Binance buying and selling bots are automated buying and selling instruments that execute trades for customers primarily based on predefined methods. These bots function 24/7 and are designed to make crypto buying and selling extra environment friendly, cut back emotional decision-making, and make the most of market alternatives that merchants could miss whereas inactive or throughout guide buying and selling.

To make sure precision, Binance automated buying and selling bots can accumulate market knowledge, analyze it, and execute trades primarily based on preset methods and collated knowledge inside milliseconds. Because the title implies, these bots are offered by Binance, a worldwide cryptocurrency change that enables traders to purchase, maintain, promote, and commerce crypto cash and non-fungible tokens (NFTs) in a single place.

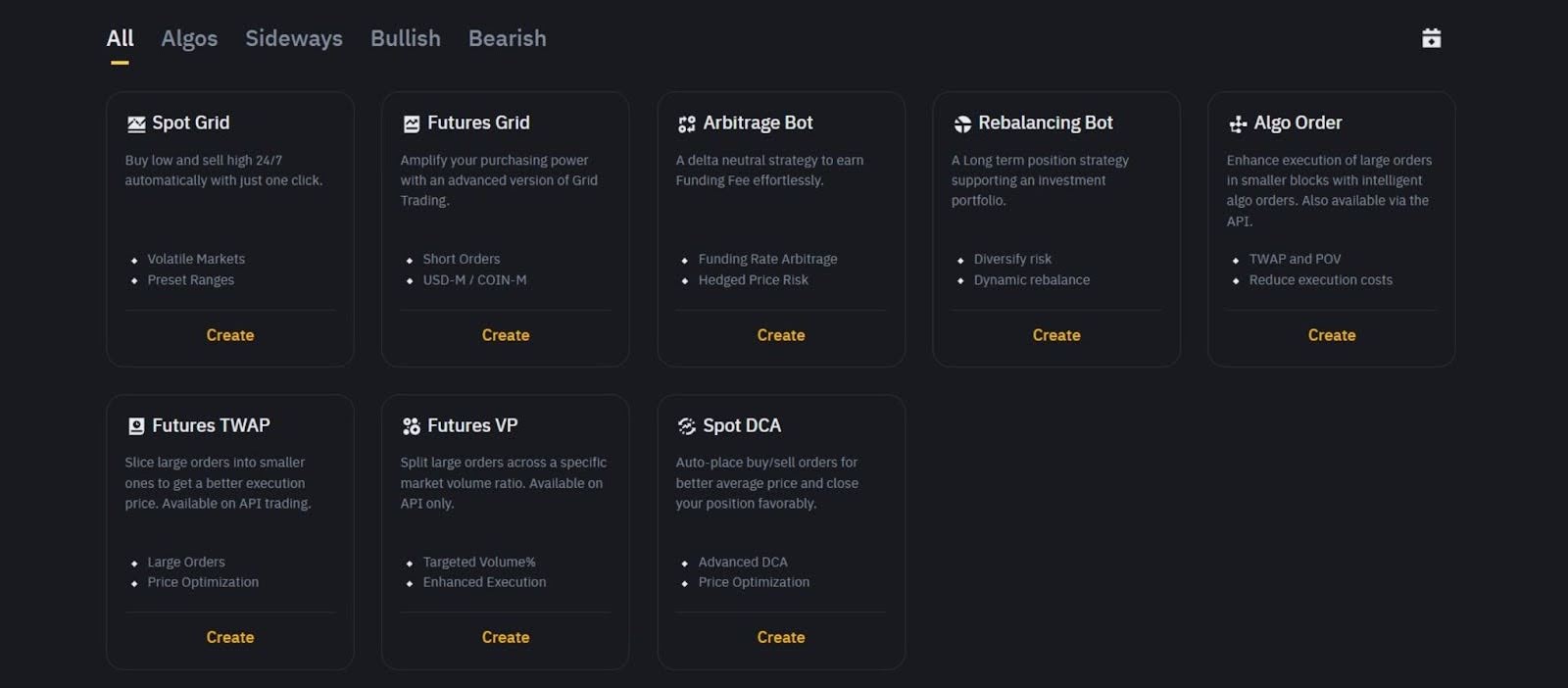

On Binance, merchants can entry eight crypto bots designed to execute completely different buying and selling methods mechanically. Preserve studying this Binance crypto buying and selling bot evaluate to study extra about buying and selling bots for Binance, the charges for utilizing Binance bots, and how you can arrange a buying and selling bot on Binance.

