One of the best crypto prop corporations in 2025 are FundedNext, FTMO, BrightFunded, HydroTrader, Funded Buying and selling Plus, The Buying and selling Pit, DNA Funded, and Apex Dealer Funding. Mainly, these firms fund you with their capital to commerce cryptocurrencies after you show your self in a buying and selling problem, after which, in change, you retain a revenue break up (typically 80-90% of your earnings) whereas they cowl losses.

On this information, you’ll discover a fast overview of the highest 8 finest crypto prop corporations, how crypto prop buying and selling works, the professionals and cons, and tips about selecting and becoming a member of the best program for you.

1. FundedNext

FundedNext is a well-liked prop agency that expanded from foreign exchange into crypto buying and selling. It’s usually identified for versatile funding fashions and a excessive revenue break up. Nicely, their greatest promoting level is that they offer you a 95% revenue break up and a 15% break up simply from the problem section on most of their plans.

FundedNext offers you entry to a number of the main buying and selling platforms (MT4, MT5, cTrader, and many others.), and the agency is fairly world, so it doesn’t matter whether or not you’re buying and selling from New York or New Delhi.

Key Options of FundedNext

Revenue Cut up: As much as 95% (performance-based)Buying and selling Platforms: MT4, MT5, cTrader, Match-DealerProblem Kind: Two-phase analysis or immediate funding programAccount Sizes: As much as $200,000 (scaling attainable to ~$4 million)Accessible Cryptos: Main pairs (BTC, ETH, and many others. through CFD)Leverage: As much as 1:100 on foreign exchange (crypto trades at decrease leverage, ~1:1)Payouts: Bi-weekly withdrawals as soon as funded

Execs of FundedNext

Get a 15% revenue share from the problem sectionNo closing dates in your analysisExcessive revenue break up, going as much as 95%A number of supported platforms (MT4, MT5, cTrader)

Cons of FundedNext

Crypto leverage is fairly low, typically round 1:1 solelyThe 15% problem payout is just not accessible on all account sortsSolely helps 9 crypto buying and selling pairs

2. FTMO

FTMO is mainly the gold customary of prop corporations. It began with foreign exchange, however now permits you to commerce crypto as nicely. You may commerce over 10 completely different crypto pairs, together with Bitcoin, Ethereum, and Litecoin. Additionally, their popularity for reliability {and professional} payouts is one other large plus.

Earlier than, FTMO used to have a 30-day time restrict, however they eliminated it. Now, you might have limitless time to finish your FTMO problem and verification half. Usually, they provide two predominant account sorts: Normal and Aggressive. The Aggressive one has fairly excessive revenue targets and better drawdown limits too.

Key Options

Revenue Cut up: 80% customary (90% after reaching milestones)Buying and selling Platforms: MetaTrader 4 and 5 (proprietary net dealer accessible)Problem Kind: Two-phase analysisAccount Sizes: As much as $200,000 preliminary (scaling plan can develop accounts additional)Accessible Cryptos: Key crypto CFDs (BTC, ETH, and many others., not all kinds)Leverage: As much as 1:100 on foreign exchange (crypto usually 1:1 or very low leverage)

Execs

One of the crucial respected prop corporations on this planetLimitless time to your problemNice platform alternative (MT4, MT5, cTrader)Revenue break up scales as much as 90%

Cons

The beginning value ($10,000) is a bit increased than some rivalsRestricted variety of supported cryptocurrencies and their leverage

3. BrightFunded

BrightFunded is one other newer participant that’s getting loads of consideration, and that’s due to its payout velocity. Really, they promise a median payout processing time of simply 4 hours. Additionally, for crypto merchants, they even assist payouts instantly within the USDC stablecoin.

BrightFunded’s standout characteristic is that you simply get a limiteless scaling plan and the Trade2Earn loyalty system. So, each time you commerce (could also be win or lose), you gonna earn factors towards perks like free retry challenges or increased payouts. They run a 2-phase analysis problem, much like FTMO, so you must move two phases to get your funded account.

