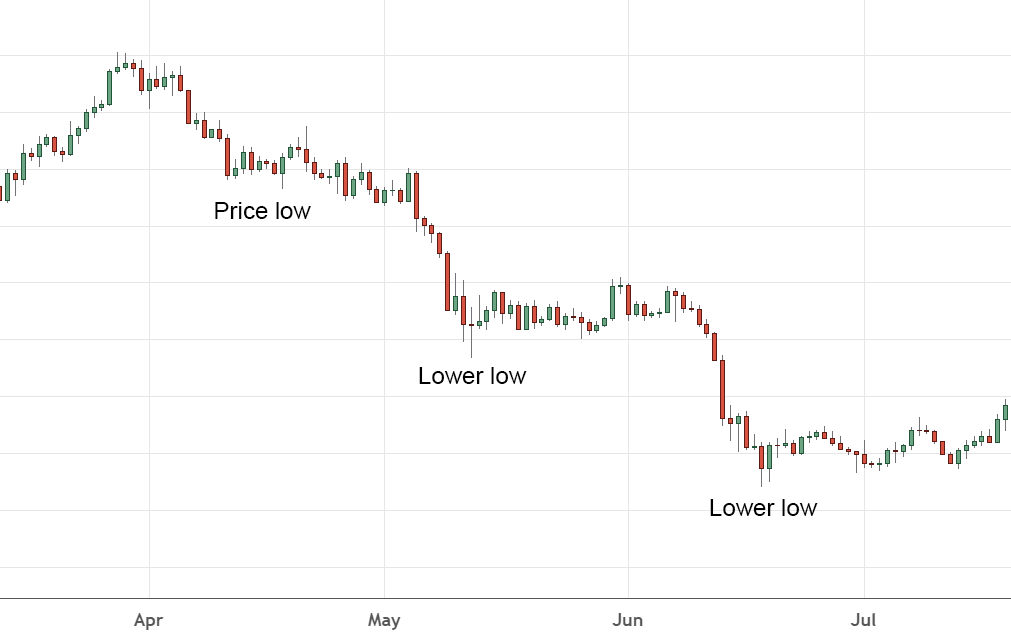

7. Downward Developments

Supply: Swyftx Be taught

A downward development exhibits decrease highs and decrease lows, signifying constant promoting stress. As costs regularly fall, look ahead to breakouts above key resistance ranges to substantiate a possible reversal. Many merchants short-sell or keep away from shopping for in a downtrend, ready for a major break of the descending line or a confirmed backside formation.

8. Consolidation Developments

Supply: Cryptohopper

Consolidation, or sideways motion, occurs when the market has low volatility and the worth strikes inside a decent vary. This section typically precedes extra dramatic strikes, with the breakout path setting the stage for future value motion. Throughout consolidation, some merchants reduce, whereas others anticipate entry factors close to key help/resistance.

9. Shifting Common Convergence Divergence (MACD)

Supply: TradingView

MACD makes use of two exponential shifting averages, the sign line and the MACD line, together with a histogram that exhibits the hole between them. When the MACD crosses above the sign line, it indicators potential bullish momentum; a drop under may suggest a bearish flip. MACD helps determine adjustments in development power and path.

10. Shifting Averages (MAs)

Shifting averages clean out value knowledge, revealing the underlying development. Easy shifting averages (SMAs) weigh all knowledge equally, whereas exponential shifting averages (EMAs) give current costs extra emphasis. MA crossovers, like a shorter MA crossing above an extended one, will typically precede adjustments in market momentum and generally is a highly effective market momentum indicator.

11. Common Directional Index

Supply: TradingView

The typical directional index (ADX), measures the depth of a development from 1 to 100. Values under 20 sign a weak or sideways market, whereas readings over 40 typically imply a strong development, both bullish or bearish. Merchants generally pair ADX with different indicators to substantiate that the market is actually trending, not whipsawing.