What’s Binance Buying and selling Bot?

Binance buying and selling bots are superior instruments that assist traders commerce cryptocurrencies mechanically on the Binance change. These bots use preset guidelines to investigate market developments, monitor costs, and place purchase or promote orders with out human supervision. Binance provides eight buying and selling bots, every designed to swimsuit a selected technique or market situation.

As a substitute of inserting each commerce your self or managing many positions simultaneaously, a Binance buying and selling bot can perform duties like shopping for low and promoting excessive (grid bots), sustaining a particular funding ratio (rebalancing bots), executing massive trades over time (TWAP or VP bots), and even regularly constructing a place over time (DCA bots).

These bots are constructed instantly into the Binance platform, which implies customers don’t want third-party software program or coding abilities to get began. As soon as configured, the bot follows the principles the person units and trades repeatedly, even when the dealer is offline.

Arrange a bot buying and selling account on Binance and obtain $100 plus as much as complete 30% low cost on spot and buying and selling charges.

What Are the Professionals and Cons of Binance Buying and selling Bot?

The professionals of the Binance buying and selling bot are listed beneath:

24/7 Buying and selling: Like different crypto bots, Binance buying and selling bots don’t want relaxation. These superior buying and selling instruments are designed to maintain watching the market, open positions, and handle trades across the clock, so that you gained’t miss any alternatives when you’re away out of your display screen.

No Emotional Buying and selling: Typically, feelings like worry, greed, impatience, or pleasure result in poor buying and selling selections. Bots strictly observe programmed logic, which implies they don’t panic throughout sudden value drops or get grasping throughout rallies. This helps preserve self-discipline and stick with your preliminary buying and selling technique.

Quicker Commerce Execution: One main purpose merchants deploy bots for seamless crypto buying and selling expertise is the execution velocity. Bots can open positions, modify, and cancel orders sooner than people. They will monitor dozens of buying and selling pairs concurrently and execute a number of trades inside seconds.

Backtesting Buying and selling Methods: Many bots allow you to backtest your technique utilizing historic knowledge. This implies you may see how it could have carried out previously earlier than risking your funds.

Customization Choices: Binance bots provide a variety of methods tailor-made to completely different market circumstances. Whether or not you’re making an attempt to position easy purchase and promote orders and revenue from value fluctuations or cut back entry danger over time, there’s a bot for practically each buying and selling type. This offers you management over how the bot trades, primarily based in your targets and danger degree.

The cons of the Binance buying and selling bot are listed beneath:

Not Newbie-Pleasant: Though you don’t have to code or be a sophisticated dealer, a fundamental understanding of buying and selling ideas like stop-loss, leverage, volatility, and danger administration is critical. You could possibly danger greater than meant in case you don’t perceive what the bot is doing.

You Can Nonetheless Lose Cash: Bots observe guidelines, however they don’t assure income. If markets transfer in opposition to your technique otherwise you configure the bot poorly (e.g., fallacious value vary), you may endure vital losses. Moreover, buying and selling with leverage-based bots, like these for the futures market, is even riskier than spot-based bots.

Requires Monitoring and Technique Changes: Though bots are automated, you continue to want to observe them, particularly throughout sudden market crashes, change points, or liquidity adjustments. For those who utterly ignore the Binance buying and selling bots, they might maintain executing trades primarily based on outdated parameters.

What Are the Kinds of Binance Automated Buying and selling Bots?

The kinds of Binance automated buying and selling bots are Spot Grid, Futures Grid, Arbitrage bot, Rebalancing bot, Algo Order, Futures TWAP, Futures VP, and Spot DCA. Here’s a breakdown of the completely different buying and selling methods these superior buying and selling instruments execute.