Key Options

Revenue Cut up: 80% beginning, as much as 100% for prime performersBuying and selling Platforms: cTrader and BrightFunded’s personal net platform (desktop & cellular)Problem Kind: Two-phase analysis (affordable revenue targets)Max Capital: $400,000 funded account per problem (with potential to increase past through scaling)Accessible Cryptos: ~40+ cryptocurrencies (from Bitcoin & Ethereum to numerous altcoins and even meme cash)Leverage: As much as 5:1 on crypto trades

Execs

Tremendous-fast 4-hour common payout timePayouts accessible in USDC cryptoRevenue break up can go as much as 100%Limitless time to move the analysis

Cons

A bit newer agency, so much less long-term popularity than FTMOThe agency prohibits sure methods, together with high-frequency bots

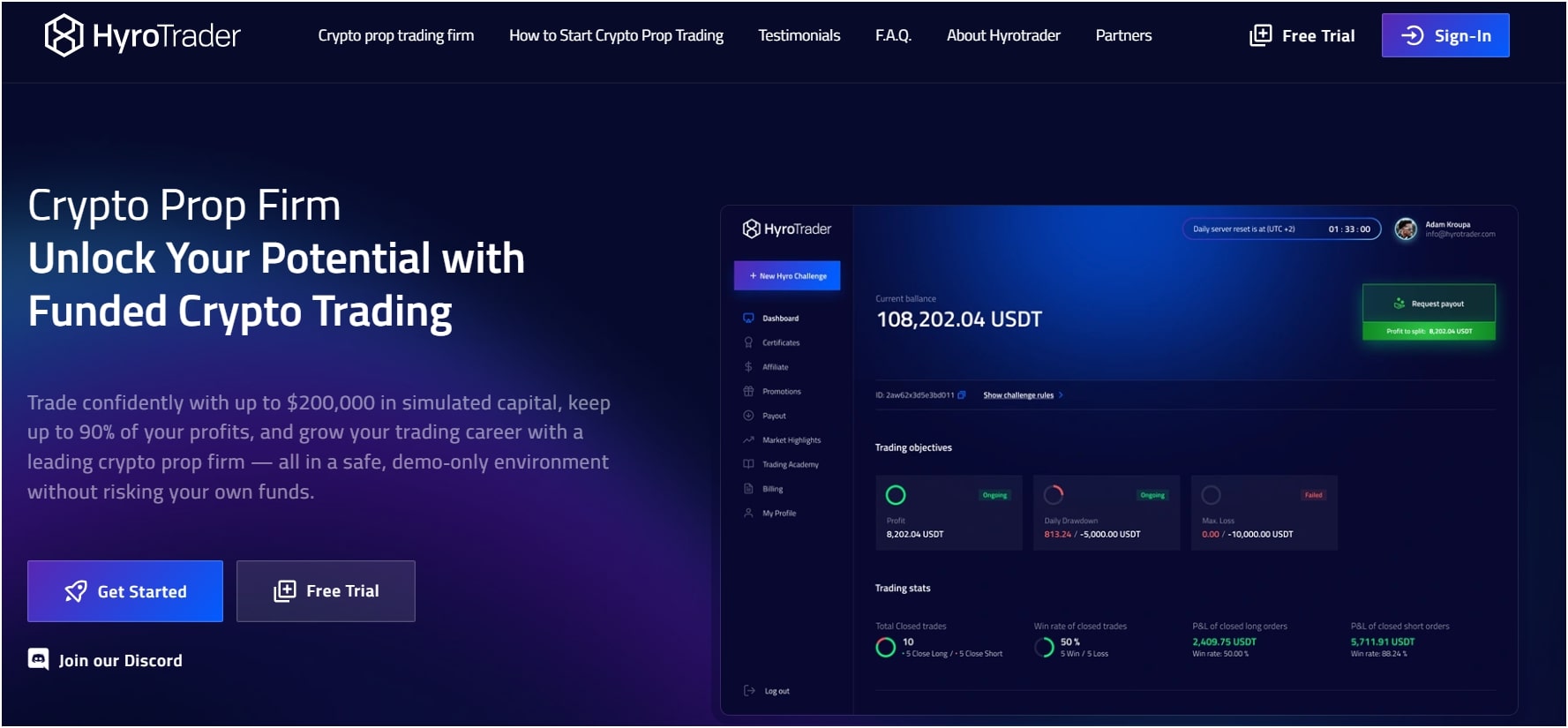

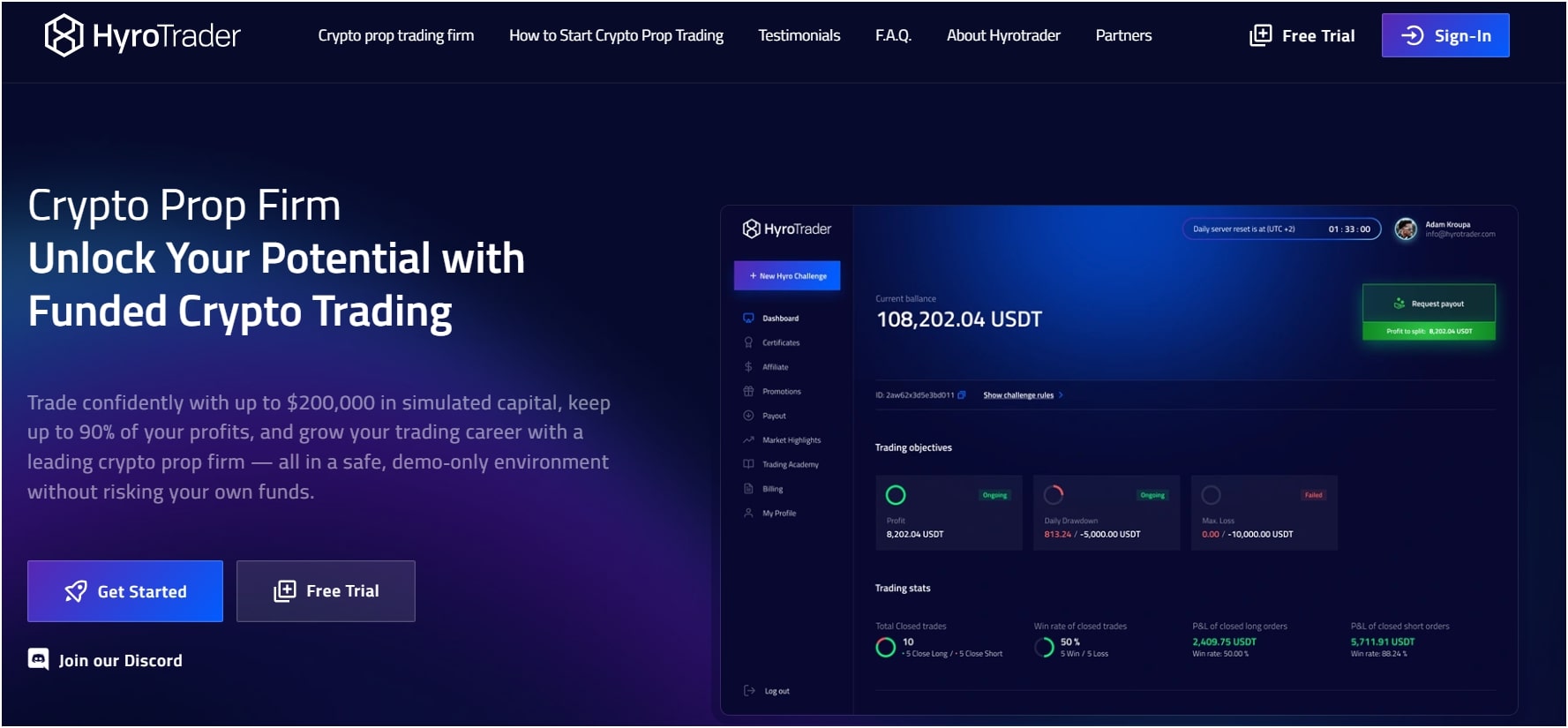

4. HyroTrader

HyroTrader is without doubt one of the finest crypto prop corporations for an excellent purpose: it permits you to commerce on actual crypto exchanges. You may even join the finest crypto exchanges like Bybit utilizing APIs. You recognize, this setup builds loads of belief because you gained’t get bizarre value spikes or “off-market” quotes.

They provide quick and on-demand payouts in lower than 24 hours and ship them instantly in USDT or USDC. Additionally, their revenue break up begins slightly decrease, at 70%, however sure, it scales as much as 90% as you show your consistency. Nicely, the perfect beginner-friendly characteristic is their refundable price. So right here, you pay for the problem up entrance, however when you move and get your first revenue payout, your fundamental price is paid again to you. It’s 100% paid again.