12. Relative Energy Index (RSI)

Supply: TradingView

The RSI ranges between 0 and 100, highlighting overbought and oversold circumstances. A studying above 70 could point out overbought territory, which suggests a dip may very well be on the best way, whereas an RSI below 30 suggests oversold ranges, hinting at a attainable bounce. This momentum oscillator will help merchants resolve when to enter or exit positions to keep away from chasing extremes.

13. Bollinger Bands

Supply: TradingView

Bollinger Bands envelop a shifting common with two normal deviation traces above and under it. When the bands widen, market volatility is excessive; after they contract, volatility drops. Costs that break above or under the bands often sign overextended circumstances or rising traits, aiding in recognizing potential reversal zones.

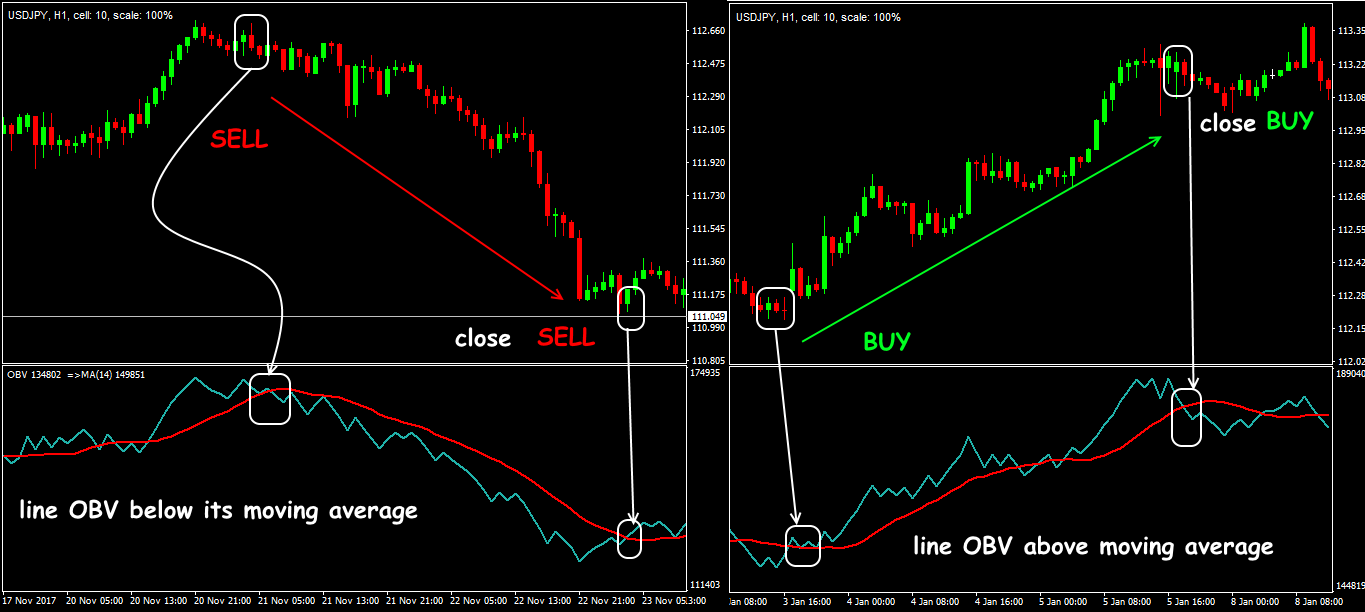

14. On-Stability-Quantity (OBV)

OBV connects buying and selling quantity with value path to evaluate whether or not shopping for or promoting stress dominates. If the worth types larger highs whereas OBV strikes decrease, it would point out weakening momentum, which generally is a big purple flag for some merchants. However, surging OBV can affirm an ongoing rally, signaling that quantity backs the present development.

15. Superior Oscillator

Supply: TradingView

Developed by Invoice Williams, the Superior Oscillator contrasts short-term and long-term value momentum. Plotted as a histogram round a zero line, optimistic bars suggest bullish momentum, whereas damaging ones recommend promoting power. Merchants look ahead to the “twin peaks” or “zero line crossover” indicators to anticipate attainable development reversals or continuations.