Spot Grid

The Spot Grid automates buying and selling within the spot market by inserting a collection of purchase and promote orders at predefined value intervals. This grid bot is constructed for market circumstances the place costs transfer sideways inside a particular vary as an alternative of up and down. The objective is to purchase an asset at decrease ranges and promote it when it strikes increased, making small income from market fluctuations.

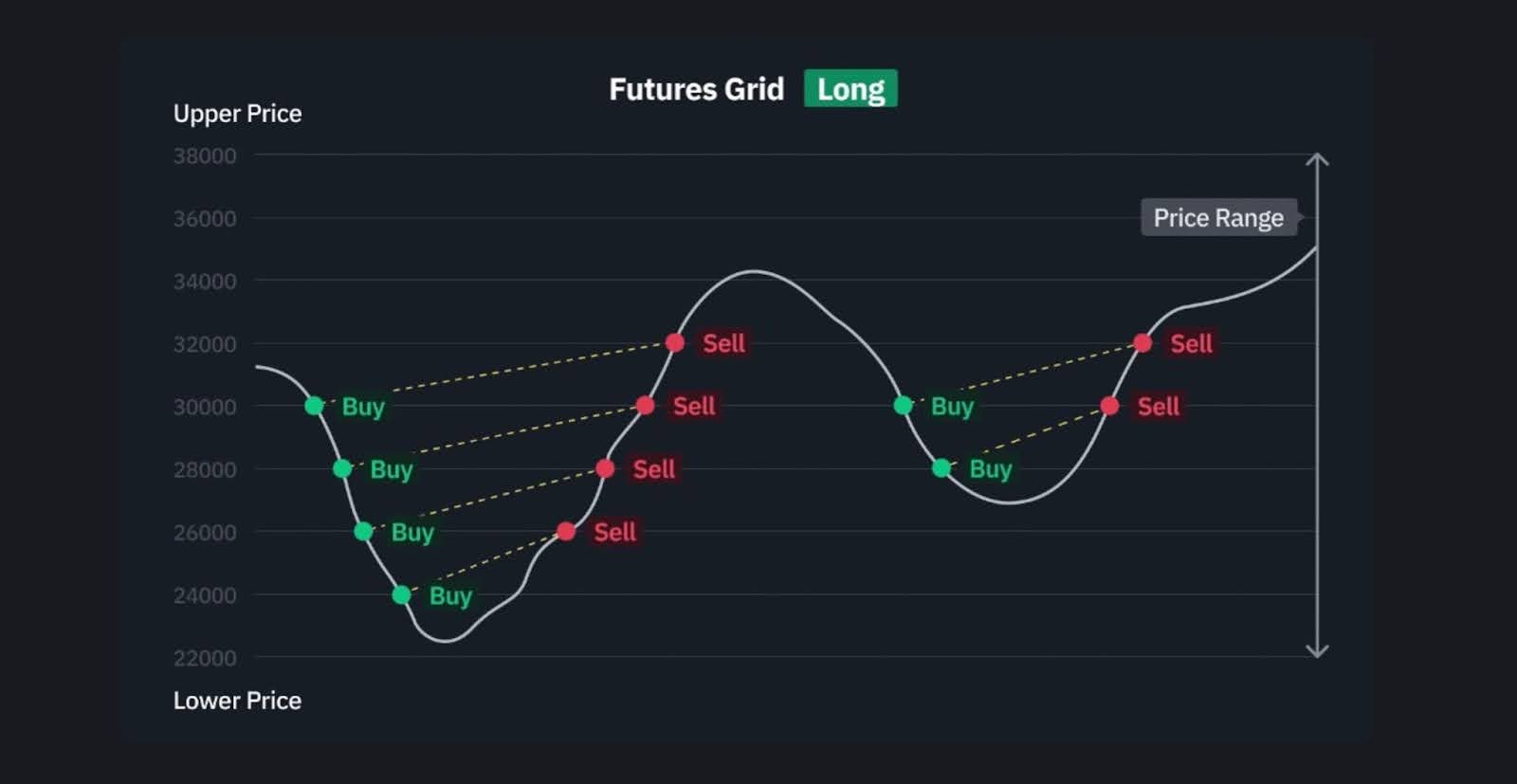

Futures Grid

This bot is much like Spot Grid however is utilized to the futures market as an alternative of the spot market. It permits merchants to go lengthy or brief and even apply leverage. The Futures Grid is ideal for merchants who wish to revenue from value actions in each instructions whereas benefiting from as much as 125x leverage to doubtlessly enhance their returns.