Key Options

Revenue Cut up: 70% to begin; can scale to 80% and 90% with constant earningsBuying and selling Platform: Built-in with BybitProblem Kind: One-phase analysisAccount Sizes: As much as $200,000 beginning funded account (with potential scaling as much as $1,000,000 for prime merchants)Accessible Cryptos: All main cash and lots of altcoins accessible on Bybit (learn our full Bybit overview)Leverage: Excessive leverage accessible (as much as 1:100 on some crypto futures, per change limits)Payouts: On-demand in crypto (USDT/USDC), usually processed inside 24 hours

Execs

A specialist agency centered on cryptocurrencyExtraordinarily quick crypto payouts (USDT/USDC)Limitless time to your analysisGood scaling plan for constant merchants

Cons

The beginning revenue break up is decrease (70%) in comparison with othersSeemingly fewer non-crypto property to commerce

5. Funded Buying and selling Plus

Funded Buying and selling Plus (FTP) is a UK-based prop agency. Nicely, their predominant attraction is the selection of problem sorts. So, you possibly can mainly select a 1-step, 2-step, and even an “Instantaneous Funding” program, the place you’re going to skip the problem.

The revenue break up is strong at 80%, and you’ll improve it to 90% (and even 100% on paper buying and selling earnings) as you obtain sure milestones. Additionally, cryptocurrency buying and selling is totally supported on every kind of account sorts, and guess what: no commissions on crypto trades.

Key Options

Revenue Cut up: 80% customary; can improve to 90% (and even 100% in demo section rewards)Account Sizes: $5,000 – as much as $200,000 preliminary accountsProblem Varieties: One-phase problem (10% goal), Two-phase problem (8% then 5% targets), or Instantaneous funding (no problem, begin at 80% revenue share)Accessible Cryptos: Main crypto pairs like BTC/USD, ETH/USD, LTC/USD, BCH/USDLeverage: Usually as much as 1:30 on most property (crypto is successfully leverage-free to cut back threat)Buying and selling Platforms: MT4, MT5, cTrader, Match-Dealer, DXtrade

Execs

A number of program sorts (1-step, 2-step, immediate)Very excessive revenue break up, as much as 90%Quick payouts each 7 daysSturdy, constructive popularity in the neighborhood

Cons

Instantaneous Funding applications have robust drawdown guidelinesCrypto leverage may be very low

6. The Buying and selling Pit

The Buying and selling Pit is a prop agency that places a giant emphasis on transparency, regulation, and multi-asset buying and selling. They’re based mostly in Liechtenstein. Additionally, they provide challenges not only for crypto, but in addition for foreign exchange, futures, shares, and many others., so it’s actually multi-asset.

The revenue break up ranges from 70% to 80%, and sure, that is barely decrease than some rivals, however nonetheless honest given the opposite advantages. Usually, they use a multi-step analysis course of. So, in follow, this implies you move an preliminary problem after which typically function as a “sign supplier” in a second section to show consistency earlier than full funding.

Key Options

Revenue Cut up: 70% beginning, as much as 80% at increased account tiersProblem Construction: Two-step course of for manyLeverage: As much as 1:20 on CFD buying and selling challenges (crypto and different property included)Account Choices: Challenges from €5,000 accounts as much as €200,000+ (with scaling to multi-million through a tiered development plan)Platforms: QuantTower and MetaTrader supplied, plus direct futures change entry (for CME, and many others., in futures challenges)Payouts: Weekly revenue withdrawals

Execs

Good regulatory background (based mostly in Liechtenstein)Presents a really wide selection of propertyStrong revenue break up as much as 80%Multi-step analysis ensures consistency earlier than scaling up

Cons

Crypto buying and selling choices are current, however not the widest varyThey might be much less centered on learners

7. Apex Dealer Funding

Apex Dealer Funding is a specialist, and they aren’t like the opposite corporations on this listing. Principally, Apex makes a speciality of futures buying and selling. So, you aren’t buying and selling crypto CFDs. You might be buying and selling crypto futures contracts, just like the Micro Bitcoin Futures (MBT), on the Chicago Mercantile Change (CME).

Their funding mannequin can be completely different, as it’s a 1-step analysis. Additionally, you simply need to hit a revenue goal with out hitting a trailing drawdown. There aren’t any closing dates. However you pay a month-to-month price for the analysis, not a one-time refundable price. And, when you move, you retain paying a month-to-month information price, however you get a large payout: 100% of your first $25,000 in earnings, and 90% after that.