16. Fibonacci Pivot Factors

Supply: TradingView

These pivot factors apply Fibonacci retracement ranges to typical pivot-level calculations, offering potential help and resistance ranges. Some merchants desire them to straightforward pivots, believing Fibonacci ratios can map out extra exact reversal zones. In crypto, the place market sentiment can shift abruptly, these ranges function goal reference factors for entries/exits.

17. Parabolic SAR

Supply: TradingView

Quick for “cease and reverse,” Parabolic SAR spots a trailing indicator that hovers under bullish value motion and above bearish motion. When the indicator flips place, it could sign a possible development reversal. Merchants typically mix Parabolic SAR with different momentum-based instruments to differentiate real indicators from routine pullbacks or rallies.

The place to Discover Crypto Charts?

TradingView

TradingView stands out as a complete charting resolution, providing an unlimited vary of technical indicators from primary shifting averages to custom-coded oscillators constructed by its thriving neighborhood. It’s generally utilized by crypto merchants, however the identical interface applies seamlessly to shares, commodities, or foreign exchange.

Supply: TradingView

The extremely interactive nature of the platform fosters collective studying and enchancment by letting you share the charts, scripts, and techniques of others. For these coping with a number of crypto pairs, TradingView’s multi-chart setup can save time and enhance analysis depth, enabling you to trace international market traits in a single streamlined dashboard.

CoinMarketCap

Whereas not as subtle as TradingView, CoinMarketCap stays a go-to website for fast knowledge on market capitalization, value fluctuations, buying and selling quantity, and general market rating. Its charting perform is primary but adequate for top-level evaluation, letting you see multi-day or multi-month traits at a look. Customers can simply examine totally different tokens, handle a watchlist, and discover related hyperlinks.

Supply: CoinMarketCap

Although superior merchants could look elsewhere for deeper chart overlays, CoinMarketCap’s streamlined interface fits those that want instant reference factors or need to test broader crypto efficiency.

Methods to commerce crypto with a technical indicator

Buying and selling with indicators entails greater than merely recognizing a crossover or an overbought studying. It is best to mix at the very least one development indicator with a momentum or volume-based software to validate indicators.

For example, in case your MACD line crosses above its sign line in a market that’s making larger highs, this mixture gives added confidence in a bullish transfer. All the time consider your threat tolerance when sizing positions, and be prepared for false indicators in a extremely risky setting.

Setting protecting stop-loss orders is one other very important step. You may place a cease slightly below a confirmed help stage in case value motion reverses.

Monitoring elementary developments and market sentiment helps you keep away from solely counting on charts. A sudden regulatory announcement or shock itemizing can shortly nullify an indicator-based entry.

Regulate your methods in keeping with the crypto’s liquidity, as smaller tokens could also be susceptible to whipsaw value shifts. Lastly, evaluation every commerce after it closes. Maintain notes on why you entered and the way the indicator carried out.

Over time, you may refine your method to adapt to altering market circumstances and keep away from repeating errors.

Conclusion

Every of those indicators can provide worthwhile insights into ongoing value motion, however no single software ensures constant beneficial properties. The crypto market stays a fast-moving area with important swings. Combining a number of indicators and verifying them with elementary observations typically yields extra balanced choices.

You also needs to keep updated on macro developments and be conscious of your individual buying and selling psychology. By approaching crypto with the correct mix of technical analysis, technique, and self-discipline, you may higher put together your self for each alternatives and potential pitfalls.

FAQs

What’s the greatest indicator for cryptocurrency?

No single indicator excels for all eventualities. Many merchants favor mixtures like shifting averages for recognizing traits and RSI for momentum. This layered method typically lowers the possibility of deceptive indicators.

What’s the most correct crypto predictor?

Accuracy relies on market circumstances, volatility, and dealer talent. Some depend on MACD or Bollinger Bands for dynamic suggestions. Others combine a number of indicators with broader analysis to extend reliability.

Do crypto indicators work?

Indicators will help make structured choices, however they don’t seem to be foolproof. Market sentiment and exterior elements can override technical patterns. Combining a number of instruments and adjusting for brand spanking new occasions is mostly the very best method.