Arbitrage Bot (Futures Funding Price Arbitrage)

The Arbitrage Bot takes benefit of value variations between buying and selling pairs or throughout completely different markets (spot and futures) to revenue from funding charges. Merely put, the Arbitrage bot permits merchants to hedge their positions within the futures market by taking an reverse place for a similar buying and selling pair within the spot market.

For those who resolve to make use of this bot, you may be opening each lengthy and brief positions in numerous markets to revenue from both market and accumulate funding charges. For those who incur a loss on the open place within the futures market, you may offset it with the revenue you make within the spot market and vice versa.

Rebalancing Bot

The Rebalancing Bot mechanically adjusts your portfolio place in your chosen token mixture to make sure you preserve the identical ratio amongst a bunch of chosen property. For instance, if you wish to maintain a 50/50 stability between Bitcoin and Ethereum, the Rebalancing Bot will monitor value adjustments and alter the holdings mechanically by shopping for or promoting to take care of that ratio.

Institutional and long-term merchants typically use this not for portfolio administration, however for energetic buying and selling. It manages dangers by spreading your capital throughout varied cryptos, helps you stick with your crypto buying and selling targets, and doubtlessly will increase returns by promoting overvalued property and shopping for undervalued ones.

Be a part of Binance at present and get an extra 20% low cost on all of your buying and selling charges.

Algo Order (TWAP & POV Methods)

The Spot Algo Order helps merchants execute massive orders and doubtlessly illiquid trades with out considerably impacting the market. As a substitute of inserting one large order that might trigger slippage or unfavourable value actions, this bot breaks the order into smaller components and spreads them out over time primarily based on a specific automated buying and selling algorithm.

Binance provides two kinds of algorithmic orders: Time-weighted Common Worth (TWAP) and Proportion of Quantity (POV). TWAP is a time-based algo bot that displays the order e-book and executes small parts of the entire order at common intervals all through the desired length to reduce market affect and cut back slippage.

In the meantime, the POV algo bot is percentage-based, executing trades primarily based on a specified share of the entire market buying and selling quantity. The execution fee of a POV algo order is dependent upon market quantity or exercise. When market exercise is excessive, the order executes sooner; when quantity decreases, execution slows down, sustaining a constant participation fee.