Key Options

Revenue Cut up: 90% (in some applications, the primary few payouts may even be 100% in promotions)Analysis: Sometimes one-phase evaluationsAccount Sizes: Ranges from $25,000 accounts to $250,000+Accessible Cryptos: Deal with Bitcoin, Ethereum, and prime crypto property through futures contracts (and main foreign exchange, indices, commodities for non-crypto trades)Leverage: Very excessive efficient leverage because you’re buying and selling futures contractsBuying and selling Platforms: NinjaTrader, Tradovate, Quantower, and many others., plus some net interfaces. No MT4/MT5 right here.

Execs

Your best option for buying and selling crypto futures100% revenue break up on the primary $25,000Easy 1-step analysisMakes use of the skilled NinjaTrader platform

Cons

Platform selections might be advanced for learners (makes use of professional software program like NinjaTrader)You pay a month-to-month price, not a one-time price

8. DNA Funded

DNA Funded is without doubt one of the newer names within the prop buying and selling business. Now, not like corporations that solely allow you to commerce futures, DNA Funded is all about Foreign exchange, commodities, indices, and crypto CFDs, and offers you entry to over 800 completely different monetary devices.

Their funding mannequin can be designed to be tremendous trader-friendly to all merchants worldwide. You may choose between a fast one-step problem, a extra customary two-step analysis, or perhaps a 10-day dash when you’re assured. Nicely, the large win right here is that the principle challenges normally haven’t any closing dates, and the price you pay is a one-time cost, which is sweet in comparison with a subscription mannequin.

Key Options

Revenue Cut up: As much as 90% (80% default, might be elevated with an add-on) Buying and selling Platforms: TradeLocker Problem Kind: 1-Step, 2-Step, and 10-Day Analysis choices Value: One-time analysis price (e.g., $59 for a $5,000 account) Most Capital: As much as $600,000 Accessible Cryptocurrencies: Crypto CFDs (a part of 800+ property) Leverage: Varies by problem, as much as 1:50

Execs

One-time analysis price, not a recurring month-to-month costHuge number of tradable property, together with Foreign exchange, Indices, and Crypto CFDsVery excessive revenue break up, as much as 90% for profitable merchantsNo closing dates on the usual analysis phases

Cons

The agency is newer, so it doesn’t have the lengthy monitor document of some rivalsMakes use of the TradeLocker platform, which can be unfamiliar to merchants used to MT4/MT5

What Is a Crypto Prop Agency?

A crypto prop agency is an organization that provides you capital to commerce cryptocurrencies. Right here, “Prop” is brief for proprietary buying and selling. Mainly, you’re buying and selling the agency’s cash, not your personal. Usually, you first need to move a take a look at (referred to as a problem or analysis) to show you’re a good dealer, and when you move that one, they offer you a funded (however simulated) account, and also you break up any earnings you make, typically round 80/20 or 90/10 in your favor.

So, how are they completely different from foreign exchange or inventory prop corporations? The primary distinction is the market solely. You recognize, crypto markets are open 24/7/365 and are rather more risky. Therefore, crypto proprietary buying and selling corporations construct their guidelines round this. Additionally, they may have completely different leverage guidelines, they usually should have platforms that may deal with risky costs of digital property like Bitcoin and Ethereum. In brief, you’re really a crypto-funded dealer working with their capital.

How Do Crypto Prop Buying and selling Companies Work?

Crypto prop buying and selling corporations usually work by way of a really structured analysis and funding course of designed to seek out good, expert merchants after which again them with cash. Whereas every agency has its personal twist, the overall workflow is:

Problem Section: It is advisable to choose an account dimension (like $10,000 or $100,000) and pay a one-time price. However this one is usually a refundable price.Analysis Section: Then, you must commerce in a demo account and need to hit a revenue goal (e.g., 8% revenue) with out breaking any guidelines. Now, crucial rule right here is the “drawdown” (e.g., don’t lose greater than 5% in sooner or later or 10% complete).Funded Account: After you move, the agency goes to present you a “funded” account, and additionally, you will get your problem price refunded along with your first revenue break up.Commerce and Get Paid: Lastly, you’ll want to commerce the funded account (which continues to be a demo account linked to actual cash) and comply with the principles. On the finish of the payout interval (e.g., weekly or bi-weekly), you request a payout, and the agency sends you your revenue break up (e.g., 80% of the earnings) and retains its 20%. Therefore, this mannequin permits you to commerce a big crypto-funded account with out risking any of your personal cash, in fact, aside from the preliminary problem price.