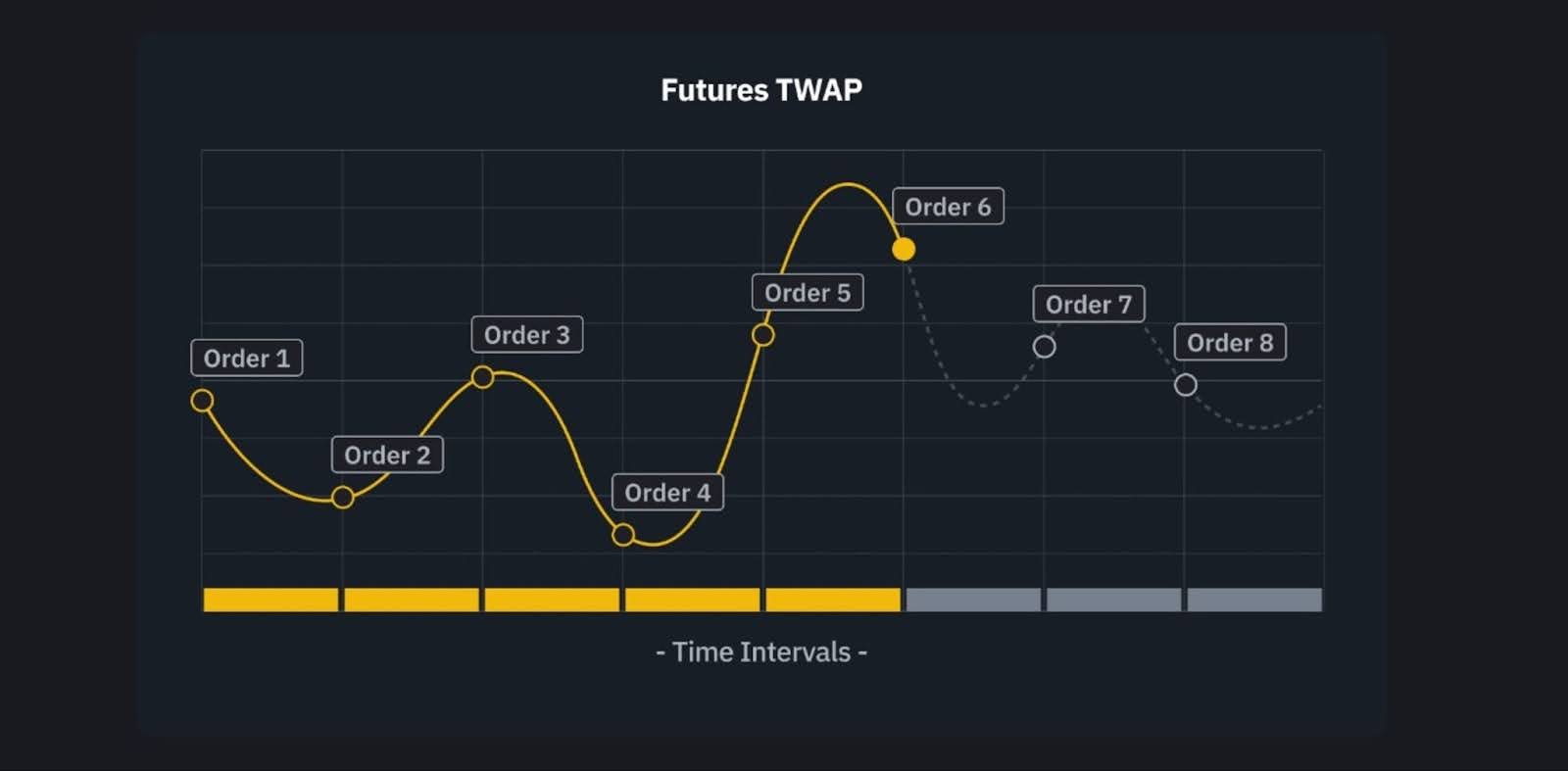

Futures TWAP

The Futures TWAP bot disperses massive futures orders into smaller portions and locations them regularly over a set interval to get higher execution costs. This bot goals to realize a mean execution value that displays the time-based common of market costs specified by the dealer.

The futures TWAP bot is helpful when making an attempt to enter or exit a place with out inflicting noticeable value disruption, particularly in much less liquid markets. In case you are contemplating utilizing the futures TWAP bot, Binance helps it on USD-M Futures contracts through API and thru the futures buying and selling bots interface.

Futures VP

The Futures Quantity Participation (VP) bot is designed to execute trades primarily based on the extent of market exercise. As a substitute of mounted time intervals like with TWAP, VP executes orders proportionally to the present market buying and selling quantity. When market quantity is excessive, the order executes sooner; when quantity is low, execution slows down. This helps preserve a gentle market participation fee and reduces the danger of shifting the market value.

Spot DCA

The Spot DCA (Greenback-Price Averaging) bot helps traders purchase or promote a set quantity of cryptocurrency property at common intervals or when the worth adjustments by a predetermined share.

The bot buys extra of the asset when the market value falls beneath your preliminary buy value, aiming to decrease your common purchase price. It continues shopping for till the worth rises above your preset take-profit share, at which level it sells the asset to lock in income.

Declare a free $100 buying and selling charge credit score to start your crypto bot buying and selling journey on Binance.

How do Binance Buying and selling Bots Work?