What Are the Execs and Cons of Crypto Prop Companies?

The professionals of crypto prop corporations are entry to giant capital, excessive revenue potential, threat administration coaching, no private losses, and entry to a 24/7 crypto market globally.

The cons of crypto prop corporations are preliminary assessments, strict buying and selling guidelines, agency reliability, and a few hidden prices.

Execs of Crypto Prop Companies

Entry to Buying and selling Capital: You may simply commerce with a giant account funded by the agency as a substitute of your personal restricted funds. It’s approach simpler for a talented dealer to make use of a $100,000 account from a agency than to someway scrape collectively $100k himself.Excessive Revenue Potential: You recognize, with the splits being 80-90% in your favor typically, you retain nearly all of what you usher in. So, if in case you have an ideal month and make $5,000, you would possibly take house $4,000 of that.Danger Administration Coaching: The analysis guidelines, like drawdown limits and revenue targets, pressure you to commerce responsibly. Right here, many merchants really enhance their technique and threat administration simply by trying prop agency challenges since you should lower unhealthy habits, like revenge buying and selling or not utilizing cease losses.No Private Losses: Once more, when you blow up a funded account throughout the outlined limits, you don’t owe the agency for these losses. You would possibly lose your spot with the agency, however you’re not in debt. Therefore, the worst-case situation is that you simply lose the analysis price, or you must begin over.World and 24/7 Alternatives: Crypto prop corporations typically absorb profitable merchants from all around the world and permit you to commerce 24/7 crypto markets. Crypto corporations are very accessible, whereas some inventory prop corporations might require you to be in a particular location or commerce at sure hours. You might be in Asia, Europe, or the Americas, and you’ll be a part of and commerce across the clock.

Cons of Crypto Prop Companies

Assessments: It isn’t simple to move the primary problem, as many candidates, in reality, fail on the primary try. You might be anticipated to succeed in pretty formidable revenue targets with out breaking any of the predetermined guidelines.Strict Buying and selling Guidelines: Even when your account is funded, you aren’t but completely free. The corporations impose ongoing guidelines on you: most day by day loss, total drawdown, and generally limits on holding trades over weekends or throughout huge information occasions. There might also be banned buying and selling methods; for instance, no martingale, no arbitrage, and many others. Additionally, you would possibly lose your funded account on the spot when you break even a kind of guidelines by mistake.Agency Reliability: You recognize, not all prop corporations are created equal, and some of them have had points with payout delays, modifications in guidelines, and even shutdowns within the crypto prop area. So, if a agency is undercapitalized or has poor administration, you may expertise issues when attempting to withdraw your earnings. Prices and Charges: Apart from the analysis price, some corporations even cost month-to-month information charges, withdrawal charges, or produce other hidden prices. All these little prices imply you’ll want to carry out that a lot better to web the identical revenue.

The best way to Select the Proper Crypto Prop Agency?

To decide on the best cryptocurrency prop agency, you’ll want to examine elements comparable to analysis guidelines, supported exchanges, revenue and payout coverage, leverage guidelines, charges, and the agency’s popularity.

Analysis Guidelines & Problem: It is advisable to examine the problem necessities. So, when you’re a whole newbie, you might have considered trying a agency that has a one-step analysis or, if mandatory, simpler guidelines, comparable to a decrease revenue goal and no time restrict.Supported Platforms & Exchanges: You may examine what buying and selling platforms can be found and the way the buying and selling is executed. Additionally, when you love TradingView or MT5, ensure the agency presents it. Some corporations combine with precise crypto exchanges or use sure brokers; for instance, a agency would possibly join you to Binance or use liquidity from OKX.Revenue Cut up & Payout Coverage: Clearly, the upper the revenue break up, the higher for you, but in addition think about payout frequency and strategies. A agency that gives an 85% break up however solely pays out month-to-month won’t be nearly as good as one with 80% that pays weekly. So, examine the critiques to have the ability to guarantee they really pay on time along with your favourite methodology, whether or not it’s crypto, PayPal, financial institution, and many others.Leverage and Devices: A lot of the cryptocurrency corporations have completely different leverage caps. Now, when you want excessive leverage to carry out your scalping technique, discover a agency that gives it; some go 5:1 or extra on crypto, whereas others keep on with a decrease one. Additionally, examine the devices: do they provide simply crypto CFDs or additionally crypto futures? What number of crypto pairs? If you wish to commerce a spread like Dogecoin, Solana, and many others., ensure they’re accessible.Charges & Pricing: You must learn how a lot the overview price and all recurring prices are. One agency’s $100,000 problem might value $500, whereas one other’s prices $349 for related parameters. Additionally, you’ll want to see if charges are refundable; many refund your price when you’re funded and get a payout. Plus, be careful for any month-to-month charges or information costs.Status & Trustworthiness: This one is large and most essential. Do your analysis in regards to the agency’s monitor document; learn dealer critiques and take a look at discussions in communities like Reddit or Discord. Usually talking, a agency that has been round longer and has verifiable payout proofs is usually safer.