Binance buying and selling bots work by following predefined methods and parameters to mechanically execute trades on the Binance platform. Customers configure the bot with particular guidelines corresponding to value ranges, order sizes, value deviation percentages, take-profit targets, and order frequency.

The bot then mechanically locations purchase or promote orders in line with these settings. As soon as activated, the bot repeatedly displays the market and executes trades in line with the technique, whether or not it’s grid buying and selling, dollar-cost averaging (DCA), arbitrage, or different supported methods.

This automation ensures your trades occur promptly and constantly, even when you’re offline. One other standout function of Binance bot buying and selling is that the Bot Market permits customers to find and replicate prime bot methods created by skilled merchants, making it simpler for newcomers to start out automated buying and selling with out creating methods from scratch.

What Are the Guidelines For Automated Binance Buying and selling Bots?

The foundations for automated Binance buying and selling bots are defined beneath:

API Entry & Permissions: To make use of a bot on Binance, that you must create an API key instantly out of your account settings. This Binance API key permits the bot to work together along with your account and perform trades in your behalf. You may resolve the bot’s permissions, whether or not studying your knowledge or actively inserting trades. For safety causes, it’s greatest to show withdrawal permissions off.

Technical and Buying and selling Limits: To keep up system stability, Binance units technical limits, corresponding to fee limits on order submissions (e.g., a most of 10 orders per second on Binance Futures). It additionally limits what number of instances your bot could make API calls inside a particular timeframe.

In case your bot sends too many requests too shortly, Binance may briefly block it. This helps maintain the system truthful and secure for everybody utilizing the platform. So, guarantee your bot is programmed to remain throughout the allowed fee limits.

Safety Compliance: By no means share your API key with anybody, and keep away from storing it in locations that aren’t safe. Hackers typically goal bots with poor safety setups, so it’s necessary to guard your buying and selling credentials. Even when your bot is dependable, one safety breach can wipe out your funds. At all times use two-factor authentication and recurrently test your bot’s entry settings.

KYC & Regional Restrictions: Earlier than you begin Binance bot buying and selling, you could full Binance’s KYC verification course of. This ensures that each one customers are recognized and meet native compliance guidelines. Additionally, in case you’re in a area the place the Binance international platform can’t function, together with the US, you can not bypass restrictions and use the bot.

Compliance with Phrases of Use: All automated buying and selling exercise should observe Binance’s phrases of use and another insurance policies they replace over time. In case your bot violates any phrases, the change reserves the precise to freeze and limit your account, which is able to have an effect on your Binance bot buying and selling account.

What Are the Charges for Utilizing Buying and selling Bot on Binance?

When utilizing Binance’s buying and selling bots, there isn’t a additional charge particularly for the bot itself; the service is built-in at no further price. This implies you may make the most of automated methods utilizing a Binance buying and selling bot freed from cost with out paying something additional past your normal buying and selling bills.

Nevertheless, you continue to incur the conventional buying and selling charges when transactions are executed. For instance, on the Spot market, the fee is round 0.1% for makers and takers, so you could pay the usual buying and selling charges. For Futures buying and selling, the charges are about 0.02% for makers and 0.04% for takers. Thankfully, these charges can drop to 0.075% in case you use BNB for charge funds or attain a better VIP degree with a better 30-day buying and selling quantity.

Learn how to Arrange a Buying and selling Bot on Binance?

To arrange a buying and selling bot on Binance, you’ll first have to create a Binance account and fund it. Step 1: Go to the Binance official web site, present the data required, add a present Binance referral code to be eligible for bonuses, and full the KYC verification course of. Learn this Binance evaluate to discover a step-by-step information on how you can register and arrange a brand new buying and selling account on Binance.

Get 100 USDT without cost and different unique rewards in welcome bonuses to fund your bot trades.

Step 2: When you’ve registered, log in to your Binance account, go to the (Commerce) menu, after which go to (Buying and selling Bots). Learn the phrases fastidiously. For those who agree, test the field after which click on “Affirm” to proceed.

Step 3: Subsequent, you will note the buying and selling bot touchdown web page. Click on “Commerce Now,” and the system will take you to the buying and selling web page.

Step 4: You can see completely different buying and selling bots on the prime. Select the one you want to create and set your parameters. You will want particulars just like the buying and selling pair, your order kind, the quantity you want to commerce, and many others. After setting the parameters, click on Begin. The bot will mechanically place purchase and promote orders throughout the specified vary.

Is Binance Buying and selling Bot Worthwhile?

Sure, Binance buying and selling bots will be worthwhile, nevertheless it is dependent upon how you employ them. Their success comes all the way down to your buying and selling technique, setting the bot up accurately, and the way properly you monitor the bot’s efficiency. For those who’re exploring choices past Binance, you may additionally wish to try a number of the greatest crypto buying and selling bots out there in the marketplace.

Does Binance Have a Buying and selling Bot?

Sure, Binance has about eight buying and selling bots that automate your trades. These bots are designed for various merchants and techniques, however they often can help you arrange methods for spot buying and selling, futures, and algorithmic buying and selling. As soon as set, the bots perform trades primarily based on the circumstances you outline. This helps you handle your investments with out being energetic on a regular basis.

Are Binance Buying and selling Bots Secure and Authorized?

Binance buying and selling bots are protected and authorized. Utilizing Binance buying and selling bots can solely change into unlawful in case you use them in opposition to the corporate’s phrases and circumstances or in international locations the place Binance is banned.

Binance itself is a trusted change licensed in lots of international locations. The buying and selling platform additionally implements sturdy safety measures, corresponding to chilly storage for customers’ funds, a separate fund to reimburse victims of safety breaches, and a bug bounty program to assist catch vulnerabilities early.

What are the Dangers of Utilizing Binance Automated Buying and selling Bots?

Binance automated buying and selling bots could make buying and selling simpler and worthwhile, however additionally they include dangers. It’s important to know these merchandise earlier than utilizing them. The dangers of utilizing Binance automated buying and selling bots are technical points, market volatility, overtrading, dependency on technique, regulatory considerations, lack of human oversight, and over-reliance.

Technical Points: Bots can expertise glitches or connection issues, resulting in missed trades or incorrect actions. If the bot’s code isn’t well-written, it may end up in surprising behaviour, which may trigger vital losses in case you’re not monitoring its efficiency.

Market Volatility: Bots don’t have the pliability to regulate to adjustments in market sentiment. They’re programmed with mounted methods that may’t adapt shortly to sudden market shifts. They may make trades primarily based on outdated indicators in unstable markets, resulting in losses.

Overtrading: Some bots, just like the Grid bots, are set to execute trades often, which may result in extreme transaction charges. If the bot isn’t programmed to keep away from overtrading, it’d tackle extra danger than you meant.

Dependency on Technique: Bots observe a set technique, which could not be efficient in all market circumstances. If the technique turns into outdated or isn’t suited to present developments, the bot will battle as a result of it may well’t improvise or alter to unexpected circumstances.

Regulatory Dangers: Completely different international locations have legal guidelines relating to cryptocurrency buying and selling, and bots can typically fall into gray areas. Utilizing an automatic bot with out contemplating native rules may result in authorized points. You could possibly face fines or account restrictions if a bot violates your nation’s guidelines.

Lack of Human Oversight: Bots function 24/7 with out human intervention. If one thing goes fallacious, you may not catch it instantly, resulting in substantial losses. With out oversight, it’s straightforward to overlook key adjustments out there.

Over-reliance on Bots: Relying solely on bots can stop you from gaining useful expertise as a dealer. Bots observe predefined methods and don’t enable you to study to learn the market. Over time, you may lose the abilities wanted to commerce successfully by yourself. So, it’s important to stability utilizing bots and studying how you can commerce manually.

Do Binance Buying and selling Bots Assure Earnings?

No, Binance buying and selling bots don’t assure income. Whereas they might help merchants earn revenue, they automate trades primarily based on predefined methods. Subsequently, the bot can’t be worthwhile if the dealer’s technique or directions are flawed or the markets go in opposition to them.

The put up Binance Buying and selling Bot Evaluate (2025): Varieties, Charges, Safety, and Profitability appeared first on CryptoNinjas.