The best way to Be a part of a Crypto Prop Buying and selling Agency?

Step 1: Analysis and Select a Prop Agency

It is advisable to choose which prop agency you’ll wish to apply for, utilizing the ideas within the prior part, in fact.

Step 2: Signal Up and Pay the Charge

After you have develop into comfy, create an account on the web site of the agency. You’ll possible want to supply an e mail and a few private info. Then you’ll want to choose the analysis problem you need, for instance, a $50k crypto account problem: one-phase or two-phase. Subsequent, proceed to checkout and make the price fee for that problem.

Step 3: Put together Your Buying and selling Plan

Earlier than you place a single commerce on the analysis, have a plan. Know the principles (max lot dimension, which cryptos are allowed, and many others.) and set your personal threat per commerce so that you don’t hit the drawdown.

Step 4: Commerce Via the Analysis

Begin buying and selling in accordance with the agency’s guidelines. You’ve gotten one focus: to move the problem, not by betting the home however by being persistently worthwhile. So, keep on with your technique, maintain losses small, and don’t violate any guidelines.

Step 5: Full Agreements & Verification

After the analysis, the corporate will ship you a contract or settlement to signal as an unbiased dealer; learn and signal it, in fact. Generally, you additionally need to confirm your id with an ID and proof of handle, an ordinary process to keep away from fraud and adjust to the regulation.

Step 6: Start buying and selling the Funded Account

As soon as the paperwork is accomplished, the corporate will open a stay account for you or a simulated account that mirrors a stay account. Now you’re buying and selling with actual cash. Hold following the principles, and your goal now’s regular earnings with none huge drawdowns.

Step 7: Withdraw Income & Scale Up

That is fairly customary, the place you go right into a portal and click on a “Withdraw” button, choosing your methodology: crypto switch, financial institution, no matter. Subsequent, from that time onward, steady buying and selling and scaling when attainable.

Which Are the Greatest Crypto Prop Buying and selling Companies for Newbie Merchants?

One of the best crypto prop buying and selling corporations for newbie merchants are FundedNext or FTMO. The primary purpose is their “no time restrict” rule on challenges. You recognize, as a newbie, the worst factor you are able to do is pressure unhealthy trades to fulfill that 30-day deadline. However right here, with limitless time, you possibly can calm down, await good setups, and commerce your plan accurately.

Additionally, they each use a 2-step problem, which is sweet for studying, and the principles are clear (e.g., 5% day by day loss, 10% complete loss), and it teaches you the self-discipline you want. Plus, FundedNext even presents a 15% revenue share from the problem, which is one other good bonus.

Which Is the Greatest Prop Agency to Commerce Futures?

One of the best prop agency to commerce futures is Apex Dealer Funding. They’re fairly specialists on this space, they usually additionally offer you entry to the skilled NinjaTrader platform and join you to regulated exchanges just like the CME. You may simply commerce crypto futures like Micro Bitcoin (MBT) and Micro Ether (MET).

Conclusion

In abstract, a crypto prop buying and selling agency is mainly an organization that stakes its personal cash in your buying and selling expertise after which offers you a bigger account to commerce cryptocurrencies in change for a share of the earnings. The highest crypto proprietary buying and selling corporations on this listing, like FundedNext and FTMO, provide incredible, dependable paths for brand new merchants.

So, what’s subsequent? It is advisable to select the agency that most closely fits your buying and selling type and provides that analysis a shot. Additionally, it is best to begin your funded buying and selling journey with certainly one of these trusted crypto prop corporations.